ABSTRACT

This paper aims to analyze the recent changes in economic relations between Latin American countries and China in the context of the transformations occurred in the latter’s development strategy after the global financial crisis. The text argues that, in relation to the first decade of the twenty-first century, connections linked to FDI, financing flows, and infrastructure projects have been growing in importance and present new challenges to Latin America, which surpass the ones based only on trade flows.

KEYWORDS:

China-Latin America relations; foreign direct investment; trade; infrastructure

RESUMO

Este artigo tem como objetivo analisar as mudanças recentes nas relações econômicas entre os países da América Latina e a China, à luz das transformações ocorridas na estratégia de desenvolvimento chinesa no período pós-crise financeira global. Argumenta-se que, em relação à primeira década do século XXI, as relações atreladas aos investimentos diretos, aos fluxos de financiamento e aos projetos de infraestrutura vêm ganhando maior importância e lançam novos desafios para região, além daquelas baseadas apenas nos fluxos comerciais.

PALAVRAS-CHAVE:

relações China-América Latina; investimento direto; comércio internacional; infraestrutura

1. INTRODUCTION

Since the beginning of the 21st century, economic relations between China and Latin America (LA) have grown quickly and focused mainly in trade. In about a decade, China has become the largest trading partner of several countries in the region. To a large extent, this relates to the pattern and pace of recent Chinese development, a process in which urbanization and industrialization relies on highly intensive use of mineral, metallic and energy commodities.

China’s demand for commodities has affected LA countries both directly and indirectly, given its effect on international prices. The establishment in China of an industrial structure with strong export capacity in a range of industrial sectors and the fast penetration in the imports structure of LA countries have resulted in a typically inter-industrial trade pattern, with exports to China heavily concentrated in basic products and with increasing imports of a basket of different manufactured products.

Whereas trade relations made up the bulk of China-LA relations in the first decade of this century, more recently some additional drivers have become more relevant. Chinese Outward Foreign Direct Investment (OFDI) flows have not only increased but also pointed to major changes in their sector profile, with infrastructure projects and the manufacturing industry growing in importance.

This paper seeks to associate these changes in China-LA relations with the transformations in the pattern of Chinese development, especially after the great international financial crisis of 2007-2008. It is argued that growth heavily based on the expansion of investments, driven by the linkage between urbanization and industrialization, has resulted in overcapacity in several Chinese industries and thus increased the pressure for capital outflows and changes towards an economy that is less dependent on gross capital formation in the internal market. Therefore, while new vectors are emerging in the relations between China and LA, the challenges and opportunities are also new in their nature and require a closer analysis by scholars, policy makers and the society.

The paper is composed of three sections, in addition to this introduction. Section 2 outlines the changes in the Chinese development strategy in the period after the outbreak of the international financial crisis of 2007-2008. Section 3 seeks to highlight China-LA economic relations, also with an emphasis on shifts in the post-crisis period. It also makes an effort to identify how these changes reflect the transformations on the Chinese strategy outlined in the section 2. The analysis focuses mainly on trade and Chinese OFDI, highlighting the increased importance of investments in infrastructure. In the last section, the final remarks emphasize some of the challenges posed to LA countries, in face of the outcomes of the two previous sections.

2. CHANGES IN CHINA’S DEVELOPMENT STRATEGY AFTER THE GLOBAL CRISIS

This section aims to highlight the recent changes in China’s development strategy in response to both the changes observed in world economy after the 2007-2008 global crisis and the unfolding of its own strategy. Particularly noteworthy are the changes announced in the 13th Five-Year Plan and the Belt and Road Initiative (BRI), which set the foundation for the planned transition to a “moderately prosperous” economy, as highlighted by the Chinese planning.

It is worth remembering the central elements of China’s previous growth pattern in order to clarify how recent changes in Chinese strategy seek to respond to the effects and contradictions generated by that pattern. In addition, it will enable a deeper analysis of China’s relations with the LA economies. As the following section will discuss, previously these relations occurred markedly through the channels of foreign trade, while the transition to the new strategy has been showing an increased importance of foreign direct investments, finance, and infrastructure projects.

Firstly, it is important to note that the scale and pace of Chinese economic development outweigh any previous historical experience. Using the database organized by Angus Maddison, the McKinsey Global Institute (2012) illustrated this fact by analyzing the period of time that different countries had taken to double the per capita income from $ 1,300 to $ 2,6001 1 In constant purchasing power parity dollars. : while England took it 154 years (19th century), the United States, 53 years; Germany, 65 years (both in the second half of the 19th century); and Japan, 33 years (second half of the 20th century). In turn, the total population of each country at the beginning of the process was respectively 9, 10, 28 and 48 million people. Not only was the Chinese development initiated at the end of the 20th century much faster (12 years), but it was also based on an incomparably larger population size (more than 1 billion inhabitants).

In addition, it is also important to highlight the profile and pattern of China’s growth. As Medeiros (2013MEDEIROS, C. A.; “Padrões de investimento, mudança institucional e transformação estrutural na economia chinesa”. In: CGEE. Padrões de Desenvolvimento Econômico (1950-2008): América Latina, Ásia e Rússia. Brasilia, DF: CGEE, 2013.), Protti (2015PROTTI, A. T. China: uma análise do papel das exportações e do investimento doméstico para o modelo de desenvolvimento econômico no período recente. Tese (Doutorado em Ciências Econômicas) - Instituto de Economia, Universidade Estadual de Campinas, 2015.) and Medeiros and Cintra (2015) point out, although several authors mention China as an example of an export-led growth economy2 2 For example, Yao (2010) and Guo and Diaye (2009). , since the end of the 20th century, and with more emphasis in the beginning of the 21st century, China’s economic dynamism has been associated with strong investment growth, with state planning combining urbanization and industrialization.

Exports and foreign demand were fundamental to the beginning of China’s insertion into the most labor-intensive production chains of traditional industries (textiles, clothing, footwear) and in some stages of the electronic sector. The Chinese economy was able to take advantage of the movement of transfer of manufacturing activities from developed to developing countries, which occurred during the 1980s and 1990s, to leverage exports and industrial development, initially in the basic steps of assembling processes within the value chains led by multinational corporations, but moving rapidly to more complex stages and with an increasing participation of national private and state companies. However, from the point of view of the economic dynamics, the external sector played a more important role as a source of foreign currency to sustain economic growth and avoid external fragility and as a technology transfer mechanism rather than as a source of demand.

