Abstract

The aim of the present study is to understand contractual relations through the complementarity of the Transaction Costs Theory, Measurement Costs Theory, and the Resource-Based View. Initially, we sought to define an analytical model appropriate to the complementarity objective, considering the categories of each approach. The proposition was: given the possibility of measuring the attributes of products, the contractual relationship can be used to guarantee property rights over assets of high specificity and strategic value, avoiding the costs of vertical integration. Secondly, a qualitative descriptive cross-cut (2014 and 2015) study was carried out. In this phase, the complementarity proposition was analyzed based on data obtained through semi-structured interviews with logistics, production, and purchasing managers of automakers located in the state of Paraná, and some of their direct suppliers. Our proposition indicates that when there is the possibility of measuring product attributes, the contractual relationship can be used to secure property rights of high-specificity assets and strategic resources, avoiding the costs of vertical integration. This proposition was verified because, in the case of high-specificity auto parts, the measurability of their dimensions ensures protection of specific and residual property rights. In the case of strategic resources, when there is a possibility of measurement and control, contracting is allowed, even including the acquisition of innovations that bring competitive advantage (Bluetooth, integrated GPS with SD card, back-up sensor, air bags). It was observed that, even though competitive advantages constitute valuable and rare resources for automakers at their launch, this did not prevent contracting. Verification can offer an alternative path to rational Transaction Costs Theory, as proposed by Williamson, and the use of vertical integration as a form of controlling strategic resources, recommended by the Resource-Based View, which still requires further studies in order to overcome persistent limitations in the model.

Keywords:

Contracts; Measurement attributes; Specific assets; Resources and strategic capabilities; Automakers

Resumo

Neste artigo, objetivou-se compreender as relações contratuais por meio da complementaridade da Teoria dos Custos de Transação, Teoria dos Custos de Mensuração e Visão Baseada em Recursos. Para tanto, buscou-se definir um modelo analítico adequado ao objetivo de complementaridade, considerando-se as categorias de cada abordagem. A proposição elaborada indica que, na possibilidade de mensuração dos atributos dos produtos, a relação contratual pode ser utilizada para garantir os direitos de propriedade sobre ativos de elevada especificidade e recursos estratégicos, evitando-se os custos da integração vertical. Em um segundo momento, a partir de uma pesquisa qualitativa descritiva, com recorte no ano de 2015, realizou-se a fase empírica da proposta. Nessa fase, analisou-se a proposição de complementaridade a partir de dados obtidos por meio de entrevistas semiestruturadas com gerentes de logísticas, produção e compras das montadoras automotivas localizadas no Estado do Paraná, e alguns de seus fornecedores diretos. A proposição foi ratificada ao se constatar que, no caso de autopeças de elevada especificidade, a capacidade de mensuração de suas dimensões garante a proteção de direitos de propriedade específicos e residuais. No caso dos recursos estratégicos, na possibilidade de mensuração e controle, a contratação permitiu a aquisição de diversas inovações geradoras de vantagem competitiva (bluetooth, o GPS integrado no veiculo, com cartão SD, o sensor de ré, air bags). Observou-se que, mesmo se constituindo em recursos valiosos e raros para as montadoras no seu lançamento, esse fato não impediu que esses fossem adquiridos por intermédio da contratação. Conclui-se que essa ratificação pode oferecer um caminho alternativo ao racional da TCT, proposto por Williamson, e à orientação pela integração de recursos, como forma de controle, preconizado pela VBR, o que ainda carece de maiores estudos visando a superar as limitações ainda presentes no modelo apresentado.

Palavras-chave:

Contratos; Mensuração de atributos; Ativos específicos; Recursos e capacidades estratégicos; Montadoras de veículos

Resumen

El propósito en este artículo es entender las relaciones contractuales por medio de la complementariedad de la Teoría de los Costos de Transacción, Teoría de los Costos de Medición y de Visión Basada en los Recursos. Para ello, se ha buscado establecer un modelo analítico apropiado al objetivo de complementariedad, teniendo en cuenta las categorías de cada enfoque. La proposición elaborada indica que, en la posibilidad de medición de los atributos del producto, la relación contractual puede utilizarse para asegurar los derechos de propiedad de activos de alta especificidad y recursos estratégicos, evitándose los costos de la integración vertical. En una segunda etapa, a partir de un estudio cualitativo descriptivo, con sección en el año 2015, se ha llevado a cabo la fase empírica de la proposición. En esta fase, se ha analizado la proposición complementaria, a partir de datos obtenidos por medio de entrevistas semiestructuradas con los directores de logística, producción y adquisición de plantas ensambladoras automotrices ubicadas en el estado de Paraná, y algunos de sus proveedores directos. La proposición ha sido ratificada por la constatación de que, en el caso de autopartes de alta especificidad, la capacidad de medición de sus dimensiones asegura la protección de los derechos de propiedad específicos y residuales. En cuanto a los recursos estratégicos, en la posibilidad de medición y control, la contratación ha permitido la adquisición de una serie de innovaciones generadoras de ventaja competitiva (bluetooth, GPS integrado en el vehículo, con tarjeta SD, sensor de marcha atrás, air bags). Se advierte que, aunque constituyan recursos valiosos y raros para los fabricantes de automóviles en su lanzamiento, este hecho no ha impedido que éstos fueran adquiridos por medio de la contratación. Se concluye que dicha comprobación puede ofrecer un medio alternativo al camino racional de la TCT, propuesto por Williamson, y a la orientación hacia la integración de los recursos, como medio de control, preconizado por la VBR. Es necesario que se realicen más estudios para superar las limitaciones todavía presentes en el modelo.

Palabras clave:

Contratos; Medición de atributos; Activos específicos; Capacidades y recursos estratégicos; Ensambladoras automotrices

Introduction

The essential idea guiding this work concerns the transactional and strategic characteristics which influence decisions to outsource production among auto assembly plants in the state of Paraná, Brazil. Understanding the motivation behind these decisions indicates paths for understanding organizations in their forms and limits, as well as productive and relational dynamics. Historically, vertical integration and disintegration movements, through contracting, have always been part of the strategic decisions of automakers, in their headquarters and extending throughout their subsidiaries, including those in Brazil. An understanding of the motivating factors behind these movements helps define relevant subsidies for investment decisions in the sector, in both the public and private spheres (Ferreira & Serra, 2010Ferreira and Serra, 2010 Ferreira, M. P., & Serra, F. A. R. (2010). Make or buy in a mature industry? Models of client supplier relationships under TCE and RBV perspectives. Brazilian Administration Review, 7(1), 22-39.; Melo, 2006Melo, 2006 Melo, A. A. de. (2006). Relações cliente-fornecedor na indústria automotiva: Motivações, estruturação e desenvolvimento. Tese de Doutorado, Programa de Pós-Graduação em Administração, Universidade Federal do Rio Grande do Sul, Brasil. Escola de Administração.).

Presently, in the Brazilian case, there is a trend toward vertical disintegration, that is, externalization of production. In recent years, automakers have started focusing on more specialized activities at the product level, prioritizing skills related to the creation of characteristics that differentiate the product in the consumer market (Cerra & Maia, 2008Cerra and Maia, 2008 Cerra, A. L., & Maia, J. L. (2008). Desenvolvimento de produtos no contexto das cadeias de suprimentos do setor automobilístico. Revista de Administração Contemporânea, Curitiba, 12 (January/March (1)), 155-176.; Costa & Henkin, 2012Costa and Henkin, 2012 Costa, R. M., & Henkin, H. (2012). Estratégias Competitivas e Desempenho da Indústria Automobilística no Brasil. In 40º Encontro da Associação Nacional dos Centros de Pós-Graduação em economia – ANPEC.; Melo, 2006Melo, 2006 Melo, A. A. de. (2006). Relações cliente-fornecedor na indústria automotiva: Motivações, estruturação e desenvolvimento. Tese de Doutorado, Programa de Pós-Graduação em Administração, Universidade Federal do Rio Grande do Sul, Brasil. Escola de Administração.). According to Melo (2006)Melo, 2006 Melo, A. A. de. (2006). Relações cliente-fornecedor na indústria automotiva: Motivações, estruturação e desenvolvimento. Tese de Doutorado, Programa de Pós-Graduação em Administração, Universidade Federal do Rio Grande do Sul, Brasil. Escola de Administração. and Costa and Henkin (2012)Costa and Henkin, 2012 Costa, R. M., & Henkin, H. (2012). Estratégias Competitivas e Desempenho da Indústria Automobilística no Brasil. In 40º Encontro da Associação Nacional dos Centros de Pós-Graduação em economia – ANPEC., suppliers have assumed responsibility for activities considered non-strategic by automakers, or those that require knowledge divergent from that which forms the basis of automakers' core competencies.

