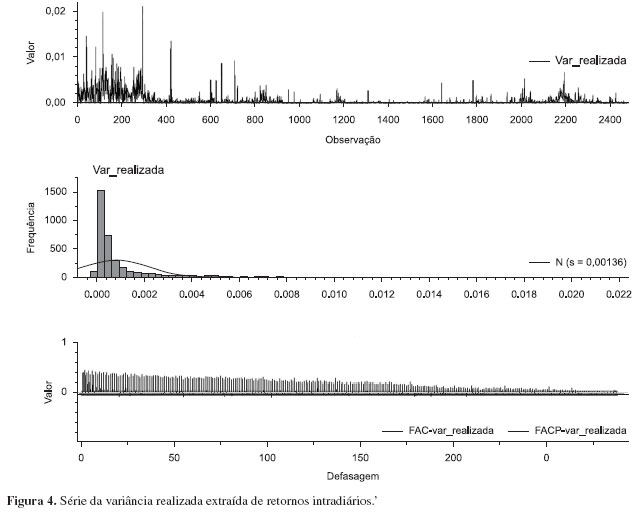

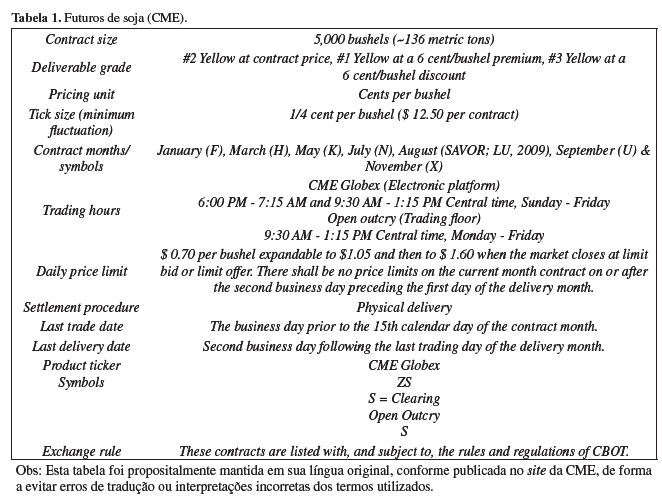

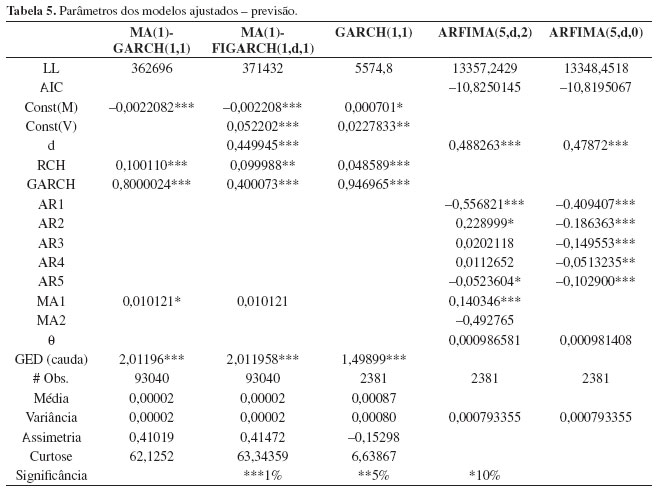

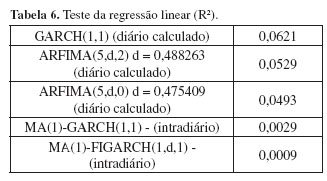

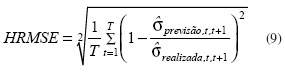

In the present study, five volatility prediction models were evaluated using a series of soybeans prices, a commodity traded in the Chicago Board of Trade (CBOT), using high-frequency data. The models used belonged to the GARCH, FIGARCH and ARFIMA families. It was possible to observe entirely different characteristics of this commodity price series, which is negotiated on a global scale, from those of the financial assets previously studied, possibly due to the continuity of the price series studied allowed by the global negotiation nature of this trade, fully independent of daily exchange markets subject to opening and closing times. It was possible to conclude that the high-frequency price data do provide additional information to the traditional daily time series, also in the case of soybeans, and that the traditional GARCH(1,1) model also has good performance on the high-frequency price data just like those of the ARFIMA family. Further investigation should be carried out on the FIGARCH models to get a better parameter fit.

Volatility; High-frequency; Realized volatility; Soybeans; GARCH; ARFIMA