Abstract

This study aims to explore government accrual-based IPSAS implementation level measurements and to test the measures associated with central government fiscal transparency. Performing content analysis and Confirmatory Factor Analysis (CFA) on a sample covering 77 countries from 2008 to 2015, measurement indicates the relative importance and significance of financial performance statements and accrual accounting policies, such as non-exchanged and exchanged transactions as accrual level constructors. Conducting panel data regression, we find that accrual level scores meet the requirements of the external validity test, as indicated by their positive association with the International Budget Initiative’s (IBP) fiscal transparency index. The evidence suggests that central governments should strategically implement accrual-based IPSAS. Accrual practices (implicitly or explicitly) based on IPSAS strengthen fiscal transparency when it prioritises developing accrual accounting policies substantially rather than accrual commitment and the completeness of reports.

Key words:

accrual-based IPSAS; fiscal transparency; confirmatory factor analysis

Introduction

Good public governance principles have become a foundation used by several countries to reform their public administration. Enhancement of accountability, transparency, efficiency, effectiveness, responsiveness, and the rule of law are the key objectives for government to successfully deliver public desires (Organisation for Economic Co-operation and Development [OECD], 2011Organisation for Economic Co-operation and Development. (2011). Public governance. Retrieved from http://www.oecd.org/investment/toolkit/policyareas/publicgovernance/41890394.pdf

http://www.oecd.org/investment/toolkit/p...

). One of the most interesting concerns is with taxpayers’ and investors’ accessibility demands towards the central government’s public finance policy. Government responses have been to increase their public financial, or fiscal, transparency by reforming their Public Financial Management (PFM) practices (Martí & Kasperskaya, 2015Martí, C., & Kasperskaya, Y. (2015). Public financial management systems and countries’ governance: A cross-country study. Public Administration and Development, 35(3), 165-178. https://doi.org/10.1002/pad.1711

https://doi.org/10.1002/pad.1711...

).

The positive trend towards fiscal transparency has pervasively spread across entire countries (Seifert, Carlitz, & Mondo, 2013Seifert, J., Carlitz, R., & Mondo, E. (2013). The open budget index (OBI) as a comparative statistical tool. Journal of Comparative Policy Analysis: Research and Practice, 15(1), 87-101. https://doi.org/10.1080/13876988.2012.748586

https://doi.org/10.1080/13876988.2012.74...

). Based on the guidelines for fiscal transparency provided by prominent international organizations - such as the International Monetary Fund (IMF), the Organization for Economic Co-operation and Development (OECD), the International Organization of Supreme Audit Institutions (INTOSAI), and the World Bank - the International Budget Partnership (IBP) documented that more than 22% of around 100 central governments surveyed had sufficient fiscal transparency (IBP, 2015International Budget Partnership. (2015). Open budget survey 2015. Retrieved from http://www.internationalbudget.org/wp-content/uploads/OBS2015-Report-English.pdf

http://www.internationalbudget.org/wp-co...

). Since the recovery from the 2008 global financial crisis (Berger, 2012Berger, T. M.-M. (2012). Impact of the global financial crisis and the sovereign debt crisis on public sector accounting. In T. M.-M. Berger, IPSAS Explained (pp. 38-50). West Sussex, UK: John Wiley & Sons, Inc.), this percentage has been growing steadily, simultaneously with PFM reforms. Using statistical reports as a fiscal transparency measurement, Wang, Irwin, and Murara (2015)Wang, R. F., Irwin, T. C., & Murara, L. K. (2015). Trends in fiscal transparency: Evidence from a new database of the coverage of fiscal reporting [IMF Working Papers, WP/15/188]. International Monetary Fund. https://doi.org/10.5089/9781513523965.001

https://doi.org/10.5089/9781513523965.00...

also demonstrated a positive trend in the availability of Government Finance Statistics (GFS) in OECD countries.

Some argue that better fiscal transparency has a positive link with most countries’ PFM reforms (De Renzio & Masud, 2011De Renzio, P., & Masud, H. (2011). Measuring and promoting budget transparency: The open budget index as a research and advocacy tool. Governance, 24(3), 607-616. https://doi.org/10.1111/j.1468-0491.2011.01539.x

https://doi.org/10.1111/j.1468-0491.2011...

; Martí & Kasperskaya, 2015Martí, C., & Kasperskaya, Y. (2015). Public financial management systems and countries’ governance: A cross-country study. Public Administration and Development, 35(3), 165-178. https://doi.org/10.1002/pad.1711

https://doi.org/10.1002/pad.1711...

). Public sector accrual accounting practices - as PFM best practices - assist in the provision of richer information with a single set of accounting procedures for the decision-making process (see Alt, Lassen, & Skilling, 2002Alt, J. E., Lassen, D. D., & Skilling, D. (2002). Fiscal transparency, gubernatorial approval, and the scale of government: Evidence from the States. State Politics & Policy Quarterly, 2(3), 230-250. https://doi.org/10.1177/153244000200200302

https://doi.org/10.1177/1532440002002003...

; Chan & Zhang, 2013Chan, J. L., & Zhang, Q. (2013). Government accounting standards and policies. In R. Allen, R. Hemming, & B. H. Potter (Eds.), The international handbook of public financial management (pp. 742-766). London: Palgrave Macmillan UK.; Diamond, 2002Diamond, J. (2002). Performance budgeting is accrual accounting required? [IMF Working Papers, WP/02/240]. International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/wp/2002/wp02240.pdf

https://www.imf.org/external/pubs/ft/wp/...

; Guthrie, 1998Guthrie, J. (1998). Application of accrual accounting in the Australian public sector - rhetoric or reality. Financial Accountability and Management, 14(1), 1-19. https://doi.org/10.1111/1468-0408.00047

https://doi.org/10.1111/1468-0408.00047...

). Therefore, most central governments have made extra efforts to improve recording and to present their advanced financial transactions by upgrading their book-keeping systems. PricewaterhouseCoopers (PwC, 2013PricewaterhouseCoopers. (2013, April). Towards a new era in government accounting and reporting. Retrieved from https://www.pwc.com/gx/en/psrc/publications/assets/pwc-global--ipsas-survey-government-accounting-and-reporting-pdf.pdf

https://www.pwc.com/gx/en/psrc/publicati...

) demonstrated the increasing trend toward accrual accounting in central governments around the world. It was predicted that more than 63% of countries would convert their traditional cash basis to accrual accounting by 2018.

However, accrual practices have been quite varied across central governments. State-of-the-art central government accrual accounting implementation reflects the resultant factor of such political compromises, cultural backgrounds (Hyndman & Connolly, 2011Hyndman, N., & Connolly, C. (2011). Accruals accounting in the public sector: A road not always taken. Management Accounting Research, 22(1), 36-45. https://doi.org/10.1016/j.mar.2010.10.008

https://doi.org/10.1016/j.mar.2010.10.00...

; Lapsley, Mussari, & Paulsson, 2009Lapsley, I., Mussari, R., & Paulsson, G. (2009). On the adoption of accrual accounting in the public sector: A self-evident and problematic reform. European Accounting Review, 18(4), 719-723. https://doi.org/10.1080/09638180903334960

https://doi.org/10.1080/0963818090333496...

), economic structures, and characteristics of business infrastructure (Pina & Torres, 2003Pina, V., & Torres, L. (2003). Reshaping public sector accounting: An international comparative view. Canadian Journal of Administrative Sciences, 20(4), 334-350. https://doi.org/10.1111/j.1936-4490.2003.tb00709.x

https://doi.org/10.1111/j.1936-4490.2003...