Within this framework of outsourcing activities, the dominant governance structure in the coordination and attainment of automakers has been contractual arrangements with direct suppliers (Augusto, 2015; Ferrato, Carvalho, Spers, & Pizzinatto, 2006Augusto, 2015 Augusto, C. A. (2015). Estruturas de governança no setor automotivo no Estado do Paraná: Implicações sob a consideração dos custos de transação, custos de mensuração e recursos estratégicos. Brasil: Tese de Doutorado, Programa de Pós-Graduação em Administração, Universidade Federal de Santa Catarina.). According to Casotti and Goldenstein (2008)Casotti and Goldenstein, 2008 Casotti, B. P., & Goldenstein, M. (2008). Panorama do Setor Automotivo: As mudanças estruturas da indústria e as perspectivas para o Brasil. In BNDES Setorial (3rd ed., pp. 147–188) (28), set., contracts between assemblers and suppliers can range between more distant, as well as closer relationships, such as those in which suppliers install themselves in the assembly plant (modular consortium). In this case, Ferreira and Serra (2010)Ferreira and Serra, 2010 Ferreira, M. P., & Serra, F. A. R. (2010). Make or buy in a mature industry? Models of client supplier relationships under TCE and RBV perspectives. Brazilian Administration Review, 7(1), 22-39. affirm that the maturity of this sector facilitates the choice of this structure, since it is inserted in a context of efficiency, where conditions reduce market imperfections and dangers in transactions, especially opportunistic behavior.

In this paper, we focus on the closer relations between automakers and their direct suppliers, taking into account the flow of formal commercial transactions that are established between these parties. These relationships, contractual arrangements guiding transactions between manufacturers and direct suppliers, involve a context of resource interdependence, such as knowledge, technology, and innovation, as well as reciprocal lines of communication (Dias, Galina, & Silva, 2008Dias et al., 2008 Dias, A. V. C., Galina, S. V. R., & Silva, F. D. (2008). Análise contemporânea da cadeia produtiva do setor automobilístico: Aspectos relativos à capacitação tecnológica. In XIX Encontro Nacional de Engenharia de Produção.; Sacomano Neto & Iemma, 2004Sacomano Neto and Iemma, 2004 Sacomano Neto, M., & Iemma, A. F. (2004). Estratégias e Arranjos Produtivos da Indústria Automobilística nos Mercados Emergentes: O Caso Brasileiro. Revista de Administração da UNIMEP, 2(3), 127-139.). In addition, these transactions are characterized by the sharing of risks and investments, and by cooperation and partnerships with suppliers in productive spaces (Sacomano Neto & Iemma, 2004Sacomano Neto and Iemma, 2004 Sacomano Neto, M., & Iemma, A. F. (2004). Estratégias e Arranjos Produtivos da Indústria Automobilística nos Mercados Emergentes: O Caso Brasileiro. Revista de Administração da UNIMEP, 2(3), 127-139.). It is also considered that the control and competitive efficiency of automakers reduces transaction costs in relation to other agents (Ferreira & Serra, 2010Ferreira and Serra, 2010 Ferreira, M. P., & Serra, F. A. R. (2010). Make or buy in a mature industry? Models of client supplier relationships under TCE and RBV perspectives. Brazilian Administration Review, 7(1), 22-39.).

The study of contractual forms may find support in theories addressed at the micro-analytical level of the New Institutional Economics (NIE), notably the Transaction Costs Theory or TCT (Coase, 1937Coase, 1937 Coase, R. H. (1937). The nature of the firm. Economica, London, New Series, 4(November (16)), 386-405.; Klein, Crawford, & Alchian, 1978Klein et al., 1978 Klein, B., Crawford, R. G., & Alchian, A. A. (1978). Vertical integration, appropriable rents, and the competitive contracting process. Journal of Law and Economics, 21(2), 297-326.; Williamson, 1975Williamson, 1975 Williamson, O. E. (1975). Markets and hierarchies: Analysis and antitrust implications. New York: Free Press., 1985Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., 1996Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press.; Zylbersztajn, 1995Zylbersztajn, 1995 Zylbersztajn, D. (1995). Estruturas de governança e coordenação do Agribusiness: Uma aplicação da Nova Economia das Instituições. Brasil: Tese de livre docência, Departamento de Administração – Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo., 2009Zylbersztajn, 2009 Zylbersztajn, D. (2009). Papel dos contratos na coordenação agro-industrial: Um olhar além dos mercados. In J. P. Souza & I. N. Prado (Org.), Cadeias produtivas: Estudos sobre competitividade e coordenação. Maringá: EDUEM.) and the Measurement Costs Theory or MCT (Barzel, 1997Barzel, 1997 Barzel, Y. (1997). Economic analysis of property rights (2nd ed.). Cambridge: Cambridge University Press., 175 pp., 2002Barzel, 2002 Barzel, Y. (2002). Standards and the form of agreement. Budapeste, Hungria: 3rd International Society for New Institutional Economics – ISNIE., 2005Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373.; Coase, 1937Coase, 1937 Coase, R. H. (1937). The nature of the firm. Economica, London, New Series, 4(November (16)), 386-405.; Zylbersztajn, 2009Coase, 1937 Coase, R. H. (1937). The nature of the firm. Economica, London, New Series, 4(November (16)), 386-405.). These approaches have their origin in an article by Coase entitled "The nature of the firm," published in 1937, which laid the basis for the study of contractual organizational forms. This set complements the discussion on property rights. Mahoney (2001)Mahoney, 2001 Mahoney, J. (2001). A resource-based theory of sustainable rents. Journal of Management, 27, 651-660. argues that Barzel (1989)Barzel, 1989 Barzel, Y. (1989). Economic analysis of property rights. Cambridge: Cambridge University Press, 122., following the premise put forward by Coase (1960)Coase, 1960 Coase, R. H. (1960). The problem of social cost. Journal of Law and Economics, 3, 1-44., unifies the discussion involving property rights and organization, in view of the difficulty of securing property rights under difficult measurement conditions. This set, under the NIE, has been taken into consideration in this article.

In addition to transaction (TCT) and measurement (MCT) costs, another factor taken as an influence in contracting decisions in the present investigation refers to strategic resources and capabilities. In the treatment of these resources, the Resource-Based View (RBV) is taken as the theoretical approach. RBV has its origin in Economic theory, especially from the studies of Penrose (1959)Penrose, 1959 Penrose, E. T. (1959). The theory of the growth of the firm. New York: John Wiley. in her work "The theory of the growth of the firm." This approach focuses on the characteristics of organizational resources in order to clarify whether they can be strategic, i.e. sources of competitive advantages (Foss, 2005Foss, 2005 Foss, N. J. (2005). The resource-based view: Aligning strategy and competitive equilibrium. In Nicolai J. Foss (Ed.), Strategy, economic organization, and the knowledge economy: The coordination of firms and resources. Oxford: Oxford University Press.). In Barney's (1991)Barney, 1991 Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120. perception, to enable the creation of a competitive advantage, the resources must be rare and valuable. To create sustainable competitive advantages (VCS), in turn, they must also be imperfectly imitable and irreplaceable.

From this perspective, RBV appears as a complementary approach to TCT and MCT for the understanding of contractual forms. Attempts to address the complementary aspects involving at least two of these approaches have already been observed in the Firm Theory literature. One of them is the integration of RBV with TCT, indicating the influence of strategic resources in the choice of governance structure (Argyres & Zenger, 2008Argyres and Zenger, 2008 Argyres, N., & Zenger, T. (2008). Capabilities, transaction costs, and firm boundaries: A dynamic perspective and integration. Social Science Research Network (SSRN)., 2012Argyres and Zenger, 2012 Argyres, N., & Zenger, T. (2012). Capabilities, transaction costs, and firm boundaries. Organization Science, 23(6), 1643-1657.; Augusto, Souza, & Cario, 2013Augusto et al., 2013 Augusto, C. A., Souza, J. P., & Cario, S. A. F. (2013). Estruturas de governança e recursos estratégicos em destilarias do estado do Paraná: Uma análise a partir da complementaridade da ECT e da VBR. Revista de Administração (São Paulo, Online), 48, 179-195.; Combs & Ketchen, 1999Combs and Ketchen, 1999 Combs, J. G., & Ketchen, D. J. (1999). Explaining interfirm cooperation and performance: Toward a reconciliation of prediction from the resource-based-view and organizational economics. Strategic Management Journal, Chichester, 20(September (9)), 867-888.; Crook, Combs, Ketchen, & Aguinis, 2013Crook et al., 2013 Crook, T. R., Combs, J. G., Ketchen, D. J., & Aguinis, H. (2013). Organizing around transaction costs: What have we learned and where do we go from here?. Academy of Management Perspectives, 27(1), 63-79.; Foss, 2005Foss, 2005 Foss, N. J. (2005). The resource-based view: Aligning strategy and competitive equilibrium. In Nicolai J. Foss (Ed.), Strategy, economic organization, and the knowledge economy: The coordination of firms and resources. Oxford: Oxford University Press.; Jacobides & Winter, 2005Jacobides and Winter, 2005 Jacobides, M. G., & Winter, S. G. (2005). Co-evolution of capabilities and transaction costs: Explaining the institutional structure of production. Strategic Management Journal, 26(1), 395-413.; Langlois, 1992Langlois, 1992 Langlois, R. N. (1992). Transaction-cost economics in real time. Oxford Journal – Industrial and Corporate Change, 1(1), 99-127.; Leiblein, 2003Leiblein, 2003 Leiblein, M. J. (2003). The choice of organizational governance form and performance: Predictions from transaction cost, resource-based, and real options theories. Journal of Management, 29(6), 937-961.; Lundgreen, 2013Lundgreen, 2013 Lundgreen, T. F. (2013). Applying the transaction cost theory, resource-based view and institutional theory in entry mode. The case of a Danish retailer entering Russia (Master thesis). School of Business and Social Sciences, Aarhus University.; Mahoney, 2001Mahoney, 2001 Mahoney, J. (2001). A resource-based theory of sustainable rents. Journal of Management, 27, 651-660.; Neves, Hamachera, & Scavarda, 2014Neves et al., 2014 Neves, L. W. A., Hamachera, S., & Scavarda, L. F. (2014). Outsourcing from the perspectives of TCE and RBV: A multiple case study. Production, 24(July/September (3)), 687-699.; Saes, 2009Saes, 2009 Saes, M. S. M. (2009). Estratégias de diferenciação e apropriação da quase-renda na agricultura: A produção de pequena escala. São Paulo: Annablume, Fapesp.; Williamson, 1999Williamson, 1999 Williamson, O. E. (1999). Strategy research: Governance and competence perspective. Strategic Management Journal, 20(12), 1087-1108.). TCT, in turn, has also been discussed through links to MCT, showing that assets measurement, in some situations, becomes more operational than its specificity (Barzel, 2005Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373.; Zylbersztajn, 2005Zylbersztajn, 2005 Zylbersztajn, D. (2005). Measurement costs and governance: Bridging perspectives of transaction cost economics. Barcelona, Espanha: International Society for the New Institutional Economics – ISNIE., 2009Zylbersztajn, 2009 Zylbersztajn, D. (2009). Papel dos contratos na coordenação agro-industrial: Um olhar além dos mercados. In J. P. Souza & I. N. Prado (Org.), Cadeias produtivas: Estudos sobre competitividade e coordenação. Maringá: EDUEM.). However, we are unaware of any theoretical–empirical studies that seek to discuss a complementary perspective on TCT, MCT, and RBV.

The search for the complementarity of these theories arises from the identification of their limitations when individually addressed within the understanding of governance structures. The consideration of specific assets by TCT, and the view of strategic resources within RBV-when taken as fundamental attributes in the choice of vertical integration-suggest some provisos when disregarding aspects of measurement. In this case, the question arises: could assets of high specificity or strategic importance in the transaction be contracted if the measurement of their dimensions was feasible? The answer, from the perspective of the MCT, may offer an alternative path to the rationale of the TCT, as proposed by Williamson (Williamson, 1975, 1985Williamson, 1975 Williamson, O. E. (1975). Markets and hierarchies: Analysis and antitrust implications. New York: Free Press.), and to orientation through the integration of resources as a form of control, as advocated by RBV (Barney, 1991Barney, 1991 Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.; Foss, 2005Foss, 2005 Foss, N. J. (2005). The resource-based view: Aligning strategy and competitive equilibrium. In Nicolai J. Foss (Ed.), Strategy, economic organization, and the knowledge economy: The coordination of firms and resources. Oxford: Oxford University Press.; Peteraf, 1993Peteraf, 1993 Peteraf, M. A. (1993). The cornerstones of competitive advantage: A resource based view. Strategic Management Journal, 14, 179-191.).

Within the framework of this theoretical discussion, it is observed empirically that direct relations between automakers and their suppliers suggest the possibility of a closer relationship, due to the interdependence of resources, optimization of communication, sharing of risks and investments, and the development of cooperation. On the other hand, the transaction and measurement costs inherent to the management of these transactions and the strategic risks related to the sharing of resources and capabilities indicate coordination challenges which should be taken into consideration. In this framework, the following research question emerges: How are the contractual forms configured in the relationships between automakers and their direct suppliers, considering the presence of strategic resources and the resulting transaction and measurement costs?

The objective of this research is to understand how the contractual forms are configured from a complementary perspective of transaction costs, measurement costs, and strategic resources, in relations involving manufacturers and their direct suppliers in the state of Paraná. It is noteworthy that the automotive industry in Paraná, the object of this study, stands out due to its transactional and strategic characteristics, which present possibilities for exploring theoretical aspects of the different approaches in a complementary way. Additionally, it is the state with the third largest automotive sector in Brazil (Anfavea, 2016Anfavea, 2016 Anfavea – Associação Nacional dos Fabricantes de Veículos Automotivos. (2016). Anuário da Indústria Automotiva Brasileira 2015.. Available at http://www.anfavea.com.br/ Accessed 20.01.16

http://www.anfavea.com.br/...

).

In addition to this introduction, this study comprises a section giving the theoretical background on TCT, MCT, and RBV, which presents relevant aspects for discussion and proposition of the theoretical model. A third section describes the methodological procedures adopted for the construction of the theoretical model and the accomplishment of empirical work. In the fourth section, the results are presented and analyzed, indicating how the findings have ratified the proposed model. A fifth section deals with findings that indicate changes in thinking about specific, measurable, and strategic assets in the study of efficiency and vertical relationships in organizations, indicating limitations that will enable future work. Finally, the references used are all listed.

Theoretical reference

The theory of contractual firms, and particularly the Transaction Costs Theory and Measurement Costs Theory, emerged from two important references initiated by Ronald Coase, in 1937 and 1960. It can be considered that Williamson's proposal (1985)Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., recognized as the Transaction Costs Theory, is based on Coase's proposal of 1937. Williamson locates these references (TCT and MCT) in what he calls the efficiency branch, with two ramifications: the incentive ramification, where Coase's influence is quite clear (1960), and which contemplates the Agency Theory as well as the Property Rights Theory; the other consists of transaction costs, which involves the expense of governance and measurement. Although Williamson (1985)Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press. himself recognizes the direct relationship of TCT and MCT together with the Property Rights Theory in considering the importance of ownership, he emphasizes the transaction costs generated from governance choices.

Although this paper's focus is based on Williamson's (1985)Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press. proposal, when treating measurement and governance as interdependent in the discussion of transaction costs, it incorporates important points from the Property Rights Theory. This is especially true when dealing with measurement and the forms of organization necessary to guarantee property rights, in terms of residual control rights and contract law (currently known as the New Property Rights Approach), with emphasis on the works of Grossman and Hart (1986)Grossman and Hart, 1986 Grossman, S., & Hart, O. (1986). The costs and benefits of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94, 691-719., Barzel (1989)Barzel, 1989 Barzel, Y. (1989). Economic analysis of property rights. Cambridge: Cambridge University Press, 122., Hart and Moore (1990)Hart and Moore, 1990 Hart, O., & Moore, J. (1990). Property rights and the nature of the firm. Journal of Political Economy, 98, 1119-1158. and Hart (1995)Hart, 1995 Hart, O. (1995). Firms, contracts, and financial structure. Oxford, England: Oxford University Press..

It is noted that, in their vast majority, inter-organizational relations take contractual forms, which formalize the commitments between two legally independent organizations. This section describes and characterizes these contractual forms, and proceeds to discuss and justify them in light of the TCT, MCT, and RBV.

Contract forms

In general, governance structures are defined by the decision of a company to carry out an activity itself or to purchase from another independent company. Within this framework, according to Williamson (1985Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., 1996)Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press., governance structures can be classified into: (1) the option to buy in the market; (2) own production, in the hierarchical form (vertical integration); and (3) the hybrid form (contracts).

Contracts are one of the three main types of governance structures identified by Williamson (1996, p. 58)Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press.. Zylbersztajn (1995Zylbersztajn, 1995 Zylbersztajn, D. (1995). Estruturas de governança e coordenação do Agribusiness: Uma aplicação da Nova Economia das Instituições. Brasil: Tese de livre docência, Departamento de Administração – Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo., 2009)Zylbersztajn, 2009 Zylbersztajn, D. (2009). Papel dos contratos na coordenação agro-industrial: Um olhar além dos mercados. In J. P. Souza & I. N. Prado (Org.), Cadeias produtivas: Estudos sobre competitividade e coordenação. Maringá: EDUEM. states that contracts, positioned between market and hierarchy, avoid hierarchy costs and also control variability and mitigate market risks.

Ménard (2004)Ménard, 2004 Ménard, C. (2004). The economics of hybrid organizations. Journal of Institutional and Theoretical Economics, Berlin, 160(3), 345-376. states that hybrid forms are presented in the daily life of companies as the almost vertical integration of a set of subcontractors: franchise networks; strategic alliances; clusters; productive, technological, and commercial joint ventures; consortia; and contractual relationships. The author points out that, over time, contracts can be improved due to the gradual decline of informational asymmetry. In addition, as the parties become better acquainted with each other, the use of informal mechanisms such as reputation, trust, information sharing, and mutual aid are increased, and subsequently used to coerce agents. Following this line of reasoning, Crook et al. (2013)Crook et al., 2013 Crook, T. R., Combs, J. G., Ketchen, D. J., & Aguinis, H. (2013). Organizing around transaction costs: What have we learned and where do we go from here?. Academy of Management Perspectives, 27(1), 63-79. argue that managers increasingly use extra-contractual means (relational governance), such as trust and cross-equity holdings of capital, which allow them to build stable relationships.

Events which are understood as breaches of contract or hold-ups occur when formal contractual relationships are interrupted (Klein, 1996Klein, 1996 Klein, B. (1996). Why hold-ups occur: the self-enforcing range of contractual relationship. Economic Inquiry, XXXIV, 444-463.; Klein et al., 1978Klein et al., 1978 Klein, B., Crawford, R. G., & Alchian, A. A. (1978). Vertical integration, appropriable rents, and the competitive contracting process. Journal of Law and Economics, 21(2), 297-326.). Klein (1996, p. 444)Klein, 1996 Klein, B. (1996). Why hold-ups occur: the self-enforcing range of contractual relationship. Economic Inquiry, XXXIV, 444-463. indicates that hold-ups "occur when unanticipated events destabilize the contractual relationship outside the self-enforcing range." In this context, the concept of opportunistic contractual break is investigated by the authors based on rent appropriation incentives arising from investments in specific assets. Thus, if a part of the contract makes specific investments which generate rent, in the absence of safeguards part of its value can be expropriated ex-post by the other party. Di Gregorio (2013)Di Gregorio, 2013 Di Gregorio, D. (2013). Value creation and value appropriation: An integrative multi-level framework. Journal of Applied Business and Economics, 15(1), 39-53. called this movement "inter-organizational value appropriation."

Contractual forms from the TCT, MCT, and RBV perspective

The treatment of contractual forms based on the individual analysis of the TCT, MCT, and RBV approaches can have different results. According to Williamson (1985Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., 1996)Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press., in the case of TCT, the choice of contractual form occurs when moderate levels of investment in specific assets occur, allowing for the use of intermediate-type structures capable of restraining opportunism, without the extra costs of hierarchy. For highly specific assets, the author emphasizes vertical integration as the most efficient option of structure to restrain opportunistic behavior.

Together with asset specificity, frequency and uncertainty complete the set of transaction attributes that may influence the choice of contractual forms (Williamson, 1985Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., 1996Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press.). In addition, together with opportunism as a behavioral assumption, Williamson (1975)Williamson, 1975 Williamson, O. E. (1975). Markets and hierarchies: Analysis and antitrust implications. New York: Free Press. takes Simon's (1979)Simon, 1979 Simon, H. A. (1979). Rational decision making in business organizations. American Economic Review, Nashville, 69(4), 493-513. concept of limited rationality into consideration. This concept indicates the information processing limitations of the agents and the consequences of this assumption on the contractual incompleteness of the transaction (Williamson, 2002Williamson, 2002 Williamson, O. E. (2002). The theory of the firm as governance structure: From choice to contract (working paper).).

For Barzel (2005)Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373., when considering MCT, measurability, information, and property rights are fundamental aspects affecting the conduct of transactions and the choice of governance structures. The intention is to ensure the benefits of contract control through measurability, availability of information, and consequent guarantee of the property rights of those involved in the transaction.

The possibility of measuring attributes of the product makes it possible to use contracts to regulate the transaction, since it enables and offers guarantees of the required specificities. Barzel (2002)Barzel, 2002 Barzel, Y. (2002). Standards and the form of agreement. Budapeste, Hungria: 3rd International Society for New Institutional Economics – ISNIE. emphasizes the influence of information asymmetry in the measurement process (MCT), since this can have an impact on the distribution of rents and property rights of those involved in the transaction.

This understanding of property rights is aggregated in the premises associated with the New Property Rights Approach, from the distinction between specific control rights and residual control rights, which define the property configuration of a particular asset, in the tradition of the proposals by Grossman and Hart (1986)Grossman and Hart, 1986 Grossman, S., & Hart, O. (1986). The costs and benefits of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94, 691-719., Hart and Moore (1990)Hart and Moore, 1990 Hart, O., & Moore, J. (1990). Property rights and the nature of the firm. Journal of Political Economy, 98, 1119-1158., and Hart (1995)Hart, 1995 Hart, O. (1995). Firms, contracts, and financial structure. Oxford, England: Oxford University Press.. The specific control rights can be defined and directly assigned through contractual means. In Barzel's words (1997, p. 4)Barzel, 1997 Barzel, Y. (1997). Economic analysis of property rights (2nd ed.). Cambridge: Cambridge University Press., 175 pp., "Legal rights are the rights recognized and enforced, in part, by the government. […] A major function of legal rights is to accommodate third-party adjudication and enforcement." The residual control rights, in turn, are obtained through the legal ownership of the assets and imply, according to Hart (1995, p. 371)Hart, 1995 Hart, O. (1995). Firms, contracts, and financial structure. Oxford, England: Oxford University Press.: "[…] right to decide on usages of the asset in uncontracted-for contingencies." For Monteiro and Zylberzstan (2011, p. 100)Monteiro and Zylberzstan, 2011 Monteiro, G. F. A., & Zylberzstan, D. (2011). Direitos de Propriedade, Custos de Transação e Concorrência: O Modelo de Barzel. Economic Analysis of Law Review, Brasília, 2(1), 95-114., the residual control right "corresponds to the agent's ability, in expected terms, to consume the goods or services associated with a given asset, directly or indirectly (i.e. through exchange)."

Thus, residual control rights cover not only the rights to use assets, but also to decide on when to use them or even when to sell them. Therefore, the economic importance of ownership stems from the ability of the owner to exercise residual control rights over the assets.

Although the rationale proposed by Williamson (1985Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., 1996)Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press. and Barzel (2002Barzel, 2002 Barzel, Y. (2002). Standards and the form of agreement. Budapeste, Hungria: 3rd International Society for New Institutional Economics – ISNIE., 2005)Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373. is presented in a structured way and indicates an analytical path for the choice of contractual forms, some criticisms point to gaps in the presented models. The overvaluation of the institution's function as a way of reducing transaction costs and the limited use of production costs as a guide for the choice of governance structure are aspects of this model which have been criticized (Baumol, 1986Baumol, 1986 Baumol, W. J. (1986). Williamson's the economic institutions of capitalism. The RAND Journal of Economics, 17(2), 279-286.; Pitelis, 1994Pitelis, 1994 Pitelis, C. (1994). On transaction cost economics and the nature of the firm. Économie Appliquée, (3), 109-130.).

The extremes between the market approach and vertical integration have also been questioned, since the same conditions of exchange-asset specificity and opportunism for instance-that hamper market performance also hinder the performance of hierarchical exchanges (Barney & Hesterly, 2004Barney and Hesterly, 2004 Barney, J. B., & Hesterly, W. (2004). Economia das Organizações: Entendendo a relação entre as organizações e a análise econômica. In S. R. Clegg, C. Hardy, & W. R. Nord (Eds.), Handbook de estudos organizacionais: Ações e análise organizacional. São Paulo, SP: Atlas.; Klein et al., 1978Klein et al., 1978 Klein, B., Crawford, R. G., & Alchian, A. A. (1978). Vertical integration, appropriable rents, and the competitive contracting process. Journal of Law and Economics, 21(2), 297-326.; Poppo & Zenger, 1998Poppo and Zenger, 1998 Poppo, L., & Zenger, T. (1998). Testing alternative theories of the firm: Transaction cost, knowledge-based, and measurement explanations for make-or-buy decisions in information services. Strategic Management Journal, 19(9), 853-877.). In addition, by focusing on cost minimization as essential for organizations, firm theory ends up considering strategies as secondary (Barney & Hesterly, 2004Barney and Hesterly, 2004 Barney, J. B., & Hesterly, W. (2004). Economia das Organizações: Entendendo a relação entre as organizações e a análise econômica. In S. R. Clegg, C. Hardy, & W. R. Nord (Eds.), Handbook de estudos organizacionais: Ações e análise organizacional. São Paulo, SP: Atlas.).

Bronzo and Honório (2005)Bronzo and Honório, 2005 Bronzo, M., & Honório, L. (2005). O institucionalismo e a abordagem das interações estratégicas da firma. RAE-eletrônica, 4(1), 1-18. criticize the approach for being focused primarily on transactions involving physical assets, leaving aside intangible assets such as knowledge economies, dynamic capabilities, and the reputation of firms. Barzel (2005)Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373., in turn, criticizes the TCT for the low operationalization of assets specificity evaluation as the main attribute in the decision to make or buy, indicating that the difficulty of measurement is more operable.

The RBV, on the other hand, does not deal with contracting, emphasizing only the function of vertical integration to justify the possession and protection of strategic resources (Argyres & Zenger, 2012Argyres and Zenger, 2012 Argyres, N., & Zenger, T. (2012). Capabilities, transaction costs, and firm boundaries. Organization Science, 23(6), 1643-1657.; Barney, 1991Barney, 1991 Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.; Combs & Ketchen, 1999Combs and Ketchen, 1999 Combs, J. G., & Ketchen, D. J. (1999). Explaining interfirm cooperation and performance: Toward a reconciliation of prediction from the resource-based-view and organizational economics. Strategic Management Journal, Chichester, 20(September (9)), 867-888.; Crook et al., 2013Crook et al., 2013 Crook, T. R., Combs, J. G., Ketchen, D. J., & Aguinis, H. (2013). Organizing around transaction costs: What have we learned and where do we go from here?. Academy of Management Perspectives, 27(1), 63-79.; Foss & Klein, 2010Foss and Klein, 2010 Foss, N. J., & Klein, P. G. (2010). Critiques of transaction cost economics: An overview. In P. G. Klein, & M. E. Sykuta (Eds.), The Elgar companion to transaction cost economics (pp. 263–272). Cheltenham: Edward Elgar Publishing, Incorporated.; Jacobides & Winter, 2005Jacobides and Winter, 2005 Jacobides, M. G., & Winter, S. G. (2005). Co-evolution of capabilities and transaction costs: Explaining the institutional structure of production. Strategic Management Journal, 26(1), 395-413.; Peteraf, 1993Peteraf, 1993 Peteraf, M. A. (1993). The cornerstones of competitive advantage: A resource based view. Strategic Management Journal, 14, 179-191.). However, in this study the importance of these features in the design of contracts is assumed, either because such resources can be traded or because of its influence on the configuration of the contracts. In addition, it is considered that strategic resources do not only occur from internal sources, but can also be present due to a combination of different external factors, thus placing a demand on contracting.

As for the transaction of strategic resources, Silverman (1999)Silverman, 1999 Silverman, B. S. (1999). Technological resources and the direction of corporate diversification: Toward an integration of the resource-based view and transaction cost economics. Management Science, 45(8), 1109-1124. points out that the RBV generally under-emphasizes the possibility that companies can exploit resources through market arrangements, focusing only on expanding the firm's boundaries. The author points out that several empirical and theoretical studies have identified conditions in which technological resources, including strategic ones, can be exploited through contractual means. Contracting, in Silverman's (1999)Silverman, 1999 Silverman, B. S. (1999). Technological resources and the direction of corporate diversification: Toward an integration of the resource-based view and transaction cost economics. Management Science, 45(8), 1109-1124. view, would be a viable alternative, unless the technological knowledge involved is highly tacit (where contracts are difficult to track and enforce), or easily transferable and weakly protected (in cases where attempts to negotiate a license are fraught with problems related to the information paradox, and secrecy is needed for adequate returns to technology).

Following this line of reasoning, Argyres and Zenger (2012)Argyres and Zenger, 2012 Argyres, N., & Zenger, T. (2012). Capabilities, transaction costs, and firm boundaries. Organization Science, 23(6), 1643-1657. state that RBV focuses almost exclusively on organizations and does not discuss the role of the market and contracts, or their comparative dynamics with the hierarchical approach in the formation of internal capacities. In the same way, Poppo and Zenger (1998, p. 19)Poppo and Zenger, 1998 Poppo, L., & Zenger, T. (1998). Testing alternative theories of the firm: Transaction cost, knowledge-based, and measurement explanations for make-or-buy decisions in information services. Strategic Management Journal, 19(9), 853-877. also affirm that RBV, as well as the actual firm's theory:

[…] have focused primarily on the failures of markets and the contrasting virtues of hierarchy. However, the focus of these theories on directionally explaining vertical integration seems at least somewhat misplaced given the apparent trends in recent decades towards disintegration, downsizing, and refocusing.

It is also important to highlight the influence of strategic resources on the routing and configuration of contracts. For Langlois (1992)Langlois, 1992 Langlois, R. N. (1992). Transaction-cost economics in real time. Oxford Journal – Industrial and Corporate Change, 1(1), 99-127., Combs and Ketchen (1999)Combs and Ketchen, 1999 Combs, J. G., & Ketchen, D. J. (1999). Explaining interfirm cooperation and performance: Toward a reconciliation of prediction from the resource-based-view and organizational economics. Strategic Management Journal, Chichester, 20(September (9)), 867-888., Argyres and Zenger (2008Argyres and Zenger, 2008 Argyres, N., & Zenger, T. (2008). Capabilities, transaction costs, and firm boundaries: A dynamic perspective and integration. Social Science Research Network (SSRN)., 2012)Argyres and Zenger, 2012 Argyres, N., & Zenger, T. (2012). Capabilities, transaction costs, and firm boundaries. Organization Science, 23(6), 1643-1657., and Saes (2009)Saes, 2009 Saes, M. S. M. (2009). Estratégias de diferenciação e apropriação da quase-renda na agricultura: A produção de pequena escala. São Paulo: Annablume, Fapesp., RBV focuses on the identification of strategic resources based on the conditions that these resources can present for the acquisition and support of competitive advantage. However, in addition to their role in gaining competitive advantage, strategic resources, especially those related to learning, can also influence the choice of governance structures.

Langlois (1992, p. 105)Langlois, 1992 Langlois, R. N. (1992). Transaction-cost economics in real time. Oxford Journal – Industrial and Corporate Change, 1(1), 99-127. states that "[…] one cannot have a complete theory of the boundaries of the firm without considering in detail the process of learning in firms and markets." The author considers it essential that a growth theory of the firm should take into account that in the long term, the parties involved go through a learning process, allowing them to gain more information from each other.

On the other hand, TCT and MCT can serve to support the discussion of coordination of these resources, providing theoretical support on which governance structures can be made more efficient in order to exploit the strategic resources of the firm. Within this framework, Argyres and Zenger (2008Argyres and Zenger, 2008 Argyres, N., & Zenger, T. (2008). Capabilities, transaction costs, and firm boundaries: A dynamic perspective and integration. Social Science Research Network (SSRN)., 2012)Argyres and Zenger, 2012 Argyres, N., & Zenger, T. (2012). Capabilities, transaction costs, and firm boundaries. Organization Science, 23(6), 1643-1657. also claim that RBV assists managers in understanding what resources are required in order to take a position and be competitive in various aspects, and organizational economics provides them with information about the supply and organization of such resources.

From the foregoing, it is possible to induce that the definition of contractual forms is based on the consideration of both the transaction costs (TCT and MCT) and strategic resources (RBV) approaches. Within this framework, the following proposition is presented for the treatment of contractual forms: Given the possibility of measuring the attributes of the transacted products, the contractual relationship can be used to guarantee property rights on high-specificity assets and strategic resources, avoiding the costs of vertical integration.

Thus, the measurement factor offers an alternative to vertical integration, in considering the contractual form as an efficient structure to govern a transaction: if the measurement can be carried out, it is therefore proposed that transactions of high-specificity assets, as well as strategic resources transactions, can occur by contract. More details of this proposition are given in the following sub-propositions:

-

High-specificity assets can be governed by contracting, as long as they involve easily measured contracted dimensions;

-

Strategic resources can be governed by contracting, provided they have easily measured contracted dimensions.

Di Gregorio (2013)Di Gregorio, 2013 Di Gregorio, D. (2013). Value creation and value appropriation: An integrative multi-level framework. Journal of Applied Business and Economics, 15(1), 39-53. states that resources play a key role because they are outcomes of value creation and are exploited in the process of value appropriation. Within this setting, Foss (2005)Foss, 2005 Foss, N. J. (2005). The resource-based view: Aligning strategy and competitive equilibrium. In Nicolai J. Foss (Ed.), Strategy, economic organization, and the knowledge economy: The coordination of firms and resources. Oxford: Oxford University Press. emphasizes that the interaction between value creation and value appropriation should be better explained in RBV, with firm theory as a useful means for this purpose. According to the author:

Much of the modern economic theory of the firm revolves around it, the ‘hold-up problem' (Hart, 1995Hart, 1995 Hart, O. (1995). Firms, contracts, and financial structure. Oxford, England: Oxford University Press.; Williamson, 1996Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press.), being an important manifestation of the expected sharing of surplus, impacting on the creation of that surplus (through the effect on investment incentives) (Foss, 2005Foss, 2005 Foss, N. J. (2005). The resource-based view: Aligning strategy and competitive equilibrium. In Nicolai J. Foss (Ed.), Strategy, economic organization, and the knowledge economy: The coordination of firms and resources. Oxford: Oxford University Press., p. 75).

Foss (2005)Foss, 2005 Foss, N. J. (2005). The resource-based view: Aligning strategy and competitive equilibrium. In Nicolai J. Foss (Ed.), Strategy, economic organization, and the knowledge economy: The coordination of firms and resources. Oxford: Oxford University Press. argues that this insight remains conspicuously and surprisingly absent in RBV. When considering asset ownership from an economic perspective, Foss and Foss (2004)Foss and Foss, 2004 Foss, K., & Foss, N. J. (2004). The next step in the evolution of the VBR: Integration with transaction cost economics. Management Revue, Mering, 15(1), 107-121. recognize that assets have multiple attributes, and that they can be captured in a world of positive measurement and enforcement costs. This implies that the notion of resource ownership is problematic. Moreover, as Foss and Klein (2010)Foss and Klein, 2010 Foss, N. J., & Klein, P. G. (2010). Critiques of transaction cost economics: An overview. In P. G. Klein, & M. E. Sykuta (Eds.), The Elgar companion to transaction cost economics (pp. 263–272). Cheltenham: Edward Elgar Publishing, Incorporated. point out, it is not made clear how resources are conceptualized, dimensioned, and measured, and it is not made clear how resources arise and are altered by the action of individuals.

It is thus perceived that the possession of strategic resources implies value creation by the ex-ante and ex-post barriers (Peteraf, 1993Peteraf, 1993 Peteraf, M. A. (1993). The cornerstones of competitive advantage: A resource based view. Strategic Management Journal, 14, 179-191.) in their construction, without considering the appropriation of value. In an environment with positive transaction costs, when considering TCT and MCT, this value can be captured simultaneously by appropriating rents and property rights over non-measurable dimensions. Following this line of thought, Silverman (1999)Silverman, 1999 Silverman, B. S. (1999). Technological resources and the direction of corporate diversification: Toward an integration of the resource-based view and transaction cost economics. Management Science, 45(8), 1109-1124. and Saes (2009)Saes, 2009 Saes, M. S. M. (2009). Estratégias de diferenciação e apropriação da quase-renda na agricultura: A produção de pequena escala. São Paulo: Annablume, Fapesp. indicate that the proposition of the RBV, in which rare and costly replication resources are important for generating income, says very little about how these resources-and which ones- should be brought together to create and Sustain Competitive Advantage (SCA).

As discussed, some of the criticisms directed at firm theory refer to the unilateral approach present in the choice of company boundaries. In other words, the definition of governance structures involves more than the presence of specific assets, measurable dimensions, opportunistic behavior, and transaction costs, as presupposed by NIE approaches. In-house resources and capabilities, which generate sustainable competitive advantages, can influence the configuration of a firm's boundaries.

In short, identifying a firm's strategic resources is not sufficient for dealing with issues of value catchment and governance of these resources. Taking TCT and MCT into consideration contributes to minimize this criticism, indicating how structures will tend to be configured in order to ensure property rights and proper distribution of value in transactions. Similarly, these features affect the way these structures are configured. In this context, contractual forms appear as mechanisms not only to reduce transaction costs, but also to obtain and sustain superior competitive conditions.

While TCT and MCT focus on the transaction as the unit of analysis, a consensus on the RBV analysis unit is not yet available. While Barney (1991)Barney, 1991 Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120. considers strategy, Peteraf (1993)Peteraf, 1993 Peteraf, M. A. (1993). The cornerstones of competitive advantage: A resource based view. Strategic Management Journal, 14, 179-191. does so with resources. Thus, for the purpose of this study, the transaction is maintained as the unit of analysis. However, the strategic condition of the resource is inserted as an additional element influencing the choice of contracting, together with specific assets, and their measurability. The identification of the constructs in the presented rationales and their direct and indirect influences are detailed in the methodological procedures section.

Methodological procedures

The present research is qualitative, and of the descriptive and theoretical–empirical type, with a transversal crosscut, carried out in 2015. The object of study were the manufacturers of automobiles and light commercial vehicles located in the State of Paraná and some of their direct suppliers. As the third most important automobile manufacturing center in Brazil after São Paulo and Rio Grande do Sul, there are three car and light truck manufacturers in Paraná, all located in São José dos Pinhais (Anfavea, 2016Anfavea, 2016 Anfavea – Associação Nacional dos Fabricantes de Veículos Automotivos. (2016). Anuário da Indústria Automotiva Brasileira 2015.. Available at http://www.anfavea.com.br/ Accessed 20.01.16

http://www.anfavea.com.br/...

), which were investigated in the present study. According to this source, these automakers jointly accounted for about 26% of the total number of vehicles sold in the Brazilian market in 2014. All the assemblers interviewed have an effective participation in the international and national market, of which one stands out not only for its tradition, but also for the volume of vehicles sold.

In order to carry out the research, we first sought to identify the basic principles of each theory individually, and from this discuss its theoretical complementarity based on the authors presented. Secondly, the primary data were collected and compared with the proposed complementarity model. At all times, we sought to meet Reay's (2014)Reay, 2014 Reay, T. (2014). Publishing qualitative research. Family Business Review, 27(2), 95-102. indications regarding the delineation of qualitative research, namely to present quality in the data obtained, make use of relevant literature, provide and detailed descriptions of procedures and data.

