Abstract

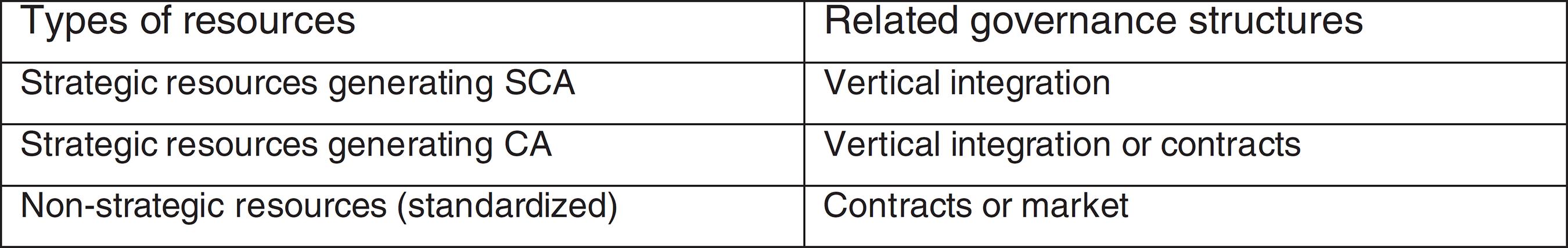

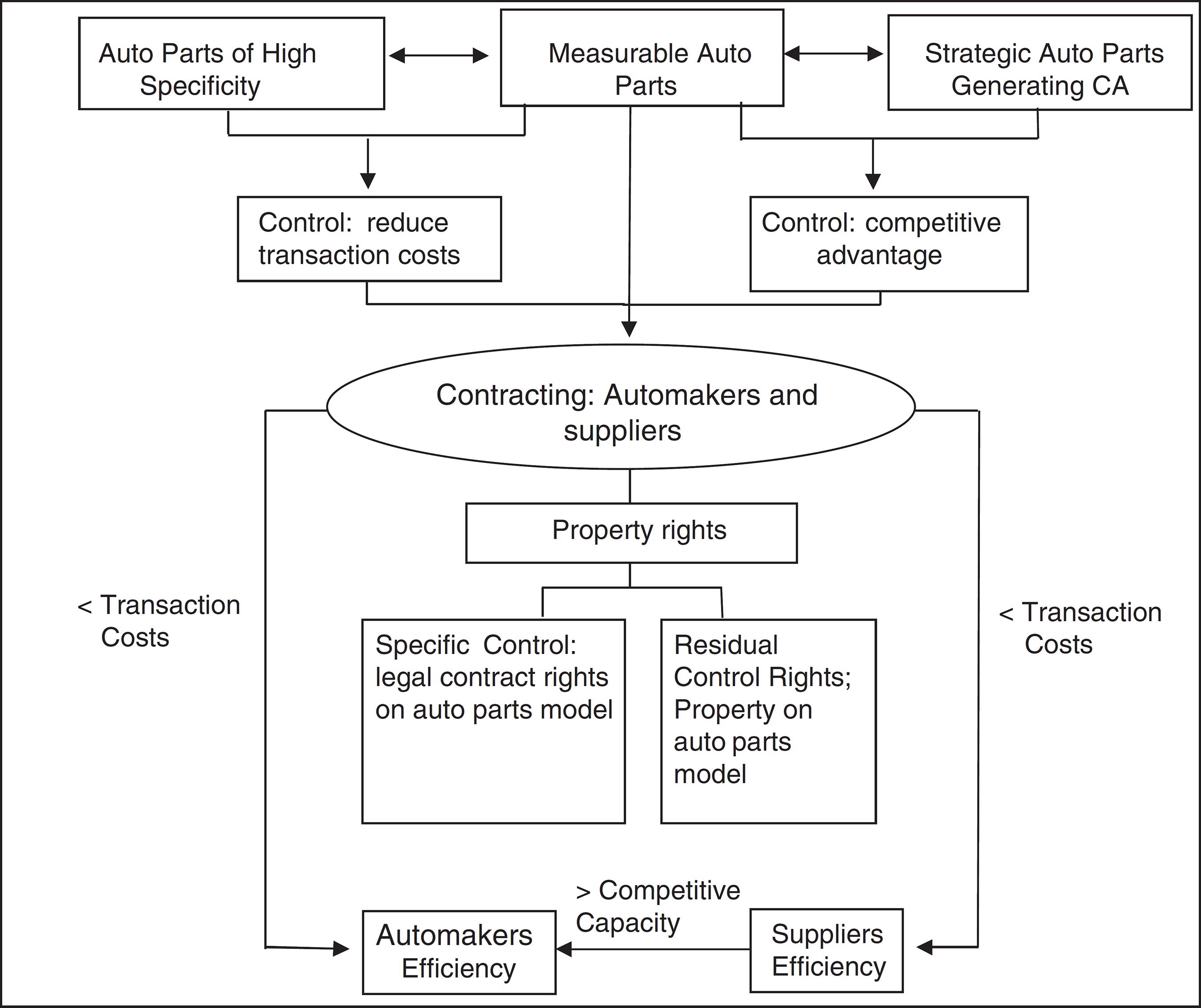

The aim of the present study is to understand contractual relations through the complementarity of the Transaction Costs Theory, Measurement Costs Theory, and the Resource-Based View. Initially, we sought to define an analytical model appropriate to the complementarity objective, considering the categories of each approach. The proposition was: given the possibility of measuring the attributes of products, the contractual relationship can be used to guarantee property rights over assets of high specificity and strategic value, avoiding the costs of vertical integration. Secondly, a qualitative descriptive cross-cut (2014 and 2015) study was carried out. In this phase, the complementarity proposition was analyzed based on data obtained through semi-structured interviews with logistics, production, and purchasing managers of automakers located in the state of Paraná, and some of their direct suppliers. Our proposition indicates that when there is the possibility of measuring product attributes, the contractual relationship can be used to secure property rights of high-specificity assets and strategic resources, avoiding the costs of vertical integration. This proposition was verified because, in the case of high-specificity auto parts, the measurability of their dimensions ensures protection of specific and residual property rights. In the case of strategic resources, when there is a possibility of measurement and control, contracting is allowed, even including the acquisition of innovations that bring competitive advantage (Bluetooth, integrated GPS with SD card, back-up sensor, air bags). It was observed that, even though competitive advantages constitute valuable and rare resources for automakers at their launch, this did not prevent contracting. Verification can offer an alternative path to rational Transaction Costs Theory, as proposed by Williamson, and the use of vertical integration as a form of controlling strategic resources, recommended by the Resource-Based View, which still requires further studies in order to overcome persistent limitations in the model.

Keywords:

Contracts; Measurement attributes; Specific assets; Resources and strategic capabilities; Automakers

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.