). The factors underlying the recognition, measurement, and presentation (RMP) of accrual policies were mainly categorized as (a) GAAP businesslike, (b) statistical-based, and (c) accrual-based IPSAS (Christiaens, Vanhee, Manes-Rossi, Aversano, & Cauwenberge, 2014Christiaens, J. R., Vanhee, C., Manes-Rossi, F., Aversano, N., & Cauwenberge, P. van (2014). The effect of IPSAS on reforming governmental financial reporting: An international comparison. International Review of Administrative Sciences, 81(1), 158-177. https://doi.org/10.1177/0020852314546580

https://doi.org/10.1177/0020852314546580...

; PwC, 2014PricewaterhouseCoopers. (2014, August 1). Collection of information related to the potential impact, including costs, of implementing accrual accounting in the public sector and technical analysis of the suitability of individual IPSAS standards. Retrieved from http://www.pwc.be/en/publications/2014/epsas_oct_2014.pdf

http://www.pwc.be/en/publications/2014/e...

). The variation in their adoption leads to incomparability and inconsistency in publicly provided government financial indicators. Even when a government financial performance outlook was provided by international financial institutions (i.e., the IMF or the World Bank), the financial adjustment inside its metadata - reflecting methodological soundness - potentially reduced its fiscal information quality (Giosi, Brunelli, & Caiffa, 2015Giosi, A., Brunelli, S., & Caiffa, M. (2015). Do accrual numbers really affect the financial market? An empirical analysis of ESA accounts across the EU. International Journal of Public Administration, 38(4), 297-310. https://doi.org/10.1080/01900692.2015.999591

https://doi.org/10.1080/01900692.2015.99...

).

Accrual-based IPSAS as a de-facto international public sector accounting standard has been - gradually, partially, or fully - referred by several country standard-setters to overcome such information quality problems. The rationale behind IPSAS adoption is that its comparability and consistency for governmental reporting systems cover systematic public fund RMP rules (International Federation of Accountants [IFAC], 2014International Federation of Accountants. (2014, April). The importance of accrual-based financial reporting in the public sector. Retrieved from https://www.ifac.org/system/files/uploads/IPSASB/IPSASB-The-Importance-of-Accrual-based-Financial-Reporting.pdf

https://www.ifac.org/system/files/upload...

). Based on International Financial Report Standards (IFRS), IPSAS is compatible with the recent fair value model of the financial instrument that attracted government entities to improve their public asset and liability valuations (Bolívar & Galera, 2012Galera, A. N., & Bolívar, M. P. R. (2012). Adopting IPSAS to improve governmental accountability in Spain: an empirical study. International Journal of Critical Accounting, 4(5/6), 572-607. https://doi.org/10.1504/ijca.2012.051465

https://doi.org/10.1504/ijca.2012.051465...

). IPSAS provides not only a full set standard of procedures for advanced credit-economy transactions (Chan & Xu, 2012Chan, J. L., & Xu, Y. (2012). How much red ink? World Economics, 13(1), 65-74. Retrieved from https://www.worldeconomics.com/Journal/Papers/How%20Much%20Red%20Ink.details?ID=507

https://www.worldeconomics.com/Journal/P...

) but also consensus on the treatment of special government entity transactions and presentations (i.e., non-exchanged revenue transactions and budgetary reports) (Diamond, 2002Diamond, J. (2002). Performance budgeting is accrual accounting required? [IMF Working Papers, WP/02/240]. International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/wp/2002/wp02240.pdf

https://www.imf.org/external/pubs/ft/wp/...

).

Previous studies have been attempted by considering accrual-based IPSAS implementation levels, with some limitations. For example, they attempted to simplify conformity of accrual-based IPSAS relying on main presentations (Pina & Torres, 2003Pina, V., & Torres, L. (2003). Reshaping public sector accounting: An international comparative view. Canadian Journal of Administrative Sciences, 20(4), 334-350. https://doi.org/10.1111/j.1936-4490.2003.tb00709.x

https://doi.org/10.1111/j.1936-4490.2003...

), identify accrual-based IPSAS regardless of RMP procedures (Christiaens et al., 2014Christiaens, J. R., Vanhee, C., Manes-Rossi, F., Aversano, N., & Cauwenberge, P. van (2014). The effect of IPSAS on reforming governmental financial reporting: An international comparison. International Review of Administrative Sciences, 81(1), 158-177. https://doi.org/10.1177/0020852314546580

https://doi.org/10.1177/0020852314546580...

), build a conformity index without non-exchanged transactions policies and employee benefits (Benito, Brusca, & Montesinos, 2007Benito, B., Brusca, I., & Montesinos, V. (2007). The harmonization of government financial information systems: The role of the IPSASs. International Review of Administrative Sciences, 73(2), 293-317. https://doi.org/10.1177/0020852307078424

https://doi.org/10.1177/0020852307078424...

), and produce a highly detailed disclosure checklist based on IPSAS paragraphs (Ernst and Young [EY], 2012Ernst and Young. (2012, September). International public sector accounting standard’s disclosure cheklist. Retrieved from https://www.ey.com/Publication/vwLUAssets/EY_-_International_Public_Sector_Accounting_Standards_Disclosure_Checklist_-_September_2012_Edition/$FILE/EY-IPSAS-Ctools-%20Disclosurechecklist-Sept2012.pdf

https://www.ey.com/Publication/vwLUAsset...

). The accounting maturity level was developed for nine (9) European countries. However, the maturity of each of the accounting policies with accrual-based IPSAS was constructed based on the European Public Sector Accounting Standards (EPSAS) context (PwC, 2014PricewaterhouseCoopers. (2014, August 1). Collection of information related to the potential impact, including costs, of implementing accrual accounting in the public sector and technical analysis of the suitability of individual IPSAS standards. Retrieved from http://www.pwc.be/en/publications/2014/epsas_oct_2014.pdf

http://www.pwc.be/en/publications/2014/e...

).

This study aims to explore accrual-based IPSAS implementation level measurement and test the measures associated with central government fiscal transparency by extending or contributing previous studies in three aspects. Firstly, we measure the accrual-based IPSAS level index in an intuitive manner based on hierarchical accrual adoption information from simple to complex identification statements. It builds upon the following information: (a) whether accrual adoption has declared - implicitly or explicitly - accrual-based IPSAS (accrual commitment), (b) whether elements of financial statements - financial position, financial performance, cash flow, changes in equity, and notes of financial statements - have been formally publicly provided (accrual report), and (c) how the specific accounting transaction policies of accrual characteristics substantially conform with IPSAS policies (accrual policy). Secondly, it completes the methodological aspect of index construction. Content analysis scored the highlighted criteria, relying on published central government financial statements and accounting policies. Further, confirmatory factor analysis was obtained for the internal validity of each accrual dimension relationship and loading factors that construct accrual level as the latent variables. Thirdly, this article demonstrates an empirical test involving 77 central governments (OECD, non-OECD, BRICS) from 2008 to 2015 for panel data - instead of cross-sectional - accrual accounting development and extends Bolívar and Galera's (2012)Galera, A. N., & Bolívar, M. P. R. (2012). Adopting IPSAS to improve governmental accountability in Spain: an empirical study. International Journal of Critical Accounting, 4(5/6), 572-607. https://doi.org/10.1504/ijca.2012.051465

https://doi.org/10.1504/ijca.2012.051465...

and Galera and Bolívar's (2007Galera, A. N., & Bolívar, M. P. R. (2007). The contribution of international accounting standards to implementing NPM in developing and developed countries. Public Administration and Development, 27(5), 413-425. https://doi.org/10.1002/pad.470

https://doi.org/10.1002/pad.470...