Conceptual model and propositions

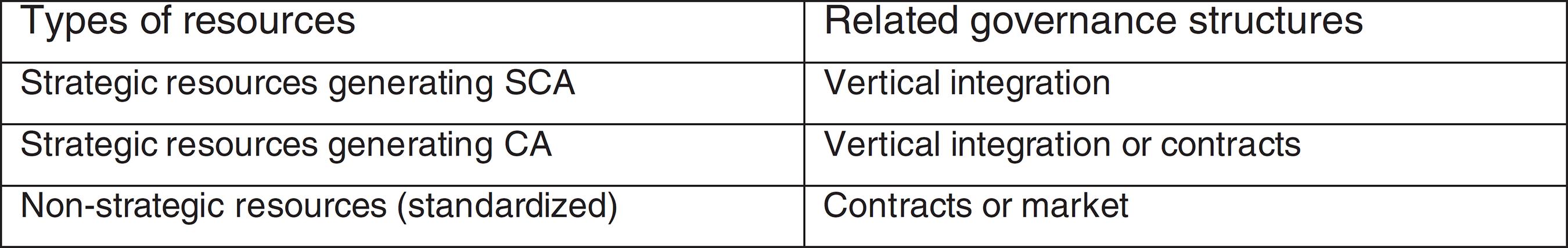

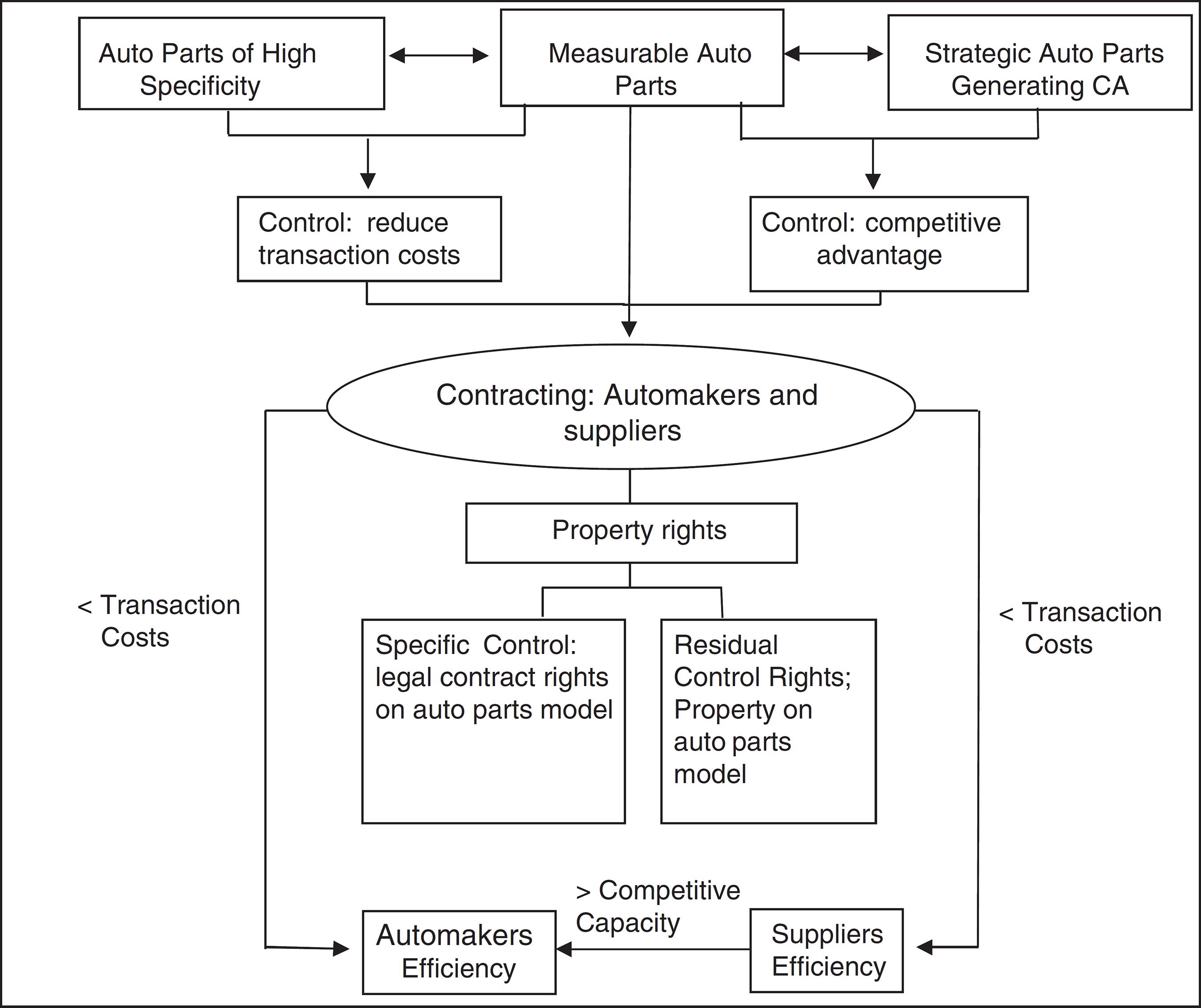

Fig. 1 presents the research analysis scheme, which considers the main constructs of each theoretical approach used: transaction costs (TCT), measurement costs (MCT), and strategic resources (RBV). From these constructs, indicated in the theoretical rationale of each of these approaches, primary influential categories were identified in the definition of contracting: specific assets; ease of measurement; and strategic resources that generate competitive advantage.

These points were treated complementarily and in sequence, through the proposition on contracting involving TCT, MCT, and RBV. This proposition was based on guidelines put forward by Bacharach (1989)Bacharach, 1989 Bacharach, S. B. (1989). Organizational theories: Some criteria for evaluation. Academy of Management Review, 14, 496-515., Whetten (2007)Whetten, 2007 Whetten, D. A. (2007). Modeling theoretical propositions. In A. S. Huff (Ed.), Design research for publication (pp. 217–250). California: Sage Publication, Incorporation., Suddaby (2010)Suddaby, 2010 Suddaby, R. (2010). Editor's comments: Construct clarity in theories of management and organization. Academy of Management Review, 35(3), 346-357., and Ennen and Richter (2010)Ennen and Richter, 2010 Ennen, E., & Richter, A. (2010). Literature on complementarities in organizations: The whole is more than the sum of its parts – Or is it? A review of the empirical. Journal of Management, 36(1), 207-233., which deal with the construction of theoretical models.

Bacharach (1989: 498)Bacharach, 1989 Bacharach, S. B. (1989). Organizational theories: Some criteria for evaluation. Academy of Management Review, 14, 496-515. defines a theory as "[…] a system of constructs […] in which constructs are related to one another through propositions." Along the same vein, Whetten (2007)Whetten, 2007 Whetten, D. A. (2007). Modeling theoretical propositions. In A. S. Huff (Ed.), Design research for publication (pp. 217–250). California: Sage Publication, Incorporation. indicates the need to present the constructs and their inter-relationships, as seen in Fig. 2. It indicates the central proposition of this research, its sub-propositions, and the identification of the influence and interactions between the categories derived from the constructs.

In the view of Ennen and Richter (2010, p. 208)Ennen and Richter, 2010 Ennen, E., & Richter, A. (2010). Literature on complementarities in organizations: The whole is more than the sum of its parts – Or is it? A review of the empirical. Journal of Management, 36(1), 207-233.: "The total economic value added by the combination of two or more complementary factors in a production system exceeds the value that would be generated by the application of these factors of production in isolation." This concept is applied in the present study and indicates that the sum of the result of each theory individually, in the understanding of contractual choice, has different results when considering the complementarity of these theories. Without considering the possibility of measurement, the presence of specific assets or strategic resources would per se indicate a need for vertical integration, not contracting.

Following this line of thought, Suddaby (2010)Suddaby, 2010 Suddaby, R. (2010). Editor's comments: Construct clarity in theories of management and organization. Academy of Management Review, 35(3), 346-357. highlights four fundamental notions that should be considered in order to obtain clarity in a theoretical construction, which this study adheres to. The first is to present definitions capable of persuasively creating precise categorical distinctions between concepts. In this sense, we sought to select and delimit categories for each approach elaborated in this investigation: specific assets (TCT); measurable assets (MCT); and resources (RBV). The second is to outline the conceptual circumstances and scope conditions under which the construction will or will not apply. As far as this is concerned, we sought to define the conceptual aspects related to contracting, linked to the theory of the firm and RBV, as well as the sector under investigation.

The third notion indicated by Suddaby (2010)Suddaby, 2010 Suddaby, R. (2010). Editor's comments: Construct clarity in theories of management and organization. Academy of Management Review, 35(3), 346-357., in convergence with Whetten (2007)Whetten, 2007 Whetten, D. A. (2007). Modeling theoretical propositions. In A. S. Huff (Ed.), Design research for publication (pp. 217–250). California: Sage Publication, Incorporation., is to show the semantic relation with other related constructs. This relation between the constructs, and respective categories, was worked out in the formulation of the sub-propositions, as seen in Fig. 2. The fourth and final notion is to demonstrate a degree of coherence or logical consistency of the construction in relation to the general theoretical argument. It can be seen that the proposition and sub-propositions constructed are directly related to the objective of theoretical complementarity of the present investigation, whose reasoning is indicated in Fig. 3. It shows how propositions "a" and "b" influence the configuration of governance structures, and consequently the efficiency of the segments involved.

Complementarity model-influence of specific, measurable, and strategic assets in the definition and efficiency of contractual governance structures.

Primary and secondary data collection

After formulating our propositions, we started with primary data collection, which was carried out through semi-structured interviews with the purchasing, quality, and logistics managers of the three automakers in the State of Paraná. In addition, we interviewed the logistics managers of seven direct suppliers as well as the industrial and automotive coordinators of the Federation of Industries of the State of Paraná (FIEP). The selection of interviewees was made according to the relevance of the areas of purchase, quality, and logistics based on the relationship with direct suppliers of auto parts. The FIEP coordinators, in turn, were included as key agents in the interviews to provide a systemic and impartial view of the assemblers. All the interviewees, a total of fifteen, had more than ten year's experience in the area, reflecting their capacity to contribute to the objective of this study.

The interviews were carried out during the first quarter of 2015, at the respective offices of the assemblers and suppliers and at the FIEP headquarters, all located in the region of São José dos Pinhais in Paraná state. Since the purchasing area of one of the automakers is based in São Paulo, the interview with its manager was held at this office. Three interviews were also carried out with logistics managers of direct suppliers whose headquarters are located in São Paulo.

The interviews, which amounted to fifteen hours of recording, were transcribed and are available in electronic media. Two specific interview guides were formulated: one directed at the managers of the automakers and the FIEP coordinators, and another for the managers of auto part supply companies. These interview guides, which share a similar structure, were elaborated and organized into three groups of questions. The first group was intended to characterize the companies under study, notably involving characteristics of contracted products. Aspects related to transaction costs, measurement costs, and strategic resources made up the second set of questions. In the third set, questions that dealt directly with the measurement of specific assets and strategic resources were added, in order to answer our propositions and sub-propositions. Secondary data, in turn, were collected through websites and institutions specialized in the treatment of industry data, such as ANFAVEA, and through studies that discussed the industry's dynamics.

Results

Considering the objective outlined for this research, this section seeks to develop propositions and sub-propositions as well as offer theoretical and empirical analysis related to the complementarity of TCT, MCT, and RBV in the configuration of contractual forms. To accomplish this, the interviews with representatives of the automakers, their direct suppliers, and FIEP were taken as our reference.

The proposition about contracting considers that, given the possibility of measuring the attributes of the products, the contractual relationship can be used to guarantee property rights over both assets of high specificity and strategic resources, generating competitive advantage and thereby avoiding the costs of vertical integration.

This proposal was confirmed by the automotive sector of Paraná. Despite the high level of specificity of transacted auto parts, the contractual relationship was identified as predominant in the interviews. In this case, even highly specific or strategic assets-generators of competitive advantage-are transacted through contracts, rather than through vertical integration. Measurability was considered by the interviewees as an essential factor for using contracts to conduct transactions for auto parts of high specificity and which are generators of competitive advantage. The assertions of these analyses, relating to sub-propositions (a) and (b), are detailed below.

