ABSTRACT

This article discusses the issue of effective financial management in agriculture. The article considers the indicators of budget spending efficiency that are used by countries with extensive experience in effective budgeting. Such indicators are recommended for adaptation in countries with transitional economy. When assessing the effectiveness of financial management of agriculture in Kazakhstan, it is necessary to take into account examples of effective audit in other countries. The article presents experience of other countries and demonstrates the inconsistency of existing policies in the agricultural sector of Kazakhstan.

KEYWORDS:

Agriculture; budget; effective budgeting; financial management; public audit

RESUMO

Este artigo discute a questão da gestão financeira eficaz na agricultura. O artigo considera os indicadores de eficiência dos gastos orçamentários usados por países com vasta experiência em orçamento efetivo. Tais indicadores são recomendados para adaptação em países com economia de transição. Ao avaliar a eficácia da gestão financeira da agricultura no Cazaquistão, é necessário levar em consideração exemplos de auditoria eficaz em outros países. O artigo apresenta a experiência de outros países e demonstra a inconsistência das políticas existentes no setor agrícola do Cazaquistão.

PALAVRAS-CHAVE:

Agricultura; despesas; orçamento eficaz; gestão financeira; auditoria pública

INTRODUCTION

In transitional economies, transformation of the budgetary process on the principle of effective budgeting requires developing appropriate mechanisms of public audit and financial control as well as determination of socio-economic outcomes that are to be achieved. The latter, in the future, will lead to a conceptual transformation from budget spending management to results-based management. Budget planning and execution at all levels should be based on clearly defined goals of public policy and the expected results (Azhgaliyeva, 2014Azhgaliyeva, D. (2014) “The effect of fiscal policy on oil revenue fund: The case of Kazakhstan,” Journal of Eurasian Studies, 5(2): 157-183. ). Nowadays, sustainable socio-economic development of the state and its constituent entities is largely determined by the implementation of state programs, their full-scale financing, timely fulfillment of financial obligations, the stability of the financial system, as well as the effectiveness of state audit and financial control over the use of public funds (Oh et al., 2019Oh, Y.; Jeong, S.H.; Shin, H. (2019) “A Strategy for a Sustainable Local Government: Are Participatory Governments More Efficient, Effective, and Equitable in the Budget Process?” Sustainability, 11(19): 5312. ).

Public authorities, while developing strategic plans, should define strategic directions, goals and target indicators of their activity. Therefore, these bodies should systematically examine the conformity of budget programs with the goals and objectives of the strategic plan (Butler and Higashi, 2018Butler, S.; Higashi, T. (2018) “Redesigning the Budget Process: A Role for Independent Commissions?” Brookings. Available at: <Available at: https://www.brookings.edu/research/redesigning-the-budget-process-a-role-for-independent-commissions/?

> Accessed November 10, 2019.

https://www.brookings.edu/research/redes...

). Public authorities’ performance should also be audited based on the purpose, target indicators of the plan, as well as according to government programs (Son et al., 2017Son, V.N.; Schinckus, C.; Chong, F. (2017) “A post-Marxist approach in development finance: PMF or production mutualisation fund model applied to agriculture.” Research in International Business and Finance, 40: 94-104. ).

However, the low level of production and the inability of local producers to provide competitive products to the population of the country become a national problem that requires state intervention and the choice of strategic directions that contribute to its solution. As international practice shows, in many countries with a developed agro-industrial complex, an effective system of state regulation of the industry is organized by providing state support and subsidizing the cost of production. The main essence of such measures is that the subsidy system is able to create advantages for some economic entities over others by improving competitiveness and increasing production volumes due to the effective use of budgetary funds, as well as to motivate agricultural organizations to perform such actions that they would not have carried out without assistance (Nurgaliyeva, 2016Nurgaliyeva, L. (2016) “Kazakhstan’s economic soft balancing policy vis-à-vis Russia: From the Eurasian Union to the economic cooperation with Turkey,” Journal of Eurasian Studies , 7(1): 92-105. ).

