ABSTRACT

This article analyzes the role of inheritance and donation on the distribution of wealth and income in Brazil and the state of Rio Grande do Sul. Although several scholars coming from branches of Social Sciences have already scrutinized the influence that slavery and colonial exploitation had - and still have - in the Brazil’s development, no work in the economic literature has thus far attempted to estimate Brazil’s current inheritance stock in monetary terms. With this in mind, this paper has three specific goals: i) to estimate, in accordance with an original framework, the inheritance stock of Brazil (and Rio Grande do Sul) and their flow with respect to national income and household disposable income; ii) to measure potential revenue through the application of a more progressive taxation of inheritance and donations based on inheritance stock estimates and iii) to simulate the distributional effect of reallocating these new fiscal resources. It is important to note, however, that the simulations presented in this paper are static exercises, and do not intend to capture general equilibrium or behavioral effects.

KEYWORDS:

Brazil; inheritance; inheritance taxation; intergenerational mobility; wealth and income distribution

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Source: Author’s own elaboration based on Luxembourg Income Study, The World Wealth and Income Database and

Source: Author’s own elaboration based on Luxembourg Income Study, The World Wealth and Income Database and  Source: Central Bank of Brazil.

Source: Central Bank of Brazil.

Source: Author’s own elaboration based on data from the Foundation of Economics and Statistics of Rio Grande do Sul and the Treasury Department of Rio Grande do Sul.

Source: Author’s own elaboration based on data from the Foundation of Economics and Statistics of Rio Grande do Sul and the Treasury Department of Rio Grande do Sul.

Source: Author’s own elaboration based on data from the Brazilian Internal Revenue Service and IBGE.

Source: Author’s own elaboration based on data from the Brazilian Internal Revenue Service and IBGE.

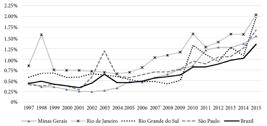

Source: Author’s own elaboration based on data from the IBGE, CONFAZ, and States Finance Secretariats of Brazil.

Source: Author’s own elaboration based on data from the IBGE, CONFAZ, and States Finance Secretariats of Brazil.

Source: Author’s elaboration based on data from CONFAZ and the Treasury National Secretary.

Source: Author’s elaboration based on data from CONFAZ and the Treasury National Secretary.