Abstract

Latin American countries have undergone a growing interest in international accounting standards. Several countries are making progress in the adoption of international standards driven by different internal factors as well as external dynamics. The role of experts in the design of public policies associated with international standards has been studied by the epistemic community theory, which is the theoretical framework used in this study to address the influence of different international organizations on the adoption of IPSAS in Brazil and Colombia. This paper discusses the isomorphic institutional pressure exerted over the governments of these two countries in order to meet an international standard considered to be adequate. Meanwhile, the emerging trend towards the adoption of IPSAS in Latin America continues to grow, although some obstacles to achieving the goals defined in the reform arise.

Keywords:

public sector accounting reform; IPSAS adoption; epistemic communities

Resumen

Los países de América Latina han experimentado un creciente interés por las normas internacionales de contabilidad. Varios países están avanzando en la adopción de estándares internacionales, impulsados por diferentes factores internos y dinámicas externas. El papel de los expertos en la definición y recomendación de las políticas públicas asociadas con los estándares internacionales ha sido estudiado por la teoría de las comunidades epistémicas. El artículo retoma este marco teórico para abordar la influencia de diferentes organismos internacionales en la adopción de IPSAS en Brasil y Colombia. Discute la presión institucional isomórfica sobre los gobiernos de estos dos países para converger a un estándar internacional que es visto como adecuado. La tendencia emergente hacia la adopción de IPSAS en los países latinoamericanos crece, aunque existen importantes obstáculos para alcanzar las metas definidas en la reforma.

Palabras clave:

reforma contable del sector público; adopción de IPSAS; comunidades epistémicas

Resumo

Os países da América Latina têm experimentado um crescente interesse pelas normas internacionais de contabilidade. Vários países estão avançando na adoção de padrões internacionais, impulsionados por diferentes fatores internos e dinâmicas externas. O papel dos especialistas na definição e recomendação de políticas públicas associadas a padrões internacionais tem sido estudado pela teoria de comunidades epistêmicas. O artigo retoma este arcabouço teórico para abordar a influência de diferentes organizações internacionais na adoção das IPSAS no Brasil e na Colômbia. Discute a pressão institucional isomórfica sobre os governos desses dois países para convergir para um padrão internacional considerado adequado. A tendência emergente para a adoção de IPSAS nos países da América Latina está crescendo, embora existam obstáculos significativos para alcançar as metas definidas na reforma.

Palavras-chave:

reforma contábil do setor público; adoção de IPSAS; comunidade epistêmica

1. INTRODUCTION

New Public Management has become the prevailing doctrine for public sector reforms during the last 30 years. These reforms cover different systems, including public financial management and accounting. The use of accounting techniques from the private sector applied to public sector entities under International Public Sector Accounting Standards (IPSAS) can be a challenging endeavor (Timoshenko & Adhikari, 2010Timoshenko, K., & Adhikari, P. (2010). A two-country comparison of public sector accounting reforms: same ideas, different paths? Journal of Public Budgeting, Accounting & Financial Management, 22(4), 449-486. Retrieved from https://doi.org/10.1108/JPBAFM-22-04-2010-B001

https://doi.org/10.1108/JPBAFM-22-04-201...

), which entails not only efforts by public sector governments regarding changing processes and practices, but also strategies by professional bodies and multilateral agencies to make the process work.

Specialized literature describes the adoption of international accounting techniques by public entities as a symbolic resource by governments looking for external legitimacy (Rahaman & Lawrence, 2001Rahaman, A. S., & Lawrence, S. (2001). A negotiated order perspective on public sector accounting and financial control. Accounting, Auditing & Accountability Journal, 14(2), 147-65. Retrieved fromhttps://doi.org/10.1108/09513570110389297

https://doi.org/10.1108/0951357011038929...

; Uddin & Hopper, 2001Uddin, S., & Hopper, T. (2001). A Bangladesh soap opera: privatisation, accounting and regimes of control in a less developed country. Accounting, Organizations and Society, 26(7-8), 643-72. Retrieved from https://doi.org/10.1016/S0361-3682(01)00019-8

https://doi.org/10.1016/S0361-3682(01)00...

) or, in other cases, as an attempt to obtain resources from international agencies for implementing public reforms (Adhikari & Mellemvik, 2011Adhikari, P., & Mellemvik, F. (2011). The rise and fall of accruals: a case of Nepalese central government. Journal of Accounting in Emerging Economies, 1(2), 123-143. Retrieved from https://doi.org/10.1108/20421161111138495

https://doi.org/10.1108/2042116111113849...

). Technical ambiguities, diversity in its application, transition costs, and scarce accrual accounting by some public actors are constantly pointed by academics, practitioners and professional accountants as restraints for IPSAS implementation (Caperchione, Salvatori & Benghi, 2014Caperchione, E., Salvatori, F., & Benghi, E. (2014). New development: where there’s will, there’s a way-acting beyond cutbacks. Public Money & Management, 34(2), 135-138. Retrieved from https://doi.org/10.1080/09540962.2014.887546

https://doi.org/10.1080/09540962.2014.88...

).

Despite the above, some studies have tried to understand the reasons for European countries to consider the adoption of IPSAS for the accrual accounting systems of central governments and, in a later approach, the different levels of adoption (Christiaens, Reyniers, & Rolle, 2010Christiaens, J., Reyniers, B., & Rolle, C. (2010). Impact of IPSAS on reforming governmental financial information systems: A comparative study. International Review of Administrative Sciences, 76(3), 537-554. Retrieved fromhttps://doi.org/10.1177/0020852310372449

https://doi.org/10.1177/0020852310372449...

; Christiaens, Vanhee, Manes-Rossi, Aversano, & van Cauwenberge, 2015). Such studies identified that some governments believe that the adoption of IPSAS would improve the comparability of financial information, both nationally and internationally. In addition, they found most jurisdictions do not choose to apply IPSAS because they fear losing their standard-setting authority or have chosen to implement their own business accrual accounting regulations (Christiaens et al., 2010Christiaens, J., Reyniers, B., & Rolle, C. (2010). Impact of IPSAS on reforming governmental financial information systems: A comparative study. International Review of Administrative Sciences, 76(3), 537-554. Retrieved fromhttps://doi.org/10.1177/0020852310372449

https://doi.org/10.1177/0020852310372449...

, 2015Christiaens, J., Vanhee, C., Manes-Rossi, F., Aversano, N., & van Cauwenberge, P. (2015). The effect of IPSAS on reforming governmental financial reporting: an international comparison. International Review of Administrative Sciences, 8(1), 158-177. Retrieved from https://doi.org/10.1177/0020852314546580

https://doi.org/10.1177/0020852314546580...

). In this context, European Union has been developing the European Public Sector Accounting Standards, EPSAS1

1

Retrieved from https://www.epsas.eu/en/

(Brusca & Gómez-Villegas, 2013Brusca, I., Montesinos, V., & Chow, D. S. L. (2013) Legitimating International Public Sector Accounting Standards (IPSAS): the case of Spain. Public Money & Management, 33(6), 437-444. Retrieved fromhttps://doi.org/10.1080/09540962.2013.836006

https://doi.org/10.1080/09540962.2013.83...

; Brusca, Caperchione, Cohen, & Manes-Rossi, 2015Caperchione, E. (2015). Standard Setting in the Public Sector: State of Art. In I. Brusca, E. Caperchione, S. Cohen, & F. Manes-Rossi (Eds.), Public sector accounting and auditing in Europe (pp. 1-11). London, England: Palgrave MacMillan.).

In Latin America, many public administration reforms are currently in progress, including IPSAS implementation (Araya-Leandro, Caba-Pérez, & López-Hernández, 2016Araya-Leandro, C., Caba-Pérez, M. D. C., & López-Hernández, A. M. (2016). The convergence of the Central American countries to International Accounting Standards. Revista de Administração Pública, 50(2), 265-283. Retrieved from http://www.scielo.br/pdf/rap/v50n2/0034-7612-rap-50-02-00265.pdf

http://www.scielo.br/pdf/rap/v50n2/0034-...

; Brusca, Gómez-Villegas, & Montesinos, 2016Brusca, I., Gómez-Villegas, M., & Montesinos, V. (2016). Public Financial Management Reforms: IPSAS Role in Latin-America. Public Administration and Development, 36(1), 51-64. Retrieved from https://doi.org/10.1002/pad.1747

https://doi.org/10.1002/pad.1747...

; Gómez-Villegas & Montesinos, 2012Gómez-Villegas, M., & Montesinos, J. V. (2012). Las Innovaciones en Contabilidad Gubernamental en Latinoamérica: el caso de Colombia. INNOVAR. Revista de Ciencias Administrativas y Sociales, 22(45), 17-35. Retrieved from https://www.redalyc.org/pdf/818/81824864003.pdf

https://www.redalyc.org/pdf/818/81824864...