Therefore, audits at the enterprises of agro-industrial complex should consider the presence of registered objects that are difficult to account for (young animals, fattening cattle, poultry, bees, etc.), as well as the specifics of the conditions in which the agricultural enterprise operates (climatic, biological and technological factors of the production process of agricultural enterprises) (Aigarinova et al., 2014Aigarinova, G.T.; Akshatayeva, Z.; Alimzhanova, M.G. (2014) “Ensuring food security of the Republic of Kazakhstan as a fundamental of modern agricultural policy,” Procedia-Social and Behavioral Sciences, 143: 884-891. ). Agriculture requires a comprehensive analysis of the material and technical base of the industry, the organization and management of production, determining the economic efficiency of the use of different resources.

One of the most pressing problems today is to further improve the efficiency of agriculture through optimization of the following problem areas (Öge, 2017Öge, K. (2017) “Elite preferences and transparency promotion in Kazakhstan,” Communist and Post-Communist Studies, 50(2): 135-143. ):

-

w labor productivity in agriculture;

-

low share of agricultural products in GDP;

-

low food security;

-

low availability of financing and optimal taxation regimes for agribusiness entities;

-

low efficiency of land and water use;

-

underdeveloped markets and export;

-

underdevelopment of agricultural science, technology transfer and the level of competence of agribusiness entities;

-

low quality of technical equipment and intensification of production in agriculture;

-

low quality of public services and ensuring the introduction of digital technologies in agriculture;

-

low level of satisfaction with the living conditions of the population in rural areas.

Thus, achieving effective financial management of the agro-industrial complex requires an integrated approach and taking into account the social significance of the industry.

RESEARCH METHODS

Information and empirical base consist of official statistics in the field of financial management of agriculture, the actual data that take place in monographic studies and publications of economists, materials of scientific conferences, in periodicals.

The development indicators of the agro-industrial complex are compared. These indicators are fixed as planned indicators of state policy in legal acts. Their contradictory nature is discovered (time lags, the lack of a single measurement for results, an intricate network of responsible persons). The latter is associated primarily with the state’s interim transition from an economy with central planning to the market-oriented one. A new model of effective financial management in the system of state audit is developed, which is adaptive to transition economies.

The results are evaluated through the prism of international experience, where, by abstracting from the regulatory framework of states of different legal systems (USA, Australia, Canada, and UK), patterns and features of existing budget management models are identified.

RESULTS

Kazakhstan’s social policy seeks resources that will balance current and long-term goals. This balance and its reflection in the main financial projects of the country should be found on the basis of audit. The body carrying out the state audit sets objectives to assess how effectively the budget funds are allocated by the state for the agro-industrial complex of the Republic of Kazakhstan for 2017-2021, through:

-

1) state programs;

-

2) strategic plans of Central state bodies;

-

3) regional development programs;

-

4) development strategies of national holdings.

For the development of Kazakhstan’s agriculture the relevant official documents have been signed: Strategic development plan of the Republic of Kazakhstan until 2025 (Official information resource of the Prime Minister of the Republic of Kazakhstan, 2017Official information resource of the Prime Minister of the Republic of Kazakhstan (2017) Strategic development plan of the Republic of Kazakhstan until 2025. Available at: <Available at: https://primeminister.kz/ru/gosprogrammy/stratplan-2025

> Accessed November 10, 2019.

https://primeminister.kz/ru/gosprogrammy...

), Program on development of agro-industrial complex in the Republic of Kazakhstan for 2013-2020 (Official Information Portal of the Akimat of Karaganda Region, 2013Official Information Portal of the Akimat of Karaganda Region (2013) Program on development of agro-industrial complex in the Republic of Kazakhstan for 2013-2020, 2013. Available at: <Available at: https://karaganda-region.gov.kz/en/business_agr_7_1/

> Accessed November 10, 2019.

https://karaganda-region.gov.kz/en/busin...

). The documents are primarily focused on offset of the global financial crisis effects, to which Kazakhstan has been exposed, and acceleration of the transition to a diversified and sustainable economic growth.

Since gaining independence, ten software products have been developed in Kazakhstan, based on which the state policy is implemented in the field of agriculture. However, when studied in detail, indicators of the agro-industrial program and the objectives of the strategic plan are not fully correlated with each other. There are no indicators for which, in general, it is possible to determine and calculate the qualitative and quantitative components. The indicators that are identified in the Strategy, for unclear reasons, are not specified in the main industry program, which creates many problems in the process of their implementation.

With the adoption of the state program, the main target indicators have changed as well, a comparative analysis of which is given in Table 1. Low-quality development of the program and imbalance of its main parameters are noted. Despite the three-fold adjustment of the program and its proper update in accordance with the adopted decisions and changes in legislation, there are still no balanced indicators of activities.

Comparative analysis of target indicators of the program for the development of agriculture in Kazakhstan

The test results show poor planning of the program of ‘Agrobusiness-2020’. This program has failed to set goals, out of 7 target indicators, only 3 have been achieved; out of 75 performance indicators of the plan, only 44 have been achieved and 12 partially achieved indicators, or 74.7%. Out of the planned 71 activities, 12 have been carried out, and 22 have been partially implemented (Statistics Committee of the Ministry of National Economy of the Republic of Kazakhstan, 2019Statistics Committee of the Ministry of National Economy of the Republic of Kazakhstan (2019) Gross output of products (services) of agriculture, forestry and fisheries of the Republic of Kazakhstan in all categories of farms. Available at: <Available at: https://tengrinews.kz/zakon/pravitelstvo_respubliki_kazahstan_premer_ministr_rk/selskoe_hozyaystvo/id-V1500012362/

> Accessed November 10, 2019.

https://tengrinews.kz/zakon/pravitelstvo...

). It is also found that the program has not provided indicators characterizing the growth rate of import substitution and exports of domestic agricultural producers, despite the purpose of the program to improve the competitiveness of agriculture. Instead, such indicators as an increase in the volume of state support for agriculture by subsidizing agribusiness entities by 4.5 times by 2020 are laid down. The result is characterized not by competitiveness, but only by an increase in public spending.

The results of the State audit Committee’s activities in 2017 show that 99.2% of budget allocations have not covered 75% of goals, but only 9% of the target indicators and 9.1% of indicators of direct result, which indicates poor planning and budget execution. During the implementation of the State program for development of agro-industrial complex of the Republic of Kazakhstan for 2017-2021, it has been planned to achieve 8 goals, 41 indicators and to implement 83 activities. Out of the planned 41 indicators, 37 have been achieved. Out of the 83 planned activities, 60 have been executed, 20 - have not been executed, 1 - partially fulfilled 2 - not fulfilled at all. Out of the planned 8 target indicators, 2 have not been achieved (Accounts Committee for Monitoring the Implementation of the Republican Budget, 2017Accounts Committee for Monitoring the Implementation of the Republican Budget, Conclusion to the report of the government of the Republic of Kazakhstan on the execution of the Republican budget for 2017. Available at: <Available at: http://www.esep.kz/upload/iblock/940/ZAKLYUCHENIE.pdf

> Accessed November 10, 2019.

http://www.esep.kz/upload/iblock/940/ZAK...

).

The main indicator of the efficiency of the entire agro-industrial complex is the number of food and non-food products derived from agricultural raw materials per capita, which ensures food security that is deeply commensurate with national, economic, environmental and other types of security. While characterizing economic efficiency of agricultural production, the system of natural and cost indicators is used. Natural indicators of efficiency are crop yields and animal productivity. Natural indicators are the basis for the calculation of cost indicators: gross and profitability of production.

In 2018, in rural areas, there were only 1228.2 thousand (or 14.1%) employed in agriculture, and 8694.9 thousand - in the whole Kazakhstan (Ministry of Agriculture of the Republic of Kazakhstan, 2017Ministry of Agriculture of the Republic of Kazakhstan (2017) State program of development of agro-industrial complex of Kazakhstan for 2017-2021. Available at: <Available at: https://egov.kz/cms/ru/law/list/U1700000420

> Accessed November 10, 2019.

https://egov.kz/cms/ru/law/list/U1700000...

). This shows that in rural areas the system of work organization is not developed. Per capita gross domestic product does not show much increase. Population in rural areas accounts for 43.1% of the population in general, thus, the degree of development of agricultural production depends not only on living standards, but also on the welfare of a large part of the Kazakhstan population.

In 2017, the index of agricultural labor productivity (in comparison with 2016) amounted to 111.3%, i.e., there was an increase in 4.3%. In 2017, the index of the physical volume of gross output (services) of agriculture was 103% compared to the previous year, which states the difference of -2.4% (Ministry of Agriculture of the Republic of Kazakhstan, 2018Ministry of Agriculture of the Republic of Kazakhstan (2018) Report on the implementation of the State program of development of agriculture of the Republic of Kazakhstan for 2017-2021. Available at: <Available at: https://moa.gov.kz/documents/1554091597717_ru.pdf

> Accessed November 10, 2019.

https://moa.gov.kz/documents/15540915977...

). The economic efficiency of the industry and production of agriculture is characterized by a system of economic indicators that reflect the level and final results of specific areas. Despite the active state support, the increasing scale of agricultural production, the availability of basic food products and participation in world trade, there are still significant problems in the agriculture of Kazakhstan.

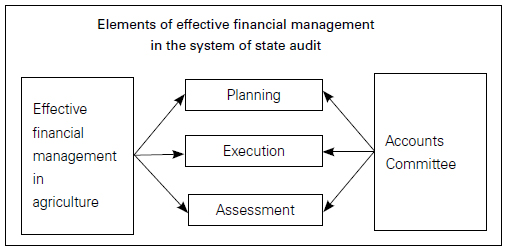

The approved State program of development of agro-industrial complex of the Republic of Kazakhstan for 2017-2021 is not sufficiently studied at the planning stage of financial resources management. The improper planning described above indicates insufficient financial management, in particular, when it comes to budgetary resources, extra-budgetary resources and loans for project implementation. The mechanism of financial management is implemented through the methods of control over the execution of these resources. Effective financial management in the system of state audit determines its rational organization, the interconnected functional elements of which are given in the Figure 1.

Each element of the proposed scheme contains important information and is of great importance for the adoption of effective financial management in the system of public audit for the purpose of both theoretical and practical planning and operational management of all financial processes. Results-based planning involves a careful analysis of expected outcomes related to macro-level impacts, such as increased employment, specific sector outcomes. These results should be clearly defined within the budget, with indicators and targets, and with appropriate monitoring and evaluation structures.

On this basis it is advisable to use two models of budget management (Table 2):

-

• performance model;

-

• cost model.

The application of effective budget management model involves control, management, setting upper bounds of the costs (the statement of cash flow per unit costs). Recipients of budget funds are set quantitative and qualitative tasks, for which they are allocated limits of budget allocations. Within these limits, they can optimize their activities, directing the savings to their own needs. Thus, the contradiction of interests of managers of budgetary funds and budget recipients is eliminated.

DISCUSSION

An effective model of budget management ensures the independence of budget users in making decisions and allows one to fully appreciate the results of this work, since the use of effective budget management model implies the existence of planned and actual performance. In accordance with the ISSAI 3000 standard, the main purpose of the performance audit is to contribute to the economical, productive and efficient use of budget funds, as well as to increase the accountability and transparency of the activities of the audited entities. Moreover, according to this standard, the concept of performance audit is based on the principles of unconditional responsibility and accountability of budget recipients for the saving, productivity and efficiency of the use of budget funds.

In order to ensure the full allocation of the necessary amount of state funds and their effective use, the foreign experience is studied. Foreign experience shows that the state audit of financial resources is always a procedure for determining the effectiveness (since the 60s of the twentieth century), while not economic efficiency in the narrow sense, but the results of financial management (Ghabri and Mauskopf, 2018Ghabri, S.; Mauskopf, J. (2018) “The use of budget impact analysis in the economic evaluation of new medicines in Australia, England, France and the United States: relationship to cost-effectiveness analysis and methodological challenges,” The European Journal of Health Economics, 19(2): 173-175. ). Therefore, in different countries it is called differently: benefit audit (Canada and the UK), operational audit (USA), performance audit (Australia), etc.

In the authors’ opinion, the effect as the end result of an action can be expressed in qualitative and quantitative terms. Qualitative indicators of the effect determine the achievement of the substantive elements of the goal, and quantitative indicators of the effect are expressed through statistical tools.

