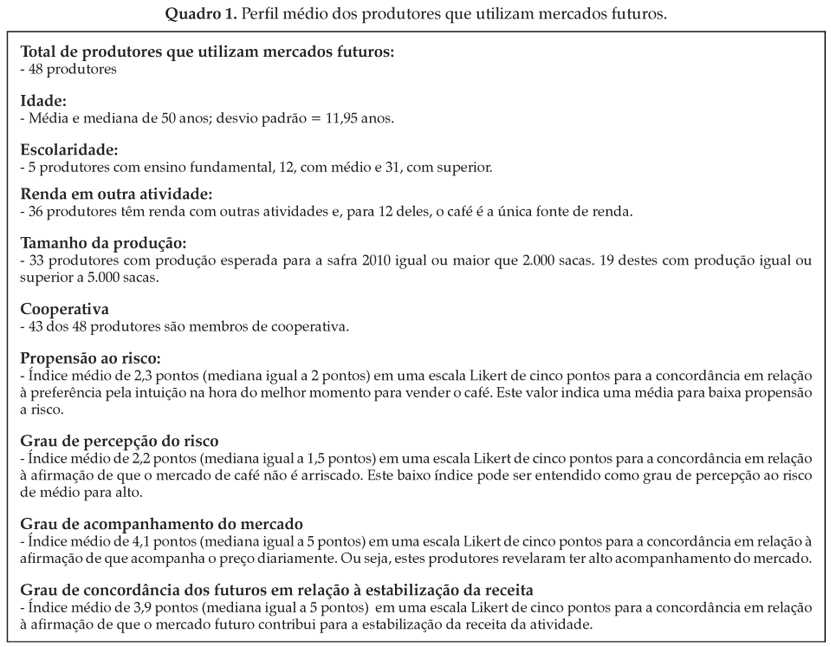

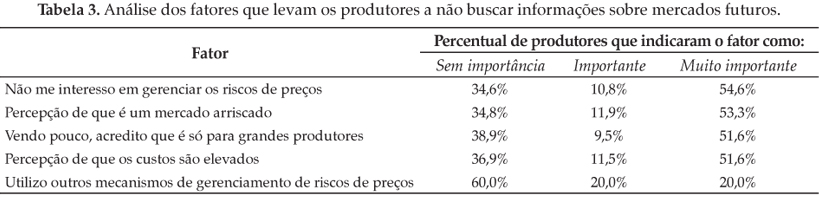

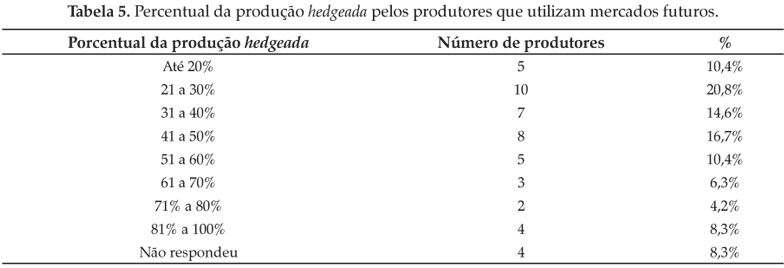

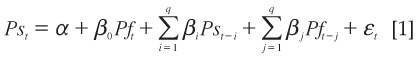

Brazilian coffee farmers use future markets in a very restricted way, which does not follow the high optimal hedge ratio observed in minimum variance models. Reasons for the low use are associated to producers and their business characteristics, their preferences about risk management tool and behavioral attitudes. In this context, the aim of this study was to examine the main factors which influence derivatives use among Brazilian coffee growers. Initially, the optimal hedge ratio was calculated with Myers and Thompson (1989) method, considering BM&FBOVESPA and ICE Futures (New York) markets. The ratio had values higher than 50%. After that, through surveys with 373 coffee farmers, it was observed that only 12.9% of the sample reported knowing and using futures as a way to manage the price risk. The hedge ratio adopted by farmers, on average, was below 50%. In a third step, a logit model was applied for data. Most important factors which explain the use of future contracts by coffee growers were risk aversion, size of production, level of understanding about future contracts and the level which farmers understand that future contracts enable the decrease of revenue fluctuation.

Future market; arabica coffee; risk management

Uma análise da gestão de risco de preço por parte dos produtores de café arábica no Brasil

Uma análise da gestão de risco de preço por parte dos produtores de café arábica no Brasil