). International and multilateral agencies, such as the World Bank or the Inter-American Development Bank, can influence accounting reforms. These organizations have broad experience in public reforms, count with experts in the implementation and design of IPSAS, and have been involved in the design and execution of standards for financial reporting by governments (Adhikari, Kuruppu, & Matilal, 2013Adhikari, P., Kuruppu, C., & Matilal, S. (2013). Dissemination and institutionalization of public sector accounting reforms in less developed countries: a comparative study of the Nepalese and Sri Lankan central governments. Accounting Forum, 37(3), 213-230. Retrieved from https://doi.org/10.1016/j.accfor.2013.01.001

https://doi.org/10.1016/j.accfor.2013.01...

; Brusca et al., 2016Christensen, M. (2006). On Public Sector Accounting Change: Epistemic Communities, Consultants, Naive Officials and a Reply to Humphrey. European Accounting Review, 15(2), 289-296. Retrieved from https://doi.org/10.1080/09638180600551544

https://doi.org/10.1080/0963818060055154...

). Therefore, they can function as an epistemic community spreading innovation, converting ideas, perceptions and beliefs, and creating opportunities for change to occur. From diffusion theory, an epistemic community is “…a network of professionals with recognized expertise in a particular field and an authoritative claim to knowledge of rulemaking in this area” (Haas, 1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144...

, p. 3). Thus, acting as carries of ideas in accounting standard-setting and financialization (Himick & Brivot, 2018Himick, D., & Brivot, M. (2018). Carriers of ideas in accounting standard-setting and financialization: The role of epistemic communities. Accounting, Organizations & Society, 66, 29-44. Retrieved from https://doi.org/10.1016/j.aos.2017.12.003

https://doi.org/10.1016/j.aos.2017.12.00...

), their influence as reform drivers is reinforced (Laughlin & Pallot, 1998Laughlin, R., & Pallot, J. (1998). Trends, patterns and influencing factors: Some reflections. Global Warning! In O. Olson, J. Guthrie, & C. Humphrey (Eds.), Debating International Developments in New Public Financial Management (pp. 376-397). Oslo, Norway: Cappelen Akademisk Forlag.).

Diffusion theory has provided some comprehensive insights into public sector accounting reforms in prior works. Several comparative studies in public sector accounting were focused on ongoing reforms by OECD nations, particularly in Anglo-Saxon countries (e.g. Benito, Brusca, & Montesinos, 2007Benito, B., Brusca, I., & Montesinos, V. (2007). The harmonization of government financial information systems: the role of the IPSAS. International Review of Administrative Science, 73, 293-317. Retrieved from https://doi.org/10.1177/0020852307078424

https://doi.org/10.1177/0020852307078424...

; Brusca, Montesinos, & Chow, 2013Christensen, M. (2006). On Public Sector Accounting Change: Epistemic Communities, Consultants, Naive Officials and a Reply to Humphrey. European Accounting Review, 15(2), 289-296. Retrieved from https://doi.org/10.1080/09638180600551544

https://doi.org/10.1080/0963818060055154...

). In contrast, there is a lack of similar studies that explain how public sector reforms are initiated and disseminated in Latin America, and that allow to understand the challenges in their implementation (Araya-Leandro et al., 2016Araya-Leandro, C., Caba-Pérez, M. D. C., & López-Hernández, A. M. (2016). The convergence of the Central American countries to International Accounting Standards. Revista de Administração Pública, 50(2), 265-283. Retrieved from http://www.scielo.br/pdf/rap/v50n2/0034-7612-rap-50-02-00265.pdf

http://www.scielo.br/pdf/rap/v50n2/0034-...

; Brusca et al., 2016Christensen, M. (2006). On Public Sector Accounting Change: Epistemic Communities, Consultants, Naive Officials and a Reply to Humphrey. European Accounting Review, 15(2), 289-296. Retrieved from https://doi.org/10.1080/09638180600551544

https://doi.org/10.1080/0963818060055154...

; Gómez-Villegas & Montesinos, 2012Gómez-Villegas, M., & Montesinos, J. V. (2012). Las Innovaciones en Contabilidad Gubernamental en Latinoamérica: el caso de Colombia. INNOVAR. Revista de Ciencias Administrativas y Sociales, 22(45), 17-35. Retrieved from https://www.redalyc.org/pdf/818/81824864003.pdf

https://www.redalyc.org/pdf/818/81824864...

).

This work attempts to fill the gap just mentioned by presenting the experience of two Latin American countries in the implementation of public sector accounting reforms, mainly accrual accounting and IPSAS. Using Colombia and Brazil as case studies, this paper aims at contributing to the growing body of comparative research on the topic by presenting a two-country comparison of public sector accounting reforms; especially in countries with different policy organization structures and diverse cultural backgrounds, all of which may have a direct impact on the articulation of public sector accounting reforms.

Differences in selected countries can lead to substantially different trajectories of reforms (Hyndman et al., 2013Hyndman, N., Liguori, M., Meyer, R., Polzer, T., Rota, S., & Seiwald, J. (2013). The translation and sedimentation of accounting reforms: a comparison of the UK, Austrian and Italian experiences. Critical Perspectives on Accounting, 25(4-5), 388-408. Retrieved from https://doi.org/10.1016/j.cpa.2013.05.008

https://doi.org/10.1016/j.cpa.2013.05.00...

). In doing so, our goal is to assist an enhanced understanding of the diversity in specific settings. We do not intend to provide a definitive description of public sector accounting reforms in Latin America. The objective of this study is to identify the underlying factors that led two so-called emerging economies (Colombia and Brazil) to the decision of adopting IPSAS. For this, two questions guide our work: How do international and multilateral agencies affect the decision of adopting IPSAS? What similarities and differences are there between the two developing countries and the adoption of accrual accounting (IPSAS based) under an epistemic influence?

After this introduction, the paper is organized as follows. The second section summarizes the convergence process towards IPSAS. The third section presents the theoretical framework of epistemic communities and the new institutionalism, which support the interpretation of the process of IPSAS adoption in Latin America. Then, in the fourth section we outline the methodological elements used to address the cases of Brazil and Colombia. The results of the interviews and the institutional document analysis are presented and discussed in the fifth section. The last section presents some conclusions of this study.

2. INTERNATIONAL CONVERGENCE PROCESS TO IPSAS

In terms of content, most IPSAS are based on a corresponding International Financial Reporting Standard (IFRS) or International Accounting Standard (IAS). IFRS/IAS are primarily designed for enterprises - and not for public sector entities -, which explains why they had to be adjusted to public sector characteristics. Hence, IPSAS are designed to be used by public sector entities (e.g. state government, municipal government), being the International Public Sector Accounting Standards Board (IPSASB), a private body within IFAC, the standard-setter.

One major issue of IPSAS is their primarily focus on accounting (e.g. ex-post financial reporting). However, public financial management reforms require of accrual-based accounting and budgeting. In the public sector the annual budget is generally one of the most important financial governance instruments (Bergmann, 2009Bergmann, A. (2009). Public Sector Financial Management. London, England: FT Prentice Hall.). However, in most countries budget is still made from the cash basis, a situation that may cause some difficulties in implementing the use of IPSAS, especially in countries where budgeting is an essential tool for political decision-making (Monteiro & Gomes, 2013Monteiro, B. R. P., & Gomes, R. C. (2013). International experiences with accrual budgeting in the public sector. Revista Contabilidade & Finanças, 24(62), 103-112. Retrieved from https://doi.org/10.1590/S1519-70772013000200002

https://doi.org/10.1590/S1519-7077201300...

).

The implementation of accrual accounting in public sector could be considered an innovation, since it allows generating financial statements with more informative content (Gómez-Villegas & Montesinos, 2012Gómez-Villegas, M., & Montesinos, J. V. (2012). Las Innovaciones en Contabilidad Gubernamental en Latinoamérica: el caso de Colombia. INNOVAR. Revista de Ciencias Administrativas y Sociales, 22(45), 17-35. Retrieved from https://www.redalyc.org/pdf/818/81824864003.pdf

https://www.redalyc.org/pdf/818/81824864...

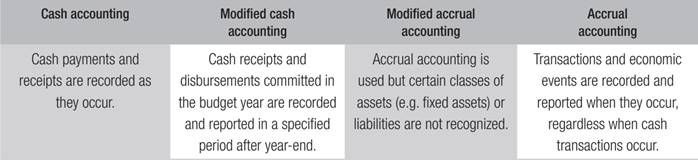

). The transition from cash accounting to accrual accounting would then allow recording the economic effects of the application of public resources through spending and investment. It would also allow the recognition of present obligations in public entities and public ownership. The different bases in governmental accounting are summarized in Box 1.

Some of the key players within the public sector regulatory field are international organizations that support business-like accounting models as the IPSAS, such as the European Commission, the Organization for Economic Co-operation and Development (OECD), the World Bank (WB) and the International Monetary Fund (IMF International Monetary Fund. (2014). The Fiscal Transparency Code. Washington, DC: IMF. Retrieved from http://www.imf.org/external/np/fad/trans/

http://www.imf.org/external/np/fad/trans...

). Several of them are IPSASB observers. This model is promoted to fight against corruption and mismanagement and enhance transparency and accountability. WB and IMF attempt explicitly to influence accounting systems of governments who are “recipients of their loans and grants” (Jones, 2007Jones, H. (2007). The functions of governmental accounting in Europe. Tékhne: Revista de Estudos Politécnicos, 4(7), 89-110. Retrieved from http://www.scielo.mec.pt/pdf/tek/n7/v4n7a04.pdf

http://www.scielo.mec.pt/pdf/tek/n7/v4n7...

).

Adoption of IPSAS by governmental organizations is considered to improve both the quality and compatibility of financial information provided by public sector bodies (Brusca et al., 2013Brusca, I., & Gómez-Villegas, M. (2013). Hacia la Armonización de la Contabilidad Pública en Europa: Las Normas Europeas de Contabilidad Pública. Revista Española de Control Externo, 15(44), 91-111. Retrieved fromhttps://dialnet.unirioja.es/descarga/articulo/5255524.pdf

https://dialnet.unirioja.es/descarga/art...

). Following this, the accrual-basis began to be adopted by other governments in a project of convergence with international standards. Thus, some international organizations, such as the OECD2

2

Retrieved from https://www.oecd.org/about/budget/financial-statements.htm

and the North Atlantic Treaty Organization (NATO)3

3

Retrieved from https://www.nato.int/nato_static_fl2014/assets/pdf/pdf_2016_04/20160509_160429-accounting-framework.pdf

, have already adopted IPSAS to prepare their financial statements (Benito et al., 2007Benito, B., Brusca, I., & Montesinos, V. (2007). The harmonization of government financial information systems: the role of the IPSAS. International Review of Administrative Science, 73, 293-317. Retrieved from https://doi.org/10.1177/0020852307078424

https://doi.org/10.1177/0020852307078424...

; Brusca et al., 2016Brusca, I., Montesinos, V., & Chow, D. S. L. (2013) Legitimating International Public Sector Accounting Standards (IPSAS): the case of Spain. Public Money & Management, 33(6), 437-444. Retrieved fromhttps://doi.org/10.1080/09540962.2013.836006

https://doi.org/10.1080/09540962.2013.83...

), while others, such as the IMF, the WB and the Inter-American Development Bank (IDB), have proposed different governments to adopt or adapt their standards to the IPSAS model (Chang, Chen, & Chow, 2008Chang, C. J., Chen, G., & Chow, C. W. (2008). Exploring the desirability and feasibility of reforming China’s governmental accounting system. Journal Public Budgeting, Accounting & Financial Management, 20(4), 482-510. Retrieved from https://doi.org/10.1108/JPBAFM-20-04-2008-B006

https://doi.org/10.1108/JPBAFM-20-04-200...

). In the same way, the IMF adopted the accrual basis for Government Finance Statistics (GFS) in 2001.

Some studies revealed an important shift to accrual accounting, especially IPSAS, in several countries, although there is still a level of resistance among central governments (e.g. the Nordic countries), and discrepancies among European countries (Christiaens et al., 2015Christiaens, J., Vanhee, C., Manes-Rossi, F., Aversano, N., & van Cauwenberge, P. (2015). The effect of IPSAS on reforming governmental financial reporting: an international comparison. International Review of Administrative Sciences, 8(1), 158-177. Retrieved from https://doi.org/10.1177/0020852314546580

https://doi.org/10.1177/0020852314546580...

). It was also stated that Anglo Saxon countries show a high level of homogeneity in adopting accrual accounting model and IPSAS (Christiaens et al., 2015Christensen, M. (2006). On Public Sector Accounting Change: Epistemic Communities, Consultants, Naive Officials and a Reply to Humphrey. European Accounting Review, 15(2), 289-296. Retrieved from https://doi.org/10.1080/09638180600551544

https://doi.org/10.1080/0963818060055154...

). Other works found that the lack of homogeneity was higher among European countries (Benito et al., 2007Benito, B., Brusca, I., & Montesinos, V. (2007). The harmonization of government financial information systems: the role of the IPSAS. International Review of Administrative Science, 73, 293-317. Retrieved from https://doi.org/10.1177/0020852307078424

https://doi.org/10.1177/0020852307078424...

). We could say that some of the reasons for this difference is that continental European countries have a strong legal-code tradition and a long-stand tradition on budgetary and cash accounting (Grossi & Steccolini, 2015Grossi, G., & Steccolini, I. (2015). Pursuing private or public accountability in the public sector: Applying IPSAS to define the reporting entity in municipal consolidation. International Journal of Public Administration, 38(4), 325-334. Retrieved fromhttps://doi.org/10.1080/01900692.2015.1001239

https://doi.org/10.1080/01900692.2015.10...

). Therefore, difficulties in the implementation of IPSAS and the heterogeneity of the European context led to creation of regional accounting standards (EPSAS); although based on IPSAS (Caperchione, 2015Caperchione, E. (2015). Standard Setting in the Public Sector: State of Art. In I. Brusca, E. Caperchione, S. Cohen, & F. Manes-Rossi (Eds.), Public sector accounting and auditing in Europe (pp. 1-11). London, England: Palgrave MacMillan.).

3. THEORETICAL SOURCES FOR RESEARCH

In order to achieve our goal, the theoretical arguments of the epistemic communities and the new sociological institutionalism are retaken.

3.1 Framing epistemic communities

The political character in the creation of accounting standards is quite accepted, along with the fact that the different alternatives considered when adopting standards are not hierarchical but depend on the objectives assigned to the accounting system and the accounting information. Adopting an accounting standard may have significant economic consequences for a society, considering these standards are not neutral and their development is considered as a public interest matter (Chiapello & Medjad, 2009Chiapello, E., & Medjad, K. (2009). An unprecedented privatisation of mandatory standard-setting: The case of European accounting policy. Critical Perspectives on Accounting, 20(4), 448-468. Retrieved fromhttps://doi.org/10.1016/j.cpa.2008.09.002

https://doi.org/10.1016/j.cpa.2008.09.00...

). Because of this, standard-setters must deal with stakeholders who are affected by the produced rules, and often consulted during the process. Some studies in the field of public policy development have emphasized the use of experts (Haas, 1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144...

; Janis & Mann, 1977Janis, I. L., & Mann, L. (1977). Decision-making: a psychological analysis of conflict, choice and commitment. New York, NY: Free Press.) and the desire to involve stakeholders in the process.

In this context, accounting standard setters face the same situation. Colasse (2005Colasse, B. (2005). La régulation comptable entre public et privé. In M. Capron (Ed.), Les normes comptables internationales, instruments du capitalisme financier (pp. 27-48). Paris, France: Éditions la Découverte.) highlights the need for dual legitimacy, both technically and politically. Therefore, the development of accounting standards is a technical and political field as it seeks to address a complex and dynamic field with the mission to satisfy public interests, which makes necessary to approach involved parties and “experts” on the topic. Differences in the structures and legal traditions of the states, common law (Anglo-Saxons) and Roman law (continental Europe), generate complexities in the process of accounting regulation. These two traditions have dissimilar conceptions of the public interest and the due process in their standards-setting (Colasse, 2005Colasse, B. (2005). La régulation comptable entre public et privé. In M. Capron (Ed.), Les normes comptables internationales, instruments du capitalisme financier (pp. 27-48). Paris, France: Éditions la Découverte.;Nobes & Parker, 2008Nobes, C., & Parker, R. (2008). Comparative international accounting. Upper Saddle River, NJ: Prentice Hall.). As an example, in the Anglo-Saxon tradition, known for favoring expertise, the development of accounting standards has traditionally been entrusted to the accounting profession.

3.2 International experts as an epistemic community in accounting standards

The concept of an epistemic community has been particularly mobilized in the field of political science and rule-making (Haas, 1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144...