The recent dynamic of the Chinese economy has been mostly associated with urbanization and all the changes related to the transformations of a society that, at the beginning of the reforms initiated in 1978, had an urbanization rate of less than 20% and that reached 55% in 20153 3 According to data from the World Development Indicators/World Bank and the United Nations Population Division’s World Urbanization Prospects. . Since the urbanization rate reached 35% in 2000, between 2000 and 2015 urban population increased by 300 million inhabitants in China. Such a huge change had to be accompanied by large investments in infrastructure for urban expansion and interconnection between big metropolises, which meant high volumes of investment in civil construction, transportation, energy, telecommunications, and sanitation (GLAESER et al., 2017GLAESER, E. HUANG, W. MA, Y e SHLEIFER, A. A real estate boom with Chinese characteristics. Journal of Economic Perspectives, v. 31, n. 1, p. 93-116, 2017.; ANSAR et al., 2016ANSAR, A.; FLYVBERG, B.; LUNN, D. Does infrastructure investment lead to economic growth or economic fragility? Evidence from China. Oxford Review of Economic Policy, v. 32, n. 3, p. 360-390, 2016. 4 4 Although Ansar et al. (2016) have a critical view of the role of infrastructure investments in Chinese growth, they provide evidence that points to the effects on gross capital formation and the role of public banks and state-owned enterprises in the process. ). As it has already been thoroughly emphasized5 5 See, for example, Farouki and Kaplinski (2012) and McKinsey (2012). Gilbert (2010) also highlights the influence of speculative financial markets on commodity prices. , these changes were fundamental elements for the demand growth and the increase in prices of metallic, energy, and mineral commodities. In addition, being coupled with a significant increase in per capita income, it also meant important changes in consumption patterns, consequently affecting agricultural commodities and demand for processed food.

While the expansion of infrastructure investments has resulted in demand growth and increased commodity prices in the global market, it also drove the growth of large companies, mainly state-owned companies, but also private ones, which have been responsible for meeting the demand growth in the Chinese market and for organizing investments in the electric power, oil, telecommunications, civil construction, and transportation sectors (DITTMER, 2017DITTMER, L. Xi Jinping’s “new normal”: Quo Vadis? Journal of Chinese Political Science, v. 22, n. 3, p. 429-446, 2017. Available at: <http://dx.doi.org/ 10.1007/s11366-017-9489-4>.

http://dx.doi.org/ 10.1007/s11366-017-94...

). These, in turn, transmitted their impulses to the heavy industry both in the sectors of basic materials (oil, petrochemicals, cement, glass, steel, aluminum) and machinery and equipment (road machinery, trains and railroad equipment, transportation machinery, telecommunications equipment, etc.). Finally, strong growth in per capita income and changes in consumption patterns stimulated the growth of the durable goods industry, especially the automotive sector. At the other end of the spectrum, resources for urbanization and industrial growth were mobilized and channeled into investments through the banking credit system organized around public development banks.

Therefore one can describe the process as a virtuous circle coordinated by state planning, in which the investment rate supported the intense structural change associated with urbanization and infrastructure deployment, which in turn has grown a strong capacity of expansion and industrial development in sectors of heavy industry and durables goods. This movement was carried out without abandoning the manufacturing sectors articulated within global chains, such as the light labor-intensive industry and other sectors and segments of the electronics, information and communication products, and machinery and equipment.

Such pattern has been reinforced after the financial crisis of 2007-2008, as the Chinese economic policy has further stimulated investments, either through credit or fiscal stimulus, in order to sustain the growth rate. The Chinese strategy has proved to be effective, since it avoided a drastic reduction in GDP growth, while contributing to sustain the prices of commodities in the years immediately after the crisis. However, with the worsening of the international scenario, especially in the European Union as of 2011, the difficulty of overcoming the global crisis became evident. The growth of the Chinese economy itself fell below 8% in 2012, for the first time in the 21st century (SCHERER, 2015SCHERER, A. L. F. A nova estratégia de projeção geoeconômica chinesa e a economia brasileira.Revista Paranaense de Desenvolvimento, v. 36, n. 129, jul./dez. 2015.; PAULINO and PIRES, 2016PAULINO, L.; PIRES, M. As relações entre China e AL frente ao novo normal da economia chinesa. Revista Economia e Políticas Públicas, v. 4, n. 1, 1 sem. 2016.).

While global and domestic demand fell, the increased production capacity has strongly expanded idle capacity in several industrial sectors (CINTRA and PINTO, 2017CINTRA, M. A. M.; PINTO, E. C. China em transformação: transição e estratégias de desenvolvimento. Revista de Economia Política, v. 37, n. 2 (147), p. 381-400, abr./jun. 2017.; CONTI and BLIKSTAD, 2017). The European Chamber study (2016) details how overcapacity rose between 2008 and 2014 in sectors such as steel, aluminum, oil refining, cement, glass, and pulp and paper, as a result of strong government incentives for investment, both at the national and regional levels. The same study also draws attention to an increase in trade tensions in the global market due to the combination of demand stagnation and aggressive foreign market search policies as a way of occupying the production capacity of Chinese companies.

These contradictions have speeded up the changes that had been underway since the 11th Five-Year Plan, seeking an economy less dependent on investment and more consumer-based. The general meaning of the changes can be seen in a polished design on the 13th Five-Year Plan. Aglietta and Bai (2016AGLIETTA, M.; BAI, G. China’s 13th Five-Year Plan. In pursuit of a “moderately prosperous” society. CEPII Policy Brief, n. 12. Setembro. 2016.), however, point out that discussions on draft versions had been taking place since 2013.

The 13th plan stresses out that China must address a number of challenges in the coming years. The main one is to move towards an economy that is less dependent on expansion in capital-intensive sectors to sustain growth around the “new normal” level of 6.5% between 2016 and 2020. In this transition, a large emphasis is given to the increase in innovative activities, with the R&D investment rate programmed to reach 2.5% by 2020.

Aglietta and Bai (2016AGLIETTA, M.; BAI, G. China’s 13th Five-Year Plan. In pursuit of a “moderately prosperous” society. CEPII Policy Brief, n. 12. Setembro. 2016.) and Dittmer (2017DITTMER, L. Xi Jinping’s “new normal”: Quo Vadis? Journal of Chinese Political Science, v. 22, n. 3, p. 429-446, 2017. Available at: <http://dx.doi.org/ 10.1007/s11366-017-9489-4>.

http://dx.doi.org/ 10.1007/s11366-017-94...

) call attention to the difficulties associated with the consolidation of this new pattern, in which success or fail will only be observed in the long term. The latest available data point to Gross Fixed Capital Formation accounting for 42.9% of China’s GDP in 2016. This latest piece of information indicates a reduction, albeit still small, from the record level achieved in 2013 of 45.5% of GDP. Household consumption, in turn, increased from 36.6% to 39% of GDP in the same period. Either way, the success of Chinese planning in managing major changes in prior periods is reason enough to closely monitor the planned changes for the future.

Concerns about increasing innovative capacity and reducing dependence on technology under foreign control have also been made explicit in the China Manufacturing 2025 Plan, launched in 2015 and incorporated into the 13th Five-Year Plan. In addition to establishing a set of 10 sectors (new energy vehicles, next-generation information technology, biotechnology, new materials, aerospace, ocean engineering and high-tech ships, advanced rail equipment, robotics, power equipment, and agricultural machinery), the document sets a list of targets, including indicators of innovation, patents, product quality, and emission reduction. Besides being fundamental to raise productivity and sustaining per capita income growth, mastering the principles of innovation and reducing dependence on foreign technology and knowledge are a key to achieving other important goals incorporated in the 13th Five-Year Plan. Among those one could mention the concern about structural change, with the reduction of resource and fixed investments intensive industries, and the increase of more sophisticated manufacturing and service sectors, as well as transformations in agriculture to incorporate technology and increase productivity. Technological progress is also a key to addressing the environmental impacts of Chinese growth.

Other relevant topics relate to: (i) the reduction of regional inequalities and between urban and rural areas; (ii) the continuity of poverty reduction and the extension of social inclusion and health services for the entire population; (iii) the reduction of emission levels of pollutants and the expansion of control instruments, with the compatibility of environmentally friendly development and the incorporation of green technologies; (iv) maintaining the balance and guarantee of resilience of the banking system and of State Owned Enterprises (SOE) and the expansion of the activities of Chinese companies and banks abroad, in order to increase the internationalization of the renminbi (AGLIETTA and BAI, 2016AGLIETTA, M.; BAI, G. China’s 13th Five-Year Plan. In pursuit of a “moderately prosperous” society. CEPII Policy Brief, n. 12. Setembro. 2016.; KOLESKI, 2017KOLESKI, K. The 13th Five Year Plan. Staff Research Report. US-China Economic and Security Review Comission, feb. 2017. Avaiable at: <https://www.uscc.gov/sites/default/files/Research/The%2013th%20Five-Year%20Plan_Final_2.14.17_Updated%20%28002%29.pdf>.

https://www.uscc.gov/sites/default/files...

).

Another pillar of the new Chinese strategy is the “One Belt One Road” initiative, also called the Belt and Road Initiative (BRI). It is an ambitious long-term program focused on infrastructure development and the promotion of connectivity and integration between Asia, Europe and Africa. It was announced by Chinese leaders at the end of 2013 on visits to Southeast and Central Asia, and took a more thorough form in terms of initiatives, priorities, and general principles in a document launched in March 20156 6 Vision and Actions on Jointly Building Silk Road Economic Belt and 21st Century Maritime Silk Road. National Development and Reform Commission, 2015. . Like Manufacturing 2025, the BRI was also incorporated into the 13th Five-Year Plan.

The initiative is organized around two main axes. The first is the Silk Road Economic Belt, which seeks to strengthen China’s connections with Central Asia and Europe. Around the main route, however, there is a number of other sub-routes that together seek to connect China with the Mediterranean, passing through the Persian Gulf, but also extending from South and Southeast Asia to Central Asia and Russia. The second is the 21st Century Maritime Silk Road, which focuses on connecting several ports from the Chinese coast to the coast of Europe, across the Indian Ocean and the east coast of Africa (UNDP/CCIEE, 2017).

While reflecting a strategy of having a more active foreign policy to increase its influence in the Asian region, several authors have highlighted the geoeconomical factors and internal aspects of the Chinese economy behind the initiative (CAI, 2017CAI, P. Understanding China’s Belt and Road Initiative. Lowy Institute for International Policy, mar. 2017.; HONG, 2017HONG, Y. Motivation behind China’s ‘One Belt, One Road’ Initiatives and establishment of the Asian Infrastructure Investment Bank. Journal of Contemporary China, 26, n. 105, p. 353-368, 2017. Available at: <https://doi.org/10.1080/10670564.2016.1245894>.

https://doi.org/10.1080/10670564.2016.12...

).

A first issue is precisely the need to implement a strategy capable of maintaining the growth rate on the planned levels in the “new normal”, with a view to manage the growth rate of investments, increase the importance of domestic consumption, and reduce idle capacity in several sectors.

The quest to promote new infrastructure investment projects directly represents opportunities for large Chinese companies to go on with its international expansion, offsetting the slowdown in China’s domestic market with more projects abroad. It is therefore a policy that gives continuity to the strategy of internationalization of large Chinese enterprises, which began in the early 2000s and was further boosted by the global crisis (SILVA, 2015SILVA, S. T. “Los patrones de internacionalización china en once años del proyecto Going Global”. In: DUSSEL PETERS, E. (Coord.). AL y el Caribe y China Economía, comercio e inversión 2015. Ciudad de México: Red Académica de AL y el Caribe sobre China, 2015.).

Secondly, the very improvement in connectivity and the maintenance of a healthy growth rate amongst the regional neighbors can stimulate the flow of trade, creating new channels for the absorption of the production capacity of the Chinese industry. In a longer-term perspective, the growth of the Asian region could facilitate structural change towards more knowledge-intensive sectors, increasing the market for these goods and making possible the transfer of productive capacity in sectors that are more capital-intensive or low-wage intensive to countries with lower level of development. Another point highlighted by Cai (2017CAI, P. Understanding China’s Belt and Road Initiative. Lowy Institute for International Policy, mar. 2017.) is the effort to expand the adoption of Chinese technological standards abroad, which is fundamental for getting a better position in high technology sectors, such as telecommunications and IT and high-speed trains.

Another motivation associated with the BRI is the need to reduce regional inequalities within China. Despite efforts by the Chinese government to lessen regional disparities in recent years, inequality remains a relevant issue, with regions in western China showing much lower levels of development than that in the eastern and southeast provinces. Most initiatives are aimed at regions and provinces with a lower income level, such as the China-Pakistan corridor, which is expected to connect the city of Kashgar in Xinjiang province to the Port of Gwadar in Pakistan and will involve around $ 46 billion (POP, 2016POP, I. L. Strengths and challenges of China’s “One belt, One road” Initiative. Centre for Geopolitics and Security in Realism Studies, fev. 2016.; CAI, 2017CAI, P. Understanding China’s Belt and Road Initiative. Lowy Institute for International Policy, mar. 2017.).

Finally, it is also important to highlight that the strategy is articulated with a search for greater leadership in the financial sphere, in response to slow changes in the traditional multilateral financial institutions. The creation of the BRICS Development Bank and the Asian Infrastructure Investment Bank (AIIB) in 2015 expressed this concern. In the case of the AIIB, with a capital of US$ 100 billion and a share of China’s subscribed capital of about 26%, despite the resistance and non-adherence of the United States and Japan, 57 countries became members7

7

In the Asian Development Bank (ADB), China’s share is only 6.4%, while Japan has 15.6% and the United States 15.5%.

(SCHERER, 2015SCHERER, A. L. F. A nova estratégia de projeção geoeconômica chinesa e a economia brasileira.Revista Paranaense de Desenvolvimento, v. 36, n. 129, jul./dez. 2015.; HONG, 2017HONG, Y. Motivation behind China’s ‘One Belt, One Road’ Initiatives and establishment of the Asian Infrastructure Investment Bank. Journal of Contemporary China, 26, n. 105, p. 353-368, 2017. Available at: <https://doi.org/10.1080/10670564.2016.1245894>.

https://doi.org/10.1080/10670564.2016.12...

). China’s role in the constitution of AIIB allows us to understand how projects within the BRI can be prioritized to receive resources from the bank.

While important, multilateral funds should not be sufficient to cover project funding needs. Chinese institutions must play a key role in supporting investment. In addition to the $ 40-billion specific fund that began to operate in 2015 (Silk Road Fund), the China Development Bank (CDB) is expected to be the main agent. The CDB announced a survey of 900 projects under the BRI in 60 countries with total value of US$ 890 billion. The Export-Import Bank of China, the Bank of China and the Industrial and Commercial Bank of China (ICBC) should also play an important role as sources of financing (CAI, 2017CAI, P. Understanding China’s Belt and Road Initiative. Lowy Institute for International Policy, mar. 2017.).