, 2010Galera, A. N., & Bolívar, M. P. R. (2010). Can government accountability be enhanced with international financial reporting standards? Public Money and Management, 30(6), 379-384. https://doi.org/10.1080/09540962.2010.525009

https://doi.org/10.1080/09540962.2010.52...

, 2011)Galera, A. N., & Bolívar, M. P. R. (2011). Modernizing governments in transitional and emerging economies through financial reporting based on international standards. International Review of Administrative Sciences, 77(3), 609-640. https://doi.org/10.1177/0020852311407365

https://doi.org/10.1177/0020852311407365...

studies of the impact of accrual-based IPSAS on government financial or fiscal transparency.

This article is organized as follows: first, it presents the theoretical framework of accrual accounting adoption and hypothesis development regarding its association with fiscal transparency. The second section outlines the research method for building the accrual level index and the regression model. The third part discusses the results and provides concluding remarks on this study.

Literature Review and Hypothesis Development

Government accounting and fiscal transparency

Improving transparency by modernizing government accounting practices is supported by agency theory. It has been assumed that bureaucratic policymakers engage in opportunistic behavior to obscure financial information from mandate givers, such as parliament, legislation, voters, or authorities (see Alt et al., 2002Alt, J. E., Lassen, D. D., & Skilling, D. (2002). Fiscal transparency, gubernatorial approval, and the scale of government: Evidence from the States. State Politics & Policy Quarterly, 2(3), 230-250. https://doi.org/10.1177/153244000200200302

https://doi.org/10.1177/1532440002002003...

; Debrun & Kumar, 2007Debrun, X., & Kumar, M. S. (2007). The discipline-enhancing role of fiscal institutions: Theory and empirical evidence [IMF Working Papers, WP/07/171]. International Monetary Fund. https://doi.org/10.5089/9781451867350.001

https://doi.org/10.5089/9781451867350.00...

; Irwin, 2012Irwin, T. C. (2012, March 28). Accounting devices and fiscal illusions (Staff Discussion Notes No. 12/02). Retrieved from https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2016/12/31/Accounting-Devices-and-Fiscal-Illusions-25795

https://www.imf.org/en/Publications/Staf...

). Better quality fiscal information assists policymakers conduct their fiscal actions transparently to demonstrate public governance practices, reduce abuse of power, and safeguard government assets (see Cicatiello, De Simone, & Gaeta, 2017Cicatiello, L., De Simone, E., & Gaeta, G. L. (2017). Political determinants of fiscal transparency: A panel data empirical investigation. Economics of Governance, 18(4), 315-336. https://doi.org/10.1007/s10101-017-0192-x

https://doi.org/10.1007/s10101-017-0192-...

; De Renzio & Masud, 2011De Renzio, P., & Masud, H. (2011). Measuring and promoting budget transparency: The open budget index as a research and advocacy tool. Governance, 24(3), 607-616. https://doi.org/10.1111/j.1468-0491.2011.01539.x

https://doi.org/10.1111/j.1468-0491.2011...

; Hameed, 2005Hameed, F. (2005). Fiscal transparency and economic outcomes [IMF Working Papers, WP/075/225]. International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/wp/2005/wp05225.pdf

https://www.imf.org/external/pubs/ft/wp/...

; Wehner & Renzio, 2013Wehner, J., & Renzio, P. de. (2013). Citizens, legislators, and executive disclosure: The political determinants of fiscal transparency. World Development, 41(January), 96-108. https://doi.org/10.1016/j.worlddev.2012.06.005

https://doi.org/10.1016/j.worlddev.2012....

).

The terms accounting stratagems (Irwin, 2012Irwin, T. C. (2012, March 28). Accounting devices and fiscal illusions (Staff Discussion Notes No. 12/02). Retrieved from https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2016/12/31/Accounting-Devices-and-Fiscal-Illusions-25795

https://www.imf.org/en/Publications/Staf...

; Weber, 2012Weber, A. (2012). Stock-flow adjustments and fiscal transparency: A cross-country comparison [IMF Working Papers, WP/12/39]. International Monetary Fund. https://doi.org/10.5089/9781463933821.001

https://doi.org/10.5089/9781463933821.00...

), creative accounting (Luder, 2000Luder, K. (2000). National accounting, governmental accounting and cross-country comparisons of government financial condition. Financial Accountability and Management, 16(2), 117-128. https://doi.org/10.1111/1468-0408.00100

https://doi.org/10.1111/1468-0408.00100...

; Reischmann, 2016Reischmann, M. (2016). Creative accounting and electoral motives: Evidence from OECD countries. Journal of Comparative Economics, 44(2), 243-257. https://doi.org/10.1016/j.jce.2015.07.001

https://doi.org/10.1016/j.jce.2015.07.00...

), and fiscal illusions (Guillamón, Bastida, & Benito, 2011Guillamón, M.-D., Bastida, F., & Benito, B. (2011). The determinants of local government’s financial transparency. Local Government Studies, 37(4), 391-406. https://doi.org/10.1080/03003930.2011.588704

https://doi.org/10.1080/03003930.2011.58...

) have been highlighted to express the problematic accounting choices of agents or policymakers. Policymakers will choose a reporting method to articulate public fund usage that reflects their best performance in the presence of voters (see Copley, 1991Copley, P. A. (1991). The association between municipal disclosure practices and audit quality. Journal of Accounting and Public Policy, 10(4), 245-266. https://doi.org/10.1016/0278-4254(91)90001-z

https://doi.org/10.1016/0278-4254(91)900...

; Zimmerman, 1977Zimmerman, J. L. (1977). The municipal accounting maze: An analysis of political incentives. Journal of Accounting Research, 15(Supplement), 107-144. https://doi.org/10.2307/2490636

https://doi.org/10.2307/2490636...

). Together with democratization, political competition, and high tax rates, the policymakers or elected politicians need to satisfy voters by using public resources in a transparent way (Arapis & Reitano, 2017Arapis, T., & Reitano, V. (2017). Examining the evolution of cross-national fiscal transparency. The American Review of Public Administration, 17(5), 643-660. https://doi.org/10.1177/0275074017706740

https://doi.org/10.1177/0275074017706740...

; Zimmerman, 1977Zimmerman, J. L. (1977). The municipal accounting maze: An analysis of political incentives. Journal of Accounting Research, 15(Supplement), 107-144. https://doi.org/10.2307/2490636

https://doi.org/10.2307/2490636...

). Thus, the competitive situation between politicians and voters will result in the demand for better procedures, standards, or regulation of choices for financial transparency reports (Baber & Sen, 1984Baber, W. R., & Sen, P. K. (1984). The role of generally accepted reporting methods in the public sector: An empirical test. Journal of Accounting and Public Policy, 3(2), 91-106. http://doi.org/10.1016/0278-4254(84)90002-4

http://doi.org/10.1016/0278-4254(84)9000...

).

Within the concept of public financial management, financial or fiscal transparency, according to Heald (2012)Heald, D. (2012). Why is transparency about public expenditure so elusive? International Review of Administrative Sciences, 78(1), 30-49. https://doi.org/10.1177/0020852311429931

https://doi.org/10.1177/0020852311429931...

, is defined as the systematic disclosure of government actions that have consequences for government accounts: revenues, expenditures, finance, liabilities, assets, and ownership changes. It stresses the openness of government policy actions that should be coherently disclosed in every PFM cycle: budget formulation, execution, and year-end report processes. In addition, the IMF (2012, p. 4)International Monetary Fund. (2012, August 7). Fiscal transparency, accountability and risk. Retrieved from http://www.imf.org/external/np/pp/eng/2012/080712.pdf

http://www.imf.org/external/np/pp/eng/20...

highlights fiscal transparency as “[t]he clarity, reliability, frequency, timeliness, and relevance of public fiscal reporting and the openness to the public of government’s fiscal policy-making process…”. It emphasizes the principles of fiscal transparency, such as (a) the comprehensiveness, relevance, timeliness, and reliability of a government’s financial position and performance reports; (b) clear fiscal and budget objectives and targets; and (c) adequate fiscal management and coordination for the decision-making process.

Furthermore, fiscal transparency quality can be identified from the credibility of fiscal policy indicators that are internationally published as fiscal outlook or finance statistics (Cicatiello et al., 2017Cicatiello, L., De Simone, E., & Gaeta, G. L. (2017). Political determinants of fiscal transparency: A panel data empirical investigation. Economics of Governance, 18(4), 315-336. https://doi.org/10.1007/s10101-017-0192-x

https://doi.org/10.1007/s10101-017-0192-...

; Wang, Irwin, & Murara, 2015Wang, R. F., Irwin, T. C., & Murara, L. K. (2015). Trends in fiscal transparency: Evidence from a new database of the coverage of fiscal reporting [IMF Working Papers, WP/15/188]. International Monetary Fund. https://doi.org/10.5089/9781513523965.001

https://doi.org/10.5089/9781513523965.00...

). In macroeconomics theory, fiscal policy itself involves government actions to adjust government expenditure levels (G), tax rates (T), and sovereign debt (D) to intervene in the national economy (GDP) (Greenwood, 2018Greenwood, D. T. (2018). Moving beyond traditional indicators of fiscal sustainability: Examples from locally chosen indicators. In D. V. Malito, G. Umbach, & N. Bhuta (Eds.), The Palgrave handbook of indicators in global governance (pp. 325-347). Cham: Springer International Publishing.), thus generating fiscal sustainability indicators such as total gross debt, net worth, net financial worth, fiscal gap, net debt/total revenues, and fiscal dependency (International Public Sector Accounting Standards Board [IPSASB], 2013International Public Sector Accounting Standards Board. (2013). Reporting on the long-term sustainability of public finances, recommended practice guideline (RPG). Retrieved from https://www.ifac.org/publications-resources/recommended-practice-guideline-reporting-long-term-sustainability-public-sect

https://www.ifac.org/publications-resour...

).

The role of the accounting system contributes to fiscal report quality. The credibility of micro-accounting transactions at the entities’ level contributes to the quality of government financial information (Luder, 2000Luder, K. (2000). National accounting, governmental accounting and cross-country comparisons of government financial condition. Financial Accountability and Management, 16(2), 117-128. https://doi.org/10.1111/1468-0408.00100

https://doi.org/10.1111/1468-0408.00100...

; Mellor, 1996Mellor, T. (1996). Why governments should produce balance sheets. Australian Journal of Public Administration, 55(1), 78-81. https://doi.org/10.1111/j.1467-8500.1996.tb01184.x

https://doi.org/10.1111/j.1467-8500.1996...

). Government accounting procedures - notably accrual-based accounting - compile budgetary accounts to encourage openness of off-budget, extra-budget, off-balance sheet, long-term financial rights, obligations, and future cash flows, which should be coherently accounted in PFM cycles, thus enhancing the integrity and reliability of the fiscal condition (Chan & Zhang, 2013Chan, J. L., & Zhang, Q. (2013). Government accounting standards and policies. In R. Allen, R. Hemming, & B. H. Potter (Eds.), The international handbook of public financial management (pp. 742-766). London: Palgrave Macmillan UK.; Mellor, 1996Mellor, T. (1996). Why governments should produce balance sheets. Australian Journal of Public Administration, 55(1), 78-81. https://doi.org/10.1111/j.1467-8500.1996.tb01184.x

https://doi.org/10.1111/j.1467-8500.1996...

). For international comparability and transparency, accounting information needs an adjustment of metadata to publish fiscal accounts based on the macroeconomic perspective as financial statistics reports (Giosi et al., 2015Giosi, A., Brunelli, S., & Caiffa, M. (2015). Do accrual numbers really affect the financial market? An empirical analysis of ESA accounts across the EU. International Journal of Public Administration, 38(4), 297-310. https://doi.org/10.1080/01900692.2015.999591

https://doi.org/10.1080/01900692.2015.99...

; Luder, 2000Luder, K. (2000). National accounting, governmental accounting and cross-country comparisons of government financial condition. Financial Accountability and Management, 16(2), 117-128. https://doi.org/10.1111/1468-0408.00100

https://doi.org/10.1111/1468-0408.00100...

). Therefore, the procedural choices of accounting systems determine the quality of both fiscal management and fiscal outlook.

Strengthening fiscal transparency: what does IPSAS already offer?

Currently, the growing demands for government financial transparency have affirmed IPSAS as a global standard. Advocating IPSAS adoption to “strengthen public finance management …, thereby increasing transparency and accountability” (IPSASB, 2016, p. 16) is often justified as “international best practices” (Heald, 2012Heald, D. (2012). Why is transparency about public expenditure so elusive? International Review of Administrative Sciences, 78(1), 30-49. https://doi.org/10.1177/0020852311429931

https://doi.org/10.1177/0020852311429931...

, p. 46). Sellami and Gafsi (2017)Sellami, Y. M., & Gafsi, Y. (2017). Institutional and economic factors affecting the adoption of international public sector accounting standards. International Journal of Public Administration, 1(13), 190-692. https://doi.org/10.1080/01900692.2017.1405444

https://doi.org/10.1080/01900692.2017.14...

empirically demonstrated the institutional factors and cost of IPSAS adoption to improve the transparency and comparability of financial statements, such as public external funding, the degree of external openness, and the importance of internal public-sector organizations. However, the benefits of IPSAS adoption have not been empirically explored.

As proposed by Mellor (1996)Mellor, T. (1996). Why governments should produce balance sheets. Australian Journal of Public Administration, 55(1), 78-81. https://doi.org/10.1111/j.1467-8500.1996.tb01184.x

https://doi.org/10.1111/j.1467-8500.1996...

, the most direct benefit of accrual-based adoptions is government financial transparency improvement. Further, the government can enhance public trust, internally, and reliance amongst the international community, externally (see Berger, 2018Berger, T. M.-M. (2018). IPSAS explained: A summary of international public sector accounting standards (3rd ed.). West Sussex, UK: Wiley Online Library.). Specifically, accrual-based IPSAS practices assist as a catalyst for operational and performance management, and provide long-term sustainability information on public finances (PwC, 2013PricewaterhouseCoopers. (2013, April). Towards a new era in government accounting and reporting. Retrieved from https://www.pwc.com/gx/en/psrc/publications/assets/pwc-global--ipsas-survey-government-accounting-and-reporting-pdf.pdf

https://www.pwc.com/gx/en/psrc/publicati...

), thus convincing service recipients (i.e., consumers, communities, and the public) and resource providers (i.e., taxpayers, donors, lenders, etc.) to support government policies (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.). Regarding intergenerational equity issues, accrual-based IPSAS provides a balanced and transparent perspective on government resources, investments, and sovereign debt that complements the nuances of the fiscal outlook in a more comprehensive and comparable manner, according to country investment prospects and potential economic vulnerability (Berger, 2012Berger, T. M.-M. (2012). Impact of the global financial crisis and the sovereign debt crisis on public sector accounting. In T. M.-M. Berger, IPSAS Explained (pp. 38-50). West Sussex, UK: John Wiley & Sons, Inc.).