The definition of performance audit, enshrined in the international standards of Supreme audit institutions, is a framework and is intended to give only a generalized description of this type of financial control (Chohan, 2018Chohan, U.W. (2018) “Independent Budget Offices and the Politics-Administration Dichotomy,” International Journal of Public Administration, 41(12): 1009-1017. ). At the same time, in the normative legal regulation of foreign countries, there are differences in the wording of the content of the performance audit, which are mainly due to national characteristics, differences in legal systems, as well as existing models of state audit in them. For example, in Canada, Germany, Australia, the performance model and performance audit work at a high level provide confidence in the existing management control system to support the implementation of selected programs financed from the budget (Official website of the George W. Bush administrationOfficial website of the George W. Bush administration. The White House. Available at: <Available at: https://georgewbush-whitehouse.archives.gov/

> Accessed November 10, 2019.

https://georgewbush-whitehouse.archives....

).

In the United States, in 1993, the Federal law was adopted (‘Government Performance and Results Act’, GPRA) (Office of Management and Budget, 1993Office of Management and Budget, Government Performance Results Act of 1993. Available at: <Available at: https://web.archive.org/web/20070628194431/http://www.whitehouse.gov/omb/mgmt-gpra/gplaw2m.html

> Accessed November 10, 2019.

https://web.archive.org/web/200706281944...

). This law defined that performance indicator means a certain assessment or characteristic used to measure output and performance. Each Agency provides an annual report on the results of its activities, which contains information on the achievement of performance indicators (or justification if the indicators have not been achieved). As a result, the law established a closer link between the results and the resources used to achieve them. Performance indicators, which were later used to assess the level of service delivery, also began to play an important role (Ho, 2018Ho, A.T.K. (2018) “From performance budgeting to performance budget management: theory and practice,” Public Administration Review, 78(5): 748-758. ). Programs are monitored and evaluated at each stage of their implementation (from the evaluation within the Department, ending with the main financial body), there is a system of ‘bottom-up’. In addition, each program, depending on its importance and duration, must be tested at least once every five years. This requirement implies saving resources, time and effort at all stages of the formation of programs.

From 2001 to 2009, the United States operated the Program Assessment Rating tool (PART), a mechanism aimed at improving the efficiency and effectiveness of government programs in the United States. PART was a series of thematic questions based on which the assessment was made. There were 30 questions; they were divided into 4 areas of evaluation:

-

the first area took into account the transparency of the goals and objectives of the program, the degree of concretization of the final results;

-

the second area included strategic issues, the validity of the program, the need for its implementation in the future, the priority of this direction with respect to the long-term period;

-

the third area corresponded to the categories of the funding programs, contained explanations about the need to ensure budgetary and extra-budgetary funds, efficiency of use of budgetary funds in the implementation of the program;

-

the fourth area was responsible for the criterion ‘final effect of the program’ (Lonsdale et al., 2011Lonsdale, J.; Wilkins, P.; Ling, T. (2011) Performance Auditing: Contributing to Accountability in Democratic Government. Cheltenham: Edward Elgar Publishing.).

At the beginning of the implementation of the PART mechanism, about half of all programs were ineffective. However, in the future, the share of ineffective programs decreased to 30%, the programs became more focused on achieving the final result. Due to the fairly successful results of this system, PART was adopted by such countries as South Korea and Thailand.

The experience of Australia in forming budget program was in order to improve the system of public and financial management. The budget process is aimed at increasing the managerial flexibility of departments (Official website of the George W. Bush administrationOfficial website of the George W. Bush administration. The White House. Available at: <Available at: https://georgewbush-whitehouse.archives.gov/

> Accessed November 10, 2019.

https://georgewbush-whitehouse.archives....

). At the same time, the level of freedom and flexibility is higher than in some other countries.