In spite of the difficulties involved in the initiative - related to the volume of committed resources, the need to coordinate complex and long-term projects and the also complex regional negotiations with countries with different degrees of economic and institutional development, as well as the need to manage geopolitics conflicts, especially in the relation to the United States, but also to countries such as Japan, India, and Russia - it is undeniable that the BRI is a fundamental pillar of China’s new development strategy and international projection.

The set of changes analyzed in this section called attention to China’s search for a transition towards a new pattern of growth - less dependent on capital-intensive investments and more efficient in the use of natural resources -, and at the same time aimed at reducing social and regional inequalities and expanding the offer of social services to the population. Simultaneously, the transition to this new pattern involves intense changes in how China projects internationally its economy, where the need to reduce idle capacity should continue to have a significant effect on foreign trade, but with a trend of increasing importance of foreign direct investments and infrastructure expansion projects abroad.

3. RECENT CHANGES IN CHINA-LA ECONOMIC RELATIONS

With the main points of recent changes in China’s development strategy outlined, this section seeks to analyze their impacts on LA countries. It should be noted that, like any analysis of LA as a whole, there is a risk of making generalizations that ignore the diversity observed among the countries in terms of size, historical evolution, development of the productive structure, institutional development, and social structure. Therefore, it is important to warn that the analysis will be carried out with a bias derived from the inescapable focus on the largest economies in the region.

LA’s economic relations with China have gained prominence especially since the beginning of the 21st century. Initially, relations were concentrated in the trade dimension, as the flows of the different countries with China showed significant growth. More recently, the changes discussed in the previous section have spawned modifications on the very trade flows, as well as on the profile of Chinese investments in the region.

With regard to trade flows, the extensive literature on the subject has highlighted that, despite the huge growth, there are substantial differences in the profile of exports and imports (JENKINS et al., 2008JENKINS, R. Measuring the competitive threat from china for other southern exporters. The World Economy, v. 31, n. 10, p. 1351-1366, 2008.; GALLAGHER and PORZECANSKY, 2010GALLAGHER, K.; PORZECANSKI, R. The dragon in the room. China and the future of Latin American industrialization. Stanford: Stanford University Press: 2010.; CEPAL, 2015; DUSSEL PETERS, 2016DUSSEL PETERS, E. La Nueva relacion comercial de America Latina y el Caribe con China. Integración o desitegración regional? 1. ed. Ciudad de México: Unión de Universidades de América Latina y el Caribe, 2016.). As noted in the previous section, the pattern of Chinese development led by investment and combining urbanization and industrialization was reflected, on one hand, in a sharp increase in exports of commodities and, on the other, in the increase of imports of manufactured goods. For that matter, the economies of Latin America and the Caribbean, especially those richer in natural resources and to which the export of primary commodities is favorable, had better conditions to achieve faster growth, as well as greater autonomy in economic policies. At the same time, manufacturing exports, although increasing, did not increase accordingly, despite the difficulties to compete with China itself. More than that, the internal supply of LA countries began to suffer an intense competition with imports, evidenced by increased import coefficients, threatening the development of domestic and regional production. Tight competition from third countries, especially China, has resulted in both import displacement in domestic markets and in intra-regional exports (DUSSEL PETERS, 2016).

Within this context, concerns about China and it effects in LA economies have prompted a wide range of analyses. Studies such as Blázques-Lidoy et al. (2006) and Lederman et al. (2009LEDERMAN, D.; OLARREAGA, M.; PERRY, G. E. China’s and India’s challenge to Latin America: opportunity or threat? Washington, DC: World Bank, 2009.) emphasize the complementarity of LA countries with China’s export structure - which is believed to provide evidence that China might not be displacing exports from LA countries -, especially those countries more specialized in the export of agricultural, mineral, or energy commodities. Notwithstanding, a number of studies - among which Lall and Weiss (2007LALL, S.; WEISS, J. “China and Latin America: trade competition 1990-2002”. In: SANTISO, J. (Org.) The visible hand of China in Latin America. Paris: OECD, 2007.), Jenkins et al. (2008JENKINS, R. Measuring the competitive threat from china for other southern exporters. The World Economy, v. 31, n. 10, p. 1351-1366, 2008.), Jenkins and Dussel-Peters (2009), Gallagher and Porzecansky (2010GALLAGHER, K.; PORZECANSKI, R. The dragon in the room. China and the future of Latin American industrialization. Stanford: Stanford University Press: 2010.), Bittencourt (2012BITTENCOURT, G. (Org.). El impacto de China en AL: comercio e inversiones. Serie Red Mercosur, n. 20, 2012.), CEPAL (2015), and Dussel Peters (2016) - based on indicators of market-share and trade structure overlapping, argues for the growth of Chinese competition not only in the domestic market of LA countries, but also in third markets. Also noteworthy is the strong concentration in a few commodities in the exports side, in contrast to a greater degree of diversification of manufactured products in imports from China, resulting in a strongly asymmetric trade.

In addition, these authors emphasize that, if on the one hand the benefits of favorable conditions for commodity exports were very positive, on the other, LA countries find it difficult to maintain a competitive manufacturing sector in face of relative favorable prices for the primary and resource-intensive products.

Studies that used estimates based on gravity models also provide evidence of China exerting important displacement effects on the exports of LA countries. Hiratuka et al. (2012HIRATUKA ET AL. “Avaliação da competição comercial chinesa em terceiros mercados”. In: BITTENCOURT, G. (Org.) El impacto de China en AL: comercio e inversiones. Serie Red Mercosur, n. 20, 2012.) sought to assess the effect of Chinese competition on the exports of LAIA (Latin American Integration Association) countries and individually in Brazil, Argentina, Mexico and Uruguay, in the very LAIA market in the period 2000-2009. The results confirmed the hypothesis of significant displacement effects in the regional market. The results also indicated that Mexico is the most affected country by the Chinese competition, although it has also been found evidence of displacement in other countries, mainly Brazil and Argentina. In general, effects are higher in more traditional sectors such as textiles, clothing and footwear, but also are present in sectors of higher technological content, such as chemicals, machinery and electrical and electronic equipment. Modolo and Hiratuka (2017MODOLO, D. B., HIRATUKA, C. The impact of Chinese competition on third markets: An analysis by region and technological category. Development Policy Review, n. 35, p. 797-821, jun. 2017. Available at: <https://doi.org/10.1111/dpr.12290>.

https://doi.org/10.1111/dpr.12290...

) found the same results for the world market, although the negative effects of Chinese competition in developing countries in Asia and in Mexico and the Caribbean were higher than those observed in South American countries.

Considering the most recent developments, an important aspect is that the slowdown in China’s growth and its effects on the price of commodities since 2012 has made the pace of LA export growth reduce to a point of absolute retraction in 2014 and 2015. Taking exports of LAIA countries as a proxy for LA exports to China, Figure 1 shows that between 2013 and 2015 exports to China dropped around US$ 25 billion. In relative terms, China’s share in the total exports from the region increased continuously from 1.2% in 2000 to 9.5% in 2011. From then on, it fluctuated around this level, reaching 9.6% in 2016.

Moreover, imports continued to increase until 2014, as a result of China’s effort to seek foreign markets as a way to reduce domestic idle capacity. The sharpest drop in imports occurred between 2015 and 2016 (a reduction of around US$ 15 billion), reflecting the slowdown of the economies of the region. In relative terms, however, the share of imports from China in total LAIA imports increased steadily from 2.5% in 2000 to 15.2% in 2011 and, in contrast to exports, continued to rise to 18.7% in 2016.

The result in terms of trade balance is a growing deficit with China. To a large extent, LAIA’s trade deficit with China has been associated with Mexico’s large negative balance related to imports of parts and components for local assembly and exports to the United States. Mexico’s deficit continued to deepen in the post-crisis period, reaching US$ 63 billion in 2015. However, even when excluding Mexico, especially from 2012 onwards, there has been a tendency for trade deficits to increase. It only showed reduction in 2016, due to the economic slowdown in several Latin American countries. Brazil had a strong influence on the result since it registered, in 2016, its second year of severe recession. In almost every country, since 2011 the same trend has been registered: increase in the trade deficit or reduce in the surplus, given the higher growth of imports in relation to exports.

Table 1 shows how China became the first or the second largest trading partner of most countries as source of imports in 2015. The position in terms of destination of exports, however, is more diverse. In 2015, China was the first destination of exports from Brazil, Chile and Peru, and the second from Argentina and Uruguay. In other countries, however, the importance of exports to China is much lower, such as in Paraguay, Panama, and even Ecuador and Bolivia.

The asymmetric profile of trade flows between LA and China remained, as exports were still concentrated in few commodities and imports still covered a wide range of manufactured products. Despite this asymmetry, except for Mexico, there were no very high trade deficits until 2011, since the growth and diversification of imports from China were offset by the increase in the volume and prices of commodity exports.

However, from 2012 on commodity prices began to fall, while international competition in manufactured products intensified, due to the stagnation of world demand combined with the excess capacity of the Chinese economy, as seen in the previous section.

Particularly for the larger LA countries, with a more diversified industrial structure, the challenge of maintaining and advancing this structure to sustain income and employment generation in face of fierce competition has become more critical, both due to strong competition in domestic markets and the displacement of exports in third markets, especially in the region’s own markets, where exports of relatively more sophisticated manufactured goods predominate (DUSSEL PETERS, 2016DUSSEL PETERS, E. La Nueva relacion comercial de America Latina y el Caribe con China. Integración o desitegración regional? 1. ed. Ciudad de México: Unión de Universidades de América Latina y el Caribe, 2016.).

In the case of direct investments, there have also been significant changes. Aciolly et al. (2011) and Santos and Milan (2014SANTOS. L.; MILAN. M. Determinantes dos investimentos diretos externos chineses: aspectos econômicos e geopolíticos. Revista Contexto Internacional, v. 36, n. 2, p. 457-486, jul./dez. 2014.) point out that the growth of Chinese investments abroad, since the beginning of the 2000s, has had the following goals: (i) to guarantee the supply of raw materials; (ii) to seek new markets for manufactured products; (iii) to acquire technology and technological assets abroad; and (iv) to increase international geopolitical influence, especially in the Asian region. As discussed in the previous section, these objectives have been reinforced in the post-crisis period and gained new strength with the projects articulated around the BRI.

Information from MOFCON (2016) shows that China became the second largest global investor in 2015, with a total value of US$ 145.7 billion, representing 9.9% of the world total, behind only the United States in terms of OFDI. In 2015, also for the first time, China’s OFDI exceeded the value of Inward FDI. In terms of stocks, the country reached US$ 1,097.9 billion, representing 4.4% of the world total and occupying the 8th position among the largest global investors.

Table 2 shows that both the flow and the stock of OFDI are concentrated in Asia, while the LA appears as the second most important region, with a share of 8.7% and 11.5% in the total flow and stock in 2015, respectively.

However, the MOFCOM data on the destination of OFDI are distorted since tax havens are included, which makes it difficult to verify the final destination of investment flows. In the case of LA, for example, in 2015, 96% of all investment were destined to the Cayman Islands and the British Virgin Islands.

Since these data fail to provide detailed information by destination and sector, one need to look for alternative sources. In the present work, the Monitor of China’s OFDI in Latin America and the Caribbean will be used. Such database is organized by the Latin America and the Caribbean Network on China (RED ALC-CHINA) and it gathers information from different sources, covering data on greenfield investment announcements and mergers and acquisitions. It is worth remembering that the announced value captured by the database does not often refer to the actual inflow of resources, either because some of the resources are likely to be financed by institutions in the destination country, or, although investments are expected to occur over several years, the total amount will be captured in a single year, or still because some of the announced investments will not be implemented for some reason. Despite these caveats, the information provided by the database is very useful and is believed to show the general trends of Chinese OFDI in LA.

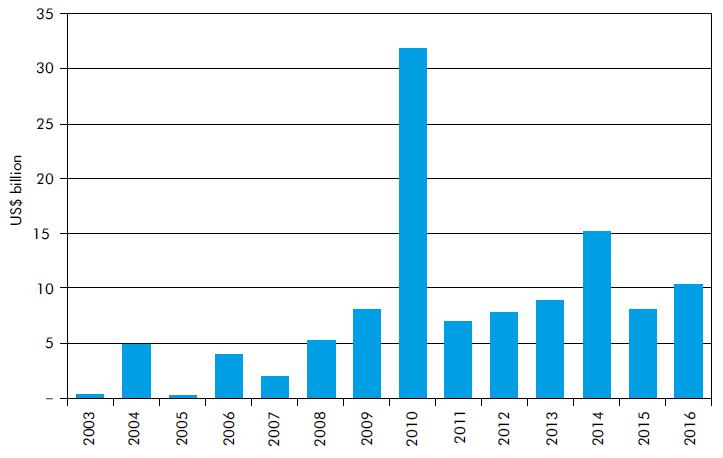

The data in Figure 3 confirms the trend of increasing importance of Chinese investments in Latin America as of 2008. As ECLAC (2015) points out, they had not been very significant until the global crisis, but started to increase thereafter. Although the year 2010 was atypical, due to the concentration of some major projects such as Sinopec’s investment in Brazil (US$ 7.1 billion), China National Petroleum Corporation (CNPC) in Cuba (US$ 4.5 billion ) and China National Offshore Oil Corporation (CNOOC) in Argentina (US$ 3.1 billion), investment values remained high until 2016.

The sectoral distribution also showed some interesting trends. While investments in the mining industry, especially in the oil and metal ores sectors, dominated the investments by 2010 - concentrating 82% of the value and 39% of operations -, between 2011 and 2016 a significant diversification was observed, with the sectors of infrastructure and activities in the manufacturing industry growing in importance (Table 3). In the infrastructure related sectors, which accounted for 35% of the value and 15% of the number of transactions, the electric power sector standed out, but important investments also occurred in the segments of telecommunications, transportation, and construction. The manufacturing industry also gained relevance, reaching 29% of the total value and 57% of all transactions. Within manufacturing, the sectors related to automotive, electronics, and machinery and equipment were the most important.

It is also worth noting that the recent increase in Chinese investment in the region has been accompanied by increased funding from the Chinese Development Banks, especially China Development Bank and China Ex-Im Bank. According to Gallagher (2016GALLAGHER, K. The China triangle. Nova York: Oxford University Press. 2016.), Chinese banks operate in sectors that are complementary to the traditional financiers, such as the World Bank and the IDB, since the former are more focused on large projects in the extractive and infrastructure sector than the latter. Most of these funds have been associated with oil supply guarantees and they differ from traditional sources because they carry less conditionalities in terms of policy reforms, although in many cases there is a “tacit understanding” that part of the projects should involve Chinese companies or imports from Chinese suppliers.