), as well as in the field of scientific production (Roth, 2008Roth, C. (2008). Réseaux épistémiques: formalizer la cognition distribuée. Sociologie du travail, 50(3), 353-371. Retrieved from https://doi.org/10.1016/j.soctra.2008.06.005

https://doi.org/10.1016/j.soctra.2008.06...

). In both, the notion of group of individuals working on shared values is present, although this work relies primarily on the political science view of this concept and on the work by Haas (1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144...

), where an epistemic community is “…a network of professionals with recognized expertise in a particular field and an authoritative claim to knowledge of rulemaking in this area” (p. 3).

The basis of an epistemic community appears to be the expertise knowledge. However, other elements can portray and distinguish it from other types of expert groups (Haas, 1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144...

). The following two characteristics can be highlighted:

-

The existence of shared values, common beliefs, the same vision of things, a paradigm in the sense of Kuhn (Haas, 1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144... ; Roth, 2008Roth, C. (2008). Réseaux épistémiques: formalizer la cognition distribuée. Sociologie du travail, 50(3), 353-371. Retrieved from https://doi.org/10.1016/j.soctra.2008.06.005

https://doi.org/10.1016/j.soctra.2008.06... ). An epistemic community is “… a sociological group with a common way of thinking” (Haas, 1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144... , p. 3). -

The presence of rules, norms and models of causality that drive the action of its members and defines the objectives of the community and the means to be used to achieve them, and the governing collective behavior within the community “… a set of rules or a code of conduct” (Cohendet, Créplet & Dupouet, 2003Cohendet, P., Créplet, F., & Dupouet, O. (2003). Innovation organisationnelle, communautés de pratique et communautés épistémiques: le cas de Linux. Revue Française de Gestion, 146, 99-121. Retrieved from https://doi.org/10.3166/rfg.146.99-121

https://doi.org/10.3166/rfg.146.99-121... , p. 105).

The concept of epistemic community seems to be flexible in many ways. Initially intended for transnational groups, this concept has been widely applied in political sciences, especially in the field of international relations, attached to the influence in international policy development, coordination and diffusion (Haas, 1992Haas, P. M. (1992). Introduction: epistemic communities and international policy coordination. International Organization, 46(1), 1-35. Retrieved fromhttps://doi.org/10.1017/S0020818300001442

https://doi.org/10.1017/S002081830000144...

).Thus, it lends itself to the study of rule-making at the international level and lies at the intersection of the two currents developed above: the use of experts in the elaboration of standards, on the one hand, and the emergence of new patterns of governance in a context of globalization on the other (Christensen, 2006Christensen, M. (2006). On Public Sector Accounting Change: Epistemic Communities, Consultants, Naive Officials and a Reply to Humphrey. European Accounting Review, 15(2), 289-296. Retrieved from https://doi.org/10.1080/09638180600551544

https://doi.org/10.1080/0963818060055154...

; Christensen, Newberry & Potter, 2010Christiaens, J., Reyniers, B., & Rolle, C. (2010). Impact of IPSAS on reforming governmental financial information systems: A comparative study. International Review of Administrative Sciences, 76(3), 537-554. Retrieved fromhttps://doi.org/10.1177/0020852310372449

https://doi.org/10.1177/0020852310372449...

).

As for the existence of shared values, the great representativeness of the Anglo-Saxon world and the accounting profession (Chiapello & Medjad, 2009Chiapello, E., & Medjad, K. (2009). An unprecedented privatisation of mandatory standard-setting: The case of European accounting policy. Critical Perspectives on Accounting, 20(4), 448-468. Retrieved fromhttps://doi.org/10.1016/j.cpa.2008.09.002

https://doi.org/10.1016/j.cpa.2008.09.00...

; Colasse, 2005Colasse, B. (2005). La régulation comptable entre public et privé. In M. Capron (Ed.), Les normes comptables internationales, instruments du capitalisme financier (pp. 27-48). Paris, France: Éditions la Découverte.) induces our thoughts to the “intellectual and ideological” dependence on the Anglo-Saxon world and the cultural qualification of the members of the Board (Colasse, 2005). We argue that the way of developing standards is based on a series of principles and governance processes (Tamm-Hallström, 2004Tamm-Hallström, K. (2004). Organizing international standardization. ISO and the IASC in quest of authority. Cheltenham, England: Edward Elgar.; IFAC, 2017International Federation of Accountants. (2017). Handbook of International Public Sector Accounting Procurement. (Volume I). New York, NY: IFAC. Retrieved from https://www.ifac.org/system/files/publications/files/IPSASB-HandBook-2018-Volume-1.pdf

https://www.ifac.org/system/files/public...

), among them, some basic principles such as the procedure of formal consultation in force in the bodies of Anglo-Saxon standardization, known as the due-process. Botzem and Quack (2006Botzem, S., & Quack, S. (2006). Contested rules and shifting boundaries: international standard-setting in accounting. In M. L. Djelic, & K. Sahlin-Andersson (Eds.), Transnational governance: Institutional dynamics of regulation (pp. 266-286). Cambridge, UK: Cambridge University Press. Retrieved from https://nbn-resolving.org/urn:nbn:de:0168-ssoar-196742

https://nbn-resolving.org/urn:nbn:de:016...

) identified it as a procedural framework to solve differences in opinions between those who oversee standardization processes. They associate the institutionalization and the legitimacy of this procedure with the emergence of a community of experts at the international level, a community of “shared meaning”, even on the event of disagreements on specific points, which could be solved democratically, since this procedure constitutes a common reference now exported to other countries.

Scholars have debated about the factors driving the adoption of IPSAS (Brusca et al., 2016Brusca, I., Gómez-Villegas, M., & Montesinos, V. (2016). Public Financial Management Reforms: IPSAS Role in Latin-America. Public Administration and Development, 36(1), 51-64. Retrieved from https://doi.org/10.1002/pad.1747

https://doi.org/10.1002/pad.1747...

; Christiaens et al., 2015Christiaens, J., Vanhee, C., Manes-Rossi, F., Aversano, N., & van Cauwenberge, P. (2015). The effect of IPSAS on reforming governmental financial reporting: an international comparison. International Review of Administrative Sciences, 8(1), 158-177. Retrieved from https://doi.org/10.1177/0020852314546580

https://doi.org/10.1177/0020852314546580...

; Gómez-Villegas & Montesinos, 2012Gómez-Villegas, M., & Montesinos, J. V. (2012). Las Innovaciones en Contabilidad Gubernamental en Latinoamérica: el caso de Colombia. INNOVAR. Revista de Ciencias Administrativas y Sociales, 22(45), 17-35. Retrieved from https://www.redalyc.org/pdf/818/81824864003.pdf

https://www.redalyc.org/pdf/818/81824864...

), but a different and yet related question remains: Who is behind the wheels of the International Public Sector Accounting Standards adoption process? A list of actors (or drivers) offers a possible answer to this question: WB, OECD, IMF, IDB, IFAC, or even rating agencies such as transnational communities of experts providing technological solutions, among others.

Epistemic community members possess a prestige that offers them access to the political system that legitimizes or authorizes their actions based on their expertise in a highly valued area by society and/or elite decision-makers, who share not only ideas but also collective policy interests and normative obedience (Irvine, Cooper, & Moerman, 2011Irvine, H. J., Cooper, K., & Moerman, L. (2011). An epistemic community as influencer and implementer in local government accounting in Australia. Financial Accountability and Management, 27(3), 249-271. Retrieved from https://doi.org/10.1111/j.1468-0408.2011.00524.x

https://doi.org/10.1111/j.1468-0408.2011...

). These actions are specific agency acting at the transnational level with an impact in terms of exercising public authority beyond the state, which contributes to processes of public policies changes (Christensen, 2006Christensen, M. (2006). On Public Sector Accounting Change: Epistemic Communities, Consultants, Naive Officials and a Reply to Humphrey. European Accounting Review, 15(2), 289-296. Retrieved from https://doi.org/10.1080/09638180600551544

https://doi.org/10.1080/0963818060055154...

; Christensen et al., 2010Christensen, M., & Skaerbaek, P. (2010). Consultancy outputs and the purification of accounting technologies. Accounting, Organizations and Society, 35, 524-545. Retrieved from https://doi.org/10.1016/j.aos.2009.12.001

https://doi.org/10.1016/j.aos.2009.12.00...

). Working together, they construct the approaches and regulations that settle and reinforce the legitimacy of their ideas. As Madsen and Christensen (2016Madsen, M., & Christensen, M. J. (2016, October 26). Global Actors: Networks, Elites, and Institutions. Oxford Research Encyclopedia of Politics. Retrieved from https://doi.org/10.1093/acrefore/9780190228637.013.9

https://doi.org/10.1093/acrefore/9780190...

