Abstracts

A partir de los avances logrados por el "nuevo-desarrollismo", examina las políticas macroeconómicas implementadas en México en el contexto del Consenso de Washington, la cuales en el caso mexicano fueron institucionalizadas con la firma del Tratado de Libre Comercio de América del Norte (TLCAN). Este tratado consolidó el modelo neoliberal y aherrojó la suerte de la economía mexicana al desempeño de la economía de Estados Unidos. Se analiza la economía mexicana como un caso paradigmático de los efectos anti-crecimiento, de desarticulación de los sistemas productivos y desestabilizadores de las políticas procíclicas inspiradas en el Consenso de Washington. Se concluye que los principales obstáculos para implementar una estrategia alternativa de desarrollo en México, orientada al crecimiento sustentable con equidad, son políticos y residen en la dominación del poder político por una oligarquía financiera rentista que carece de todo idea de proyecto nacional,

México; Consenso de Washington; Estancamiento económico; Nuevo- desarrollismo; Estrategias de desarrollo; Nafta

A partir dos avanços conseguidos pelo "novo-desenvolvimentismo", o artigo examina as políticas macroeconômicas implementadas no México no contexto do Consenso de Washington, as quais, no caso mexicano, foram institucionalizadas com a assinatura do Tratado de Livre Comércio de América do Norte (TLCAN). Este tratado consolidou o modelo neoliberal e agrilhoou a sorte da economia mexicana ao desempenho da economia dos Estados Unidos. No artigo, a economia mexicana analisa-se como um caso paradigmático dos efeitos anticrescimento, de desarticulação dos sistemas produtivos e desestabilizadores das políticas pró-cíclicas inspiradas no Consenso de Washington. Conclui-se que os principais obstáculos para levar à prática uma estratégia alternativa de desenvolvimento no México, orientada ao crescimento sustentável com equidade, são políticos e residem na dominação do poder político por uma oligarquia financeira rentista que carece de qualquer ideia de projeto nacional.

México; Consenso de Washington; Estagnação econômica; Novo-desenvolvimentismo; Estratégias de desenvolvimento; Nafta (TLCAN)

NEW DEVELOPMENTALISM

Mexico, an example of the anti-development policies of the Washington Consensus

Arturo Guíllen

Arturo Guillén is a professor and researcher at Universidad Autónoma Metropolitana Iztapalapa, Mexico, D.F. and general coordinator of the “Celso Furtado Network for Development Studies” (www.redcelsofurtado.edu.mx). Visiting Professor at the Celso Furtado International Centre for Policy Development in Rio de Janeiro, Brazil. Member of the National System of Researchers of Mexico. @ – artguillenrom@hotmail.com

ABSTRACT

From the advances achieved by the “new developmentalism”, the article examines the macroeconomic policies implemented in Mexico in the context of the Washington Consensus which, in the Mexican case were institutionalized with the signing of the North American Free Trade Agreement (NAFTA). This treaty consolidated the neoliberal model and fettered the luck of the Mexican economy to the performance of the U.S. economy. In the article, the Mexican economy is analyzed as a paradigmatic case of the effects of anti-growth, dismantling of productive systems and destabilizers of the pro-cyclical policies inspired by the Washington Consensus. The study concludes that the main obstacles to implementing an alternative development strategy in Mexico, oriented towards sustainable growth with equity, are of a political nature and lie in the control of political power by a rent-seeking financial oligarchy that lacks any idea of national project.

Keywords: Mexico, Washington Consensus, Economic stagnation, New developmentalism, Development strategies, NAFTA.

Introduction

The purpose of this article is to provide a brief review of the development strategy and neoliberal macroeconomic policies implemented in Mexico. Like most Latin American countries, Mexico adopted the Washington Consensus policies in the 1990s. NAFTA was the icing on the cake of the new strategy, as it consolidated the neoliberal model and linked the fate of the Mexican economy to the performance of the U.S. economy.

The paper will analyze the Mexican economy as a paradigmatic case of the anti-growth effects that disrupted the production systems and destabilized the pro-cyclical policies inspired by the Washington Consensus. A summary of the major changes that occurred in Mexico in the early 1990s and that defined the future course of the Mexican economy is presented in the next section: the stabilization program (Pact); the renegotiation of the foreign debt under the Brady Plan; the signing of NAFTA; and the accelerated privatization process which led to a profound restructuring of the ruling oligarchy. Based on the proposals of the "new developmentalism", the next section establishes the links between pro-cyclical macroeconomic policies inherent in financial globalization and the semi-stagnation process of the Mexican economy, as Mexico is among the least growing countries in Latin American in the last two decades. The following section points out some of the main effects of the neoliberal strategy on the production system, which can be summarized in the destruction of rural economies, the financialization of the economy, and a persistent deindustrialization process, characterized by the disruption of production chains created during the import substitution phase and by the conversion of much of the industry into a platform of export-oriented maquiladoras, based on low wages as the main competitive tool. These changes, far from ensuring a better articulation of the productive system, have emphasized its heterogeneity and its dependence on imports of inputs and equipment. Finally, the last section provides a brief summary of the main political obstacles to the recovery of a national development project as an alternative to neoliberalism.

