Abstract:

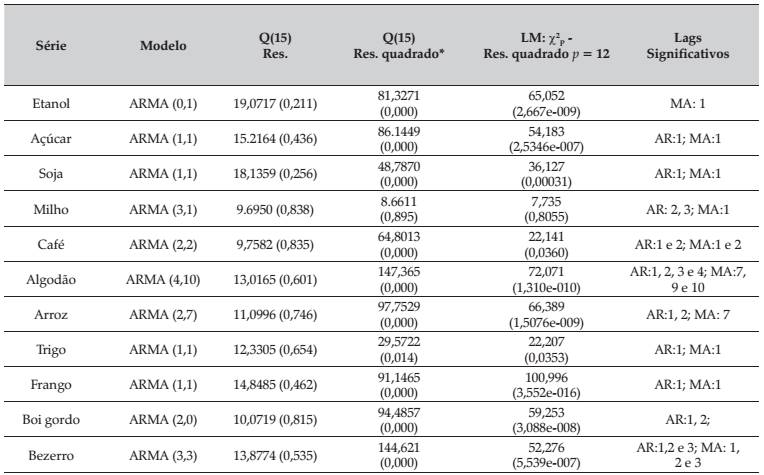

This research analyzed (2005-2013) persistence, leverage and unconditional variance Agricultural-commodities 4 return. Therefore, we resorted to APARCH model. Estimates pointed out that leverage was not confirmed in these series; conditional variance was asymmetric in ethanol, coffee, cotton, cattle and calf's return; the most intense volatilities, although converging to its historical averages, happened to sugar, soybean, coffee, wheat, poultry and cattle; the largest unconditional volatilities were on ethanol, poultry, cotton, soybean and sugar returns.

Key-words:

Leverage effect; ARCH model; Agriculture series; Asymmetric power.

Volatilidade dos Retornos de Commodities Agropecuárias Brasileiras: um teste utilizando o modelo APARCH

Volatilidade dos Retornos de Commodities Agropecuárias Brasileiras: um teste utilizando o modelo APARCH Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail