Abstract

Why do merger talks collapse? – an exploratory study about the contributing factors behind ‘wedding cold feet' and deal making failures in Mergers and Acquisitions according to the perspective of active deal making professionals in Brazil. One basic question has encouraged the present study: after all the effort, expectations and money often invested in deal making, why are M&A transactions simply abandoned, even when the benefits to the business, shareholders, customers and employees seem to be clear?

Keywords:

Mergers and acquisitions; Due diligence; Deal breakers; M&A failure

Resumo

Por que as negociações de fusão entram em colapso – um estudo exploratório sobre os fatores por trás dos "pés frios de casamento" e fracassos nas negociações em fusões e aquisições a partir da perspectiva dos profissionais atuantes no negócio no Brasil. Uma pergunta básica incentivou este estudo: Após todo o esforço, expectativas e dinheiro normalmente investidos em dealmaking, porque tantas transações são simplesmente abandonadas, mesmo quando os benefícios são claros para a empresa, acionistas, clientes e funcionários?

Palavras-chave:

Fusões e aquisições; Diligência prévia; Impedimento de negócios; Fracasso em F&A

Resumen

Por qué las negociaciones de fusión colapsan – un estudio exploratorio sobre los factores que llevan al fracaso en fusiones y adquisiciones desde la perspectiva de profesionales que actúan en Brasil. Una pregunta básica ha estimulado este estudio: después de todo el esfuerzo, expectativas y dinero normalmente invertidos en dealmaking, ¿por qué tantas transacciones son simplemente abandonadas, incluso cuando los beneficios son claros para la empresa, accionistas, clientes y empleados?

Palabras clave:

Fusiones y adquisiciones; Diligencia previa; Impedimento de negocios; Fracaso en fusiones y adquisiciones

Introduction

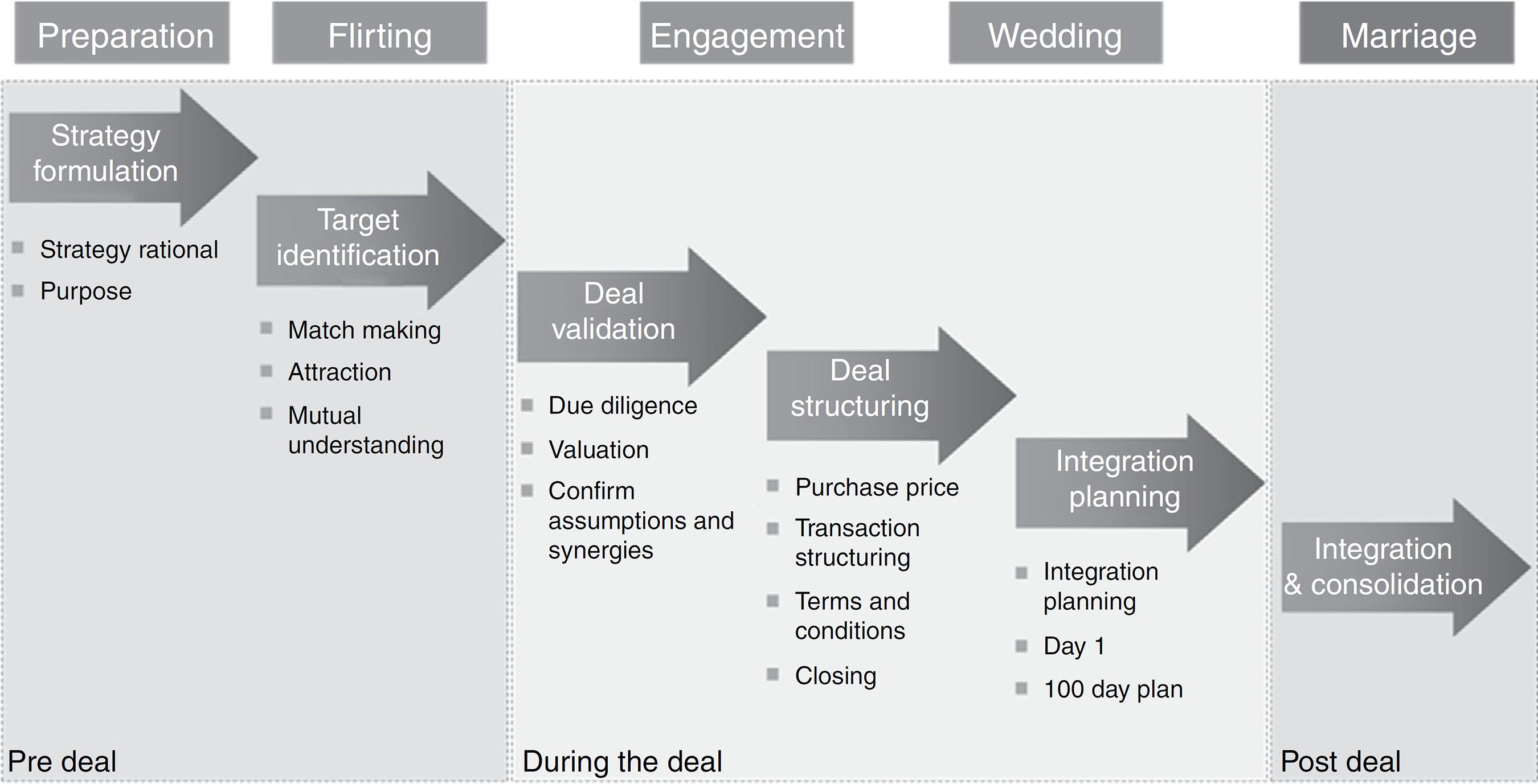

Mergers and Acquisitions represent a ‘marriage' between two partners that are not often equal (Caldas & Tonelli, 2002Caldas and Tonelli, 2002 Caldas, M. P., & Tonelli, M. J. (2002). Casamento, estupro ou dormindo com o inimigo? Interpretando imagens e representações dos sobreviventes de fusões e aquisições. Organizações & Sociedade, 9(23), 171-186.; Coffey, Garrow, & Holbeche, 2002Coffey et al., 2002 Coffey, J., Garrow, V., & Holbeche, L. (2002). Reaping the benefits of mergers and acquisitions: In search of the golden fleece. Butterworth-Heinemann.). In fact, the path that leads to this ‘marriage' between two companies well resembles the typical sequence of events that brings a couple together. It all starts with some sort of flirting, then the relationship starts to evolve and gets a bit more serious, which leads to a commitment level that eventually ends up in marriage. Like any other marriage, M&A also has a day after, a honeymoon and, then, life goes on (or not). If a merger can be illustrated through a marriage scene, then the aim of the current study is to understand why "brides" are left at the altar, and which factors are behind the ‘wedding cold feet' in mergers and acquisitions.

The M&A activity phenomenon is relatively well-studied by academics and practitioners within management environments. These studies have helped shedding light on issues such as the alignment between deal making and strategy, critical success factors in mergers and acquisitions, acquisition process management, due diligence conduction, as well as on valuations and post-deal integrations (Gomes, Angwin, Weber, & Yedidia Tarba, 2013Gomes et al., 2013 Gomes, E., Angwin, D. N., Weber, Y., & Yedidia Tarba, S. (2013). Critical success factors through the mergers and acquisitions process: Revealing pre and post M&A connections for improved performance. Thunderbird International Business Review, 55(1), 13-35.).

Other interesting topics include cultural impacts on M&A deals and CEO's overconfidence in M&A processes, besides matters about why transactions fail to create value. However, very few attempts to study the "No-deal" phenomenon or the reasons why merger talks fail to reach the completion phase have been made, i.e., the eventual signing of the sales and purchase agreement, which is often referred to as "SPA".

One basic question has encouraged the conduction of the present study: why are M&A transactions simply abandoned after all the efforts, expectations and money invested in deal making, even when the benefits to the business, shareholders, customers and employees (acquisition of resources or supplies, vertical integration, market entry, tax incentives, knowledge about other companies, technological expertise, among others) seem to be clear? Overall, stakeholders have different points of view and that is why the current exploratory study was focused on assessing the factors contributing to deal making failures according to the perspective of active deal making professionals in Brazil.

Thus, the aims of the present study were to identify what makes transactions fail midway, to better understand why companies analyze M&A transactions, get involved in negative actions and give up the negotiation afterwards, as well as to identify the causes for such failures and their undelaying motives.

The current study was structured as follows: first, the theoretical background is presented and discussed along with the M&A process and its phases; the second section refers to the adopted research method. The third section concerns data analysis and discussions about the herein found results. Finally, the last section presents the main conclusions.

Literature review

Mergers and acquisitions are corporate strategies that have been helping to foster corporate growth; moreover, productivity and operational excellence also represent important profit drivers. However, other actions are necessary to maintain competitive advantage in environments where executives are pressured to generate increasing revenues (Porter, 1985Porter, 1985 Porter, M. E. (1985). Competitive advantage: Creating and sustaining superior performance. New York: Free Press.). Organic activities (internal development) tend to offer limited growth opportunities, fact that forces companies to seek inorganic growth strategies, mainly mergers, acquisitions and joint ventures, i.e., growth resulting from mergers or takeovers, rather than from increased business activity in the company (Carnevalli Filho, 2000Carnevalli Filho, 2000 Carnevalli Filho, W. (2000). Construindo a sinergia após a aquisição: Um caso real brasileiro sobre integração de empresas. Revista de Administração de Empresas, 40(2), 2-7.).

In order to meet the aims of the current study, the terms "Mergers and Acquisitions", "M&A", "Transaction", "Deal" or "Merger" will be used in an interchangeable manner to denote any combination between two or more companies in order to absorb, merge and combine the assets and liabilities of a company into those of a buying firm or new entity. In addition, it is necessary knowing the M&A motives and processes as a way to further understand the No-deal phenomenon in order to possibly identify the reasons why merger talks collapse, even when they present the potential to significantly create value and seem to be theoretically logical.

There are numerous reasons to pursue a transaction since acquisitions are often at the center of any debate about expansion strategies. Mergers and acquisitions are justified by several reasons and they should comply with the companies' strategic plans on a case-to-case basis.

The different reasons to chase acquisition targets were explained by Hubbard (2013)Hubbard, 2013 Hubbard, N. A. (2013). Conquering global markets: Secrets from the World's most successful multinationals. UK: Palgrave Macmilan., who listed analogous or complementary reasons to start M&A talks, namely: resource acquisition, vertical integration, market entry, client's follow up, gain with economies of scale, market share enhancement, tax incentives, and competitive differentiation. Vermeulen and Barkema (2001)Vermeulen and Barkema, 2001 Vermeulen, F., & Barkema, H. (2001). Learning through acquisitions. Academy of Management journal, 44(3), 457-476. found that ongoing acquisitions might broaden a company's knowledge and decrease its inertia, which are valuable reasons to enter an M&A deal.

Jensen (1982)Jensen, 1982 Jensen, A. E. (1982). Practice of business seeking a candidate for merger or acquisition. Business Horizons, 25(3), 80-84. identified another set of reasons, which includes the access to resources or supplies, technological expertise, the acquisition of talents, geographical expansion, new products, and diversification. Porter (1980)Porter, 1980 Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. Free Press. goes beyond the typical motivations for value-creation acquisitions, and addresses the irrational desire to pursue a target attributable to management idiosyncrasies. In other words, vanity, eccentricity and the need of showing power are part of motivations driven by value-creation acquisitions.

Alam, Khan, and Zafar (2014)Alam et al., 2014 Alam, A., Khan, S., & Zafar, F. (2014). Strategic management: Managing mergers and acquisitions. International Journal of BRIC Business Research (IJBBR), 3(1), . conclude that the basic concept behind transaction processes lies on the fundamental assumption that two companies together are more valuable than the sum of their values in separate. Haspeslagh and Jemison (1990)Haspeslagh and Jemison, 1990 Haspeslagh, C., & Jemison, B. (1990). Managing acquisitions – Creating value through corporate renewal. New York: The Free Press. share the same opinion, they believe that the essential task in any acquisition process lies on creating value by merging two organizations. These authors explain that value created through merging is unique and that such value creation would not be possible if the companies were operated in separate. Thus, they corroborate the idea that the analysis, negotiation and internal selling of an acquisition nominee and the offered ultimate premium are based on the main idea of value creation through business combinations.

The M&A process can be divided in three stages (pre deal, on-going deal and post deal), which are based on seven clear workflows. The following paragraphs are an attempt to link these three transaction stages to the wedding metaphor.

The pre deal or flirting phase has two moments. First, Gole and Hilger (2009)Gole and Hilger, 2009 Gole, W. J., & Hilger, P. J. (2009). Due diligence: An M&A value creation approach. John Wiley & Sons, Inc. state that strategy formulation is a central M&A tenet, because this practice is better than the investment strategy; therefore, acquisitions should be guided and driven by significant strategic planning. Executives need to address the advantages and disadvantages of organic versus inorganic growth ("buy" or "build" analysis) throughout the strategic review. A central question lies on whether the organization has the capability to develop the desired competences internally, as well as on the required cost, time and effort. After reasoning about such matters, executives shall analyze the possibility of buying these competences in the market.

Cullinan and Holland (2002)Cullinan and Holland, 2002 Cullinan, G., & Holland, T. (2002). Strategic due diligence – Excerpted from Global deal making: Definitive guide to cross-border mergers and acquisitions, joint ventures, financings and strategic alliances. Bloomberg Press. reinforce the assumption that significant strategic planning should drive acquisition processes. They believe that the chance to achieve transactional success increases dramatically when the target business of the company complies with the buyer's strategic goals. According to Hubbard (2013)Hubbard, 2013 Hubbard, N. A. (2013). Conquering global markets: Secrets from the World's most successful multinationals. UK: Palgrave Macmilan., pre-acquisition planning is a key factor to the acquisition process. He states that without proper planning the acquirer is at risk, since the information available to support the negotiations with the target company is limited; therefore, it could limit synergy and jeopardize the due diligence process. According to this author, the understanding about the vision and the planning to go forward are essential to gain and keep the acceptance and the enthusiasm of target employees.

Howson (2003)Howson, 2003 Howson, P. (2003). Due diligence: The critical stage in acquisitions and mergers. Gower Publishing Limited. states that only after doing a proper strategic review it is reasonable identifying and approaching an acquisition target. A target screening exercise should begin by setting the goals and aims of the M&A. According to Jensen (1982)Jensen, 1982 Jensen, A. E. (1982). Practice of business seeking a candidate for merger or acquisition. Business Horizons, 25(3), 80-84., many companies act prematurely and begin looking for deals without first considering the company that would best meet their strategic goals.

Jensen (1982)Jensen, 1982 Jensen, A. E. (1982). Practice of business seeking a candidate for merger or acquisition. Business Horizons, 25(3), 80-84. lists five target screening and approaching process phases, namely: (a) defining objectives and ranking the most important strategic benefits; (b) establishing criteria, measures and attributes of the target company; (c) identifying nominees in public and private databases, based on market research; (d) gathering information; and (e) contacting prospects.

According to Howson (2003)Howson, 2003 Howson, P. (2003). Due diligence: The critical stage in acquisitions and mergers. Gower Publishing Limited., if an approach leads to mutual interest, both parts will look forward to starting serious negotiations. If there is good match between the parts, the due diligence process can get started. Accordingly, the second phase of the M&A process, which also includes a due diligence, starts while the dealing process is still going. At this point, the two companies agree on getting to know each other better and on sharing critical and strategic information concerning financial, commercial, operational, personnel, legal and tax aspects. As explained by Bing (1996)Bing, 1996 Bing, G. (1996). Due diligence techniques and analysis: Critical questions for business decisions. Westport, Connecticut: Quorum Books., this phase often takes place after the parts involved in the deal decide that it is feasible and after they get to a preliminary understanding (or to what appears to be reachable understanding); however, at this point the binding contract was not signed yet.

Howson (2003)Howson, 2003 Howson, P. (2003). Due diligence: The critical stage in acquisitions and mergers. Gower Publishing Limited. states that a successful due diligence leads to negotiation rounds and, if such negotiations go well, the deal is set. Bing (1996)Bing, 1996 Bing, G. (1996). Due diligence techniques and analysis: Critical questions for business decisions. Westport, Connecticut: Quorum Books. lists topics to be covered during the due diligence process, but he does not define the field this diligence fits into. The topics include Capital structure and Ownership, Products and Services, R&D and Technology, Competition and Customers, Marketing, Pricing, Advertising and PR, Manufacturing, Purchasing, HR, Corporate Culture, Budgeting and Planning, Debt and Banking, Investments and Cash Management, Taxes, among others.

Drastic consequences can come from unsuccessful due diligences, from overlooking critical areas and, particularly, from non-financial matters. According to Bing (1996)Bing, 1996 Bing, G. (1996). Due diligence techniques and analysis: Critical questions for business decisions. Westport, Connecticut: Quorum Books., financial statements provide thumbnail sketches of a business and of its background, as well as give few clues and trigger insights about the company in the present-term, and enable reasonable guessing about its near future.

Valuation is also an important point throughout the dealing process. Wilde (2014)Wilde, 2014 Wilde, O. (2014). The picture of dorian gray. Enhanced Books., 1890 (First Published in Lippincott's Magazine, June). defines as cynical a person who makes the distinction between value and price, i.e., a person who knows the price of everything and the value of nothing. According to Damodaran (2011)Damodaran, 2011 Damodaran, A. (2011). The little book of valuation: How to value a company, pick a stock, and profit. New Jersey: John Wiley & Sons, Inc., such profile would fit many investors who see investing as a game and define winning as staying "ahead of the pack".

The deal often goes on when the valuation process depicts a win-win situation for both the acquirer and the seller (Gole & Hilger, 2009Gole and Hilger, 2009 Gole, W. J., & Hilger, P. J. (2009). Due diligence: An M&A value creation approach. John Wiley & Sons, Inc.). According to the acquirer, in the buyer's viewpoint, the combined value of the acquired business exceeds the purchase price; on the other hand, in the seller's viewpoint, the price paid is more important than other alternatives, including the continuous ownership of the stand-alone business. Valuation issues able to derail a transaction emerge when the acquirer realizes that such transaction would unlikely destroy the value (Gole & Hilger, 2009Gole and Hilger, 2009 Gole, W. J., & Hilger, P. J. (2009). Due diligence: An M&A value creation approach. John Wiley & Sons, Inc.).

Naturally, negotiations start at the beginning of the process (e.g. when the counterpart is approached) and keep on going until the transaction is closed. The critical stage during the negotiation process is felt right after the due diligence, when the information gathered during it is added to and factored in the valuation model. Such compilation is conducted in order to determine the combined value of the acquisition (Gole & Hilger, 2009Gole and Hilger, 2009 Gole, W. J., & Hilger, P. J. (2009). Due diligence: An M&A value creation approach. John Wiley & Sons, Inc.). A higher premium must be paid if the value predicted for the target company is lower than it was previously thought, fact that could lead to the renegotiation of transaction terms.

Closing the deal means signing the Sales and Purchase Agreement ("SPA"), and it can be compared to saying "yes" in a wedding ceremony; there is no way back after the deal is closed and the merger is complete. Then, it is time to celebrate and start the integration and consolidation process. Integration regards the transition period, when the merged entity is designed and set. Often, a lot of effort and planning is demanded to accomplish a smooth integration, which involves people, assets, customers, suppliers, technologies, infrastructure and operations (Epstein, 2004Epstein, 2004 Epstein, M. J. (2004). The drivers of success in post-merger integration. Organizational Dynamics, 33(2), 174-189.). Consolidation follows the integration process; it is the process when the new entity is already set to work and accomplish the plan, which was the basis for the merger rationale.

Methodological strategy

The current study follows an exploratory qualitative research design. According to Chizzotti (1995)Chizzotti, 1995 Chizzotti, A. (1995). Pesquisa em Ciências Humanas e Sociais. Cortez: São Paulo., exploratory studies often clarify situations in order to raise the awareness about them. This research method was chosen because it offers specialized techniques for information gathering (Bauer & Gaskel, 2003Bauer and Gaskel, 2003 Bauer, M. W., & Gaskel, G. (2003). (Qualitative researching with text, image and sound: A practical handbook) Pesquisa qualitativa com texto, imagem e som. Um manual prático (P.A. Guareschi, Trans.). Petrópolis: Editora Vozes.). Such information result in rich and substantial descriptions of the herein studied phenomenon (Vieira, 2004Vieira, 2004 Vieira, M. M. F. (2004). Por uma boa pesquisa qualitativa. In M. M. F. Vieira, & D. M. Zouain (Eds.), Pesquisa qualitativa em administração (Vol. 2). Rio de Janeiro: FGV).

Merger talks collapse due to a number of objective and subjective reasons. This type of information is often confidential and treated with a lot of discretion. The qualitative approach was chosen, because the reasons for a failure are not often disclosed. According to Neves (1996)Neves, 1996 Neves, J. L. (1996). Pesquisa qualitativa: Características, usos e possibilidades. Caderno de Pesquisa em Administração, 1(3), ., this approach comprises a set of different interpretative techniques that aim at describing and decoding the components of a complex system of meanings.

The qualitative approach was applied to extract executives' impressions about- and experiences with promising M&A talks that have collapsed. The statement by Malhotra (2006)Malhotra, 2006 Malhotra, N. K. (2006). Pesquisa de Marketing – Uma orientação aplicada (4th ed.). Editora Bookman. about the sampling technique, which was developed for qualitative research purposes and to select the participants to be considered, addresses it as a non-probabilistic technique, since it relies on personal judgments about the researcher rather than on the possibility of selecting sample elements.

Moreover, data were collected between March and June 2014 through 16 in-depth interviews with deal makers from different backgrounds, including corporate and private equity professionals, advisors and investment bankers. Sixteen (16) interviewees were intentionally chosen depending on their experience and on the role they played in the transaction processes; their availability and interview accessibility were taken into account.

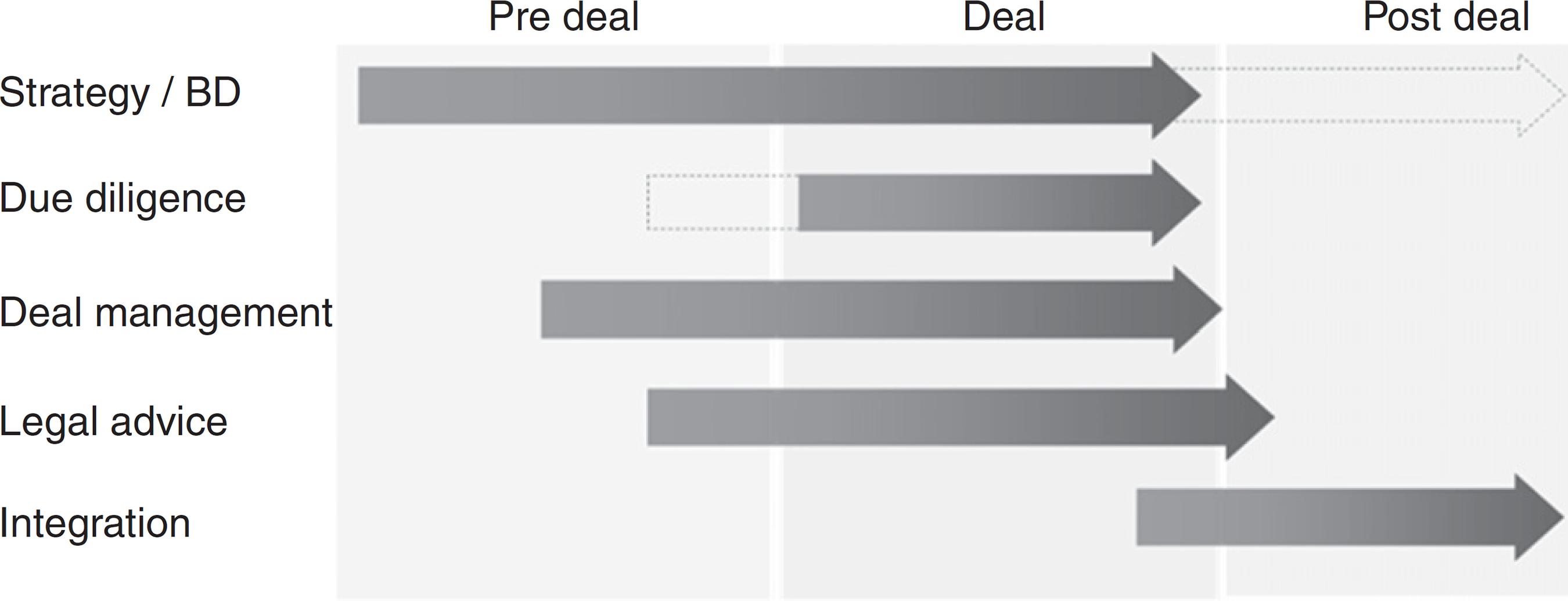

The aim was to investigate the entire deal flow and to understand the correlation between different dialogs, as well as between different viewpoints. The sample was firstly divided in five categories of professionals in order to make it easier to each participant to contribute to the research (Fig. 1):

-

Strategy and Business Development "BD" professionals are often brought in before the deal takes shape and put in direct contact with the top management, either if the deal is considered to be made or not. Strategy and Business Development professionals often participate in the process before, during and, sometimes, after the deal is made.

-

Deal Management professionals are individuals hired to coordinate the M&A process, as well as to negotiate, value and close the deal. They are often responsible for the target (or investor) approach, for liaising with the valuation teams and attorneys in charge of drafting the SPA, during the due diligence.

-

Due Diligence professionals control the transaction evaluation (aka due diligence) process.

-

Legal Advisors are responsible for drafting the SPA and performing a legal due diligence.

-

Integration professionals are consultants hired to conduct the Post Deal Integration work. These professionals are often brought in during the due diligence phase.

Interviewee classification

The sample was divided into (A) Advisor and (B) Buyer/Seller based on other aspects in order to simplify the process. Sample categorization results can be seen in Table 1, which presents the following information: the role a person plays in the negotiation, this person's focus on the transaction, the total number of transactions this person has participated in, the number of failed transactions (non-deal) this person has participated in, and the person's level of involvement. The names of the participants were omitted for confidentiality reasons, to give them neutral identification (column identification).

Overall, the interviewer was aware of the interviewees' general willingness to cooperate, mainly because of the way the interviews were conducted. It seems that the ideal interview recommended by Lodi (1991)Lodi, 1991 Lodi, J. B. (1991). A entrevista: Teoria e prática. Editora Pioneira: São Paulo. was accomplished, i.e., the interviewee raised the favorable and unfavorable reasons to participate in the interview. Some favorable reasons included altruism, and the pursuit of emotional and intellectual satisfaction.

Open questionnaire

The questions, which were relatively open, were placed according to the interviewee's profile, personal experience and willingness to share. However, a free script comprising relevant questions about the subject was used as guide during the interviews in order to contextualize the investigated topic and to better understand the respondent's relation with the M&A process, for example:

-

What is the role you play in the transaction process?

-

How many transactions have you participated in?

-

How many transactions have you seen abandoned?

-

How active was your participation in these processes?

-

Based on your personal experience, what are the factors leading to the abandonment of a transaction? Think about an emblematic transaction you have participated in, but that was actually not completed. What were the contributing factors leading one or both parts away from the deal? Is there a price to be paid for walking away from a deal? Please comment.

-

Finally, have you witnessed transactions that were not supposed to be completed, transactions that, despite the ‘cold feet' or hesitation of one part of or both parts, ended up going all the way to the end? What were the consequences of it? Please comment.

Data analysis

A content analysis was conducted in order to treat the collected information. It is an extremely useful analysis technique, especially for qualitative research emphasizing the need of systematizing testimonies and relying on language studies (Dellagnello & Silva, 2005Dellagnello and Silva, 2005 Dellagnello, E. H. L., & Silva, R. C. (2005). Análise do conteúdo e sua aplicação em pesquisa de administração. Pesquisa qualitativa: Teoria e prática (Vol.2) Rio de Janeiro: FGV.). According to Gill (2003)Gill, 2003 Gill, R. (2003). Análise de Discurso. In M. W. Bauer, & G. Gaskell (Eds.), Pesquisa qualitativa com texto, imagem e som: Um manual prático. Editora Vozes: Petrópolis., there is no single perspective on content analysis, but a number of different analysis types.

The narratives were transcribed in the pre-analysis stage and, subsequently, assessed and organized according to factors that have led to the abandonment of the transaction process. At the end, based on the collected information, data were interpreted in order to find the link between elements in the narrative and the simultaneous presence of two or more elements in a testimony.

Although the very nature of the exploratory design does not allow formulating hypotheses a priori (Vergara, 2000Vergara, 2000 Vergara, S. C. (2000). Projetos e relatórios de pesquisa em administração (3ª edic¸ão). Editora Atlas: São Paulo.), there is consensus that it is possible generating new assumptions by analyzing the collected testimonies. Such assumptions may be useful to future research and studies on the topic, as well as to help developing knowledge on business management, mainly in the Merger and Acquisition field.

The gathered information mostly consisted of recollecting and interpreting the interviewees, who are a group of active professionals who have valuable insights, as well as vast experience on- and knowledge about deal making. It is important mentioning that these professionals could have introduced biases and subjective elements from their personal involvement with the studied subject, the so-called "No-deal" phenomenon. Additionally, a diversified sample may cover important trends and findings if the study is performed according to a particular subset of participants.

Research results

The current section presents the analysis applied to the performed interviews, as well as the collected information, the key findings and interpretations. Data interpretation focused on factors that have contributed to merger talk collapses. Interviewees were very collaborative, and the data collected during the interviews were filtered, so that only information relevant to the present study was used. It was done in order not to disturb reader's understanding.

Data were presented according to the logical order of the conversations: typical roles played during a transaction, the usual deal flow; when the merger talks could collapse during the negotiation, common factors contributing to merger talk collapses, the price paid for walking away from a deal, and other considerations.

What are the typical roles played in M&A processes?

The interview results corroborated the belief that the roles played during transactions have close link to the part professionals are playing (e.g. buyer, seller, advisor), to their contribution to the deal evaluation (e.g. strategy, due diligence, valuation) and to different stages of the transaction process (e.g. pre-deal, on-going deal, post-deal).

The main actors within the deal-making process are (a) the "Buyer" or "Investor", who is the one paying for the stake in a business by acquiring shares or assets from other company; and (b) the "Seller" or "Target", who is the part selling a stake in a business by divesting shares or assets to another company.

The buyer and seller characters in a so-called merge of equals may not be very clear or easy to identify. There are times when these characters may not even be present at all, if the newly merged company keeps a 50/50 shareholding structure, since this system gives no special powers or benefits to any of the parts.

Buyers and Sellers can be grouped according to their nature; they can be of corporate or private equity nature and include public (listed companies) and private companies. On the other hand, private equity parts are often composed of investment companies dedicated to invest in operating companies. These equity companies make their living by acquiring, fixing and selling business.

Finally, depending on the origin of the capital, Buyers and Sellers can be classified as domestic (Brazilian) and foreign companies. Interviewees also approached companies based on the type of capital: family-owned, public (listed) companies, multinationals and state-controlled entities.

It is worth emphasizing that governments and state-owned companies can make acquisitions in the market. According to the interviewees, the reason for governments and state-owned companies to engage in business deals demands a reasonable level of political interest.

Advisors support buyers and sellers in searching for-, assessing and managing a deal. They often work side by side with executives in mixed teams or in functions supporting decision makers. Depending on the size and complexity of the transaction, the number of advisors can be larger.

The action perimeter of advisors can vary, but the scope of their typical work can be set according to the stages of the deal.

-

Stage 1: Pre-deal advisory. Buyers and sellers evaluate the opportunities to invest in a certain market or divest a business during the pre-deal phase. At this point, it is not rare to have CEOs, CFOs and Boards searching for an external opinion to develop or validate the strategy formulation process.

-

Stage 2: Deal advisory. It starts by identifying acquisition targets or potential investors to invest in a company. Buyers and sellers can use advisory support to manage the deal, because these advisors are negotiation and project management experts. The deal manager coordinates other advisors and internal teams in charge of closing the best deal possible. Remuneration is based on success rates, and on the role played by specialized financial advisory firms, M&A boutiques and investment bankers.

The due diligence, as well as valuation and the drafting of key deal documents, including understanding memos, offer letters and SPAs, are activities performed during the dealing process.

-

Stage 3: Post deal advisory. Consultancy focused on planning and accomplishing a smooth integration process by preparing the merging companies from Day 1 on. The consultants also calculate and validate synergies, besides integrating teams; a number of consulting works can be used to support the newly merged entity during the post deal phase.

How does the deal usually flow?

Interviewees confirmed the deal flow previously discussed in the literature review. They explained that, some of the phases tend to run concomitantly; therefore, in practical terms, there is some degree of flexibility in the way things are done. They also corroborated the assumption that merger talks tend to collapse when companies start to get to know each other in detail. This result meets the ‘flirting, engagement and wedding' analogy, since it is similar to what happens to engaged couples. The more you know the other one, the more susceptible you are to see beyond the first impression.

The following deal flow was based on contribution from the literature and on the interview program (Fig. 2):

Is it possible determining when a merger talk often collapses?

Not all M&A processes get to a successful conclusion, because of the negative perception that the opportunity for potential value creation does not compensate the merging costs when the parts become more and more familiar with one another; thus, one or both parts decide to abort the negotiations and walk away from the deal. According to the business jargon, the so-called "Deal breaker" consists of unresolved issues that come up during the negotiation process and that may cause one or more parts to walk away from the deal.

According to the interviews, merger talks often collapse between the deal validation and structuring stages, mainly during or right after the due diligence.

"It's at the due diligence that information is exchanged and that the skeletons in the closet can be unveiled" (A4, Advisor, Deal management)

"All relevant issues raised during the due diligence exercise will impact the valuation [purchase price], terms and conditions of the deal to be closed, as well as the structure of the deal. Sometimes, the risks are so high that they surpass the price to be paid by the target, thus destroying the deal". (A3, Advisor, Deal management)

"It's during the due diligence that deal breakers arise". (B3, Buyer/Seller, Due diligence)

"A risk revealed during the due diligence phase may be manageable with proper deal structuring. Depending on the situation, certain measures can be adopted to try shielding the merged entity or ‘newco'. This is particularly valid for tax, labor and legal risks. Advisors bring their market experience to design mechanisms to mitigate the risks, without eliminating them, but by bringing a better level of comfort to the involved parts." (A8, Advisor, Legal)

"In certain cases, the deal structure proposed by the sellers need to be negotiated. Sometime the transaction falls apart because of lack of flexibility between the parts. Obviously, it all involves the cash to be paid or received and the respective timing of cashing it." (B3, Buyer/Seller, Deal management)

What are the common factors contributing to merger talk collapses?

It is possible classifying deal breakers in two categories – qualitative and quantitative – by analyzing the interview program results. Qualitative issues are difficult to be expressed in numbers, but they can represent a real threat to the deal, to the acquirer or to the newly merged entity. The quantitative issues can be translated into numbers, as well as factored through purchase price, valuation model adjustments and/or through the normalization of the multiples.

As it can be seen in Table 2, although a number of issues were reported, priority was given to the six main topics, namely: (1) window dressing; (2) unrealistic expectations concerning business valuation; (3) tax-related risks, aggressive tax planning and over engineered schemes; (4) lack of information during the due diligence exercise; (5) interpretation disputes and failure on getting to an agreement due to the adjustments proposed for the due diligence; (6) general lack of governance, informalities and questionable corporate practices; which were acknowledged for having great influence on deal collapses.

Window dressing

According to the interviewees, it is not rare that many target companies make questionable adjustments to the financial statements and management reports during the preparation of a sales process in order to draw the most optimistic picture possible to potential buyers. Such reports and statements can jeopardize credibility and eventually lead the merger talks to collapse.

"Numbers that have no proper support predictions and based on wishful thinking, hidden issues brought to light during the due diligence process or the non-disclosure of material items at the appropriate time are typical manifestations of window dressings in transactions. It obviously impacts trust, which is fundamental for any type of negotiation, particularly in M&A" (A7, Advisor, Due diligence)

Unrealistic expectations regarding business valuation

Different expectations concerning the value of the business about to be sold or merged were the second most common issues reported by interviewees.

"It is normal to see gaps between the expectations of sellers and buyers. The more sophisticated the seller, less dissonance will be seen in the negotiation. For example, I have seen cases wherein sellers do not have a clear idea of what a discount cash flow is and about what they have in mind in a multiple thrown in the air by some amateur advisor. It creates a lot of confusion and at the end, we have to try educating the seller on how to proper value a business. The problem is that when the seller has a number in mind it is difficult to override it." (B1, Buyer/Seller, Strategy/BD)

Tax-related risks

The taxation environment in Brazil is complex, it is often changing and the burden is one of the highest in the world. According to the interviewees, it is not rare to see Brazilian companies, particularly family-owned business and mid-sized companies, trying to reduce the burden.

"Tax complexity is significant and it can be a deal breaker. Different interpretations of complex rules, and the fact that there is no tax clearance, increase the level of uncertainty in negotiations. Challengeable tax incentives, aggressive tax planning and creative schemes to reduce tax burden can have direct impact on risk perception and, consequently, on the valuation of the company to be acquired" (B5, Buyer/Seller, Due diligence)

"Tax evasion is more difficult to be achieved in the new tax electronic systems in place (e.g. SPED), but it is still out there" (A6, Advisor, Due diligence)

Lack of information (or preparation)

"There is nothing more frustrating for us than signing a non-binding offer, kicking-off the due diligence and realizing that the target company is not prepared for the deal. There was this particular transaction where the information was so scarce that we had to hire an accounting firm to reconstruct the target company accounting and to gather information for us, so we could analyze and evaluate the business opportunity. Sellers were managing the business on a cash basis and had very little structured financial information to share. This transaction was painful. We tried very hard because it was an interesting asset in a geography that was key for us to expand into… but after months digging the scarce information available we decided to walk away." (B1, Buyer/Seller, Strategy/BD)

Failure to get to an agreement on the adjustments proposed for the due diligence

At the end of the due diligence period, buyer and seller get together to discuss the key due diligence issues and the respective impacts of it on the negotiation and valuation of the acquisition target company, as well as to discuss the mechanisms to mitigate risks identified throughout the process.

"During the financial due diligence, we tend to focus on assets that could be overstated or that are at risk of realization, on unrecorded liabilities or on hidden contingencies, working capital trends, CAPEX trends. On the income statements side, we investigate the quality of earnings, non-recurring items impacting EBTIDA, related part transactions, provisions, allocations, capitalization of expenses and cut-off issues. The due diligence report includes a summary of all identified adjustments that will feed the valuation model and price negotiations. Obviously, there are cases where seller's risk perception is very different than that of the buyers and it creates an impasse, sometimes, difficult to reconcile… and the deal collapses." (A5, Advisor, Due diligence).

"Due diligence exercises in Brazil often identify more issues and risks than investors in developed markets may be used to, particularly in tax and labor spaces." (A7, Advisor, Due diligence)

General lack of governance, informalities and questionable corporate practices

According to the interviewees, questionable practices, informality and lack of governance were some of the main factors contributing to merger talk collapses. A seasoned due diligence advisor has well-summarized the feelings shared by most interviewees:

"By talking about deal making in Brazil, I understand that there are cases that may lead to the abandonment of a transaction due to qualitative issues, particularly those involving reckless management; fraudulent and criminal acts clearly contrary to the laws that can have weight in the decision. Still, this decision depends on the type of investor and on the objectives of the transaction. Institutional investors (PE's, Investment Funds and the like) are more reluctant to treat such issues as listed above. However, Brazilian strategic investors may have a more complacent view (in the sense of being able to resolve the situation in the ‘post-acquisition') due to the need of acquiring the asset (or entity, or technological knowledge, or withdraw a potential competitor). The price drop is also related to the type of investor. Funds and PEs may present the gains (at short and medium terms) that could be assessed, given that the potential of the target company was not acquired. Strategic buyers may face a future major competitor, or fail to acquire certain knowledge or technology that could lead to increased revenue levels, EBITDA and market share. In general, the most visible consequences at first are issues involving litigation and contingencies (materialized and not materialized) that arise from tax, and tax and labor issues. However, concerning frauds, acts and conducts contrary to the law also become possible future problems. Having said that, I perceive a clear distinction between Brazilians and foreign investors: local deal makers are more complacent and tolerant to ethical issues. U.S., European and Japanese investors are very concerned with reputational risks and with the FCPA type of issues." (A7, Advisor, Due diligence)

Another interviewee confirmed:

"I witnessed Brazilian strategic investors who, with the support of a large financial institution that has entirely financed the deal, did not care for the numerous indications of financial and accounting misconduct (some of those confessed in written by sellers), acts contrary to the laws (including bribery of government officials), and the consequent exposure of the target company. The transaction was completed, the buyer worked to adjust the internal practices of the acquired company and managed all contingencies and risks identified during the due diligence. Sales price, form of payment and the terms of the acquisition were also adjusted during the closing, so that the buyer could mitigate some risks and get some protections against possible future risks. That included getting the formal commitment of former owners to respond to any risks and exposures (including the payment of fines, debts, costs and court and attorney's fees when applicable). In some cases, the mechanism of ‘escrow account' was used. (…) "Based on my experience, this is the type of negotiation that only a buyer well versed in doing business in Brazil can achieve. Sophisticated buyers, particularly international firms, have difficulties to live with and manage that kind of risk, particularly if they originated from questionable corporate practices." (A9, Advisor, Integration)

Brazilian companies are becoming increasingly aware of recent anti-corruption and anti-bribery laws in Brazil. The new rules are similar to the US FCPA and UK Bribery act. A number of small and mid-sized companies will soon need to adapt because they still make use of non-orthodox practices to avoid bureaucracy and reduce tax burden. Nowadays, these companies rarely engage top reputable accounting firms to audit their financial statements.

Is there a price for walking away from a deal?

The collapse of a merger talk can trigger frustration feelings in the involved parts, particularly in those emotionally connected to the deal. However, when the due diligence unveils a high degree of uncertainty, risks beyond the acceptable levels or a purchase price that is difficult to achieve in the future, the best decision to make is to walk away.

Accordingly, a Brazilian deal maker quoted:

"Get to know your walk away number". (A4, Advisor, Deal Management)

However, walking away from a deal is not that obvious, Gole and Hilger (2009)Gole and Hilger, 2009 Gole, W. J., & Hilger, P. J. (2009). Due diligence: An M&A value creation approach. John Wiley & Sons, Inc. explain that acquisition transactions take on a life of their own, individuals and organizations become committed to them, and such commitment is expressed through dangerous enthusiastic support, optimistic expectations and broad-based company involvement. Many of the forces at work would mitigate the ‘pulling the plug' effect during the transaction and any attempt to keep on justifying the transaction is often a triumph of hope over good judgment, thus it should be strongly avoided.

This contrary force pushing to deal completion is a behavior commonly referred to as "deal fever", a mindset not rarely manifested in the M&A process, which is featured by overconfidence and "high testosterone levels". As suggested by Bing (1996)Bing, 1996 Bing, G. (1996). Due diligence techniques and analysis: Critical questions for business decisions. Westport, Connecticut: Quorum Books., investors' enthusiasm with the business can be so great it clouds their sight. He goes further and makes a distinction between the time the business has been coveted for- and if this time represents a key component in a strategic plan. Therefore, great irrational enthusiasm impairs objectiveness.

The same view is shared by a large number of interviewees:

"You don't want ‘deal fever' to blind your objectivity or hijack your reason. Consequences can be disastrous." (B1, Buyer/Seller, Deal Management)

The next case shows a foreign investor doing what was necessary to close the transaction, a typical case of ‘deal fever' as described in the interview:

"Again, family-owned businesses are complicated. I was working for this client [buyer] for two years trying to crack a deal with this promising business. The main driver was the potential of the Oil & Gas industry in Brazil. The target had a very optimistic view about the future of the business. It was in 2009–2010 and the potential of Pre-Salt discoveries were blinding everybody involved in the deal. Aside from the problems to validate the forecast assumptions, sellers were not very sophisticated and it took almost one year to complete the due diligence. No proper financial reporting was in place and, despite its size, the company was managed on a cash basis. It was no deal for amateurs. There were all possible complications including ex-wife, broken relationships with sons of the first marriage, and three advisors trying to manage the deal on behalf of the founder of the business and selling part (!)… The length of the negotiations almost killed the deal, but the buyers were in the ‘deal fever' mode and there was a mandate from HQ to close the deal." (A5, Advisor, Due diligence)

It is interesting to observe the different risk perceptions between sellers and buyers. The following case illustrates the case of a seller who, in his view, believed that there was "excess of caution" from the buying side. The potential acquirer here was a foreign investor:

"The merger was clearly a win-win proposition for all parts involved. On the buying-side, there was a foreign investor and we were the private equity fund working with the sellers, a Brazilian company. The buying-side due diligence advisors informed their client about potential tax risks. They took the opinion of the advisors in a very strict way, differently from what we are used to see in Brazil. In practice, the tax risk was very low or almost nonexistent. Particularly because the sellers offered the ability to adjust the "risk" through a deposit in an escrow account, an attitude totally "pro deal"! The advisors certainly had a decisive influence on the deal to be abandoned. In my view, the attitude of advisor was the worst possible, clearly, he wanted to get rid of the problem. The advisor simply preferred to say that the risk was high and the buyer dropped the deal. What a shame for the investor because a few months after the negotiation the risk actually never materialized and a great opportunity was lost. The company has been delivering a result above the forecasted business plan." (B3, Buyer/Seller, Deal Management)

Other considerations

Cultural aspects and other soft underestimated issues

The interviewees did not see cultural aspects as important risks for deal making, except when cultural issues were manifested in questionable corporate practices.