The Mexican path towards neo-liberalism

We know that neoliberalism was born in the Chile of Pinochet and in the military dictatorships of the Southern Cone. But its generalization at continental level started with the debt crisis that began in Mexico in August 1982.

The debt crisis of 1982 marked the end of the Import Substitution Model (ISM). The decision of foreign creditors to voluntary suspend funding and the strictness of adjustment programs imposed by the International Monetary Fund (IMF) forced Latin American countries to shift their economies overseas and finance the payment of the debt service by obtaining trade balance surplus, which resulted in a drastic compression of the ability to import as well as of the investment, consumption and employment levels.

In 1983 Mexico, like other Latin American countries, started the transition to a neoliberal model (NM), a model of open economy, facing outward, characterized by the conversion of manufactured exports into the axis of accumulation pattern. In fact, as pointed out by ECLAC, the transition to the new model followed two different routes. On one side were the South American countries, where a trend towards the "re-primarization" of their economies was gestated, and on the other were Mexico and Central American and Caribbean countries, which became export platforms to the U.S. market through maquiladoras.

The new model was a consequence of global trends to shift production systems overseas as a result of the "great crisis" started in the late 1960s in the major developed countries, following the end of the long boom of the post-world war period. Globalization became a strategy to "step out" of the crisis for the most powerful and internationalized transnational corporations (TNC) and banks. In turn, indebted countries in the periphery, large domestic private groups, corporations and banks operating within it, as well as governments, found in globalization an option to convert their businesses and focus them on the foreign market, in the Mexican case mainly the United States.

During Miguel de la Madrid's administration (1982-1988), which virtually spanned the so-called lost decade, Mexico implemented a draconian adjustment program monitored by the IMF, which included, among other measures, a drastic reduction in public spending, credit crunch, rising interest rates, increased excise taxes and wage restraint, by imposing "caps". During this administration alone, minimum wages recorded a real contraction of 44%, while contractual wages fell 40.5 %.1 1 For a more comprehensive analysis of the performance of the Mexican economy and economic policies pursued by governments during the 1980s and 1990s see Guillén (2010).

The Mexican economy stagnated during the "orthodox adjustment" period. In Between 1983 and 1987 GDP fell 0.03% in real terms, while per capita GDP declined 1.9% (Table 1). The causes of stagnation followed the perverse situation created by orthodox foreign debt renegotiations agreed with the creditor bloc. The debt service had to be financed with balance of trade surplus. In 1983-1987 Mexico accumulated a trade surplus of $47,900 million. In the same period, the net transfer of resources abroad was $63,300, representing 7% of GDP. The transfer of surplus abroad led to a drastic drop in imports, and therefore in investment as well. The gross investment rate in the period fell nearly ten percentage points from 26.4% to 16.8%, a figure that virtually matched the net transfer of resources abroad.

In short, the orthodox adjustment policy was ineffective to control the structural imbalances of the Mexican economy. Far from being under control, inflation soared 150%, while production and employment, rather than recovering stagnated without recovering the levels prior to the crisis of 1982-1983. The orthodox adjustment had proved a failure as regarded creating the necessary conditions for resuming economic growth and curbing inflation. Exchange rate had not failed in making Latin American countries abandon, one after another, national development projects and reorient their economies outwardly, a stated objective of both the external monopolistic-financial capital and the internal elites of Latin America. Our region was passively integrated into neoliberal globalization.

During Miguel de la Madrid's administration, of transition to neoliberalism, progress was made in implementing structural reforms promoted at the time by the IMF and the World Bank: a unilateral and generalized trade liberalization was effected; incorporation to GATT was decided; the foreign investment policy was relaxed; the privatization of state enterprises began; the financial system was liberalized; and the nationalization of banks enacted during the 1982 crisis began to be reversed.

The failure of the orthodox adjustment of 1980 forced the country to rethink the neoliberal reform. Mexico was again the guinea pig. It was urgent to control inflation and find a new formula to revive economic growth. The Baker Plan had been a resounding failure for its inability to convince transnational banks to commit new funds in debtor countries. It was up to the Salinas de Gortari's government (1989-1994) to push forward the new strategy outlined in the U.S. Treasury and multilateral organizations. This would later be launched by J. Williamson (1990) as the Washington Consensus. The new decalogue would be applied as an iron rule throughout the region.2 2 Williamson's text (1990) proposed ten economic policy measures ranging from fiscal discipline to trade and financial liberalization. It was the product of a conference organized by him under the auspices of the Institute for International Economic Studies in Washington, D.C., a neoliberal U.S. think tank that counted on the participation of U.S. and Latin America economists. According to its author, Washington would have to be understood as "both the political Washington of Congress and senior members of the administration, and the technocratic Washington of international financial institutions, economic U.S. government agencies, the Federal Reserve Board and the think tanks' of ideologues" (Williamson, 1990, p.27). In the document Williamson recognized the danger that the Consensus would be interpreted as an imposition of the United States on its neighbors, but found comfort in seeing that the Latin American economists attending the conference - mainly technocrats from the financial area of governments and the central banks agreed with the Americans, which justified speaking of a consensus.