From the perspective of the economics of public finance, the legitimacy of central government depends on how policymakers should necessarily and sufficiently clarify the impact of their policy interventions in the country’s economics (Berger, 2012Berger, T. M.-M. (2012). Impact of the global financial crisis and the sovereign debt crisis on public sector accounting. In T. M.-M. Berger, IPSAS Explained (pp. 38-50). West Sussex, UK: John Wiley & Sons, Inc.). Musgrave and colleagues defined the openness of government roles in fiscal stewardship and economic sustainability as allocation, redistribution, and stabilization (Musgrave, Musgrave, & Bird, 1989Musgrave, R. A., Musgrave, P. B., & Bird, R. M. (1989). Public finance in theory and practice. New York: McGraw-Hill.). The government should strictly define their functions and programs for delivering public services activity when allocating the budget for specific public goods and services (i.e., public roads, network, and infrastructures). Redistribution means that policymakers have a certain strategy to collect public funds (i.e., progressive tax, grants, and charges) and distribute them to society without ignoring the equity. Lastly, the government is accountably issuing fiscal stimuli for stabilization in times of economic slowdown and decline (i.e., blanket guarantee, public debt).

IPSAS statements have overcome the demands for transparency in government policymakers’ actions (IFAC, 2012aInternational Federation of Accountants. (2012a). Public sector financial management transparency and accountability: The use of international public sector accounting standards. New York, NY: Author.). Based on the IFRS, IPSAS will match and fit with complex and advanced government intervention schemes. In allocation function, fiscal policy has an incentive effect on economic agents by providing public spending on economic infrastructures with many schemes. For example, capital spending can be financed with common public sector procurements (IPSAS 17) and construction contracts (IPSAS 11). The government can also utilize public-private partnerships (PPP) with service concession arrangements (IPSAS 32) or financial leasing (IPSAS 13) to procure public infrastructures.

Government redistributive function aims to achieve social welfare through non-exchanged revenue transaction schemes (IPSAS 23). The government can impose the collection of public funds - such as tax mechanisms - on the public without directly returning any goods and services. IPSAS related to its RMP accommodates revenue transfers from different levels of government (to achieve national fiscal balance), donations, gifts, and goods and services in-kind as characteristics of the public sector.

The stabilization function is the government role in providing sustainability and intergenerational equity implication of allocation and redistribution policies (Robinson, 1998Robinson, M. (1998). Accrual accounting and the efficiency of the core public sector. Financial Accountability and Management, 14(1), 21-37. https://doi.org/10.1111/1468-0408.00048

https://doi.org/10.1111/1468-0408.00048...

). The government must adjust the operating deficit and maintain public sector net equity via a prudent indebtedness policy (IPSAS 28-30). Reactively, stabilization is government feedback on macroeconomic indicators such as economic growth, unemployment, aggregate consumption and production, and external economic shock. The nature of government intervention schemes must at least meet necessary and sufficient conditions. For example, if the systemic impact of financial institution crisis was met, then the government might prevent it with tactical interventions such as financial asset guarantee or buying an asset to maintain public trust. Further, accrual-based IPSAS provides recording procedures for purchasing financial assets as an investment and periodically evaluates their value (IPSAS 28-30).

In addition, according to harmonization between government accounting and finance statistics (as fiscal transparency reports), the IPSAS Board is earnestly concerned with identifying, managing, and reducing discrepancies (IFAC, 2012bInternational Federation of Accountants. (2012b, October). IPSASs and government - Finance statistics reporting guidelines. Retrieved from https://www.ifac.org/system/files/publications/files/IPSASsandGFSGuidelinesFINALOctober16 2012.pdf

https://www.ifac.org/system/files/public...

). For example, IPSASB has mapped a chart of accounts and reconciled fiscal accounts between IPSAS and the GFS concept, such as IPSAS net equity vs. GFS net worth, IPSAS surplus/deficit vs. GFS revenue net operating balance, IPSAS vs. GFS revenue - expenses, and IPSAS vs. GFS measurement and recognition.

Fiscal transparency measurement

Fiscal policy transparency indicators are defined as the openness of fiscal accounts in each of the PFM cycles (see De Renzio & Masud, 2011De Renzio, P., & Masud, H. (2011). Measuring and promoting budget transparency: The open budget index as a research and advocacy tool. Governance, 24(3), 607-616. https://doi.org/10.1111/j.1468-0491.2011.01539.x

https://doi.org/10.1111/j.1468-0491.2011...

; Hameed, 2005Hameed, F. (2005). Fiscal transparency and economic outcomes [IMF Working Papers, WP/075/225]. International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/wp/2005/wp05225.pdf

https://www.imf.org/external/pubs/ft/wp/...

). The IBP developed the Open Budget Index (OBI) based on PFM best practices of IMF, OECD, and World Bank prescriptions. It indicates the availability, timeliness, and comprehensiveness of (a) formulation of the budget by the executive, (b) budget enactment by the legislative, (c) budget execution by the executive, and (d) year-end reports (Seifert et al., 2013Seifert, J., Carlitz, R., & Mondo, E. (2013). The open budget index (OBI) as a comparative statistical tool. Journal of Comparative Policy Analysis: Research and Practice, 15(1), 87-101. https://doi.org/10.1080/13876988.2012.748586

https://doi.org/10.1080/13876988.2012.74...

).

Specifically, the OBI elaborates the existing budgeting process, such as budget preparation (executive budget proposal, pre-budget statement, citizens’ budget), and enacts the budget, in-year reports, mid-year review, and year-end report until the audit report. The elements of the budget document contain fiscal information. For example, the budget must disclose revenue compositions, expenditure dimensions, and financing activities. The OBI also highlights the importance of managing fiscal risk, revealing extra-budget, off-budget, and intergovernmental funds, investment in associations, and financial and non-financial assets. All documents must coherently present the budget vs. the actual comparison and its variance analysis. Eventually, the year-end report must be guaranteed by the assurance procedure of the external audit.

Advocating a comparable index across countries and methodological soundness, the IBP conducts primary data questionnaires that are completed by independent researchers in each country and blindly reviewed by two country experts, acquires feedback from government, and makes final decisions scored by the IBP team based on citations and attaches them to relevant documents (De Renzio & Masud, 2011De Renzio, P., & Masud, H. (2011). Measuring and promoting budget transparency: The open budget index as a research and advocacy tool. Governance, 24(3), 607-616. https://doi.org/10.1111/j.1468-0491.2011.01539.x

https://doi.org/10.1111/j.1468-0491.2011...

; IBP, 2012International Budget Partnership. (2012). Open budget survey methodology. Retrieved from http://www.internationalbudget.org/publications/obi-methodology-201-english-2/

http://www.internationalbudget.org/publi...

). The IBP has released OBI surveys in 2006, 2008, 2010, 2012, 2015, and 2017 and has been empirically used by several researchers to investigate the determinants of fiscal transparency (see Arapis & Reitano, 2017Arapis, T., & Reitano, V. (2017). Examining the evolution of cross-national fiscal transparency. The American Review of Public Administration, 17(5), 643-660. https://doi.org/10.1177/0275074017706740

https://doi.org/10.1177/0275074017706740...

; Wehner & Renzio, 2013Wehner, J., & Renzio, P. de. (2013). Citizens, legislators, and executive disclosure: The political determinants of fiscal transparency. World Development, 41(January), 96-108. https://doi.org/10.1016/j.worlddev.2012.06.005

https://doi.org/10.1016/j.worlddev.2012....

) and its impacts (see Blume & Voigt, 2013Blume, L., & Voigt, S. (2013). The economic effects of constitutional budget institutions. European Journal of Political Economy, 29, 236-251. https://doi.org/10.1016/j.ejpoleco.2012.10.004

https://doi.org/10.1016/j.ejpoleco.2012....

