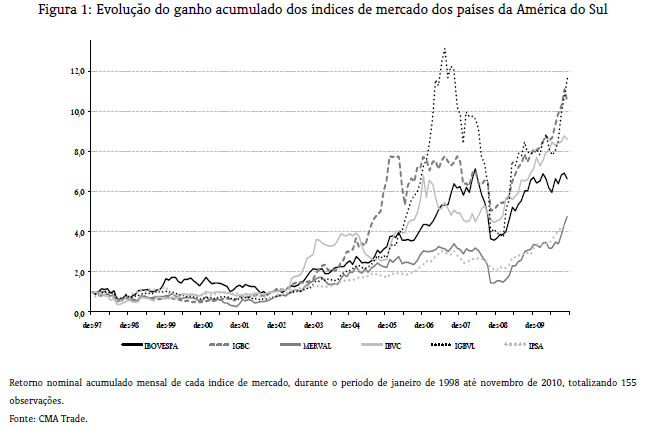

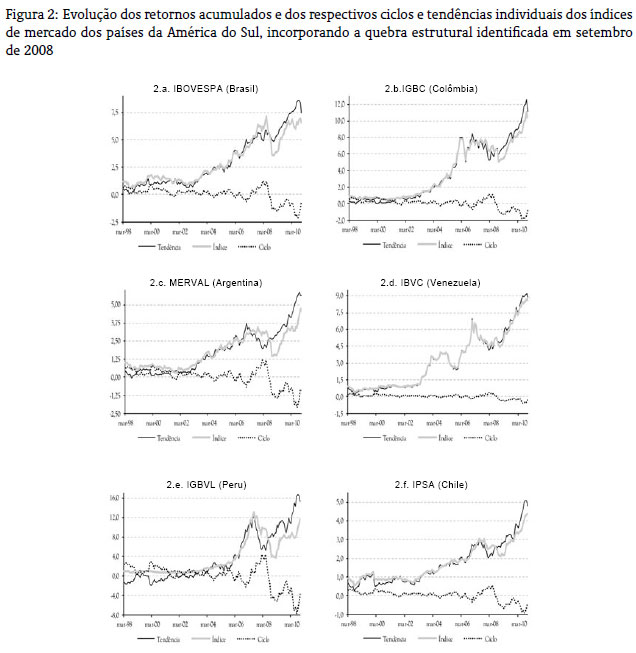

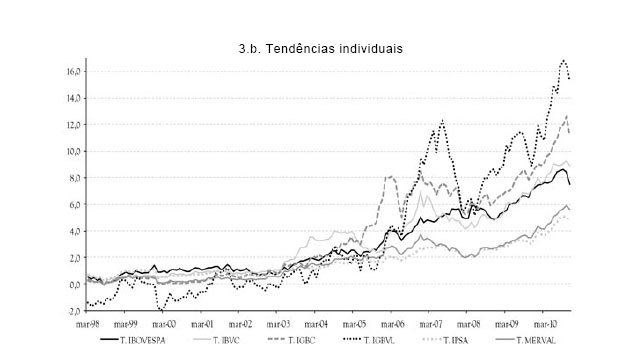

We enter the debate promoted by Mejía-Reyes (2000) and Hecq (2001) on financial integration and contagion in the countries of South America, based on the methodology of common characteristics in the long and short run of the major stock indexes time paths. Although this is a continent with diverse economic fundamentals, our results suggest that these financial markets should not be analyzed individually, since the extent of any deviation from long-run equilibrium in one of the markets seems to be able to influence the behavior the other ones, during the period between January 1998 and November 2010. Corroborating D'ecclesia e Costantini (2006), we are able to evidence financial contagion, due to some extreme negative global events that can cause imitative behaviours in short run. We also identify the Peruvian financial market as the unique unpredictable and also the most relevant in the study of reactions to transitory shocks in South America.