The Consensus was neither merely an economic policy decalogue imposed from Washington in collaboration with the IMF and the World Bank, nor did it reflect only a convergence of ideas as Williamson intended to convince us of, but expressed, above all, a political commitment, a network of interests between the globalized financial capital of the U.S. center and internal Latin American elites. With the rise of neoliberalism, a restructuring of the power block was conceived in Mexico, as we shall see below, through which hegemony was achieved by the internal oligarchic groups that managed to shift their capital overseas, closely linked to TNCs, and large capital located in global financial circuits.

The Consensus strategy represented on the one hand a continuity of traditional IMF-style contractionary policies, but on the other it entailed an implicit criticism and a relative break from monetarist anti-inflationary policies which merely acted from the demand side. Without abandoning the hardcore of neoliberal policies (monetary restriction and zero financial deficit in public finances), the new formula consisted in implementing "heterodox" stabilization programs based on income policies and on the use of the exchange rate as an anchor against inflation.3 3 It should be noted that the use of the exchange rate as an anchor against inflation was an implicit recognition (of course not explicitly recognized by any of the formulators of "heterodox" stabilization programs of the late 1980s and 1990s) of the structural approach to inflation developed by the Mexican economist Noyola Vázquez (1957) and the ECLAC school in the 1950s, which stressed that inflation, in the case of the countries of the Latin American periphery, more than a monetary phenomenon had a structural basis, and that one of its basic causes was external imbalance and the devaluation tendencies inherent in that imbalance. The aim then was to stop inertial inflation and reintegrate Latin America into international capital markets.

In Mexico the strategy was implemented in three phases. The first phase included the release of the Pact, a "heterodox" stabilization program, which was later replicated in Brazil with the Real Plan. While the Pact was implemented in 1987, the last year of De la Madrid's administration, it was developed by the team of Salinas de Gortari, who at the time was Secretary of Planning and Budget, and soon after officially announced his candidacy to president of Mexico. The Pact was based on the price-wage agreement - in which the corporate control of the ruling party on trade unions was crucial - but especially through the use of the exchange rate as an anchor against inflation.3 The Pact was a successful program, unlike previous shock programs tested in other Latin American countries. Inflation fell from 159% in 1987 to 51.7% in 1988 and to 19.7 % in 1989 and down to single-digit levels in 1993 (8%).

The second phase of the strategy involved renegotiating of the foreign debt. When Salinas de Gortari took office (1989-1994), his first action was to renegotiate the external debt under the auspices of the Brady Plan, which enabled reducing the principal and interest payments, but above all, with inflation in a downward trend, raised the expectations of the actors involved in the neoliberal reform.

Renegotiation was followed by opening of the capital account, which was considered essential to resume growth and finance the current account imbalance through free access of foreign investment. Inflation control was a prerequisite of the new scheme, with the primary objective of maintaining the confidence of foreign equity investors in emerging economies, and stopping the flight of domestic capital.

The growth strategy of the Consensus was based on foreign savings. It was assumed that the foreign capital inflow, besides promoting the modernization and competitiveness of the productive system and the financial system of recipient countries, would ultimately increase the investment rate, and thus labor productivity, economic growth and employment. Sooner or later, that growth would trickle down in the form of higher wages and lower poverty levels.

The financial openness of the 1990s involved incorporating the so-called emerging countries into the "regime of accumulation with financial domination" (Chesnais, 1994; Guillén, 2007a) that prevailed in central countries in response to the crisis of 1970. In this regime, the financial logic, i.e., speculative rather than productive logic, determines the course of capital accumulation.

Salinas' neoliberal reform was completed in a third phase by NAFTA, which went into effect in 1994, and by the accelerated privatization of public assets.

NAFTA was the jewel in the crown of neoliberal reform. It was an agreement between governments and oligopolistic business groups that saw in integration an important lever to expand their markets and areas of operation and influence, as well as to maximize their profits. In essence, it was driven by the most globalized groups and companies of the U.S. financial capital and by the most powerful groups and companies in Canada and Mexico. The most globalized TNCs in the U.S. saw in NAFTA an instrument to raise their competitiveness in relation to other world regions (Europe and Asia, mainly), by taking advantage of Mexico's low wages and lax environmental rules. For the U.S. government it meant putting into practice a set of rules for the operation of foreign investment with unrestricted freedom, as well as a set of prerogatives: intellectual property, national treatment to foreign investors, elimination of behavior standards, etc.).

But perhaps the most important strategic objective of NAFTA both on the Mexican and American side was that the signing of a Treaty converted into law the constituent elements of neoliberal policies, thus ensuring its irreversibility and barring the way to any further "populist" attempt.