) stated, we also stick to the mainstream term “actors”, even implying “agency” in terms of their capacity to engage in social action on the global scenario.

In some cases, an epistemic community is perceived to be arising, as in the case of the transnational regulation of professional services offered by large auditing companies (Suddaby, Cooper, & Greenwood, 2007Suddaby, R., Cooper, D., & Greenwood, R. (2007). Transnational Regulation of Professional Services: Governance Dynamics of Field Level Organizational Change. Accounting Organizations and Society, 32(4-5), 333-62. Retrieved from https://doi.org/10.1016/j.aos.2006.08.002

https://doi.org/10.1016/j.aos.2006.08.00...

). This community operates instrumentally, defining a problem and providing the solution (Laughlin & Pallot, 1998Laughlin, R., & Pallot, J. (1998). Trends, patterns and influencing factors: Some reflections. Global Warning! In O. Olson, J. Guthrie, & C. Humphrey (Eds.), Debating International Developments in New Public Financial Management (pp. 376-397). Oslo, Norway: Cappelen Akademisk Forlag.), thus altering accounting dominance. An epistemic community often operates as implementers of the accounting policies they have been instrumentally operating.

3.3 Neo-Institutional Theory and isomorphic pressures in the countries

According to neo-institutional theory, organizations that occupy a shared sector will eventually begin to duplicate one another because of coercive, normative and mimetic pressures. A key element of institutional theory is the belief “that organizations sharing the same surroundings will employ resembling practices and thus, become isomorphic with each other.” In the classical formulation of isomorphic pressures, DiMaggio and Powell (1983DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147-160. Retrieved from https://doi.org/10.2307/2095101

https://doi.org/10.2307/2095101...

, p. 150) posit that: “(1) coercive isomorphism results from political influence and the problem of legitimacy; (2) mimetic isomorphism stems from standard responses to uncertainty; and (3) normative isomorphism is associated with professionalization.” These epistemic communities are primarily originated from normative isomorphism as a result of professionalization, where similar individuals or organizations assemble and become organized in order to establish, promote and practice cognitive templates to legitimize their activities (DiMaggio & Powell, 1983DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147-160. Retrieved from https://doi.org/10.2307/2095101

https://doi.org/10.2307/2095101...

).

There is important literature documenting isomorphic processes in public sector reforms in developed and developing countries (Adhikari et al., 2013Adhikari, P., Kuruppu, C., & Matilal, S. (2013). Dissemination and institutionalization of public sector accounting reforms in less developed countries: a comparative study of the Nepalese and Sri Lankan central governments. Accounting Forum, 37(3), 213-230. Retrieved from https://doi.org/10.1016/j.accfor.2013.01.001

https://doi.org/10.1016/j.accfor.2013.01...

; Brinkerhoff & Brinkerhoff, 2015Brinkerhoff, D., & Brinkerhoff, J. (2015). Public Sector Management Reform in developing countries: perspectives beyond NPM orthodoxy. Public Administration and Development, 33, 222-237. Retrieved from https://doi.org/10.1002/pad.1739

https://doi.org/10.1002/pad.1739...

; Brusca et al., 2013Brusca, I., Montesinos, V., & Chow, D. S. L. (2013) Legitimating International Public Sector Accounting Standards (IPSAS): the case of Spain. Public Money & Management, 33(6), 437-444. Retrieved fromhttps://doi.org/10.1080/09540962.2013.836006

https://doi.org/10.1080/09540962.2013.83...

; Potter, 2005Potter, B. (2005). Accounting as a Social and Institutional Practice: Perspective to Enrich our Understanding of Accounting Change. Abacus, 41(3), 265-89. Retrieved fromhttps://doi.org/10.1111/j.1467-6281.2005.00182.x

https://doi.org/10.1111/j.1467-6281.2005...

). Isomorphism in the context of IPSAS adoption thus refers to the different factors molding the development of accounting procedures to a similar shape, structure or form. The degree of isomorphic pressure in Latin American countries varies upon their operating environment. We propose that the role of epistemic communities is reinforced, since Latin American governments are requesting and receiving support from consultants and experts from multilateral agencies, thus following an isomorphic process. In addition, many regional consultants reinforce their expertise by participating as reform advisers in different countries.

4. METHODOLOGY

This work assumes a qualitative positioning (Ryan, Scapens, & Theobald, 2002Ryan, B., Scapens, R. W., & Theobald, M. (2002). Research Method and Methodology in Finance and Accounting(2 ed.). Cambridge, MA: Academic Press/Thomson Business Press.) in order to interpret and understand IPSAS adoption process in the region. We carry out an in-depth analysis of different institutional documents, such as reports by governments, national accounting standard-setting bodies, multilateral agencies and professional bodies. Likewise, we conducted structured and semi-structured interviews with key actors in the regulatory processes of the studied countries.

Questionnaire and semi-structured interviews with six key actors engaged in the public sector accounting standards setters of Brazil and Colombia were conducted. Our questionnaire has five items about nature, processes and perceived factors about IPSAS adoption. Interviews took place individually with representatives from the Latin American Government Accounting Forum (Foro de Contadores Gubernamentales de América Latina - FOCAL) in Colombia and Brazil, and IPSASB’s staff in Brasilia (Brazil), during the V Brazilian Seminar on Accounting and Costs Applied to the Public Sector held in April 2018, and through online chat when it was possible. Interviews consisted of questions about the stimuli for and barriers to the reform process of financial management and IPSAS implementation, and the results obtained from the process. Interviews took 45 minutes and were recorded and transcribed. The interpretation of results follows a qualitative methodological approach for these instruments (Ryan et al., 2002Ryan, B., Scapens, R. W., & Theobald, M. (2002). Research Method and Methodology in Finance and Accounting(2 ed.). Cambridge, MA: Academic Press/Thomson Business Press.).

The comparative case setting facilitates the assessment of similarities and differences of institutional logics between countries and becomes a means for achieving a better understanding how and to what extent accounting has been applied in different contexts (Potter, 2005Potter, B. (2005). Accounting as a Social and Institutional Practice: Perspective to Enrich our Understanding of Accounting Change. Abacus, 41(3), 265-89. Retrieved fromhttps://doi.org/10.1111/j.1467-6281.2005.00182.x

https://doi.org/10.1111/j.1467-6281.2005...

).

5. RESULTS

First, we characterize the process of accrual accounting implementation and formal IPSAS adoption (endorsement) in Brazil and Colombia based on in-depth analysis of institutional documents and other academic sources. Subsequently, we present the findings of the interviews to make visible the role of epistemic communities and their institutional dynamics within IPSAS adoption process.

5.1 Accrual and IPSAS adoption in Brazil

International accounting standards are not mandatory, since there is no international law that demands their adoption. Instead, each country should adopt or adapt relevant standards into its own national law or regulations. IPSAS adoption can be carried out directly or indirectly (Bergmann, 2009Bergmann, A. (2009). Public Sector Financial Management. London, England: FT Prentice Hall.). In the direct application the country’s legislation refers specifically to the adoption of the original IPSAS text. Indirectly, as in the Brazilian and Colombian cases, the country approves standards based on IPSAS to a greater or lesser extent in its legislation. These are followed by secondary regulations, such as guides or manuals, that put them into force. In both approaches, an accounting manual is a carrier to disseminate international standards nationwide, while technical consultations regarding their implementation are carried out through administrative resolutions or decrees.

In 2005 the WB prepared the Report of the Observance of Standards and Codes on Accounting and Auditing (ROSC-A&A) of Brazil for the first time. Due to the fact that Brazil hadn’t adopted any of the international standards issued by the International Accounting Standards Board or by IFAC and to the fact that the accounting standard-setting authority in Brazil was dispersed among different organizations, the WB presented a key recommendation: the creation of a professional body that would translate international accounting standards to Portuguese and verify their compatibility with the Brazilian laws. In the same year, the Accounting Standards Committee (Comitê de Pronunciamentos Contábeis) was established and composed of six voting members - the Association of Listed Companies (Associação Brasileira de Companhias Abertas), the Association of Financial Analysts (Associação dos Analistas e Profissionais de Investimento do Mercado de Capitais), the Brazilian Stock Exchange (Brasil Bolsa e Balcão), the Federal Accounting Council (Conselho Federal de Contabilidade), a representative of the accounting academy (Fundação Instituto de Pesquisa em Contabilidade e Finanças), and the Association of Auditors (Instituto Brasileiro dos Auditores Independentes); and some non-voting observers such as the Securities and Exchange Comission (Comissão de Valores Mobiliários), the Central Bank (Banco Central do Brasil), the Internal Revenue Service (Secretaria da Receita Federal do Brasil) among others. Based on the capital market orientation of its members, the Accounting Standards Committee has dedicated itself only to the translation of the IFRS. Two years later, Law 11.638/2007Lei n. 11638, de 28 de dezembro de 2007. (2007). Altera e revoga dispositivos da Lei no 6.404, de 15 de dezembro de 1976, e da Lei no 6.385, de 7 de dezembro de 1976, e estende às sociedades de grande porte disposições relativas à elaboração e divulgação de demonstrações financeiras. Brasília, DF. Retrieved from https://www.planalto.gov.br/ccivil_03/_ato2007-2010/2007/lei/l11638.htm

https://www.planalto.gov.br/ccivil_03/_a...

was issued, requiring that listed companies and large-sized entities to implement the IFRS.