"Cultural aspects are taken more seriously in developed markets. For example, in those markets, we do integration planning as part of the due diligence process and one of the things we analyze is ‘cultural fit'. I have been working in Brazil for two years now and I haven't seen cultural issues being taken into consideration for closing a deal. It is only analyzed after the transaction is closed and the companies have to integrate their operations. In Brazil, people are much more worried about numbers, synergies, operations and the infrastructure to support the business. I think it is part of the stage we are in. As the M&A industry evolves, we will get there." (A10, Advisor, Integration)

Haspeslagh and Jemison (1990)Haspeslagh and Jemison, 1990 Haspeslagh, C., & Jemison, B. (1990). Managing acquisitions – Creating value through corporate renewal. New York: The Free Press. analyzed the cultural aspects of deal making and stated that managers may not always have information to judge how different cultures and subcultures in both organizations are, before they experience those differences themselves. They suggest an early focus on the strategic capabilities that need to be preserved, on to what extent they depend on keeping a cultural difference and can be held in a sub-part of the organizational focus.

In other words, value creation, in its various forms (size, customers, markets, synergies, competences), may be directly linked to cultural aspects. Losing these skills may potentially have a reasonable impact on the ability to find the potential value to be created by the merger. Therefore, the cultural issues should not be underestimated, but should be factored into the decision-making process, along with other quantitative or qualitative issues.

Investors trying to enter Brazil may accept to pay extra money.

According to the interview program, foreign investors trying to enter Brazil seem to be willing to pay a higher price when they are compared to domestic players:

"Every time a foreign investor is willing to pay more than what the valuation says it is justifiable by the word ‘strategic'. ‘It's a strategic investment', they say. As a valuation professional, I have to accept the fact that these buyers are seeing something more than just the numbers we present to them." (A3, Advisor, Deal management)

"I have seen a number of transactions where foreign investors have a mandate to enter Brazil and they will pay as much as the target asks for. Sometimes they accept a ridiculous price." (A5, Advisor, Due diligence)

"Private Equity investors are very conscious about the price they are paying and they are just the opposite of some eccentric foreign investors. Price equity tend to try paying less than the fair price. They are clever investors and their focus lies on the short-term. Strategic investors tend to think in the long-term. Their decision-making process is based on the next ten to twenty years, not on the next five years." (A1, Advisor, Strategy/BD)

"For our HQ, it was important to expand into Brazil and we believed it was possible to turnaround the business and bring synergies and new products to conquer the Brazilian market. The acquisition was just a platform for further consolidation." (B1, Buyer/Seller, Strategy/BD)

Deal fever is a powerful force and may bring irrationality to deal making

Liu and Taffler (1998)Liu and Taffler, 1998 Liu, Y., & Taffler, R. (1998). Damned out of their own mouth: CEO overconfidence in M&A decision-making and its impact on firm performance. Working Paper. Edinburgh: University of Edinburgh Business School. studied CEOs' overconfidence in M&A decision making by analyzing a sample composed of 1900 transactions and data from more than 3100 CEOs. They concluded that CEO overconfidence has significantly negative impact on both short- and long-term post-M&A performance, and it corroborates Bing's hypothesis.

McSweeney and Happonen (2012)McSweeney and Happonen, 2012 McSweeney, B., & Happonen, E. (2012). In D. Faulkner, S. Teerikangas, & R. J. Joseph (Eds.), The handbook of mergers and acquisitions. Oxford: Oxford University Press. state that commitment, secrecy and intense concentration, as well as pressure from outside advisors can create a situation where the acquisition team may feel unable to stop the process or to slow its tempo, thus making the No-deal phenomenon unlikely to manifest. According to these authors, this phenomenon can lead to escalading desires, to quick process completion and to ‘close the deal', which also leads to overvaluation and inadequate considerations about integration issues.

The idea that the transaction momentum is hard to resist to is also supported by Cullinan, Le Roux, and Weddinger (2004)Cullinan et al., 2004 Cullinan, G., Le Roux, J., & Weddinger, R. (2004). When to walk away from a deal. Harvard Business Review, 82(4), 96-104., who corroborate such statement by exemplifying the case of the Dominicks' acquisition by Safeway (a leading American grocery chain) in 1998. The deal was closed in a hurry, within five weeks, which was approximately a third of the mean closing time for large transactions. This swift transaction was based on Safeway CEO's confidence on his own capacity to increase Dominick's operating margin from 7.5% to 9.5%, although Safeway was operating at 8.4% only.

On the strategic side, the deal proved to be unfitting. According to Cullinan et al. (2004)Cullinan et al., 2004 Cullinan, G., Le Roux, J., & Weddinger, R. (2004). When to walk away from a deal. Harvard Business Review, 82(4), 96-104., Dominick's focus on prepared food, on in-store cafes, and on product variety did not fit Safeway's emphasis on store brands and cost discipline. Dominick's strong unions resisted Safeway's aggressive cost-cutting plans. Because Dominick's customers were unwilling to accept Safeway's private label goods, Dominick's was soon losing share to its archrival, Jewel. Therefore, Safeway was not able to sell Dominick for even one fifth of the original purchase price.

According to Cullinan et al. (2004)Cullinan et al., 2004 Cullinan, G., Le Roux, J., & Weddinger, R. (2004). When to walk away from a deal. Harvard Business Review, 82(4), 96-104., a proper due diligence process was followed and the risks were well-studied by Safeway. The company would have possibly been able to detect potential dangers and to quantify some of the problems manifested after the deal was closed. In other words, the proper due diligence would have given elements for Safeway to walk away from the deal. Table 3 shows a summary of the key findings in the current study by analyzing those interviews and the most relevant points to the herein presented problem.

Conclusions

According to Gole and Hilger (2009)Gole and Hilger, 2009 Gole, W. J., & Hilger, P. J. (2009). Due diligence: An M&A value creation approach. John Wiley & Sons, Inc., there are two circumstances leading to deal-failures: when the transaction presents an unacceptable level of risk or when its value-creation plan is based on seriously flawed assumptions or both.

Horn, Lovallo, and Viguerie (2006)Horn et al., 2006 Horn, J. T., Lovallo, D. P., & Viguerie, S. P. (2006). Learning to let go: Making better exit decisions. McKinsey Quarterly, 2, 64. state that, although the canceling of a project or exiting business may be often regarded to as a sign of failure, such moves are perfectly normal parts of creative-destruction processes. Actually, the unaccepted alternative lies on gambling away the company's resources on endeavors likely to fail in the long run, regardless of the invested amount.

Based on the exploratory interview program conducted to support the present qualitative research, the present study gave six contributions to the M&A literature, particularly to the Brazilian transaction context. First, issues contributing to merger talk collapses such as window dressing, unrealistic expectations regarding business valuation, tax-related risks, lack of information (or preparation), failure to agree on the adjustments proposed for the due diligence, general lack of governance, informalities and questionable corporate practices were identified, as it can be seen in Table 2.

Second, qualitative issues can be as destructive for merger talks as valuation issues such as tax risks, contingencies, quality of earnings and other liabilities. Third, the feeling of active deal makers in Brazil about foreign investors, who tend to be stricter to qualitative issues, was captured; domestic buyers tended to be more flexible and complacent.

Fourth, according to the present results, the existing powerful counter-force, – which is commonly referred to as ‘deal fever' by practitioners, was acknowledged as a form of overconfidence able to override rational decisions about mergers and acquisitions. Fifth, it was also possible to conclude that merger talks often collapse at (or right after) the due diligence phase.

The last contribution regards the Brazilian bureaucracy, which, apparently, is complex and imposes high tax burden, fact that may be an important informality driver, as well as regards the adoption of non-orthodox tax practices, particularly on the family-owned business environment.

When it comes to the main herein addressed questions, interview data supporting the findings and conclusions also provided valuable insights about each factor driving merger talks collapse, as well as opened up new potential areas for future research. It is possible stating that "lack of professionalism", on one or on both sides, is potentially the only common factor driving the risk of reaching an unacceptable level. Moreover, it is an important condition allowing the use of flawed assumptions to create a false portrait of value by critically analyzing the six main issues contributing to merger talks collapse.