The end of the political cycle of the Institutional Revolutionary Party (PRI), which remained in power for seventy years, and the rise to power of the National Action Party (PAN) with Vicente Fox (2000-2006) and Felipe Calderón (2006-2012), did not mean any change in the economic strategy based on the Consensus (Guillén, 2010). Procyclical macroeconomic policies continued to be implemented, the structural reform agenda proposed by multilateral organizations was maintained, and trade liberalization, financial liberalization and the privatization program remained unchanged, resorting to the disguised privatization of oil and electricity, areas that under the Mexican Constitution should be exploited exclusively by the State.

Economic stagnation and recurrent crises

Mexico has been a preferred student of Washington since its passive insertion into neoliberal globalization, which is the root of the debt crisis. Under the neoliberal model, Mexico became an export "power", the largest in Latin America, and opened its economy like no other country in the subcontinent. Exports soared from US$ 40.711 in 1990 to US$ 349.676 in 2011. Of this total, 80% were manufactured goods (US$282.367), but about half were assembly activities of maquiladoras. The degree of openness increased from 16.3% of GDP in 1981, at the apex of the import substitution model, to 30.4% in 1994, when NAFTA came into force, reaching 73.2% in 2011 (Figure 1).

However, despite the dramatic growth in exports, the results in terms of economic and employment growth have been mediocre, while revenue has been concentrated like never before, and informality and labor migration to the United States have spread like mushrooms.

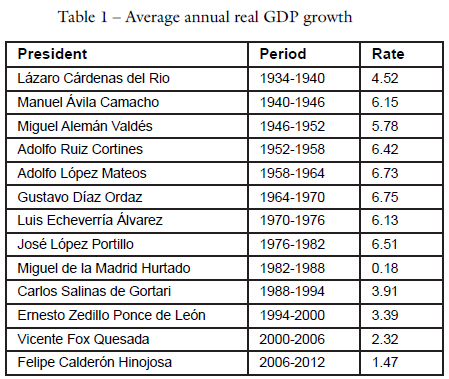

During the period 2000-2011, the growth of GDP and GDP per capita in Mexico was lower than that achieved by Latin America as a whole, except for the years 2000 and 2002. During the V. Fox administration, the average annual growth rate was only 2.4%, and as far as the government of F. Calderón (2007-2011) is concerned, the average growth was 2.1%. The average GDP growth in the neoliberal administrations (from De la Madrid to present) have stood far behind that achieved in the previous stage of import substitution (Table 1). The per capita income over the last decade (2000-2010) has barely shown a cumulative growth of 6.7%, while Brazil and Argentina, both with progressive governments, achieved in the same period an increase of 27% and 35.9%, respectively.

The mediocre growth of Mexico should not be surprising. The growth model based on the opening of the capital account and the import of private foreign capital flows tends to generate economic stagnation. Paradoxically, the opening of the capital account was offered as a panacea to overcome the so-called "lost decade" and the subsequent stagnation caused by the Orthodox renegotiation of the foreign debt. However, the results have been the opposite. Sustained growth in foreign savings was ephemeral and therefore unsustainable. It is, like someone has said, the "chicken's flight" - short and just a few feet off the ground.

The inflow of foreign capital under passive and restrictive monetary policies may temporarily have a positive effect on economic growth, but does not create the conditions for a deep and lasting expansion, which is a fundamental aspect in any authentic development policy. Indeed, the resumption of foreign capital inflows usually occurs after a period of crisis in which there is a high margin of idle productive capacity. Capital inflow produces a revitalizing effect on aggregate demand, especially private consumption (spurred also by the trend towards income concentration). Real GDP grows, but below potential supply, which is defined by the installed production capacity (French-Davis, 2005). Hence the marginal effect of growth on the investment rate. At the same time, as has been said, imports of luxury consumer goods and inputs grow, and with them the current account deficit financed by the capital account surplus. While there may be a rise in productivity, this results from a better use of existing resources, rather than from an increase in productive capacity.

But it is precisely at that point that the "virtuous" effects of economic growth sustained by foreign saving stop. In other words, in the expansionary phase of the cycle, sustaining growth would imply substantially increasing the investment rate. However, this is not the case. The inflow of foreign capital causes a shift in domestic saving toward spending, private consumption and financial savings, rather than increasing investment rates.

Twenty years after the establishment of this strategy, we know from experience that these virtuous effects have not occurred and that, on the contrary, financial openness has distorted the development processes of Latin American countries. The use of the exchange rate as a price anchor, achieved through the inflow of foreign private capital, actually allowed breaking inflationary inertia, but its cost in terms of growth, employment and economic and social development was very high.

The Consensus strategy has been challenged by alternative heterodox theoretical approaches. Since the beginning of this decade we have seen what has been called a new development macroeconomics or "new developmentalism". In various texts (Ffrench-Davis, 2005; Bresser-Pereira, 2010; Gala, 2007; Guillén, 2007a, to name a few) it has been suggested that this strategy based on foreign savings, while stabilizing domestic prices has distorting effects on the economy by: halting economic growth, thus generating stagnation trends; shifting domestic savings; encouraging the growth of consumption and imports of these goods; inhibiting investment growth; promoting the industrialization of the production system; unbalancing the current account of the balance of payments; fostering the external indebtedness of economic agents; and causing, sooner than later, the emergence of recurrent crises, as happened successively in Mexico (1994-1995), Brazil (1998-1999) and Argentina (2000-2001).

The theses proposed by the "new developmentalism" were ratified by over a hundred major economists from Latin America and other countries. Its founding document states, among other things:

Economic development should be financed essentially with domestic savings. In order to achieve this goal, the creation of public financial institutions to ensure full utilization of domestic resources, in particular labor, finance innovation and support investment is required. The attempt to use foreign savings via current account deficits usually does not increase the investment rate (as claimed by orthodox economics), but instead increases domestic indebtedness and reinforces financial instability. (Structuralist Development Macroeconomics Center, 2010)

The monetary and exchange rate policies are what I have called elsewhere (Guillén, 2007b ) the "critical points" or "hard core" of the neoliberal model, as they are the basis of financial globalization. The interest rate and the exchange rate are the key variables considered in arbitrage operations of financial market underwriters. But the level of both variables is also crucial to the domestic growth of the economies. As Nakano (2010, p.44), referring to the nominal exchange rate says, this "is one of the factors that determine the price level and, consequently, real wages and the profit margin of the companies; i.e., income distribution."

When the currency is overvalued, growth slows down, and conversely, when overvaluation is reduced or the currency depreciates, growth is stimulated. Rodrik (2008) presents evidence that the recent growth of China and India is correlated to the level of undervaluation of their currencies. By contrast, the recent Latin American experience shows that in countries such as Mexico and Brazil, which have kept their currencies overvalued for long periods, growth has been slow and below its potential, while Argentina, which has avoided overvaluation by managing its monetary and exchange rate policy, has achieved output growth rates similar to those of East Asian countries. Or to put it in the words of Bresser-Pereira (2012, p.6):

If the exchange rate tends [...] to be overvalued, it's easy to understand why it will become a major obstacle to economic development. An overvalued exchange rate hinders the access of efficient companies in developing countries to international markets. However, if the developing country succeeds in neutralizing this trend and the exchange rate remains at a competitive level, its efficient companies will have access to the entire external demand. In this case we have an "export-led" growth strategy.

This author does not share Bresser-Pereira's view that development should be led by exports. While it is true that these are fundamental to mitigate external constraints and that efficient integration into international markets contributes to the modernization, technological progress and higher productivity of production systems, it is also true that especially in larger and more developed countries - which have a very large structural heterogeneity such as Brazil, Mexico and Argentina - the strategy must be dual, i.e., one that combines the promotion of exports with the strengthening of the domestic market.4 4 C. Furtado pointed out that in the late 1990s, and it remains true to date, "the economic systems of large territorial dimensions and marked by regional and structural disparities - among them Brazil, China and India - will hardly survive if they lose the cohesion derived from the expansion of the domestic market. In these cases, albeit effective, international integration is insufficient to ensure the dynamism of the economy. In a world dominated by transnational corporations, these heterogeneous systems can only survive and grow from political will supported by a project with deep historical roots" (Furtado, 2003, p.54). The establishment of a competitive exchange rate not only facilitates the growth of exports but creates favorable conditions for and promotes the profitability of import substitution and the creation and strengthening of domestic supply chains.

There are restrictions on the financial and fiscal sector that aggravate the tendency to stagnation in Mexico. On the fiscal side the country has one of the lowest burdens in the world. In 2010 it represented 10.1% of GDP. The tax structure is weak and regressive. To fill the tax gap the Mexican state depends on oil revenues, which account for 32% of federal budget revenues. But even with the fiscal revenues from oil, the programmable government spending is around 20%, a level well below that of other Latin American countries. Public investment, which played a central role in the development process of the MSI, represents a little more than 3% of GDP and 23% of federal spending.

On the financial side, Mexico has a commercial banking system in the hands of foreign capital, which controls 80% of its funds and whose contribution to the investment process is virtually null. Commercial banks have focused mainly on financing the consumption of high-income groups through spreads, well above those found in the central countries (Ibarra, 2009, p.16). Development banks, meanwhile, which played a major role in capital formation have fallen apart and are being liquidated by the neoliberals who rule the country.

In summary, the MN has not allowed Mexico to achieve a high and sustainable growth. The open economy export pattern did not translate into a new path towards economic and social development, but in many ways into a historical regression, a deviation from the development route. The promoters of the Washington Consensus postulated that the neoliberal reform would enable recovering growth, which over time would "trickle down" to the population at large. The results achieved demonstrate the futility of expecting development to occur relying on the market, economic liberalization and privatization of public assets alone. The results have been rather "bad development" as Furtado used to call it, characterized by chronic semi-stagnation, recurrent crises and deeper structural heterogeneity, compounded by informality and poverty.