; Peat, Svec, & Wang, 2015Peat, M., Svec, J., & Wang, J. (2015). The effects of fiscal opacity on sovereign credit spreads. Emerging Markets Review, 24(September), 34-45. https://doi.org/10.1016/j.ememar.2015.05.001

https://doi.org/10.1016/j.ememar.2015.05...

).

Accrual-based IPSAS conformity level and central government fiscal transparency

Enhancing financial transparency has become the tagline for the consequences of the adoption of global accounting standards. In the private sector, several researchers have developed strong arguments and empirically tested the effect of IFRS adoption on improving transparency. Lang and Stice-Lawrence (2015)Lang, M. H., & Stice-Lawrence, L. (2015). Textual analysis and international financial reporting: Large sample evidence. Journal of Accounting and Economics, 60(2-3), 110-135. https://doi.org/10.1016/j.jacceco.2015.09.002

https://doi.org/10.1016/j.jacceco.2015.0...

found that IFRS adoption improves annual reports’ disclosure by reducing redundancy and increasing comparability. Li and Yang (2016)Li, X., & Yang, H. I. (2016). Mandatory financial reporting and voluntary disclosure: The effect of mandatory IFRS adoption on management forecasts. The Accounting Review, 91(3), 933-953. http://doi.org/10.2308/accr-51296

http://doi.org/10.2308/accr-51296...

and Beattie, Fearnley, and Hines (2012)Beattie, V., Fearnley, S., & Hines, T. (2012). Reaching key financial reporting decisions: How directors and auditors interact. Accounting Review, 87(5), 1819-1820. https://doi.org/10.1080/17449480.2013.834742

https://doi.org/10.1080/17449480.2013.83...

suggested that IFRS adoption has decreased the complexity of excessive disclosure, thus reflecting the usefulness of annual reports.

In the public sector, financial transparency is conceptually related to the adoption of international accounting standards (see IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.), accrual-based accounting practices (see Mellor, 1996Mellor, T. (1996). Why governments should produce balance sheets. Australian Journal of Public Administration, 55(1), 78-81. https://doi.org/10.1111/j.1467-8500.1996.tb01184.x

https://doi.org/10.1111/j.1467-8500.1996...

; Robinson, 1998Robinson, M. (1998). Accrual accounting and the efficiency of the core public sector. Financial Accountability and Management, 14(1), 21-37. https://doi.org/10.1111/1468-0408.00048

https://doi.org/10.1111/1468-0408.00048...

) and more general New Public Management (NPM) best practices (see Galera & Bolívar, 2007Galera, A. N., & Bolívar, M. P. R. (2007). The contribution of international accounting standards to implementing NPM in developing and developed countries. Public Administration and Development, 27(5), 413-425. https://doi.org/10.1002/pad.470

https://doi.org/10.1002/pad.470...

). Accrual-based IPSAS reflects better quality in various dimensions of government reports, such as understandability, comparability, and consistency (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.). The consistency of financial statements’ formats, procedures, and policies will promote better understandability and comparability among entities. Therefore, IPSAS produces a high-quality report that enhances financial informativeness and usefulness for the decision-making process.

There are several kinds of research focusing on empirical evidence of the adoption of global accounting standards on government transparency. Galera and Bolívar (2007)Galera, A. N., & Bolívar, M. P. R. (2007). The contribution of international accounting standards to implementing NPM in developing and developed countries. Public Administration and Development, 27(5), 413-425. https://doi.org/10.1002/pad.470

https://doi.org/10.1002/pad.470...

have empirically demonstrated perceptions from National Accounting Standard Setter (NASS) respondents from 47 countries according to the role of IPSAS in promoting NPM postulates, such as improving information transparency, efficiency, and benchmarking analysis. In particular, IPSAS encourages fair value measurement, which is perceived to provide more accurate and complete information, since it considers the current market and economic environment, thus improving the relevancy, understandability, and timeliness of government financial statements. Further, Galera and Bolívar (2011)Galera, A. N., & Bolívar, M. P. R. (2011). Modernizing governments in transitional and emerging economies through financial reporting based on international standards. International Review of Administrative Sciences, 77(3), 609-640. https://doi.org/10.1177/0020852311407365

https://doi.org/10.1177/0020852311407365...

examined the NASS respondents for OECD and non-OECD countries to demonstrate the positive influence of accrual-based IPSAS on financial transparency.

Bolívar and Galera (2012)Bolívar, M. P. R., & Galera, A. N. (2012). The role of fair value accounting in promoting government accountability. Abacus, 48(3), 348-386. https://doi.org/10.1111/j.1467-6281.2011.00352.x

https://doi.org/10.1111/j.1467-6281.2011...

subsequently explored the NASS perception of fair-value IPSAS capability in transparency improvement in OECD. The estimation results remained consistent with their previous study, finding that financial transparency supports qualitative aspects (understandability, comparability and timeliness). Galera and Bolívar (2012)Galera, A. N., & Bolívar, M. P. R. (2012). Adopting IPSAS to improve governmental accountability in Spain: an empirical study. International Journal of Critical Accounting, 4(5/6), 572-607. https://doi.org/10.1504/ijca.2012.051465

https://doi.org/10.1504/ijca.2012.051465...

went on to empirically test their previous argument in the Spanish context. The same results have suggested that IPSAS supports the transparency and timeliness of financial reporting in a proper public governance environment.

Some studies limited accrual adoptions to a certain country. By using the Greek municipal context, Cohen (2012)Cohen, S. (2012). Cash versus accrual accounting measures in Greek municipalities: Proxies or not for decision-making? International Journal of Accounting, Auditing and Performance Evaluation, 8(3), 203. https://doi.org/10.1504/ijaape.2012.047807

https://doi.org/10.1504/ijaape.2012.0478...

found that accrual accounting improved decision-making by exposing more reliable and transparent presentation of financial indicators. For monitoring fiscal stance, rather than the traditional cash basis, accrual numbers exploited a wide horizon and more clearly exposed the revenue and expense accounts. Other empirical evidence exhibited a positive relationship between the adoption of accrual and efficiencies across German municipalities (Lampe, Hilgers, & Ihl, 2015Lampe, L. W., Hilgers, D., & Ihl, C. (2015). Does accrual accounting improve municipalities’ efficiency? Evidence from Germany. Applied Economics, 47(41), 4349-4363. https://doi.org/10.1080/00036846.2015.1030562

https://doi.org/10.1080/00036846.2015.10...

). Even though that study was not focused on transparency, it argued that due to higher openness, the efficiency of resource allocation would increase.

According to fiscal transparency, OBI captures the availability, timeliness, and comprehensiveness of three public financial management cycles: (a) budget formulation, (b) budget enactment, (c) budget execution, and (d) year-end reports (Begg, 2014Begg, I. (2014). Fiscal policy transparency. In J. Forssbaeck & L. Oxelheim (Eds.), The Oxford handbook of economic and institutional transparency (pp. 98-115). New York: Oxford University Press.; De Renzio & Masud, 2011De Renzio, P., & Masud, H. (2011). Measuring and promoting budget transparency: The open budget index as a research and advocacy tool. Governance, 24(3), 607-616. https://doi.org/10.1111/j.1468-0491.2011.01539.x

https://doi.org/10.1111/j.1468-0491.2011...

; Heald, 2012Heald, D. (2012). Why is transparency about public expenditure so elusive? International Review of Administrative Sciences, 78(1), 30-49. https://doi.org/10.1177/0020852311429931

https://doi.org/10.1177/0020852311429931...