Nowadays, based on the conducted interview program, it is important emphasizing that deal makers who are actively working in Brazil do not report issues such as macroeconomic conditions, political and social environment or market as determinant factors contributing to deal making failures. Such issues can be treated through relatively objective approaches and factored into the valuation model. Additionally, these factors are potentially evaluated upfront at the strategy formulation phase or at the target identification phase, since they are external to the deal.

The M&A process demands time and often encompasses an acknowledged ritual between the parties. This ritual could be comparable to human relationships to some extent; for example, for a man or woman who just met each other, it is difficult to ask for a background check, credit report, and about psychological, behavioral or medical opinions when they are still in the flirting stage.

Therefore, it is recommended that companies seeking to engage in merger talks, particularly those trying to attract investors, to get prepared before entering in serious negotiations. Preparation is herein understood as improving corporate governance; resolving informalities, challengeable tax practices and evidences of questionable corporate acts and window dressing mechanisms.

Thus, hiring specialized external professional advice may be the proper solution. Certain issues are not fixable from one day to another (for example, certain tax risks need at least five years to disappear). However, companies contemplating M&A should not wait for a due diligence exercise conducted by a counterpart, because it would expose their internal problems. Instead of letting the deal collapse, these companies should start considering to become more professional.

On the other hand, investors should apply all the mechanisms available to identify certain issues that could potentially lead to deal making failure upfront, before engaging in serious negotiations. These issues should be raised according to a phased approach or through a pre-deal fast track due diligence agreed with the counterpart. This diligence could avoid spending a tremendous amount of money, time and resources in merger talks that are doomed to fail.

Finally, deal makers should have Scott Neustadter's cynical advice [(500) Days of Summer] in mind: some people are meant to fall in love with each other… but they are not meant to be together.

-

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.

References

-

Alam et al., 2014Alam, A., Khan, S., & Zafar, F. (2014). Strategic management: Managing mergers and acquisitions. International Journal of BRIC Business Research (IJBBR), 3(1), .

-

Bauer and Gaskel, 2003Bauer, M. W., & Gaskel, G. (2003). (Qualitative researching with text, image and sound: A practical handbook) Pesquisa qualitativa com texto, imagem e som. Um manual prático (P.A. Guareschi, Trans.). Petrópolis: Editora Vozes.

-

Bing, 1996Bing, G. (1996). Due diligence techniques and analysis: Critical questions for business decisions Westport, Connecticut: Quorum Books.

-

Caldas and Tonelli, 2002Caldas, M. P., & Tonelli, M. J. (2002). Casamento, estupro ou dormindo com o inimigo? Interpretando imagens e representações dos sobreviventes de fusões e aquisições. Organizações & Sociedade, 9(23), 171-186.

-

Carnevalli Filho, 2000Carnevalli Filho, W. (2000). Construindo a sinergia após a aquisição: Um caso real brasileiro sobre integração de empresas. Revista de Administração de Empresas, 40(2), 2-7.

-

Coffey et al., 2002Coffey, J., Garrow, V., & Holbeche, L. (2002). Reaping the benefits of mergers and acquisitions: In search of the golden fleece Butterworth-Heinemann.

-

Chizzotti, 1995Chizzotti, A. (1995). Pesquisa em Ciências Humanas e Sociais Cortez: São Paulo.

-

Cullinan and Holland, 2002Cullinan, G., & Holland, T. (2002). Strategic due diligence – Excerpted from Global deal making: Definitive guide to cross-border mergers and acquisitions, joint ventures, financings and strategic alliances Bloomberg Press.

-

Cullinan et al., 2004Cullinan, G., Le Roux, J., & Weddinger, R. (2004). When to walk away from a deal. Harvard Business Review, 82(4), 96-104.

-

Damodaran, 2011Damodaran, A. (2011). The little book of valuation: How to value a company, pick a stock, and profit New Jersey: John Wiley & Sons, Inc.

-

Dellagnello and Silva, 2005Dellagnello, E. H. L., & Silva, R. C. (2005). Análise do conteúdo e sua aplicação em pesquisa de administração. Pesquisa qualitativa: Teoria e prática (Vol.2) Rio de Janeiro: FGV.

-

Epstein, 2004Epstein, M. J. (2004). The drivers of success in post-merger integration. Organizational Dynamics, 33(2), 174-189.

-

Gill, 2003Gill, R. (2003). Análise de Discurso. In M. W. Bauer, & G. Gaskell (Eds.), Pesquisa qualitativa com texto, imagem e som: Um manual prático. Editora Vozes: Petrópolis.

-

Gole and Hilger, 2009Gole, W. J., & Hilger, P. J. (2009). Due diligence: An M&A value creation approach John Wiley & Sons, Inc.

-

Gomes et al., 2013Gomes, E., Angwin, D. N., Weber, Y., & Yedidia Tarba, S. (2013). Critical success factors through the mergers and acquisitions process: Revealing pre and post M&A connections for improved performance. Thunderbird International Business Review, 55(1), 13-35.

-

Haspeslagh and Jemison, 1990Haspeslagh, C., & Jemison, B. (1990). Managing acquisitions – Creating value through corporate renewal New York: The Free Press.

-

Horn et al., 2006Horn, J. T., Lovallo, D. P., & Viguerie, S. P. (2006). Learning to let go: Making better exit decisions. McKinsey Quarterly, 2, 64.

-

Howson, 2003Howson, P. (2003). Due diligence: The critical stage in acquisitions and mergers Gower Publishing Limited.

-

Hubbard, 2013Hubbard, N. A. (2013). Conquering global markets: Secrets from the World's most successful multinationals UK: Palgrave Macmilan.

-

Jensen, 1982Jensen, A. E. (1982). Practice of business seeking a candidate for merger or acquisition. Business Horizons, 25(3), 80-84.

-

Liu and Taffler, 1998Liu, Y., & Taffler, R. (1998). Damned out of their own mouth: CEO overconfidence in M&A decision-making and its impact on firm performance. Working Paper Edinburgh: University of Edinburgh Business School.

-

Lodi, 1991Lodi, J. B. (1991). A entrevista: Teoria e prática Editora Pioneira: São Paulo.

-

Malhotra, 2006Malhotra, N. K. (2006). Pesquisa de Marketing – Uma orientação aplicada (4th ed.). Editora Bookman.

-

McSweeney and Happonen, 2012McSweeney, B., & Happonen, E. (2012). In D. Faulkner, S. Teerikangas, & R. J. Joseph (Eds.), The handbook of mergers and acquisitions Oxford: Oxford University Press.

-

Neves, 1996Neves, J. L. (1996). Pesquisa qualitativa: Características, usos e possibilidades. Caderno de Pesquisa em Administração, 1(3), .

-

Porter, 1980Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors Free Press.

-

Porter, 1985Porter, M. E. (1985). Competitive advantage: Creating and sustaining superior performance New York: Free Press.

-

Vergara, 2000Vergara, S. C. (2000). Projetos e relatórios de pesquisa em administração (3ª edic¸ão). Editora Atlas: São Paulo.

-

Vermeulen and Barkema, 2001Vermeulen, F., & Barkema, H. (2001). Learning through acquisitions. Academy of Management journal, 44(3), 457-476.

-

Vieira, 2004Vieira, M. M. F. (2004). Por uma boa pesquisa qualitativa. In M. M. F. Vieira, & D. M. Zouain (Eds.), Pesquisa qualitativa em administração (Vol. 2). Rio de Janeiro: FGV

-

Wilde, 2014Wilde, O. (2014). The picture of dorian gray Enhanced Books., 1890 (First Published in Lippincott's Magazine, June).

Publication Dates

-

Publication in this collection

Oct-Dec 2017

History

-

Received

1 Mar 2016 -

Accepted

22 Nov 2016

Source: the authors.

Source: the authors.