Finally, it is also worth highlighting that most of the Chinese OFDI is associated with State-Owned Enterprises (SOE). In the specific case of LA, Dussel Peters and Armony (2017) point out that, from 2003 to 2016, SOE accounted for 72.43% of all the investment made by Chinese companies in the region.

These new features of China’s economic relations with LA countries reflect the more general changes in China’s economic development and international projection strategy (PAULINO and PIRES, 2016PAULINO, L.; PIRES, M. As relações entre China e AL frente ao novo normal da economia chinesa. Revista Economia e Políticas Públicas, v. 4, n. 1, 1 sem. 2016.). While much of the focus of the BRI has targeted interconnections with Asia, Europe and Africa, LA has not been left out. To a large extent, the evolution of China’s foreign policy towards LA follows the same broader background. In 2008, the Chinese government launched for the first time a document explicitly focused on relations with LA: “China’s Policy for Latin America and the Caribbean.” The document highlighted the general principle of a cooperative relationship based on the idea of peaceful coexistence and mutual gains between regions with similar degrees of development. This general principle gained more concreteness in 2014 and 2015. In 2014, Chinese President Xi Jinping visited Argentina, Brazil, Cuba and Venezuela. In Brazil alone, 56 cooperation agreements were signed, mainly in infrastructure. In early 2015, China hosted the first China-CELAC Forum, in which the China-LAC cooperation plan 2015-2019 was approved, and China promised to increase trade with LA to US$ 500 billion and invest more than US$ 250 billion by 2025.

The document lists 13 thematic areas for cooperation, eight of them involving economic issues, namely: Trade, Investments and Finance (III), Infrastructure and Transportation (IV), Energy and Natural Resources (V), Agriculture (VI), Industry, Science and Technology (VII), Education and Human Resources Training (VIII), Tourism (XI), and Environmental Protection, Disaster Risk Management and Reduction, Poverty Eradication and Health (XII).The topic of investment increase is not only summarized in area III but involves several other areas. Area IV (Infrastructure) refers to the goal of promoting cooperation in transport, ports, roads and storage facilities, business logistics, information and communication technologies, broadband, radio and television, agriculture, energy and electricity, and housing development. Area V (Energy and Natural Resources) points out the possibilities for cooperation in research and technological development in the sustainable use of natural resources, cooperation and investments in electricity, including power generation, high voltage electric transmission, water resources planning and development, bio-energy, solar, geothermal and wind power (FORUM CHINA-CELAC, 2015).

From the standpoint of LA countries, Chinese investments are interesting because infrastructure construction is a chronic problem for those economies. Since the debt crisis of the 1980s and the period of privatization and more liberal policies of the 1990s, LA countries have not been able to recover adequate levels of investment in this area. In fact, due to high capital volumes and long maturation periods, infrastructure projects require a high capacity to mobilize resources by the public and private sectors, as well as the technical capabilities to detail projects, carry out feasibility studies and environmental impact studies, and combine sources of financing. These factors have not been adequately addressed, not even during the growth recovery allowed by the commodities cycle.

As can be seen in Figure 4, for the 1992-2013 period, LA investments in infrastructure as a percentage of GDP was well below other developing countries, such as China and India, and developed countries that already had an advanced infrastructure, such as the United States and the European Union.

Finally, at the end of 2016, China’s foreign ministry released an update on the Policy Paper on Latin America and the Caribbean. While reaffirming the general principles of the 2008 document, some important changes can be noted, for example: (i) reference in the field of trade relations to the encouragement of the exchange of high added value and high technology products; (ii) more detailed mention of financial cooperation mechanisms such as the China-Latin America Cooperation Fund, special loans for Chinese-Latin American infrastructure and the China-Latin American Production Capacity Cooperation Investment Fund; (iii) in the area of cooperation in resources and energy, the reference to the need to involve more links in the production chain, such as logistics and equipment, in order to improve the added value of products; (iv) recognition of infrastructure, resource, and energy projects as a basis for increasing local industrial and service activities (in building materials, metallurgical products, machinery and equipment, railway equipment, electrical and renewable energy equipment, telecommunications equipment, automotive, and chemical industry) to increase the degree of industrialization and the level of employment to promote the economic and social development of the region; and (v) the inclusion of cooperation in the area of technology and innovation, with reference to the information technology industry, aviation, nuclear energy and new sources of energy, as well as the search for partnerships in R&D centers and technology parks.

Therefore, China has a clear vision of the future of relations with Latin America, one that is articulated with a more general strategy of economic development and expansion of its global projection. The challenge for LA as a whole, and also for each of the individual countries in the region, is how to effectively take advantage of the spaces of cooperation opened up by the new Chinese strategy. In the following concluding remarks, a few brief comments are made on this issue.

4. FINAL REMARKS

Economic relations between China and Latin America have evolved rapidly and been through major changes, reflecting the transformations in China’s development strategy.

From the point of view of trade, post-crisis changes have caused the growth rate of exports to decrease due to the fall in commodity prices and the slowdown in the growth of the Chinese economy. However, the accumulation of idle capacity and the stagnation of world demand mean that imports from China continued to increase to be only interrupted by the sharp slowdown in LA economies more recently.

Such situation uncovered the fragility of a type of insertion excessively concentrated in commodities. Although urbanization in China has not yet been exhausted, prices are hardly expected to return to the levels reached at the height of the boom, and the pace of growth of imported volumes should also be much lower. Idle capacity is still high, notwithstanding, not only in China, but in most of the world’s major economies. The Chinese strategy of channeling investments into infrastructure and transferring productive capacity to the regions involved in the BRI can alleviate the country’s situation, but it can also raise other industrial competitors in Asia who might continue to push LA countries into the role of commodity exporter and importer of manufactured goods.

Particularly for the larger countries in Latin America and the Caribbean, it shall remain the challenge of implementing productive development strategies and policies that seek to maintain a more diversified productive structure and activities that are more sophisticated and capable of sustaining increased employment, productivity, and income levels of the population, while also diversifying the export structure.

As for the new vectors of expansion of Chinese relations with LA, the analyses carried out in this paper indicate that there is potential for new opportunities to emerge. Evidence suggests that investments and financing mechanisms from Chinese sources may have greater influence on infrastructure and industrial activities and are less focused on mineral extraction and oil activities. Sectoral diversification of investments would reinforce the type of export insertion focused on commodities less than in the past; at the same time, it has the potential to contribute to improving infrastructure and diversifying industrial activities in the region. However, these potential benefits will not become concrete automatically. On the contrary, they require the definition of a clear strategy to articulate these new Chinese interest vectors with the development of LA countries themselves.

In addition, the article sought to point out that China is very clear about its interests in regard to the relationship with LA, which are embodied in the Policy Paper launched in 2008 and updated in 2016. The response by the countries of the region should go in the direction of making a greater effort to understand the objectives and particularities of the way Chinese companies operate, and to build and/or improve mechanisms to maximize positive effects in terms of job creation, links with domestic production chains, and generation of technological spillovers, as well as to mitigate possible negative effects in terms of environmental impacts. In the absence of this strategy, however, investments may increase, but with depleted productive chains, increased imported content, scarce effects of local linkages and technological overflows, low employment generation and negative environmental effects.

Likewise, it is paramount to improve coordination mechanisms among the LA countries to promote projects aimed at achieving enhanced integration in infrastructure, energy and production and fostering intra-regional trade. Additionally, they should avoid disputes involving incentive “wars” or degradation of environmental or labor rules to attract investment.

It is worth remembering, however, the difficulties faced by governments of LA countries in implementing a more assertive strategy with a view to seize the opportunities and minimize the risks associated with the Chinese strategy. Great weaknesses in the institutional dimension still prevent coordination actions and policies to be implemented for the development of production and infrastructure, as well as the mobilization of financing sources and fostering of innovative activities. At the regional and supra-national levels, coordination and cooperation bodies are also fragile.

And, finally, an idea opposite to that seen in China persists and seems to be gaining ground in the region. The role of the State as the coordinator and articulator of private actions, or as a player who acts strategically through public banks and state-owned enterprises, is now viewed with suspicion, while at the same time there is an exacerbated belief that the development policy must confine itself to creating the conditions conducive to the free performance of private actors.

REFERENCES

- ACIOLY, L.; COSTA PINTO, E.; CINTRA M. A. M. China e Brasil: Oportunidades e desafios. In: LEÃO, R.; ACIOLY, L.; COSTA PINTO, E. (Orgs.). A china na nova configuração global: impactos políticos e econômicos. Brasília: IPEA. 2011.

- AGLIETTA, M.; BAI, G. China’s 13th Five-Year Plan. In pursuit of a “moderately prosperous” society. CEPII Policy Brief, n. 12. Setembro. 2016.

- ANDERSON, J. Is China export-led? Global economic research. UBS Investment Research Asian Focus, 2007.

- ANSAR, A.; FLYVBERG, B.; LUNN, D. Does infrastructure investment lead to economic growth or economic fragility? Evidence from China. Oxford Review of Economic Policy, v. 32, n. 3, p. 360-390, 2016.

- BITTENCOURT, G. (Org.). El impacto de China en AL: comercio e inversiones. Serie Red Mercosur, n. 20, 2012.

- BLAZQUEZ-LIDOY, J.; RODRÍGUEZ J.; SANTISO, J. Angel or devil? China’s trade impact on Latin American emerging markets. OECD Development Centre Working Paper, n. 252, 2006.

- CAI, P. Understanding China’s Belt and Road Initiative. Lowy Institute for International Policy, mar. 2017.

- CEPAL - COMISSÃO ECONÔMICA PARA A AMÉRICA LATINA E O CARIBE. La AL y el Caribe y China: hacia una nova era de cooperación económica. Santiago de Chile: CEPAL, 2015

- CENTRAL PEOPLE’S GOVERNMENT OF THE PEOPLE’S REPUBLIC OF CHINA. China’s policy paper on Latin America and the Caribbean 2008. Beijing: Central People’s Government of the People’s Republic of China, nov. 2008. Available at: <http://www.gov.cn/english/official/2008-11/05/content_1140347.htm>.

» http://www.gov.cn/english/official/2008-11/05/content_1140347.htm - CINTRA, M. A. M.; PINTO, E. C. China em transformação: transição e estratégias de desenvolvimento. Revista de Economia Política, v. 37, n. 2 (147), p. 381-400, abr./jun. 2017.

- COATES, B.; HORTON, D.; MCNAMEE, L. China: prospects for export-driven growth. Economic Roundup Issue, n. 4, 2012. Available at: <www.treasury.gov.au/publicationsandmedia/publications/2012/economic-roundup-issue-4/html/aricle4>.

» www.treasury.gov.au/publicationsandmedia/publications/2012/economic-roundup-issue-4/html/aricle4 - CONTI, B.; BLIKSTAD, N. Impactos da economia chinesa sobre a brasileira no início do século XXI: o que querem que sejamos e o que queremos ser. Texto para Discussão, IE/UNICAMP, n. 292, 2017.

- DITTMER, L. Xi Jinping’s “new normal”: Quo Vadis? Journal of Chinese Political Science, v. 22, n. 3, p. 429-446, 2017. Available at: <http://dx.doi.org/ 10.1007/s11366-017-9489-4>.

» http://dx.doi.org/ 10.1007/s11366-017-9489-4 - DUSSEL PETERS, E.; ARMONY, A. Efectos de China en la cantidad y calidad del empleo en América Latina y el Caribe. OIT Américas Informes Técnicos, n. 2017/6, 2017.

- DUSSEL PETERS, E. La Nueva relacion comercial de America Latina y el Caribe con China. Integración o desitegración regional? 1. ed. Ciudad de México: Unión de Universidades de América Latina y el Caribe, 2016.

- DUSSEL PETERS, E. “The omnipresent role of China’s public sector in its relationship with Latin America and the Caribbean”. In: DUSSEL PETERS, E.; ARMONY, A. (Coords.). Beyond raw materials. Who are the actors in the Latin America and Caribbean-China relationship? Buenos Aires: Nueva Sociedad; Buenos Aires: Friedrich-Ebert-Stiftung; México, DF: Red Académica de América Latina y el Caribe sobre China; Pittsburgh: University of Pittsburgh, Center of Latin American Studies, 2015.

- EUROPEAN CHAMBER OF COMMERCE IN CHINA. Overcapacity in China: an impediment to the Party’s reform agenda. Beijing: European Union Chamber of Commerce in China, 2016.

- FAROOKI, M.; KAPLINSKY, R. The impact f China on global commodity prices. New York: Routledge, 2012.

- FORUM CHINA-CELAC. Cooperation Plan (2015-2019). [On-line] Forum China - ECLAC, 23 jan. 2015. Available at: <http://www.chinacelacforum.org/eng/zywj_3/t1230944.htm>.

» http://www.chinacelacforum.org/eng/zywj_3/t1230944.htm - GALLAGHER, K. The China triangle. Nova York: Oxford University Press. 2016.

- GALLAGHER, K.; PORZECANSKI, R. The dragon in the room. China and the future of Latin American industrialization. Stanford: Stanford University Press: 2010.

- GILBERT, C. Speculative influence on commodity future prices 2006-2008. Unctad Discussion Papers, n. 197, 2010.

- GLAESER, E. HUANG, W. MA, Y e SHLEIFER, A. A real estate boom with Chinese characteristics. Journal of Economic Perspectives, v. 31, n. 1, p. 93-116, 2017.

- GUO, K.; DIAYE, P. Is China’s export oriented growth sustainable? IMF Working Paper, WP/09/172, Aug. 2009.

- HIRATUKA ET AL. “Avaliação da competição comercial chinesa em terceiros mercados”. In: BITTENCOURT, G. (Org.) El impacto de China en AL: comercio e inversiones. Serie Red Mercosur, n. 20, 2012.

- HONG, Y. Motivation behind China’s ‘One Belt, One Road’ Initiatives and establishment of the Asian Infrastructure Investment Bank. Journal of Contemporary China, 26, n. 105, p. 353-368, 2017. Available at: <https://doi.org/10.1080/10670564.2016.1245894>.

