ABSTRACT

The economic literature in the Keynesian tradition disagrees on the relationship between income levels and debt charge-off ratios: while the Post-Keynesian analysis, in especial that of Minsky (1986), indicates an increasing financial fragility during economic booms, the New Keynesians state that these periods are characterized by an easiness in information asymmetry problems and greater robustness of the financial system as income expands. This article analyzes the relationship between the behavior of credit defaults and the cyclical variations in economic activity in Brazil. Using monthly data ranging from 2001 to 2013, a Vector Autoregressive Model (VAR) was estimated to analyze the credit cycles in the indicated time period. The results show that a positive income shock stimulates credit concessions and reduces charge-off ratios in the short run, but, in the long-run, a reduced credit rationing is followed by a greater risk exposure by the financial institutions.

KEYWORDS:

Default; credit; income; business cycles

Fonte: Adaptado de

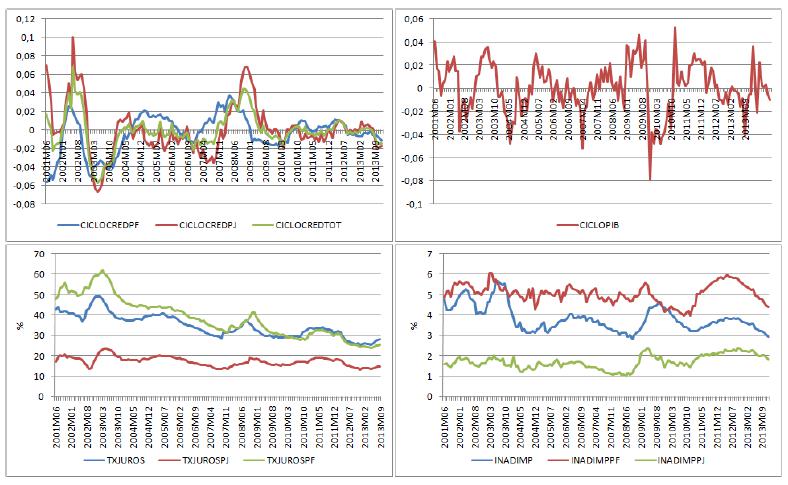

Fonte: Adaptado de  Fonte: Elaboração própria.

Fonte: Elaboração própria.

Fonte: Elaboração própria.

Fonte: Elaboração própria.

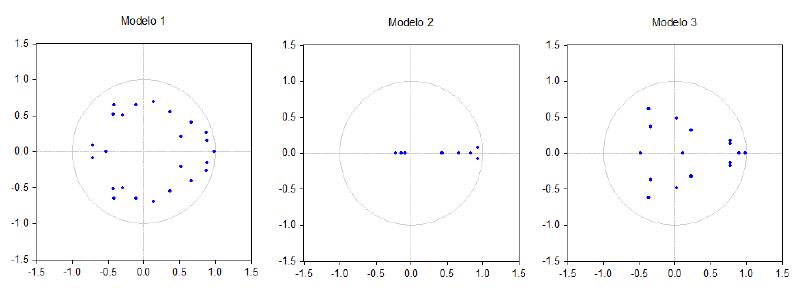

Fonte: Elaboração própria.

Fonte: Elaboração própria.

Fonte: Elaboração própria.

Fonte: Elaboração própria.

Fonte: Elaboração própria.

Fonte: Elaboração própria.