In Brazil, the Federal Accounting Council is the regulatory agency of the profession and has the legal authority to take disciplinary actions. The Convergence Committee Board decided to incorporate the IPSAS issued by the IPSASB into the Brazilian convergence process. Working together with the National Treasury this decision was made with great involvement of Brazilian government representatives in order to ensure this important commitment for the country. Implementation will be carried out gradually for federal, state and municipalities.

The Public Financial Management framework in Brazil - based on the 1988 Constitution, Law 4320/1964Lei n. 4320, de 17 de março de 1964. (1964). Estatui Normas Gerais de Direito Financeiro para elaboração e contrôle dos orçamentos e balanços da União, dos Estados, dos Municípios e do Distrito Federal. Brasília, DF. Retrieved from http://www.planalto.gov.br/ccivil_03/leis/l4320.htm

http://www.planalto.gov.br/ccivil_03/lei...

and Fiscal Responsibility Law 101/2000Lei Complementar n. 101, de 04 de maio de 2000. (2000). Estabelece normas de finanças públicas voltadas para a responsabilidade na gestão fiscal e dá outras providências. Brasília, DF. Retrieved from http://www.planalto.gov.br/ccivil_03/leis/LCP/Lcp101.htm

http://www.planalto.gov.br/ccivil_03/lei...

- provides the primary financial regulatory framework that guides all financial procedures in all governmental levels, gathering the general rules for the preparation, accounting, and reporting of the budget, under a modified cash-accounting regime. Brazilian state-owned enterprises are classified as dependent or independent from the government budget, follow a specific law, and are classified as such when wholly owned by the Government, following both Law 4320 and the corporate law (Law 6404/1976Hyndman, N., Liguori, M., Meyer, R., Polzer, T., Rota, S., & Seiwald, J. (2013). The translation and sedimentation of accounting reforms: a comparison of the UK, Austrian and Italian experiences. Critical Perspectives on Accounting, 25(4-5), 388-408. Retrieved from https://doi.org/10.1016/j.cpa.2013.05.008

https://doi.org/10.1016/j.cpa.2013.05.00...

- IFRS based). When capital is mixed, companies are subject solely to the corporate law.

Brazil currently uses a modified cash basis of accounting that is a combination of the two accounting methods (Box 1), which is used to report money received and liabilities incurred. Brazil didn’t fully adopt IPSAS in a first time, but the decision came in 2008 by Ministerial Order 184/2008Portaria n. 184, de 25 de agosto de 2008. (2008). Dispõe sobre as diretrizes a serem observadas no setor público (pelos entes públicos) quanto aos procedimentos, práticas, elaboração e divulgação das demonstrações contábeis, de forma a torná-los convergentes com as Normas Internacionais de Contabilidade Aplicadas ao Setor Público. Brasília, DF. Retrieved from http://www.fazenda.gov.br/acesso-a-informacao/institucional/legislacao/portarias-ministeriais/2008/arquivos/portaria-no-184-de-25-de-agosto-de-2008.pdf

http://www.fazenda.gov.br/acesso-a-infor...

. At the end of that year, Brazil came up with the first 10 new normative orientations from the Federal Accounting Council that is also working on the “adaptation” process.

The first guide appeared in 2009 when the Brazilian National Treasury issued order 751/2009Portaria STN n. 751, de 16 de dezembro de 2009. (2009). Aprova o volume V - Demonstrações Contábeis Aplicadas ao Setor Público e republica o volume IV - Plano de Contas Aplicado ao Setor Público, da 2ª edição do Manual de Contabilidade Aplicada ao Setor Público, e dá outras providências. Brasília, DF. Retrieved from https://www.legisweb.com.br/legislacao/?id=218737

https://www.legisweb.com.br/legislacao/?...

stating that implementation will occur optionally from 2010 and mandatory from 2012 for the Central Government and the Federal States, and in 2013 for municipalities. Later, in 2015, the procedure changed, and Brazil started an adoption process overriding old standards and issuing new ones for adopting IPSAS-based standards.

5.2 Accrual and IPSAS adoption in Colombia

In Colombia, with the Political Constitution of 1991Constitución Constitución Política de Colombia de 20 de julio de 1991. (1991). Retrieved from http://www.secretariasenado.gov.co/index.php/constitucion-politica

http://www.secretariasenado.gov.co/index...

(article 354), the General Accounting Office (Contaduría General de la Nación) was created to regulate, centralize and consolidate public sector accounting information. With Law 298/1996Ley 298, de 23 de julio de 1996. (1996). Ley por la cual se desarrolla el artículo 354 de la Constitución Política y se crea a Contaduría General de la Nación. Retrieved from http://www.suin.gov.co/viewDocument.asp?ruta=Leyes/1657792

http://www.suin.gov.co/viewDocument.asp?...

, the General Accounting Office was formally introduced, ushering the modern stage of patrimonial and accrual accounting in the Colombian public sector. Two regulatory changes were made during the first 10 years of the process. All initial regulations were built with the participation of key actors from all over the country (public officials, financial managers of public companies, etc.). In the first stage (1996-2004), state-owned companies (country’s largest companies: Ecopetrol, ISA, ISAGEN, EPM, EEB, among others) applied the same standards used by government entities and set by General Accounting Office, which were not like International Accounting Standards for private companies.

During 2005 and 2006 a study that sought to harmonize the General Accounting Plan with the 21 IPSAS of that time was conducted. It was aimed to identify novel aspects of IPSAS that do not struggle with the Colombian legal system and the provisions of the Political Constitution of Colombia. This led to the issuance of the Public Accounting Regime through resolution 354/2007Resolución 354, de 5 de septiembre 2007. (2007). Por la cual se adopta el Régimen de Contabilidad Pública. Contaduría General de la Nación. Colombia. Retrieved from https://www.apccolombia.gov.co/resolucion-no-354-de-2007-de-la-contaduria-general-de-la-nacion

https://www.apccolombia.gov.co/resolucio...

, which is the current regulatory framework.

In 2009, Colombia started a new process for the regulation of large public companies. Law 1314/2009Ley 1314, de 13 de julio de 2009. (2009). Ley que regula los principios y normas de contabilidad e información financiera y de aseguramiento de información aceptadas en Colombia. Retrieved from http://suin.gov.co/viewDocument.asp?ruta=Leyes/1677255

http://suin.gov.co/viewDocument.asp?ruta...

had been issued for private companies, establishing a convergence with international standards (IFRS), and this resulted in great pressure over utilities companies (some of them are state-owned enterprises). IFRS allow the revaluation of property, plant and equipment assets, benefitting companies via tariffs. In this scenario, the main concern was to harmonize and differentiate requirements for government entities and private companies, as well as “consolidate” the entire public sector (companies and government). Law 1314/2009 established that in the private sector, the Technical Council of Public Accounting, TCPA (CTCP in Spanish), is the standard-setting body and the regulators of this sector will jointly be the Ministry of Finance and the Ministry of Industry, Commerce and Tourism. The TCPA must assess the convenience of each IFRS and recommending their adoption by the country. This law also restates that the General Accounting Office is the regulator and accounting standards-setting body of public sector accounting.

In 2011, the country experienced policy changes with the arrival of the new General Accountant, and the country started to work on the construction of three regulatory frameworks: i) one for the government, with elements from IPSAS (impairment of the value of cash-and-non-cash generating assets, among others); ii) another for state companies that do not operate on stock markets; and iii) a third for large state-owned companies where IFRS application was allowed. In this way, some resolutions were issued: the regulatory framework for companies which debt or equity instruments are traded in a public market or hold assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses (Resolution 743/2013Resolución 743, de 5 de septiembre 2013. (2013). Por la cual se incorpora, en el Régimen de Contabilidad Pública, el marco normativo aplicable para algunas empresas sujetas a su ámbito. Derogada por la Resolución 037/2017. Contaduría General de la Nación. Colombia. Retrieved from http://www.contaduria.gov.co/wps/portal/internetes/home/internet/rcp1/rcp-niif/marco-normativo-res-743/entidades-sujetas-res-037/

http://www.contaduria.gov.co/wps/portal/...

repealed by Resolution 037/2017Resolución 37, de 7 febrero, 2017. (2017). Por la cual se regula el Marco Normativo para Empresas que Cotizan en el Mercado de Valores, o que Captan o Administran Ahorro del Público. Contaduría General de la Nación. Colombia. Retrieved from https://cdn.actualicese.com/normatividad/2017/Resoluciones/R037-17.pdf

https://cdn.actualicese.com/normatividad...

