Abstract

Fish consumption per capita in Brazil is relatively modest when compared to other animal proteins. This study analyses the influence of protein prices, other food prices and population income on the fish demand in Brazil. First, the problem of fish supply in Brazil is characterized. It is followed by reviews of the relevant economic theory and methods of Almost Ideal Demand System - AIDS and their elasticity calculations. A descriptive analysis of fish demand in Brazil using the microdata called "Pesquisa de Orçamento Familiar" (Familiar Budget Research) - POF 2002-2003 is presented. Finally, demand functions and their elasticities are calculated for two different cases: one considering five groups of animal proteins (Chicken; Milk and Eggs; Fish; Processed Proteins and Red Meat) and other with seven groups of food categories (Cereals; Vegetables and Fruits; Milky and Eggs; Oils and Condiments; Fish; Other processed foods; and Meats). The main results are: per capita consumption of fish (4.6 kg per inhabitant per year) is low in Brazil because few households consume fish. When only households with fish consumption are considered, the per capita consumption would be higher: 27.2 kg per inhabitant per year. The fish consumption in the North-East Region is concentrated in the low-income class. In the Center-South Region, the fish consumption is lower and concentrated in the intermediate income classes. The main substitutes for fish are the processed proteins and not the traditional types of meat, such as chicken and red meat.

AIDS; fish; supply; elasticity; market

BIOMETRY, MODELING AND STATISTICS

Demand for fisheries products in Brazil

Daniel Yokoyama SonodaI,* * Corresponding author < dysonoda@pecege.esalq.usp.br> ; Silvia Kanadani CamposII; José Eurico Possebon CyrinoIII; Ricardo ShirotaIV

IPECEGE, R. Alexandre Herculano, 120, sala T-4 13418-445 Piracicaba, SP Brasil

IIEmbrapa Estudos e Capacitação (CECAT), Parque Estação Biológica PqEB s/n 70770-901 Brasília, DF Brasil

IIIUSP/ESALQ Depto. de Zootecnia, C.P. 09 13418-900 Piracicaba, SP Brasil

IVUSP/ESALQ Depto. de Economia, Administração e Sociologia

ABSTRACT

Fish consumption per capita in Brazil is relatively modest when compared to other animal proteins. This study analyses the influence of protein prices, other food prices and population income on the fish demand in Brazil. First, the problem of fish supply in Brazil is characterized. It is followed by reviews of the relevant economic theory and methods of Almost Ideal Demand System - AIDS and their elasticity calculations. A descriptive analysis of fish demand in Brazil using the microdata called "Pesquisa de Orçamento Familiar" (Familiar Budget Research) - POF 2002-2003 is presented. Finally, demand functions and their elasticities are calculated for two different cases: one considering five groups of animal proteins (Chicken; Milk and Eggs; Fish; Processed Proteins and Red Meat) and other with seven groups of food categories (Cereals; Vegetables and Fruits; Milky and Eggs; Oils and Condiments; Fish; Other processed foods; and Meats). The main results are: per capita consumption of fish (4.6 kg per inhabitant per year) is low in Brazil because few households consume fish. When only households with fish consumption are considered, the per capita consumption would be higher: 27.2 kg per inhabitant per year. The fish consumption in the North-East Region is concentrated in the low-income class. In the Center-South Region, the fish consumption is lower and concentrated in the intermediate income classes. The main substitutes for fish are the processed proteins and not the traditional types of meat, such as chicken and red meat.

Keywords: AIDS, fish, supply, elasticity, market

Introduction

The world fishery production decreased steadily from the early 1960s to the 1990s, when it stabilized at about 80 million tonnes per year. Since the 1970s, aquaculture has increased its share in the total fish production and since the mid-1980s was the only source of growth in the total global production (FAO, 2005). In Brazil, fishery production increased until 1985 reaching one million ton per year. The national production fell abruptly in 1986 with the end of governmental incentives to the industry and then remained constant at around 0.7 million ton until the end of the 1990s (Abdallah and Bacha, 1999).

Since the 1970s, technological advances in traditional substitutes for fishery products in the food market, namely beef, pork and poultry industries, resulted in a continuous price reduction of those products in Brazil, whereas the price of fishery products did not decrease in the same period (Sonoda et al., 2002). As a consequence, fish lost its price competitiveness with other meats (Figure 1).

The impact of these developments on the fish market was quite significant: while per capita consumption of fish decreased from 8 to 5 kg per year between 1978 and 2003, poultry consumption increased sharply from 7 to 34 kg per year in the same period (Figure 2) (ABEF, 2005). This trend could be changed by increasing the supply of fishery products which would benefit producers and promote healthier food for the population. However, when t demand for fish increases, it is necessary to understand the relative demand for this product regarding other groups. These answers are important to guide public and private national fishery development processes and plan the growth of its production, industrial and distribution sectors.