Australia’s budget program is divided into four levels (Chohan and Jacobs, 2018Chohan, U.W.; Jacobs, K. (2018) “Public Value as Rhetoric: a budgeting approach,” International Journal of Public Administration , 41(15): 1217-1227. ). The first level is a portfolio structure, which, in fact, is an enlarged departmental structure of expenditures. Each portfolio is a separate sector of public administration. The second level of the budget program indicates that each agency has a high degree of freedom within the approved appropriations, as well as the ability to independently dispose the budget funds provided and is vested with greater authority to set priorities in expenditures. The third level of the program structure of the Australian budget is objectives and outcomes. The budget is allocated on the basis of the achievement of the final results. There are requirements that expenditure increase or new types of expenditure should be supported by targets or performance evaluations. The fourth level of Australia’s budget program is presented in the form of authority resources and administrative resources (funds used to finance the authority’s own activities, such as payroll costs, procurement of goods and services, and other operating expenses). Besides, at the fourth level, there are programs and expenditures that are not controlled by the agencies (administrative expenses): various types of grants, subsidies, social benefits.

All indicators of the results of budget programs in Australia are divided into quantitative and qualitative, depending on whether they can be measured, or can be based on public opinion, or on the opinion of experts (Clark et al., 2018Clark, C.; Menifield, C.E.; Stewart, L.M. (2018) “Policy diffusion and performance-based budgeting,” International Journal of Public Administration , 41(7): 528-534. ). Performance indicators can also be comparative. Comparison can occur in the following ways:

-

comparison of actual and planned costs, savings, program effects, etc.;

-

comparison of actual and planned progress, growth rates, increase in efficiency;

-

comparison of certain indicators in different sectors of the economy;

-

comparison of the achieved results (for the department) for the same periods of time, for example, for the current reporting and the previous one.

CONCLUSIONS

For Kazakhstan, the increase in the efficiency of public administration today is seen in the change of fundamental approaches to the quality of planning. One of the primary tasks of the state audit bodies at the present stage, in the authors’ opinion, is to assess the planned indicators, identify the shortcomings of planning through expert and analytical activities. This should lead to an increase in the quality of program documents and the degree of responsibility for planning, since the preventive nature of the state audit, which allows adjusting the program at the earliest possible stages. Existing methods of evaluation of target programs in the Republic of Kazakhstan at different levels require improvement, since indicators and objectives in different legal acts are different and have not been implemented in previous periods.

REFERENCES

- Accounts Committee for Monitoring the Implementation of the Republican Budget, Conclusion to the report of the government of the Republic of Kazakhstan on the execution of the Republican budget for 2017. Available at: <Available at: http://www.esep.kz/upload/iblock/940/ZAKLYUCHENIE.pdf > Accessed November 10, 2019.

» http://www.esep.kz/upload/iblock/940/ZAKLYUCHENIE.pdf - Aigarinova, G.T.; Akshatayeva, Z.; Alimzhanova, M.G. (2014) “Ensuring food security of the Republic of Kazakhstan as a fundamental of modern agricultural policy,” Procedia-Social and Behavioral Sciences, 143: 884-891.

- Azhgaliyeva, D. (2014) “The effect of fiscal policy on oil revenue fund: The case of Kazakhstan,” Journal of Eurasian Studies, 5(2): 157-183.

- Butler, S.; Higashi, T. (2018) “Redesigning the Budget Process: A Role for Independent Commissions?” Brookings. Available at: <Available at: https://www.brookings.edu/research/redesigning-the-budget-process-a-role-for-independent-commissions/? > Accessed November 10, 2019.

» https://www.brookings.edu/research/redesigning-the-budget-process-a-role-for-independent-commissions/? - Chohan, U.W. (2018) “Independent Budget Offices and the Politics-Administration Dichotomy,” International Journal of Public Administration, 41(12): 1009-1017.

- Chohan, U.W.; Jacobs, K. (2018) “Public Value as Rhetoric: a budgeting approach,” International Journal of Public Administration , 41(15): 1217-1227.

- Clark, C.; Menifield, C.E.; Stewart, L.M. (2018) “Policy diffusion and performance-based budgeting,” International Journal of Public Administration , 41(7): 528-534.

- Ghabri, S.; Mauskopf, J. (2018) “The use of budget impact analysis in the economic evaluation of new medicines in Australia, England, France and the United States: relationship to cost-effectiveness analysis and methodological challenges,” The European Journal of Health Economics, 19(2): 173-175.