), for government entities (Resolution 533/2015Resolución 533, de 8 de octubre 2015. (2015). Por la cual se incorpora, en el régimen de contabilidad pública, el marco normativo aplicable a entidades de gobierno. Contaduría General de la Nación. Colombia. Retrieved from https://www.redjurista.com/Documents/resolucion_533_de_2015_contaduria_general_de_la_nacion.aspx#/

https://www.redjurista.com/Documents/res...

), and non-listed companies (Resolution 414/2014Resolución 414, de 8 de septiembre 2014. (2014). Por la cual se incorpora, en el régimen de contabilidad pública, el marco normativo aplicable para algunas empresas sujetas a su ámbito. Contaduría General de la Nación. Colombia. Retrieved from https://www.redjurista.com/Documents/resolucion_414_de_2014_contaduria_general_de_la_nacion.aspx#/

https://www.redjurista.com/Documents/res...

). Box 2 summarizes the references to which the standards converge in Colombian and Brazilian public sector.

5.3 Multilateral agencies influencing IPSAS implementation in Brazil and Colombia

Formally, the main reason for IPSAS implementation advocated by multilateral agencies is to ensure transparency and quality of public sector financial reports, looking for stability in international financial markets. IFAC has issued a call to the Group of 20 (G20) in search of stronger governance across public and private sectors and a stable regulatory environment that enhances global economic stability, after the 2008 global financial crisis. One of the recommendations was to strengthen governance and integrity in the private and public sectors by smoothing and encouraging the adoption of IPSAS, which requires the Financial Stability Board (FSB) to encompass the public sector (IFAC, 2016bInternational Federation of Accountants. (2016b). Trust and Integrity. The Accountancy Profession’s call for action by the G-20. G-20 Leaders’ Summit. Retrieved fromhttp://www.ifac.org/system/files/publications/files/Trust-and-Integrity-2016-IFAC-G20-V10_Singles.pdf

http://www.ifac.org/system/files/publica...

).

IPSASB supports countries in adopting the accrual accounting basis and the transition from cash to accrual basis, although this entity has no power to compel every country in adopting IPSAS in order to achieve financial reporting uniformity (Christians, 2010Christensen, M., & Skaerbaek, P. (2010). Consultancy outputs and the purification of accounting technologies. Accounting, Organizations and Society, 35, 524-545. Retrieved from https://doi.org/10.1016/j.aos.2009.12.001

https://doi.org/10.1016/j.aos.2009.12.00...

). Instead, cooperation is the common path for IPSAS adoption process, as stated by IFAC (2016aInternational Federation of Accountants (2016a, June). Due Process and Working Procedures Effective. Retrieved from https://www.ifac.org/system/files/uploads/IPSASB/IPSASB-Due-Process-and-Working-Procedures-June-2016.pdf

https://www.ifac.org/system/files/upload...

):

“The IPSASB may carry out projects in cooperation, or conduct projects jointly, with an international or national standard setter(s) or other organizations with relevant expertise. In the case where a project is to be conducted jointly, a member of the IPSASB chairs, or co-chairs, the joint Task Force. Where practicable, joint projects are conducted on a multi-national basis whereby two or more national standard setters or national organizations are involved in the joint project” (p. 6, emphasis added).

In Brazil and Colombia, the determining factor in IPSAS adoption or adaptation process has been the goal of modernizing public accounting systems (Gómez & Montesinos, 2012Gómez-Villegas, M., & Montesinos, J. V. (2012). Las Innovaciones en Contabilidad Gubernamental en Latinoamérica: el caso de Colombia. INNOVAR. Revista de Ciencias Administrativas y Sociales, 22(45), 17-35. Retrieved from https://www.redalyc.org/pdf/818/81824864003.pdf

https://www.redalyc.org/pdf/818/81824864...

; Sousa, Vasconcelos, Caneca & Niyama, 2013Sousa, R., Vasconcelos, A., Caneca, R., & Niyama, J. (2013). Accrual basis accounting in the Brazilian public sector: empirical research on the usefulness of accounting information. Revista Contabilidade & Finanças, 24(63), 219-230. Retrieved from https://doi.org/10.1590/S1519-70772013000300005

https://doi.org/10.1590/S1519-7077201300...

). In this context, the IDB has provided substantial technical assistance to many Latin American countries regarding PFM issues, including project finance, training, and capacity-building, and helped countries in the implementation of PFM reforms, particularly in terms of treasury management and public accounting. In addition, since its inception in 2010, the Latin American Treasury Forum (Foro de Tesorerías Gubernamentales de América Latina - FOTEGAL4

4

Retrieved from http://fotegal.hacienda.go.cr/?p=3260

in Spanish) has become the main forum on treasury management, promoting and facilitating debates on key topics and challenges for the region (Pimenta et al., 2015Pimenta, C., Pessoa, M., Varea, M., Arosteguiberry, A., Williams, M., Fainboim, I. Rezai, N. (2015). Public Financial Management in Latin America: The Key to Efficiency and Transparency. New York, NY: Inter-American Development Bank. Retrieved from https://publications.iadb.org/publications/english/document/Public-Financial-Management-in-Latin-America-The-Key-to-Efficiency-and-Transparency.pdf

https://publications.iadb.org/publicatio...

).

FOTEGAL is composed of 17 national treasuries. Recently, the Latin American Government Accounting Forum (Foro de Contadores Gubernamentales de América Latina - FOCAL5 5 Retrieved from https://www.focal.red/ in Spanish) was created. This is expected to generate a similar impact regarding government accounting dominated by a new wave of reforms. Brazil and Colombia are members of both forums.

A tendency to mimic presumable best practices adopted by international institutions has also contributed to IPSAS growth as the leading model for the public sector (Brusca et al., 2013Brusca, I., Montesinos, V., & Chow, D. S. L. (2013) Legitimating International Public Sector Accounting Standards (IPSAS): the case of Spain. Public Money & Management, 33(6), 437-444. Retrieved fromhttps://doi.org/10.1080/09540962.2013.836006

https://doi.org/10.1080/09540962.2013.83...

). This made governments aware of the need to modernize their accounting systems in order to achieve legitimacy, with international standards as the most viable means for doing so. In the context of globalization and New Public Management, this was all consequence of the international trend towards the implementation of IPSAS. Quoting a Brazilian key actor…

“The convergence to IPSAS and the consequent adoption of the accrual basis, will allow public bodies, citizens, investors, administrators, among others, to have clear visibility of the country’s real economic and financial situation and will be an important tool to support compliance with Brazil’s Fiscal Responsibility Law, allowing, for example, greater visibility of public indebtedness and personnel expenses” (Key Actor A, Brazil).

Even though Brazil and Colombia are not part of the OECD6 6 By the time this research was carried out, in the case of Colombia. , these countries showed an interest to become part of the group, which pressures both nations to make the necessary adjustments in their reform processes (political and budgetary). Brazil is an active key partner of the OECD, whose co-operation dates back to 1994. Colombia, in turn, carried out a process since 2013 that resulted in its accession to OECD convention in May 2018. In this process, the adoption of good practices and standards was decisive.

As a key partner, Brazil has access to Partnerships in OECD Bodies, adherence to OECD instruments, integration into OECD statistical reporting and information systems, sector-specific peer reviews, and has been invited to all OECD meetings at Ministerial level since 1999. This country also contributes to the work of OECD Committees and participates with OECD Members in several significant bodies and projects.

In this regard, a key actor stated the following:

“The OECD mission is rather to collect data on practices; conduct research and elaborate recommendations” (Key Actor C, Brazil).

This implies that being accepted as an OECD member would improve the perception of other countries and external investors, as a mimetic isomorphism, increasing their willingness for doing business. OECD works on countries’ rankings and such rankings aim to push countries into promoting those policies the organization considers to be important.

Multilateral agencies have played an important role in promoting the adoption of IPSAS. As an example, this has been encouraged by the World Bank and the IMF (2014International Federation of Accountants. (2017). Handbook of International Public Sector Accounting Procurement. (Volume I). New York, NY: IFAC. Retrieved from https://www.ifac.org/system/files/publications/files/IPSASB-HandBook-2018-Volume-1.pdf

https://www.ifac.org/system/files/public...