This study aims to estimate demand functions for fishery products in Brazil and to calculate compensated and uncompensated price elasticity for animal protein being fish, red meats, poultry, milk and eggs, and processed proteins; other foods such as cereals, fruit and vegetables, milk and eggs, oils and condiments, fish, other processed foods, and meats.

Materials and Methods

Almost Ideal Demand System-AIDS is a system of equations that belongs to a class denominated piglog functions. It defines the minimum cost (or expenditure) required to attain a certain utility level, known the prices. The piglog was, originally, represented by a cost function c(u, p), where u represents utility and p the vector of prices (Deaton and Muellbauer, 1980):

The utility level is delimited between zero and one (0 < u < 1), where 0 (zero) represents the subsistence level and 1 (one) represents the limit of satisfaction for the consumption. These functions are linearly homogeneous and positive in a(p) and b(p). The functional forms of a(p) and b(p)are usually expressed by:

The AIDS cost function becomes:

where, α i, β iand γ *ij are parameters.

The expenditure share of good I (wi ) derivate from ln c(u,p) in terms of ln pi is given by (Griliches and Intriligator, 1990):

Expressing wi in terms of expenditure of good i (adapted from Silberberg, 1990):

where P is a price index:

Taking restrictions (9), (10) and (11) into account, and assuming that (7) represents a system of equations where Σ wi = 1 (additive condition), the demand model is homogeneous of degree 0 (zero) for prices and income, and satisfies the Slutsky symmetry. In absence of variation in the relative prices (p) and the real income (x/P), the expenditure share (wi) remains constant. Changes in the real income modify βi and its sum in i is 0 (zero). The positive values of βi represents luxury goods and the negative ones, subsistence goods.

A better approximation of wi could be achieved generalizing (7) for a individual household, h:

Parameter kh is interpreted as a measure of household size and reflects an adjustment for an "adult coefficient" of food consumption that takes into account the age and gender of its members. This parameter is used to correct or to weight the per capita income xh (Deaton and Muellbauer, 1980). If the household members were homogeneous in terms of food consumption, the parameter kh could be represented by the number of resident people in household h. However, household components are generally heterogeneous in terms of age and gender, for instance. Thus, kh makes an adjustment for this factor that affect food consumption, to a relative value of "adult equivalent". For example, a child or adolescent is considered a fraction of an adult male. The Amsterdam Scale (Stone, 1954 apud Deaton and Muellbauer, 1986), based on the nutritional requirement of people, is an empirical application of this method (Table 1). A household represented by one man, one woman and a couple of children (< 14 years), has the "adult equivalent" of 2.94 instead of 4.0 if this per capita index was considered.

There are two alternative methods of estimation. First, a nonlinear system using maximum likelihood, which follows by substituting (8) in (7):

The main problem with this approach is the identification of parameter α 0 (Deaton and Muellbauer, 1980). Alternatively, such as in this study, these equations could be estimated by Seemingly Unrelated Regressions (SUR) using ordinary least square (OLS) if P in (7) were linear in terms of parameters α , β and γ.

In a situation where prices are closely collinear, P could be known as an index price P* (Stone, 1954 apud Deaton and Muelbauer, 1980):

The same index was used to calculate the prices pj in (7) and (8). If P ≅ φ P*, then equation (7) can be written as:

considering α i* = α i- βi logφ and, Σ  = 0, if Σ βk = 0.

= 0, if Σ βk = 0.

In eq. (15) if high income households consume the same amount of food as the low income households, but their expenditures are higher as a result of prices differences, results could be understood as a proxy to the quality associated to the food products consumed. Therefore, x/P* represents the amount weighed for the quality of food product per household. Uncompensated price elasticities in AIDS functions are calculated from eq. (8) as follows (Alston et al., 1994):

where, δij is Kronecker delta (δij = 1 if i = j and δij = 0 if i ≠ j).

Compensated price elasticities (ε*ij) are calculated using Slutsky equation:

where: εi,x is expenditure elasticity for good i.

Therefore, compensated price elasticity for AIDS function is given by:

The elasticities can be calculated by a linear approximation (Chalfant, 1987 apud Alston, 1994). Considering a special case of derivation of P* from (14):

The linear approximation of εij(AL) and ε*ij(AL):

The study uses data from "Pesquisa de Orçamento Familiar" [POF] (Household Budget Research) from 2002-2003 (IBGE, 2004) which contains information about the expenditure of a sample of 48,471 Brazilian households. Data was collected from July 2002 to June 2003 and is the most recent data available. All the expenses were registered for one week in each household in the sample. The data set covers all geographic regions and economic stratum with prices adjusted to 01 Mar., 2003.

