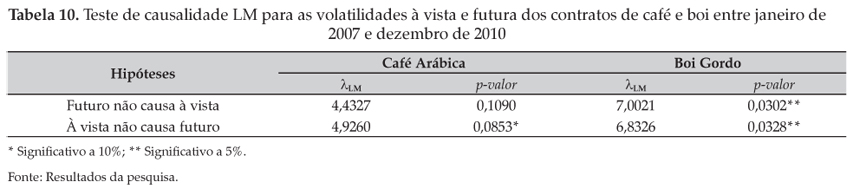

Além de fatores conjunturais da economia mundial e estruturais relativos à oferta e demanda global por commodities, aponta-se que o movimento altista dos preços destes produtos na década de 2000 pode também ser explicado pelo maior contágio dos derivativos nos seus respectivos mercados à vista. Argumenta-se ainda que esses papéis contribuíram para a elevação da volatilidade das cotações spot. Neste contexto, este artigo avaliou a influência das negociações e da volatilidade dos preços futuros sobre a volatilidade dos preços à vista nos mercados de café arábica e de boi gordo no Brasil. Realizaram-se testes de causalidade de Granger, decomposição da variância do erro de previsão, considerando modelos VAR, além de testes de causalidade na variância, baseados na função de correlação cruzada e no multiplicador de Lagrange. Os resultados mostraram que, em geral, variações não esperadas do volume de negociação e variabilidade dos preços futuros alteraram o padrão de volatilidade dos respectivos mercados spot.

Mercados futuros; commodities; volatilidade; causalidade