Deconstruction and dismantling of the productive system

The restructuring of the productive system in Mexico caused by the neoliberal model in the country is a topic that requires an extensive and comprehensive approach, which is beyond the scope of this article. Therefore, I shall limit myself to outlining some of the strongest trends.

Trade liberalization and NAFTA substantially changed the structure of relative prices by promoting the competition, on equal terms, of goods produced in developing economies and with diametrically different levels of productivity. The change in relative prices was compounded by the financial openness by generating a tendency towards an overvaluation of the exchange rate, which is a disadvantage for domestic production. The result has been the creation of a more disjointed and extroverted production system. I will briefly mention two processes that illustrate this situation.

The destruction of rural economies

The agricultural sector in Mexico is among those that were affected the most by external opening and NAFTA. Although its share in GDP is relatively small - 4.4% of GDP in 2010, its role in absorbing labor remains significant, since it is home to 12.8% of the economically active population. The decision to open with NAFTA all agricultural products with zero tax has undermined the agricultural production of small farmers and indigenous communities. In terms of basic grains, Mexico has become increasingly dependent on imports from large agricultural producers in the United States and Canada. The displacement of small farmers has led them to leave their lands and thicken the lines of the informal economy or of migrants to the United States. Prior to the global crisis, migration to that country stood at one million people a year. The only beneficiaries of liberalization within rural activities in Mexico have been large farmers who produce fruits, vegetables and flowers for sale in the U.S. market (Garcia, 2010).

Deindustrialization and dismantling

As already mentioned, under the neoliberal model the industrial apparatus in Mexico shifted overseas. Large groups and TNCs that once produced mainly for the domestic market have restructured their production for export, mainly to the United States, a process that was facilitated by NAFTA.

Mexico, in fact, has become a leading exporter of manufactured goods. But it is an export industry that instead of strengthening the national production plant is a mere platform controlled by a few TNCs and national groups, which use low wages as a competitive advantage, but lack almost entirely links to the rest of the production system. The manufacturing industry has lost importance in domestic output. Its share of GDP fell from 23.9% in 1988 to 18.5% in 2010. The occupation of workers has declined, including in absolute terms. The workforce decreased from 4,397,034 jobs in 2000 to 3,933,134 in 2011.

The exporting center established in Mexico is highly concentrated in both sectoral - in a few products (automobiles, auto parts and electronic products account for a high proportion of sales) - and geographic terms, since over 80% of them are aimed at the U.S. market. A high proportion of foreign sales consist of intra-company trade by TNCs, and more than half of manufacturing exports, as mentioned above, corresponds to maquiladoras.

The industrialization developed under the umbrella of NAFTA has probably meant the modernization of some segments of the productive apparatus, but does not create internal supply chains. The "backward effects" do not occur in the national space, but move to the U.S. territory, which provides most of the inputs used by the exporting sector. That is why the expansion of exports has been accompanied by a true imports boom. The import ratio jumped from 7.6% of GDP in 1990 to 36.7% in 2011 (Figure 1). According to official data, imported inputs account for 80.4% of exports (Vidal, 2011, p.387). Maquiladoras purchase in the domestic market only 3% of their inputs and the rest is brought in from abroad. Manufactured exports are also heavily subsidized by the Mexican government, since 80% of them depend on temporary import processes, through which tax incentives are used to import parts and components and re-export the finished and manufactured product with discounts on income tax, on the value added tax, and temporary import at minimum customs tariffs (Dussel, 2009, p.7). No wonder, then, that this industrialization linked to imports has been unable to overcome external restrictions. As seen in Figure 2, the negative balance of the manufacturing trade balance increased from $19,064 in 1993 to $28,353 in 2008, but decreased somewhat during the 2008-2009 recession.

We then have an industry perhaps modernized in some segments, but more disjointed than the one we had during the MSI stage. It is a kind of enclave, which explains its inability to stimulate the Mexican economy as a whole. Its capacity to absorb technological progress is very restricted. Actually, what Mexico exports is cheap labor in the form of industrial products, packaged in Mexico but conceived and designed in other spaces; state-of-the art techniques in some cases, but which are not internalized, i.e., are neither assimilated nor transmitted. More than an industrialization process, what this country has experienced is a process of "maquilization" of manufacturing activities.

The main obstacles to an alternative development strategy in Mexico are political

Mexico's transition to neoliberalism meant not only the establishment of a new capital accumulation pattern, but also changes in the social structure and rearrangements in the "power bloc". "Power bloc", according to Poulantzas (1968, p.302), should be understood as "a contradictory unity of dominant classes or fractions, in their relationship with a particular form of the capitalist State." One of the fractions that make up the "power bloc" plays the role of hegemonic fragment in relation to the other segments of the dominant class and in relation to the dominated classes.