- Ho, A.T.K. (2018) “From performance budgeting to performance budget management: theory and practice,” Public Administration Review, 78(5): 748-758.

- Lonsdale, J.; Wilkins, P.; Ling, T. (2011) Performance Auditing: Contributing to Accountability in Democratic Government Cheltenham: Edward Elgar Publishing.

- Ministry of Agriculture of the Republic of Kazakhstan (2017) State program of development of agro-industrial complex of Kazakhstan for 2017-2021. Available at: <Available at: https://egov.kz/cms/ru/law/list/U1700000420 > Accessed November 10, 2019.

» https://egov.kz/cms/ru/law/list/U1700000420 - Ministry of Agriculture of the Republic of Kazakhstan (2018) Report on the implementation of the State program of development of agriculture of the Republic of Kazakhstan for 2017-2021. Available at: <Available at: https://moa.gov.kz/documents/1554091597717_ru.pdf > Accessed November 10, 2019.

» https://moa.gov.kz/documents/1554091597717_ru.pdf - Nurgaliyeva, L. (2016) “Kazakhstan’s economic soft balancing policy vis-à-vis Russia: From the Eurasian Union to the economic cooperation with Turkey,” Journal of Eurasian Studies , 7(1): 92-105.

- Office of Management and Budget, Government Performance Results Act of 1993. Available at: <Available at: https://web.archive.org/web/20070628194431/http://www.whitehouse.gov/omb/mgmt-gpra/gplaw2m.html > Accessed November 10, 2019.

» https://web.archive.org/web/20070628194431/http://www.whitehouse.gov/omb/mgmt-gpra/gplaw2m.html - Official Information Portal of the Akimat of Karaganda Region (2013) Program on development of agro-industrial complex in the Republic of Kazakhstan for 2013-2020, 2013. Available at: <Available at: https://karaganda-region.gov.kz/en/business_agr_7_1/ > Accessed November 10, 2019.

» https://karaganda-region.gov.kz/en/business_agr_7_1/ - Official information resource of the Prime Minister of the Republic of Kazakhstan (2017) Strategic development plan of the Republic of Kazakhstan until 2025. Available at: <Available at: https://primeminister.kz/ru/gosprogrammy/stratplan-2025 > Accessed November 10, 2019.

» https://primeminister.kz/ru/gosprogrammy/stratplan-2025 - Official website of the George W. Bush administration. The White House. Available at: <Available at: https://georgewbush-whitehouse.archives.gov/ > Accessed November 10, 2019.

» https://georgewbush-whitehouse.archives.gov/ - Öge, K. (2017) “Elite preferences and transparency promotion in Kazakhstan,” Communist and Post-Communist Studies, 50(2): 135-143.

- Oh, Y.; Jeong, S.H.; Shin, H. (2019) “A Strategy for a Sustainable Local Government: Are Participatory Governments More Efficient, Effective, and Equitable in the Budget Process?” Sustainability, 11(19): 5312.

- Son, V.N.; Schinckus, C.; Chong, F. (2017) “A post-Marxist approach in development finance: PMF or production mutualisation fund model applied to agriculture.” Research in International Business and Finance, 40: 94-104.

- Statistics Committee of the Ministry of National Economy of the Republic of Kazakhstan (2019) Gross output of products (services) of agriculture, forestry and fisheries of the Republic of Kazakhstan in all categories of farms. Available at: <Available at: https://tengrinews.kz/zakon/pravitelstvo_respubliki_kazahstan_premer_ministr_rk/selskoe_hozyaystvo/id-V1500012362/ > Accessed November 10, 2019.

» https://tengrinews.kz/zakon/pravitelstvo_respubliki_kazahstan_premer_ministr_rk/selskoe_hozyaystvo/id-V1500012362/

-

1

JEL Classification: Q13.

Publication Dates

-

Publication in this collection

10 June 2020 -

Date of issue

Jul-Sep 2020

History

-

Received

26 Dec 2019 -

Accepted

05 Feb 2020

Elaborated by the authors.

Elaborated by the authors.