Sub-proposition (a): specific and measurable assets

In general, contracts can be used to obtain auto parts in two different situations: standardized assets and specific assets. In the case of standardized assets, whose presence was previously ratified by Melo (2006)Melo, 2006 Melo, A. A. de. (2006). Relações cliente-fornecedor na indústria automotiva: Motivações, estruturação e desenvolvimento. Tese de Doutorado, Programa de Pós-Graduação em Administração, Universidade Federal do Rio Grande do Sul, Brasil. Escola de Administração., and Costa and Henkin (2012)Costa and Henkin, 2012 Costa, R. M., & Henkin, H. (2012). Estratégias Competitivas e Desempenho da Indústria Automobilística no Brasil. In 40º Encontro da Associação Nacional dos Centros de Pós-Graduação em economia – ANPEC., respondents were unanimous in stating that their acquisition could occur through the market, but this option is unsuitable for automakers given the need for traceability. Thus, contracts emerge as mechanisms to ensure this traceability, and ensure the property rights of manufacturers, as highlighted by Ferrato et al. (2006)Ferrato et al., 2006 Ferrato, E., Carvalho, R. Q., Spers, E. E., & Pizzinatto, M. K. (2006). Relacionamento Interorganizacional e Hold-Up no Setor Automotivo: Uma Análise sob o Enfoque da Economia dos Custos de Transação. Revista de Gestão USP, 13(1), 75-87., Casotti and Goldenstein (2008)Casotti and Goldenstein, 2008 Casotti, B. P., & Goldenstein, M. (2008). Panorama do Setor Automotivo: As mudanças estruturas da indústria e as perspectivas para o Brasil. In BNDES Setorial (3rd ed., pp. 147–188) (28), set., and Augusto (2015)Augusto, 2015 Augusto, C. A. (2015). Estruturas de governança no setor automotivo no Estado do Paraná: Implicações sob a consideração dos custos de transação, custos de mensuração e recursos estratégicos. Brasil: Tese de Doutorado, Programa de Pós-Graduação em Administração, Universidade Federal de Santa Catarina.. However, according to Barzel (2002)Barzel, 2002 Barzel, Y. (2002). Standards and the form of agreement. Budapeste, Hungria: 3rd International Society for New Institutional Economics – ISNIE., this is because automakers are able to measure the attributes of the auto parts acquired, especially technical specifications such as quality, quantity, width, weight and origin.

This is clearly demonstrated by the response of the manager of Supply Company 3: "Since the contract can guarantee the assemblers that we will deliver, why will they take responsibility for making these standardized, more basic parts? It's much cheaper and smarter to leave it up to us." Logistics Manager of Automaker A–B adds:

The contract guarantees our rights very effectively, because there are many ways to guarantee; this is all very well planned, every little thing is detailed and we know what to detail. There is a lot of control and if the supplier does not comply, he will be the loser. He will be fined and he will be replaced, so the cost is very high for him to risk doing so. For him it's much more interesting to have a long-term relationship with the automaker, because his volume of sales increases a lot. I worked eight years in engineering and never saw any problem related to the leaking of information or anything. If they do, they will break [the contract].

The situation is the same when it comes to highly specific auto parts. In the first case, even when dealing with transactions for high-specificity auto parts, which would justify vertical integration given the possibility of opportunistic behavior, as proposed by Williamson (1985Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., 1996)Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press., and Ménard (2004)Ménard, 2004 Ménard, C. (2004). The economics of hybrid organizations. Journal of Institutional and Theoretical Economics, Berlin, 160(3), 345-376., there was still a predominance of contractual relations. This predominance is justified, according to respondents, by the existing safeguards, stemming from the possibility of measuring auto parts and reducing transaction costs, as stated by Ferreira and Serra (2010)Ferreira and Serra, 2010 Ferreira, M. P., & Serra, F. A. R. (2010). Make or buy in a mature industry? Models of client supplier relationships under TCE and RBV perspectives. Brazilian Administration Review, 7(1), 22-39.. Therefore, as emphasized by Barzel (2005)Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373., the presence of feasible measurement in the auto parts purchased by the automakers (color, weight, width, and technical specifications in general), makes it possible to have a satisfactory guarantee of property rights over them.

The Quality Manager of Automaker A–B clarifies: "I have a very specific auto part, but I contract, so you ask me why? Because I have more advantage in contracting, I have the means of control; why should I produce if someone does it better and I can control?" Likewise, the Logistics Manager of Supplier Company 5 claims: "The question is: why not contract? Even for specific parts, they control all the details. If there is a mistake, they find out with a recall, and worse, they can track every component that we and our suppliers put in."

In view of the above considerations, it is valid to assume that high-specificity assets can be governed by contracting as long as they have clear measurable dimensions, thus validating the sub-proposition. In other words, even in the case of the high-specificity assets characteristic of the automotive sector (Williamson, 1985Williamson, 1985 Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York: Free Press., 1996Williamson, 1996 Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press.), contracting and control inhibits opportunistic behavior, given the possibility of measurement (Barzel, 2005Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373.), favoring the parties with a guarantee of property rights.

It is worth noting that the interviewees affirm that measurement cannot always be exact, so there is a certain measure of tolerance practiced by the automakers. This situation is exemplified by the Purchasing Manager of Assembler A-B: "My measurement might not always be accurate, but if it goes past me, it can be accepted, because it is within what we quote or produce, so in a way I guarantee that I am not losing in the exchange: sometimes there are acceptable losses." Typically, tolerance in error acceptance relates to the recognition that suppliers have the ability to meet the stated design specifications.

Sub-proposition (b): strategic and measurable resources

In addition to specific assets, several strategic resources generating competitive advantage are also transacted, and even developed, in the relationships between the automakers and their suppliers. It is worth remembering that the resources that generate competitive advantages, using Barney's classification (1991)Barney, 1991 Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120., are those considered rare and valuable, and thus differ from the generators of SCA that, besides these characteristics, must also be difficult to imitate and replace.

It is worth noting that in the process of our investigation several resources generating competitive advantage, which today are common among competitors, were considered innovative at the time (Bluetooth, integrated GPS with SD card, reversing sensor, air bags, among others). In such cases, these are considered valuable and rare resources for automakers (Barney, 1991Barney, 1991 Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.). At the time of release, many of these features had been developed jointly with the more innovative suppliers present in the sector. It was noted that the control exercised by the automakers, enabled by means of measurement, is satisfactory through a contractual relationship because it allows the exercise of specific rights (Barzel, 1997Barzel, 1997 Barzel, Y. (1997). Economic analysis of property rights (2nd ed.). Cambridge: Cambridge University Press., 175 pp.) and, in most cases, residual control rights (Hart, 1995Hart, 1995 Hart, O. (1995). Firms, contracts, and financial structure. Oxford, England: Oxford University Press.; Monteiro & Zylberzstan, 2011Monteiro and Zylberzstan, 2011 Monteiro, G. F. A., & Zylberzstan, D. (2011). Direitos de Propriedade, Custos de Transação e Concorrência: O Modelo de Barzel. Economic Analysis of Law Review, Brasília, 2(1), 95-114.).

Respondents reported that specific control rights are exercised in all auto parts transactions, including cases where the supplier is responsible for mold development and auto parts manufacturing. In these cases, control is ensured through the design of the contract and the existing legal apparatus, supporting Barzel's proposition (2002Barzel, 2002 Barzel, Y. (2002). Standards and the form of agreement. Budapeste, Hungria: 3rd International Society for New Institutional Economics – ISNIE., 2005)Barzel, 2005 Barzel, Y. (2005). Organizational forms and measurement costs. Journal of Institutional and Theoretical Economics, 161, 357-373.. In situations where the automaker is responsible for the development of the auto part mold, and situations in which this development occurs in conjunction with the supplier, the assembler also obtains the ownership of the mold, exercising residual control rights (Barzel, 1989Barzel, 1989 Barzel, Y. (1989). Economic analysis of property rights. Cambridge: Cambridge University Press, 122.; Crook et al., 2013Crook et al., 2013 Crook, T. R., Combs, J. G., Ketchen, D. J., & Aguinis, H. (2013). Organizing around transaction costs: What have we learned and where do we go from here?. Academy of Management Perspectives, 27(1), 63-79.; Grossman & Hart, 1986Grossman and Hart, 1986 Grossman, S., & Hart, O. (1986). The costs and benefits of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94, 691-719.; Hart, 1995Hart, 1995 Hart, O. (1995). Firms, contracts, and financial structure. Oxford, England: Oxford University Press.; Hart & Moore, 1990Hart and Moore, 1990 Hart, O., & Moore, J. (1990). Property rights and the nature of the firm. Journal of Political Economy, 98, 1119-1158.). Therefore, the automaker can decide on the use of some auto parts in situations not foreseen by contract, because it owns the property.