). Budget documents should disclose revenue compositions, expenditure dimensions, financing activities, fiscal risk analysis, extra-budget, off-budget, and intergovernmental funds, investment in associations, and financial and non-financial asset. All documents in each stage must be coherently presented between budgets and their actual variances analysed, and the reporting quality should be assured (Seifert et al., 2013Seifert, J., Carlitz, R., & Mondo, E. (2013). The open budget index (OBI) as a comparative statistical tool. Journal of Comparative Policy Analysis: Research and Practice, 15(1), 87-101. https://doi.org/10.1080/13876988.2012.748586

https://doi.org/10.1080/13876988.2012.74...

).

In accordance with budgetary systems that are mostly on a cash basis (Moretti, 2016Moretti, D. (2016). Accrual practices and reform experiences in OECD countries results of the 2016 OECD accruals survey. OECD Journal on Budgeting, 16(1), 9-28. https://doi.org/10.1787/budget-16-5jlv2jx2mtzq

https://doi.org/10.1787/budget-16-5jlv2j...

), accrual-based IPSAS encourages the disclosure of hidden fiscal transactions in the year-end fiscal report, such as off-budget, extra-budget, and off-balance sheet related entries (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.). In terms of budgeting, off-budget and extra-budget entries are flow resources that have not passed the normal procedure or are not clearly reflected in budgetary transactions, such as non-cash transactions, pensions, social security, divestments of equities, privatizations, waivers of debt agreements, and other separate accounting entities and transactions. Non-cash transactions that recognize rights and obligations of central government are improperly captured from normal cash-based accounting and budgeting reports. For example, suspense of accounts and arrears of payment are only recognized in financial position and performance statements, not budgetary statements. Off-balance sheet information such as financing of operating leases and contingent liabilities must be appropriately disclosed in the notes of financial statements that are mandated by accrual-based IPSAS. Therefore, a single set accrual-based IPSAS implementation that produces all financial statement reports and pervasive compliance with accounting policies will systematically promote higher fiscal transparency. The following hypothesis statement is:

H1: Higher accrual-based IPSAS level is associated with increased fiscal transparency.

Research Methodology

Sample selection

This study utilizes central government financial statements that cover OECD and non-OECD - including BRICS - countries. It intends to include as many samples as possible from databases of Word Bank and IMF economic and governance indicators; the OBI surveys only provide 80-100 central governments samples. Using published financial statements and/or accounting policies from the Ministry of Finance website to measure accrual levels, we collected 77 central government reports from 2008 until 2015. The fiscal year 2008 was the start of the global financial crisis, which made central governments decide to execute fiscal policies and commit to PFM initiatives (Berger, 2012Berger, T. M.-M. (2012). Impact of the global financial crisis and the sovereign debt crisis on public sector accounting. In T. M.-M. Berger, IPSAS Explained (pp. 38-50). West Sussex, UK: John Wiley & Sons, Inc.), until 2015, the year of the latest financial reports we have populated. In particular, the sample represents 59 non-OECD and 18 OECD countries with a total of 616 observations. However, the estimation model reduces this figure to 511 observations due to incomplete data (see Table 1).

Measuring accrual-based IPSAS implementation levels

We have distinguished three measures of IPSAS implementation in previous research. Each proxy type has demonstrated its accomplishment, with some limitations. The first type of identification of accrual is whether the government has the commitment to refer to international based standards. Previous studies have mapped central government accounting practices and simply identified whether IPSAS has been adopted, regardless of whether a cash or accrual basis is used (see Christiaens et al., 2014Christiaens, J. R., Vanhee, C., Manes-Rossi, F., Aversano, N., & Cauwenberge, P. van (2014). The effect of IPSAS on reforming governmental financial reporting: An international comparison. International Review of Administrative Sciences, 81(1), 158-177. https://doi.org/10.1177/0020852314546580

https://doi.org/10.1177/0020852314546580...

; Christiaens, Reyniers, & Rolle, 2010; Sellami & Gafsi, 2017Sellami, Y. M., & Gafsi, Y. (2017). Institutional and economic factors affecting the adoption of international public sector accounting standards. International Journal of Public Administration, 1(13), 190-692. https://doi.org/10.1080/01900692.2017.1405444

https://doi.org/10.1080/01900692.2017.14...

). The second type of identification of accrual-based government financial statements can be distinguished from main presentations and notes. Pina and Torres (2003)Pina, V., & Torres, L. (2003). Reshaping public sector accounting: An international comparative view. Canadian Journal of Administrative Sciences, 20(4), 334-350. https://doi.org/10.1111/j.1936-4490.2003.tb00709.x

https://doi.org/10.1111/j.1936-4490.2003...

found that accrual transactions were represented in the financial position and financial performance statements. However, it was challenging to distinguish the main presentations between modified accrual and full accrual. Therefore, the accounting policy will precisely show the real entity’s revenue and expense recognition of accounting rules (see Appendix A

APPENDIX A

Prior Sudies of Accrual-based IPSAS Measurements

Sellami and Gafsi (2017)

PwC (2013)

Christiaens et al. (2014)

Pina and Torres (2003)

Benito et al. (2007)

PwC (2014)

Purpose of Study

determinants of IPSAS adoptions

mapping of accounting basis

mapping of IPSAS(-like) accrual adopters

Mapping of IPSAS adopters

analyzed IPSAS convergence across countries

analyzed accounting maturity level for EPSAS initiative

Highlighting:

Main Presentations

no

no

no

yes

yes

yes

Accounting Policies:

Revenues; Expense; Inventories; Investment; PPE; Employee Benefits; Financial Liab; Provision & Cont. Liab.;

no

no

no

no

partially; yes; yes; yes; yes; no; yes; yes;

yes; yes; yes; yes; yes; yes; yes; yes;

Measure:

Types

Binary

Categorical

Categorical

Continues (in %)

Continues (in %)

Continues (in %)

Measurement

IPSAS vs. non IPSAS adopter

four categories: cash, modified cash, modified accrual, and full accrual

three categories: IPSAS accrual, IPSAS (-like) accrual, cash

Completeness of main presentation accounts (i.e., balance sheet: account receivable, account payables, etc.)

Recognition and measurement conformity level

Recognition, measurement, and presentation maturity level

Is accrual-based IPSAS?

not necessarily, cash-based IPSAS is included

not necessarily

yes

yes

yes

yes but not necessarily conformed to IPSASs and ESAs

Sample of countries

110 OECD and non-OECD

100 OECD and non-OECD

59 of OECD and non-OECD

17 Europeans

15 OECD

9 Europeans

Periode

2014

2012

2012

2002

2003

2013

).

The third type of identification is at the level of accounting policies. PwC (2014)PricewaterhouseCoopers. (2014, August 1). Collection of information related to the potential impact, including costs, of implementing accrual accounting in the public sector and technical analysis of the suitability of individual IPSAS standards. Retrieved from http://www.pwc.be/en/publications/2014/epsas_oct_2014.pdf

http://www.pwc.be/en/publications/2014/e...

has explored the maturity level of European central government accounting practices coherently with IPSAS (see Appendix A

APPENDIX A

Prior Sudies of Accrual-based IPSAS Measurements

Sellami and Gafsi (2017)

PwC (2013)

Christiaens et al. (2014)

Pina and Torres (2003)

Benito et al. (2007)

PwC (2014)

Purpose of Study

determinants of IPSAS adoptions

mapping of accounting basis

mapping of IPSAS(-like) accrual adopters

Mapping of IPSAS adopters

analyzed IPSAS convergence across countries

analyzed accounting maturity level for EPSAS initiative

Highlighting:

Main Presentations

no

no

no

yes

yes

yes

Accounting Policies:

Revenues; Expense; Inventories; Investment; PPE; Employee Benefits; Financial Liab; Provision & Cont. Liab.;

no

no

no

no

partially; yes; yes; yes; yes; no; yes; yes;

yes; yes; yes; yes; yes; yes; yes; yes;

Measure:

Types

Binary

Categorical

Categorical

Continues (in %)

Continues (in %)

Continues (in %)

Measurement

IPSAS vs. non IPSAS adopter

four categories: cash, modified cash, modified accrual, and full accrual

three categories: IPSAS accrual, IPSAS (-like) accrual, cash

Completeness of main presentation accounts (i.e., balance sheet: account receivable, account payables, etc.)