In the case of Mexico, for decades and as a result of the intense process of capital concentration and centralization and transnationalization experienced by the Mexican economy at the end of the MSI stage, a small financial oligarchy has dominated the economy and become the hegemonic bloc in power. In an excellent book of that time (Aguilar & Carrión, 1975, p.112), Alonso Aguilar concluded that the core of economic power was concentrated in no more than a thousand families. Their immense economic power ensured their hegemony in the definition of politics within the State.

The MN introduced significant changes in the composition of the ruling class and oligarchy itself. As already mentioned, the Washington Consensus implied a close alliance between the financial capital of the centers and the internal elites of the periphery. In the 1980s and 1990s, several large Mexican business groups and multinational companies operating in the country, mainly for the domestic market, managed to shift their businesses and focus on the external market. Other groups and small and medium enterprises failed in this restructuring process and were anchored to a dwindling domestic market. New segments of the oligarchy linked to the so-called "shadow banking system" promoted during the Miguel de la Madrid administration were established at the pinnacle of power. The process of privatization of state and para-state enterprises [accumulation by dispossession, as it is called by D. Harvey (2003)], strongly boosted during the Salinas de Gortari's government, favored the restructuring process of the Mexican oligarchy.

The "new oligarchy" inserted itself mainly in the banking, telecommunications and mass media sectors. The hegemonic fraction in power in Mexico is comprised of owners of large local monopolies with intertwined interests in the industry, trade, finance, and services sectors; owners of mass media institutions on TV, radio and major national and regional newspapers; and high Church and Army officials. Transnational companies and banks are not an integral part, strictly speaking, of the ruling class; however, their interests in Mexico are represented by the local oligarchy, which is its younger partner or manager. The really rich account for no more than 1% of the population, and these probably house the richest 0.1% of the oligarchy, which is the true owner of economic power and controls the whole "power bloc" and the State political power in Mexico.

Along with increased income concentration in the hands of a tiny albeit changing oligarchy, there has been an acceleration of the process of transnationalization and integration of the economy to the U.S. production system, a process favored by the entry into force of NAFTA. The different Mexican administrations rather than promote its renegotiation, in order to reduce asymmetries, as requested by various sectors concerned, reject its review. Instead, they have no qualms in joining the Security and Prosperity Partnership of North America (SPP), in which the Canadian and Mexican governments have submitted to the anti-terrorism security policy of the United States.

With the PAN governments there has been a democratic regression. While the unsustainable hegemony of the Institutional Revolutionary Party (PRI) as a State party ended in 2000, numerous setbacks threaten to reduce democracy to a hollow and costly exercise of the vote, while reinforcing tendencies towards power centralization, hardening and breakdown. The transition to democracy has been stalled.

So, parallel to the process of economic power concentration and increasing submission to the United States, a process of political power centralization is being produced in Mexico. More than a real democracy in which the people choose their government, the country experiences a simulated democracy, a hollow democracy in which elections become a mere shell to legitimize the concentrated power. Representative democracy becomes an expensive scenario in which voters validate at the polls the candidates previously selected by the oligarchic power. Effective suffrage, an old democratic aspiration of Mexico, is replaced by democratic simulation.

Since the post-war period the notorious Marxist intellectual György Lukács (2003, p.29) has referred to the crisis of democracy as "the contradiction between freedom and political equality and the real freedom and equality of people." According to this author, at the monopoly stage of capitalism, when power is concentrated in the financial oligarchy

one of the central weaknesses of formal bourgeois democracy is expressed: the masses emerge - formally, in the act of voting - as absolute, final rulers; in fact they are, however, completely powerless and should - according to the will of the true manipulators - remain powerless. To fully clarify this state of affairs, it should be enough to state a few facts, such as the excessive cost of the electoral apparatus, the daily costs for the masses, etc., whose economic character necessarily concentrates all the power in few hands [...] Briefly: the so-called new elite is actually chosen by a few limited anonymous figures that generally remain in the shadows; in part it elects itself. (ibid, p.35)

If this was true in the post-war Europe deeply attached to old democratic traditions and fraught with powerful labor parties and organizations, what to say of a country like Mexico, a paradise of inequality and where effective elections remain an aspiration met only on rare occasions in the course of its history? If this was true at the time of the great printed newspapers, what to say of the age of mass media, CNN, Televisa and Azteca TV? Behind and before the voters are the "great voters" of the tiny oligarchy that dominates Mexico and controls the state power, in both the political and in civil society spaces where it prevails.

Mexico currently faces two problems of great importance that threaten the future of new generations. One is the global crisis affecting the entire capitalist system, and that struck Mexico like a few other countries, and the other is the severe political and governance crisis that followed the fraudulent rise of Felipe Calderon as president of Mexico and his declared war on drugs.

The global crisis still has a long way to go. The process of capital devaluation is not over yet. Until now developed countries have reduced to the limit the interest rates and implemented aggressive programs to stabilize their financial markets, break the credit crunch and avoid a recession (which has already begun in Europe), without having succeeded in changing substantially the scenario of uncertainty facing the global economy today.

