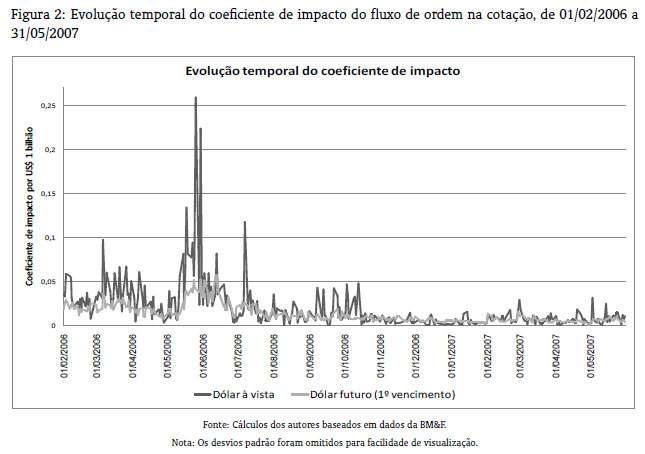

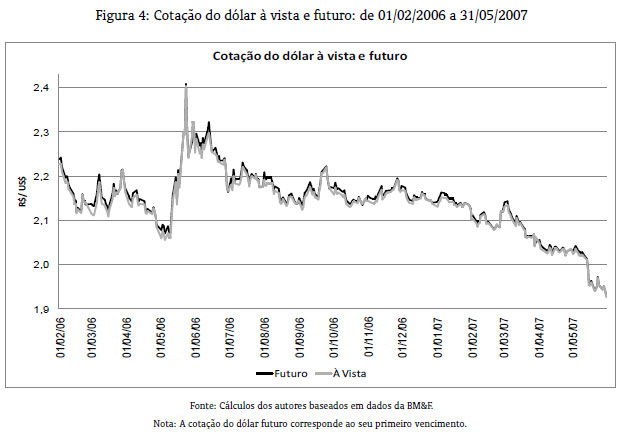

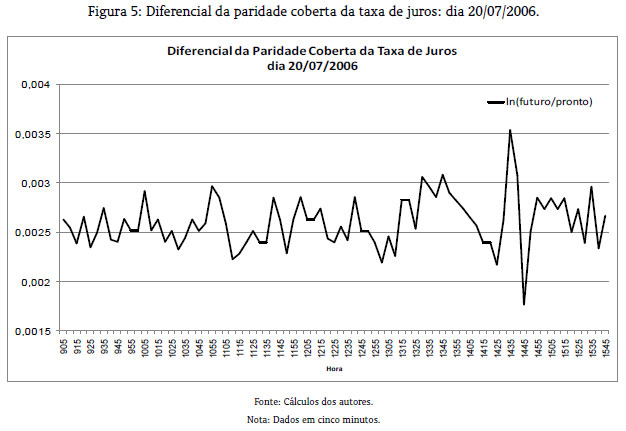

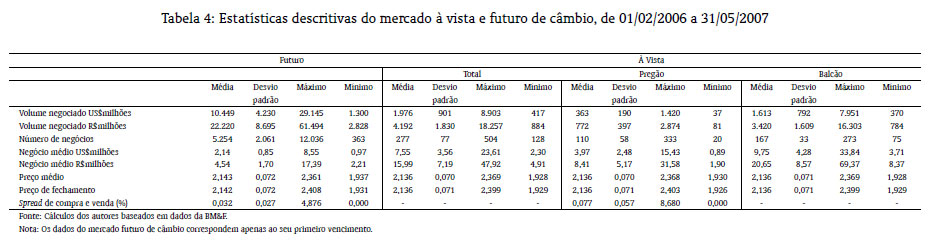

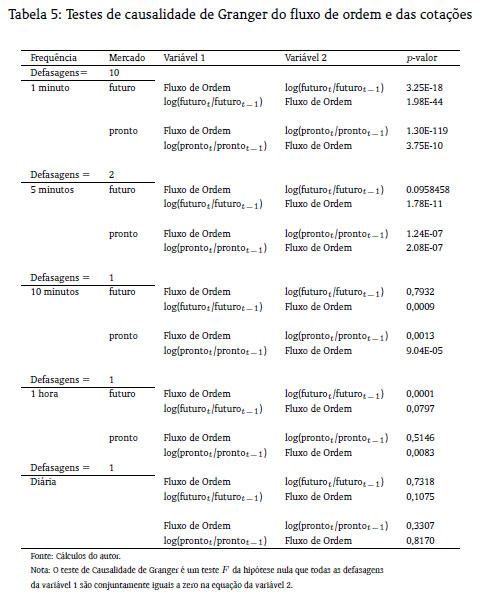

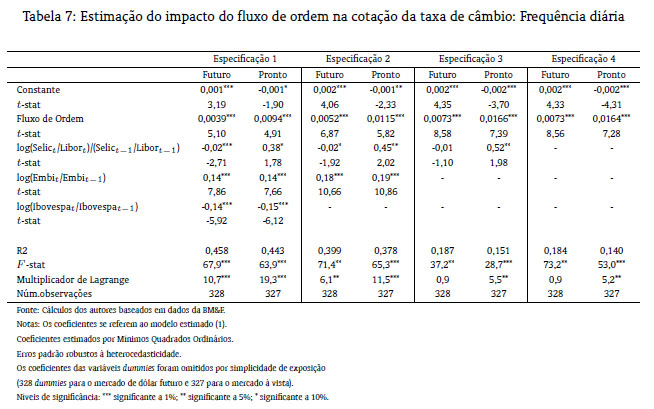

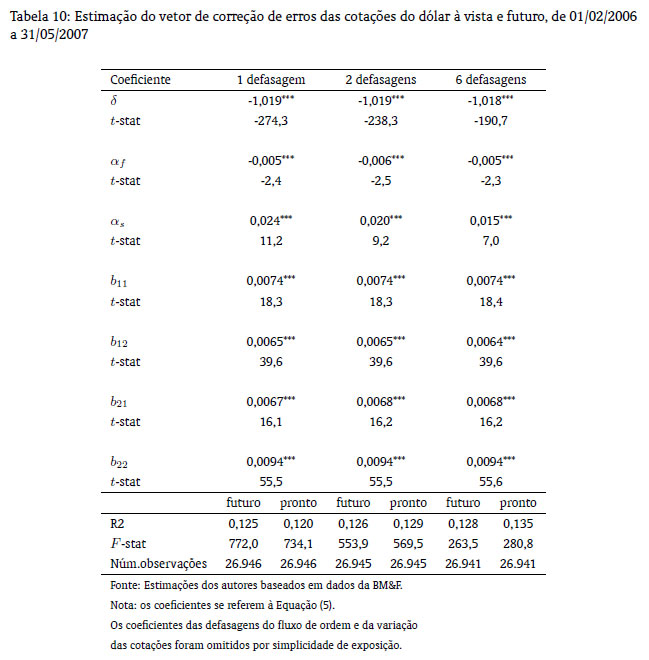

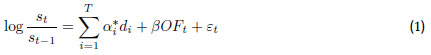

Com base na nova literatura de microestrutura de mercados, comparamos os dois principais mercados cambiais no Brasil - o mercado à vista e o mercado futuro de curta maturidade - buscando identificar em qual dos mercados se dá a formação da taxa de câmbio. Analisa-se o funcionamento do mercado cambial no seu nível micro, isto é, nas suas instituições e nas assimetrias entre seus participantes, através da abordagem da microestrutura de mercados. Utiliza-se uma base de dados inédita que contém 100% das propostas de compra, venda e dos negócios fechados dos pregões de dólar futuro e do mercado interbancário de dólar à vista entre 01/02/2006 a 31/05/2007. Mostra-se que o mercado de dólar futuro é muito mais líquido do que o mercado à vista no Brasil. Demonstra-se também que a cotação da taxa de câmbio se forma primeiro no mercado futuro, sendo então transmitida por arbitragem para o mercado à vista. Assim sendo, os mercados cambiais no Brasil possuem uma configuração absolutamente atípica no mundo. Breve análise histórica do desenvolvimento do mercado de câmbio explica por que tal idiossincrasia desenvolveu-se no Brasil.

Mercado Futuro de Taxa de Câmbio; Microestrutura da Taxa Câmbio; Mercados de Câmbio no Brasil