» https://doi.org/10.1080/10670564.2016.1245894 - JENKINS, R. Measuring the competitive threat from china for other southern exporters. The World Economy, v. 31, n. 10, p. 1351-1366, 2008.

- JENKINS, R.; PETERS, E. D. (Orgs.). China and Latin America: economic relations in the twenty-first century. Bonn: German Development Institute, 2009.

- KOLESKI, K. The 13th Five Year Plan. Staff Research Report. US-China Economic and Security Review Comission, feb. 2017. Avaiable at: <https://www.uscc.gov/sites/default/files/Research/The%2013th%20Five-Year%20Plan_Final_2.14.17_Updated%20%28002%29.pdf>.

» https://www.uscc.gov/sites/default/files/Research/The%2013th%20Five-Year%20Plan_Final_2.14.17_Updated%20%28002%29.pdf - LALL, S.; WEISS, J. “China and Latin America: trade competition 1990-2002”. In: SANTISO, J. (Org.) The visible hand of China in Latin America. Paris: OECD, 2007.

- LEDERMAN, D.; OLARREAGA, M.; PERRY, G. E. China’s and India’s challenge to Latin America: opportunity or threat? Washington, DC: World Bank, 2009.

- MCKINSEY GLOBAL INSTITUTE. Bridging global infrastructure gaps. [On-line] McKinsey& Company, 2016.

- MCKINSEY GLOBAL INSTITUTE. Urban world: the cities and the rise of consuming class. [On-line] McKinsey&Company, 2012.

- MEDEIROS, C. A., CINTRA, M. R. V. P. Impacto da ascensão chinesa sobre os países latino-americanos. Revista de Economia Política, v. 35, n. 1 (138), p. 28-42, jan./mar. 2015.

- MEDEIROS, C. A.; “Padrões de investimento, mudança institucional e transformação estrutural na economia chinesa”. In: CGEE. Padrões de Desenvolvimento Econômico (1950-2008): América Latina, Ásia e Rússia. Brasilia, DF: CGEE, 2013.

- MOFCOM - MINISTRY OF COMMERCE PEOPLE’S REPUBLIC OF CHINA. Statistical Bulletin of China’s Outward Foreign Direct Investment 2015. Beijing: MOFCOM, 2016.

- MINISTRY OF FOREIGN AFFAIRS OF THE PEOPLE’S REPUBLIC OF CHINA. China’s policy paper on Latin America and the Caribbean. Beijing: Ministry of Foreign Affairs of the People’s Republic of China, 24 nov. 2016. Available at: <http://www.fmprc.gov.cn/mfa_eng/wjdt_665385/2649_665393/t1418254.shtml>.

» http://www.fmprc.gov.cn/mfa_eng/wjdt_665385/2649_665393/t1418254.shtml - MODOLO, D. B., HIRATUKA, C. The impact of Chinese competition on third markets: An analysis by region and technological category. Development Policy Review, n. 35, p. 797-821, jun. 2017. Available at: <https://doi.org/10.1111/dpr.12290>.

» https://doi.org/10.1111/dpr.12290 - NATIONAL Development and Reform Commission, Ministry of Foreign Affairs, and Ministry of Commerce of the People’s Republic of China. Vision and actions on jointly building Silk Road Economic Belt and 21st Century Maritime Silk Road. 2015. Available at <http://en.ndrc.gov.cn/newsrelease/201503/t20150330_669367.html>

» http://en.ndrc.gov.cn/newsrelease/201503/t20150330_669367.html - PAULINO, L.; PIRES, M. As relações entre China e AL frente ao novo normal da economia chinesa. Revista Economia e Políticas Públicas, v. 4, n. 1, 1 sem. 2016.

- POP, I. L. Strengths and challenges of China’s “One belt, One road” Initiative. Centre for Geopolitics and Security in Realism Studies, fev. 2016.

- PROTTI, A. T. China: uma análise do papel das exportações e do investimento doméstico para o modelo de desenvolvimento econômico no período recente. Tese (Doutorado em Ciências Econômicas) - Instituto de Economia, Universidade Estadual de Campinas, 2015.

- RED ACADÊMICA DE AMÉRICA LATINA Y EL CARIBE. Monitor de la OFDI de China en AL y el Caribe. [On-line] Red Alc-China. Available at:<http://www.redalc-china.org/monitor/informacion-por-pais/busqueda-por-pais/80-america-latina-y-el-caribe>.

» http://www.redalc-china.org/monitor/informacion-por-pais/busqueda-por-pais/80-america-latina-y-el-caribe - SANTOS. L.; MILAN. M. Determinantes dos investimentos diretos externos chineses: aspectos econômicos e geopolíticos. Revista Contexto Internacional, v. 36, n. 2, p. 457-486, jul./dez. 2014.

- SCHERER, A. L. F. A nova estratégia de projeção geoeconômica chinesa e a economia brasileira.Revista Paranaense de Desenvolvimento, v. 36, n. 129, jul./dez. 2015.

- SILVA, S. T. “Los patrones de internacionalización china en once años del proyecto Going Global”. In: DUSSEL PETERS, E. (Coord.). AL y el Caribe y China Economía, comercio e inversión 2015. Ciudad de México: Red Académica de AL y el Caribe sobre China, 2015.

- UNDP - UNITED NATIONS DEVELOPMENT PROGRAMME; CHINA CENTER FOR INTERNATIONAL ECONOMIC EXCHANGES. The Belt and Road Initiative. A new means to transformative global governance towards sustainable development. Beijing: UN/CN, 2017.

- YAO, Y. The double transition and China’s export-led growth. In: THE PACIFIC TRADE AND DEVELOPMENT (PAFTAD) CONFERENCE, 34, 6-9 Dec. 2010. Available at: <http://paftad.org/files/ 34/01_YANG%20YAO_Growth.pdf>.

» http://paftad.org/files/ 34/01_YANG%20YAO_Growth.pdf

-

1

In constant purchasing power parity dollars.

-

2

For example, Yao (2010) and Guo and Diaye (2009).

-

3

According to data from the World Development Indicators/World Bank and the United Nations Population Division’s World Urbanization Prospects.

-

4

Although Ansar et al. (2016) have a critical view of the role of infrastructure investments in Chinese growth, they provide evidence that points to the effects on gross capital formation and the role of public banks and state-owned enterprises in the process.

-

5

See, for example, Farouki and Kaplinski (2012) and McKinsey (2012). Gilbert (2010) also highlights the influence of speculative financial markets on commodity prices.

-

6

Vision and Actions on Jointly Building Silk Road Economic Belt and 21st Century Maritime Silk Road. National Development and Reform Commission, 2015.

-

7

In the Asian Development Bank (ADB), China’s share is only 6.4%, while Japan has 15.6% and the United States 15.5%.

Publication Dates

-

Publication in this collection

2018

History

-

Received

27 July 2017 -

Accepted

17 Jan 2018

Source: Unctad.

Source: Unctad.

Source: Unctad.

Source: Unctad.

Source: The Latin America and the Caribbean Network on China (RED ALC-CHINA).

Source: The Latin America and the Caribbean Network on China (RED ALC-CHINA).

Source: McKinsey (2016).

Source: McKinsey (2016).