In order to understand the demand function better, data was grouped and analyzed in two alternative forms. First, non-processed fish consumption was compared with the consumption of other animal protein. "Protein" demand was divided into five categories: fish, red meats, chicken, milk and eggs, and processed proteins. The first four categories represent purchases of proteins of low level processing (chilled, frozen or salted meat (whole or in cuts) or live animals) and the last includes these four proteins purchased by households but with higher degrees of processing.

The second analysis considers wider consumption categories ignoring the degree of processing. Foods were separated into seven groups namely cereals, fruit and vegetables, milk and eggs; oils and condiments; fish, other processed foods, and other meats. Here though, processed proteins were placed in their respective fish, milk and egg, and total meat categories.

"Outside goods" were not included due to the hypothesis that there is no substitution of food with other goods. The estimate implicitly assumes that the customer defines what fraction of their income will be allocated to the purchase of animal protein and subsequently chooses products based on relative prices. It is worth noting that in the estimation of compensated price elasticity of demand, the omission of the outside alternative in conjunction with the usual restrictions (symmetry of the Slutsky matrix, the sum of shares equal to 1, etc. ...), tends to exaggerate the income effect and this tendency is proportional to the expenditure share of the good in the total expenditure.

The data line was considered in the model only when the budget share of all categories (five for Proteins and seven for Food) was more than zero, otherwise it was deleted.

Results and Discussion

Figure 3 shows the income distribution in Brazil, in total and by regions. In the North-Northeast Region, the population is concentrated in lower income levels whereas in the Central-South the concentration is intermediate levels of income. Interesting enough, fish consumption has a similar distribution (Figure 4).

Overall, the per capita consumption of 4.59 kg per year of fish is quite low in comparison with other countries. However it is clear that this results from the fact that few individuals (only 29.6 million people out of 175 million report fish consumption) eat a good quantity of fish. This number needs increasing and not just among current consumers. The per capita consumption rises up to 27.22 kg per year when one considers only fish consumers. The consumption pattern also varies between regions. In the North and Northeast Regions, 28 % of the population eats fish while in the Central-South that ratio drops to 11 %. As a consequence, 60 % of fish consumers are in the North-Northeast Region and 40 % are located in the Central-South.

The third fact worth mentioning is the proportion of households reporting fish consumption: 11,296 out of 48,471 in the sample, and only 1,324 households reporting simultaneous consumption of all five animal protein categories. This scenario could be explained by the facts that: (i) the household consumes all animal proteins but some (or all) of these were not consumed in the survey week; (ii) the household does not have the habit of consuming either a little (or any) animal protein; and, (iii) for some reason (unknown), the information regarding this amount (kg) consumed is absent.

In the first model, AIDS function was applied to the five animal protein categories, represented by: a - chicken; l - milk and eggs; p - fish; t - processed proteins; and, v - red meats. Another three important abbreviations for the understanding of these functions are: wi expenditure share of protein, i (out of x- total expenditure in animal protein); lpi Neperian logarithms of i-th animal protein price; and x/kP Neperian logarithms of expenditure with animal proteins divided by the adult index equivalent in the household (k) times the price index (P). The percentage of expenditure on animal protein per category (wti) of POF was compared with the same percentage of expenditure to the group of 5 protein categories consumed simultaneously (wi). The main difference was that (wi) consumers had spent three times more on fish than the national average. The ready protein consumption was practically the same; however, (wi) consumers had a larger consumption of chicken and a lesser consumption of red meats, milk and eggs than the national average for meat (Figure 5).

The estimative results of the model, test t, F and the low value for R2 were already expected since cross-section data (Griffiths et al., 1993) (Table 2). The t test using the restricted model parameters (equations 10, 11 and 12) is better than the partially restricted model (equation 11).

Uncompensated and compensated price elasticity (both sample and cross price data) and income elasticity were estimated from wi and parameter functions. The signs of most of the price itself and income elasticity were consistent with the microeconomic theory. In some cases, the signs for the uncompensated and compensated cross price elasticity are the contrary to those expected. This analysis was based on the compensated elasticity and is hence coherent with the microeconomic theory (Table 3). All elasticity in compensated cross price analysis was positive. Curiously, the highest cross price elasticity was for processed proteins (ε*ppt) milk and eggs (ε*ppl) and not for chicken (ε*ppa) or red meat (ε*ppv) which were expected to be the main fish competitors.

Price of fishery products and income elasticity estimated in this study are similar to those found for Japan (Hayes et al., 1990; Chalfant et al., 1991). Although these studies do not compare the same animal protein groups, all cross elasticity, (USA data excluded), is lower than their prices and income elasticity. Income elasticity estimated for Brazil, Japan and Canada have a stronger influence on fish demand than the surrogate goods (Table 4).