For Mexico, the way out of the crisis seems even more distant than for other countries. The "government strategy" has been that of "playing dead", waiting for the U.S. economy to recover and for things to back to the way they used to be. So, you think, it will be enough to retake the path, resuming the worn-down refrain of the structural reforms. But the difficulties are great. This time there will be no exporting solution for any country, which will force them to restructure their production systems and seek a way out of the crisis in domestic markets and regional integration spaces.

The way out of the crisis requires changing course and implementing a program of economic emergency with job creation in the foreground. But one cannot ask for the impossible. The Mexican government and the dominant oligarchy are so deeply intertwined with the international - and especially the U.S. monopolist-financial capital that it is unfeasible to expect that the framework of neoliberalism can be transcended.

In short, Mexico is facing one of the most difficult situations in its history: an economy fully submitted to crisis, a weak State, increasingly militarized and submitted to the interests of the domestic oligarchy and the United States, and a simulated democracy in which political parties and electoral bodies have lost representation and legitimacy in the eyes of society.

Prospects for change lie in the ability to mobilize and organize social movements, like the one formed around Manuel Lopez Obrador, who is running again for the presidency, or those that implement a strategy of resistance, like the EZLN Zapatista and other organizations. Only organized popular mobilization in the electoral and other fronts will enable transforming the country and putting it on the path of a national development project that improves the lives of the majority.

Notes

References

- AGUILAR, A.; CARRIÓN, J. La burguesía, la oligarquía y el estado 3.ed. México: Editorial Nuestro Tiempo, 1975.

- BRESSER-PEREIRA L. C. Globalización y competencia. Buenos Aires: Siglo XXI, 2010.

- _______. Structuralist Macroeconomics and the New Developmentalism Sao Paulo, Fundación Getulio Vargas, 2012.

- CEPAL. Disponível em: <http://websie.eclac.cl/infest/ajax/cepalstat.asp?carpeta=publicaciones#tab2>

» link - CHESNAIS, F. La mondialisation du capital Paris: Syros, 1994.

- DUSSEL, E. El aparato productivo mexicano. Entre la crisis global y el caos de la política nacional. Nueva Sociedad, México, n.220, marzo-abril 2009.

- FFRENCH-DAVIS R. Reformas para América Latina Buenos Aires: Siglo XXI; Cepal, 2005.

- FURTADO, C. El capitalismo global México: F.C.E., 2003.

- GALA, P. Real exchange rate levels and economic development: theoretical analysis and empirical evidence. São Paulo: Fundação Getulio Vargas, 2007.

- GARCIA, R. México: efectos de la globalización en la agricultura y agroindustria de exportación en hortalizas y frutas, 1982-2005 2010. Tesis (Maestría) Universidad Autônoma Metropolitana. México, 2010.

- GUILLÉN, A. Mito y realidad de la globalización neoliberal México: Miguel Ángel Porrúa Editores; Uami, 2007a.

- _______. Para superar el estancamiento económico en México: nudos críticos de un proyecto nacional de desarrollo. Revista de Economía Política, São Paulo, v.27, n.4, out.-dez. 2007b.

- _______. México hacia el siglo XXI: crisis y modelo económico alternativo. 2.ed. México: Plaza y Valdés Editores, 2010.

- HARVEY, D. The new imperialism Oxford: Oxford University Press, 2003.

- IBARRA, D. Crisis, consumismo, dolarización. Revista Economía UNAM, México, n.16, enero-abril, 2009.

- INEGI. Disponível em: <http://www.inegi.org.mx/sistemas/bie>

» link - LUKÁCS, G. Testamento político y otros escritos sobre política y filosofía Buenos Aires: Herramienta, 2003.

- NAKANO, Y. Brazilian Exchange Policy. Cadernos FGV Projetos, São Paulo (FGV), ano 5, n.14, 2010.

- NOYOLA VÁSQUEZ, J. N. Inflación y desarrollo económico en Chile y México. Panorama Económico, v.170, julio 1957.

- POULANTZAS, N. Poder politico y clases sociales en el Estado capitalista. 23.ed. México: Siglo XXI, 1968.

- RODRIK, D. The real exchange rate and economic growth. Brookings Papers in Economic Activity, Washington, Fall 2008. Available in: < www.brookings.edu/economics/bpea/bpea.aspx>

- STRUCTURALIST DEVELOPMENT MACROECONOMICS CENTER. Ten theses about new developmentalism São Paulo: Fundação Getulio Vargas, 2010. Available in: <http://www.tenthesesonnewdevelopmentalism.org>

- VIDAL, G. México: o secundário-exportador e o aprofundamento do desenvolvimento. Cadernos do Desenvolvimento, Rio de Janeiro, v.6, n.9, jul.-dez. 2011.

- WILLIAMSON, J. El cambio de las políticas económicas en América Latina. México: Ediciones Gernika, 1990.

Publication Dates

-

Publication in this collection

25 July 2012 -

Date of issue

Aug 2012

History

-

Received

28 May 2012 -

Accepted

19 June 2012