) as part of their recommendations for improving accountability and transparency in public sector entities. These agencies cooperate actively through their financial assistance and capacity for developing programs (PwC, 2013PricewaterhouseCoopers. (2013). PWC Global Survey on Accounting and Reporting by Central Governments. London, England: Author. Retrieved from: https://www.pwc.com/gx/en/psrc/publications/assets/pwc-global--ipsas-survey-government-accounting-and-reporting-pdf.pdf

https://www.pwc.com/gx/en/psrc/publicati...

).

The World Bank has supported the development of IPSAS by engaging in technical agendas and providing significant funding. As part of this support, the Bank is cosponsoring a project to develop an IPSAS on Accounting for Development Assistance. The bank’s involvement reflects its interest in improving the quality of financial reporting by governments and their constituent agencies.

Regarding this situation, one of the interviewees pointed out the following:

“PFM reforms in the region started several years ago with the design and implementation of financial management information systems covering from budget formulation and execution, payroll, accounting and financial reporting and so forth. However, countries in the region realized that PFM reforms were not just about systems but also it is about strengthening governance and institutions. The Bank, through its Governance Global Practice offers a suite of PFM advisory and technical assistance to our clients in their pursuit of reforming its public-sector management for better service delivery to citizens and increase accountability and transparency, which is a cross-cutting issue in the region now” (Key Actor B, World Bank).

In addition, a key actor from Colombian General Accounting Office stated:

“We have made important advances in public accounting reform in Colombia, benefitting from collaboration with the World Bank financial management team. For us, it will be vital to rely on the Bank’s continued support in the next reform phases” (Key Actor E, Colombia).

The Bank encourages borrowers to use their own systems for the elaboration of financial monitoring reports, although it recommends projects’ financial monitoring reports comply with IPSAS.

Another interviewee stated that:

“We don’t have any project to the central government in Brazil, we have a couple of projects to help State governments with technical support, training and projects regarding IT update and infrastructure’s funding” (Key Actor A, Brazil).

We could say that the adoption of IPSAS in Colombia and Brazil has been mainly mimetic, with some components of normative isomorphism. This shows that multilateral bodies are a determining factor for development, the promotion of structural reforms and the macroeconomic stability of programs (Brusca et al., 2013Brusca, I., Montesinos, V., & Chow, D. S. L. (2013) Legitimating International Public Sector Accounting Standards (IPSAS): the case of Spain. Public Money & Management, 33(6), 437-444. Retrieved fromhttps://doi.org/10.1080/09540962.2013.836006

https://doi.org/10.1080/09540962.2013.83...

, 2016Brusca, I., Caperchione, E., Cohen, S., & Manes-Rossi, F. (eds). (2015). Public Sector Accounting and Auditing in Europe. The Challenge of Harmonization. London, England: Palgrave Macmillan.).

Moreover, we were also interested in acknowledging the role of major auditing firms (The Big Four) within the harmonization process of IPSAS.

In this regard, we quote a Brazilian interviewee:

“The firm has Government and Public Sector (GPS) advisory services which cover a variety of services. Here in Brazil we already provide a lot of services, mostly consultancy, as Rio 2016 Olympic Games and Mineirão’s stadium to develop a conceptual project. We would like to strengthen our performance also in the public sector. We do not perform any IPSAS-related task in Brazil because there is no completed process” (Key Actor D, Brazil).

In Colombia, an interviewee said:

“The main public sector consultants were academics and professionals not linked to mayor auditing firms” (Key Actor F, Colombia).

The lack of influence of these firms could be explained by public sector characteristics, considering accounting and financial systems are very different from the business sector. For years, public sector entities were not seen as clients by large audit firms. This was due to the limited financial resources available and legal limitations in the processes of fiscal control and auditing by public agencies. However, the introduction of IPSAS, over the basis of the IFRS model, clearly offers possibilities for these firms to start working on IPSAS and benefit from the implementation of business models and tools (Christensen & Skærbæk, 2010Christensen, M, Newberry, S., & Potter, B. (2010). The role of global epistemic communities in enabling accounting change creating a more business-like public sector, Accounting and the state: proceedings of the

6th

Accounting History International Conference, Wellington, New Zealand, Victoria University of Wellington. Retrieved from https://epubs.scu.edu.au/bus_pubs/841/

https://epubs.scu.edu.au/bus_pubs/841/...

).

Disadvantages and barriers include implementation costs, increased complexity, not-for-profit orientation, and low use of balance sheet information by decision-makers (Brusca et al., 2013Brusca, I., Montesinos, V., & Chow, D. S. L. (2013) Legitimating International Public Sector Accounting Standards (IPSAS): the case of Spain. Public Money & Management, 33(6), 437-444. Retrieved fromhttps://doi.org/10.1080/09540962.2013.836006

https://doi.org/10.1080/09540962.2013.83...

; Caperchione, 2006Caperchione, E. (2006). The new public management: A perspective for finance practitioners. Brussels, Belgic: FEE.; Guthrie, 1998Guthrie, J. (1998). Application of accrual accounting in the Australian public sector-rhetoric or reality. Financial Accountability & Management, 14(1), 1-19. Retrieved from https://doi.org/10.1111/1468-0408.00047

https://doi.org/10.1111/1468-0408.00047...

; Hepworth, 2003Hepworth, N. (2003). Preconditions for successful implementation of accrual accounting in central government. Public Money & Management, 23(1), 37-43. Retrieved fromhttps://doi.org/10.1111/1467-9302.00339

https://doi.org/10.1111/1467-9302.00339...

).

It seems that the idea of modernization, the comparability of financial information, and the increasing number of countries adopting are the main reason for changing to IPSAS model, despite the difficulties, as interviewees stated:

“Many countries worldwide have recently decided to migrate to the accrual basis of accounting to enable better decision-making and are gradually realizing that the adoption of accrual-based accounting is far more than an accounting reform. IPSAS have become fundamentally the “global accounting standard for the public sector”, and increasingly countries in the region have issued or are planning to issue IPSAS-based accounting regulations. Benefits of IPSAS-based regulations are expected to produce standardized comprehensive financial information for governments to optimize the use of limited resources for improved service delivery, and build transparent and accountable institutions” (Key Actor B, World Bank).

“Better accounting/internal controls: transition to accruals is a mean for modernizing public sector accounting and count on more complete and reliable accounting data, even though countries struggle for using it” (Key Actor C, Brazil).

This is also advocated by government representatives:

“With the adoption of IPSAS-based accrual accounting standards, the country will be able to better project cash flows, as well as evaluate and compare with other countries” (Key Actor G, Ministry of Finance, Brazil).

Rhetoric can be identified in the opinions by interviewees. As a result of the different IPSAS implementation processes in the studied cases, these standards have been adjusted to the specific context and technical frameworks in each country. All this has negative implications for the comparability of public information among countries in the region. However, actors with a key role as consultants ignore these circumstances and recap the logical arguments that grant them identity as members of an epistemic community.

Finally, key actors acknowledge the challenges of reforms and IPSAS implementation. In this regard, some interviewees said:

“One of the main challenges faced in IPSAS implementation is the involvement of other departments, such as Information Technology, Legal Counsel, and most importantly the Public Servants/Managers, who still have a very strong budget culture (logic of inflows and outflows of cash) and a lack of understanding of the accrual concept. Political support is also critical for the successful implementation of standards in Brazil” (Key Actor A, Brazil).

“System, training and budget. I see the process is not yet on government’s central agenda. A lot of politicians don’t see accrual accounting as a control mechanism. It is also difficult for a practitioner with many years of experience to change a budget view to accrual accounting” (Key Actor E, Colombia).

From the perspective of epistemic community’s literature, multilateral agencies are the main supporters of reforms and, at the same time, the most important users of the information generated. These agencies request new information from governments to monitor and evaluate policies implementation.

In addition, coercive isomorphism can be observed by examining the impact of state regulation in IPSAS adoption process. For example, in the case of Brazil, the adoption of Order 184 of the Ministry of Finance in 2008 gave a new direction to accounting reform for the Federal, State and Local levels, introducing the convergence to IPSAS model in some legal frameworks, and determining the vector of coercive isomorphism. This process has been similar in Colombia, where IPSAS were used as the basis for updating local public accounting systems by means of legal instruments. When legal sources ordered their mandatory implementation, all actors assumed ownership of arguments about IPSAS model benefits. However, achievements are still rhetorical manifestations rather than facts.

6. CONCLUSIONS