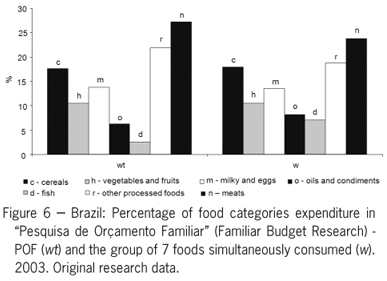

The other model, with seven food categories (c - cereals; h - fruit and vegetables; m - milk and eggs; o - oils and condiments; d - fish; r - other processed foods; and, n meats) was estimated using 3,430 households reporting simultaneous consumption of these foods. The percentage of expenditure per food category (wt) of POF was compared with the same percentage of expenditure to the group of seven food categories consumed simultaneously (wi). Similar to the situation previously considered, the main difference was that the consumers sampled (wi) had spent three times more on fish than the national average. The other food consumption was similar to the national average (Figure 6).

The statistical results were similar to the previous model (Table 5). The signs of uncompensated and compensated price elasticity itself for fishery products and income elasticity were coherent with the microeconomic theory. The price elasticity itself was higher while income elasticity was lower than the earlier model, but the signs remained the same. All elasticity in compensated cross price analysis was positive except for cereal, indicating they are complements. Consistent to the first model, highest cross price elasticity was found for other processed food, milk and eggs (but not for meat) which were expected to be the main competitors for fish (Table 6).

In conclusion, the main substitute products for fishery products are neither red meats nor chicken, and the main markets for these products are in the lowest income stratum in North-Northeast Regions and in the intermediate stratum for the Central-South. The low per capita fish consumption in Brazil results, not from a low individual consumption rate but the fact that few households have the habit of consuming fish. Therefore, the challenge of raising the demand for fish is one of attracting new consumers and not increasing the expenditure of current consumers.

Acknowledgments

We would like to thank the reviewers for helpful comments on the paper.

Received April 09, 2010

Accepted February 14, 2012

Edited by: Gerson Barreto Mourão

- Abdallah, P.R.; Bacha, C.J.C. 1999. Evolution of fish activity in Brazil: 19601994. Teoria e Evidência Econômica 7: 924 (in Portuguese, with abstract in English).

- Associação Brasileira de Produtores e Exportadores de Frango [ABEF]. 2005. Brazilian Association of Chicken Producers and Exporters. Available at: http://www.abef.com.br/Estatisticas/MercadoInterno/Historico.php [Accessed Oct. 31, 2005] (in Portuguese).

- Alston, M.J.; Foster, K.A.; Green, R.D. 1994. Estimating elasticities with the linear approximate almost ideal demand system: some Monte Carlo results. The Review of Economics and Statistics 76: 351356.

- Chalfant, J.A. 1987. A globally flexible, almost ideal demand system. Journal of Business and Economic Statistics 5: 233242.

- Chalfant, J.A.; Gray, R.S.; White, K.J. 1991. Evaluating prior beliefs in demand system: the case of meat demand in Canada. American Journal of Agriculture Economics 72: 476490.

- Deaton, A.; Muellbauer, J. 1980. An almost ideal demand system. The American Economic Review 70: 312326.

- Deaton, A.; Muellbauer, J. 1986. Economics and consumer behavior. Cambridge University Press, New York, NY, USA.

- Food and Agriculture Organization of the United Nations [FAO]. 2005. The State of World Fisheries and Aquaculture 2005. FAO Fisheries and Aquaculture Department. Rome, Italy.

- Griffiths, W.E.; Hill, R.C.; Judge, G.G. 1993. Learning and Practicing Econometrics. John Wiley, New York, NY, USA.

- Griliches, Z.; Intriligator, M.D. 1990. Handbook of Econometrics. 2ed. Elsevier Science, Amsterdam, Netherlands.

- Hayes, D.J.; Wahl, T.I.; Williams, G.W. 1990. Testing restrictions on a model of Japanese meat demand. American Journal of Agriculture Economics 72: 556566.

- Instituto Brasileiro de Geografia e Estatística [IBGE]. 2004. Familiar Budget Research: 2002–2003: Microdata. IBGE, Rio de Janeiro, RJ, Brazil. (CD-ROM) (in Portuguese).

- Silberberg, E. 1990. The Structure of Economics: A Mathematical Analysis. 2ed. McGraw Hill, New York, NY, USA.

- Sonoda, D.Y.; Conte, L.; Scorvo Filho, J.D.; Shirota, R.; Cyrino, J.E.P. 2002. Comparative analysis of CEAGESP fish commercialization data between 80's e 90's. Informações Econômicas 32: 5056 (in Portuguese, with abstract in English).

Publication Dates

-

Publication in this collection

28 Sept 2012 -

Date of issue

Oct 2012

History

-

Received

09 Apr 2010 -

Accepted

14 Feb 2012