Recognition and measurement conformity level

Recognition, measurement, and presentation maturity level

Is accrual-based IPSAS?

not necessarily, cash-based IPSAS is included

not necessarily

yes

yes

yes

yes but not necessarily conformed to IPSASs and ESAs

Sample of countries

110 OECD and non-OECD

100 OECD and non-OECD

59 of OECD and non-OECD

17 Europeans

15 OECD

9 Europeans

Periode

2014

2012

2012

2002

2003

2013

). However, by using the European Public Sector Accounting Standards (EPSAS) in the EU, an accrual measure was developed based on accrual-based IPSAS and European System of Accounts (ESA). It comprises recognition, measurement, and presentation policies in IPSAS and also accommodates ESA policies. For example, IPSAS policies do not recognize social security, whereas ESA policies do.

Accrual transactions and timely recognition of revenues and expenses when they are incurred (regardless of cash received for revenues and paid for expenses) creates the full picture of future cash flows, thus enhancing cash management and prediction (Berger, 2018Berger, T. M.-M. (2018). IPSAS explained: A summary of international public sector accounting standards (3rd ed.). West Sussex, UK: Wiley Online Library.). Based on PwC (2014)PricewaterhouseCoopers. (2014, August 1). Collection of information related to the potential impact, including costs, of implementing accrual accounting in the public sector and technical analysis of the suitability of individual IPSAS standards. Retrieved from http://www.pwc.be/en/publications/2014/epsas_oct_2014.pdf

http://www.pwc.be/en/publications/2014/e...

measure and IPSAS statements, we develop eight (8) basic accrual accounting policies.

-

Recognition of the non-exchanged transaction (NET) of revenues (i.e., Tax revenue, transfer revenue) reflects the gross amount of fair value (IPSAS 23.48).

-

Exchanged transactions (ET) of revenues (i.e., revenue from sales of goods and services, interest, and dividends) are measured at the net amount of fair value (IPSAS 9.14). Further, disclosing collection management and efforts, the value of receivables or payables must be systematically evaluated for reliability, such as inflating both value and collectability. Thus, the allowance and impairment loss will be considered as a potential deduction of tax revenues (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.).

-

Inventory policies are also affected by specific characteristics of accrual recordings. The life cycle of inventories in accounting statements recognizes purchased inventories - at the lower of cost and net realizable value or at the lower cost and current replacement cost - in a timely manner with account payables (IPSAS 12.15), and the process of costing of finished goods and transferring to citizens (in certain circumstances, for example, the existing co-payment needs to be recorded as revenues and the cost of goods sold as expenses) (IPSAS 12.15). Periodically, inventories are examined for their value to be appropriately impaired (IPSAS 12.44) to transparently expose inventory management (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.).

-

Property, plant, and equipment (PPE) form the most considerable part of public sector assets in financial position statements. The management of fixed assets is mostly decentralized and requires a register of individual items, periodic inspection, and proper valuation. In accrual principles, the initial acquisition of fixed assets needs to be identified in terms of cost, including any transaction costs, useful life, and residual values for depreciation purposes (IPSAS 17.26-30). The mark-to-market value of fixed assets may necessarily establish the value through revaluation (upward valuation) or impairment loss (downward valuation) (IPSAS 21.14). The public sector recognizes gains or losses related to changes in the value of fixed assets in financial position statements. However, fixed asset public sector accounting policies are different from those in the private sector. In the public sector, systematic consumption - through depreciation - and revaluation of fixed assets are intended for cost allocation purposes; in particular, it is dedicated to the pricing (value for money) of maintenance costs and public services rather than satisfying principles of matching cost against revenue (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.).

-

The recognition and measurement of employee benefits need specific technical aspects if they are to be correctly presented in the notes of financial statements. Actuarial assessment imposes the amount of employee benefit liabilities at best estimation (IPSAS 25.13). Therefore, accrual recognition of employee benefits requires full disclosure of calculations based on adequate systems.

-

A present obligation arising from past events that potentially causes an outflow of resources should be recognized as a liability. In addition, accrual accounting involves best estimate measurement (including risks and uncertainties) of the present value of the liability required for an uncertain time or amount, and possible commitments that are not probable or not reliably measurable (IPSAS 19.50-62). For example, warranty provisions for goods and services expenses for future outflow must be consistently recognized. Less probable (possible) outflow has recognized the contingent liabilities in accounting disclosure, and thus provides complete information on liabilities (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.).

-

Investments in associations are instruments of public sector intervention in the market to support public interest in the corporation to provide public goods or publicly private goods (Musgrave et al., 1989Musgrave, R. A., Musgrave, P. B., & Bird, R. M. (1989). Public finance in theory and practice. New York: McGraw-Hill.). The government has to maintain its vote in public financial corporations (PFC), public nonfinancial corporations (PNFC), and government business enterprises (GBE) sector equities to control corporate policies for social welfare (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.). For governments with minimal market interventions, investment in associations is an instrument of the stability process when it is necessary and sufficiently recognized at cost or equity method (IPSAS 7.12): for example, acquisition in times of financial distress and divestment when the market is stable. Further, changes in ownership should adjust its control level systematically (PSAS 7.12) and also impair its value (PSAS 7.35) when it occurs.

-

Financial liabilities and borrowing costs are the main routines of public sector funding activities. Expansion fiscal policy leads to upward budget deficit, which increases financial support from public debt at cost or fair value (IPSAS 29.8). Appropriate public debt valuation promotes government transparency and credibility. Accrual-based accounting provides a complete liability recording, such as amortization, capitalization, and proper maturity value of discounted public debt for disclosure purpose (IPSASB, 2016International Public Sector Accounting Standards Board. (2016). Handbook of international public sector accounting pronouncements. New York, NY: Author.). Indeed, comprehensive financial liabilities and the cost of sovereign debt presentation are supported by accrual accounting (Table 2).

Content analyses of hand-collected financial statements are conducted to achieve reliable scoring of accrual level index measurements. Using ATLAS.ti software, the important phrases, sentences, and paragraphs from financial statement documents are highlighted based on the dimensions (observed variables) of the accrual-level construct. Each aspect score depends on subjective judgments of its conformity on accrual-based IPSAS (0.5=partially conforms and 1=fully conforms). For example, IPSAS non-exchanged transactions revenue is measured in terms of the gross amount of increase in the net asset. If central government measures use the gross amount for taxes and the net amount for grants, then this is identified as partially conforming to IPSAS.

The list of basic accrual-based IPSAS transactions is shown in Table 2. Further, the technical validity objective is handled via confirmatory factor analysis (CFA), utilizing the STATA statistical package. This study estimates CFA as pool data with year groups due to the nature of growing accrual adoption year-by-year assumptions. The accrual level latent variable is reliable when the loading factors, as the weight of each dimension and item, are strong. Technically, standardized loading factors between observed variables (dimensions) and observed variables (accrual level latent variable) are ≥ 0.5 (Hair, Black, Babin, & Anderson, 2010Hair, J., Black, W., Babin, B., & Anderson, R. (2010). Multivariate data analysis. Upper Saddle River, NJ: Prentice-Hall, Inc.).

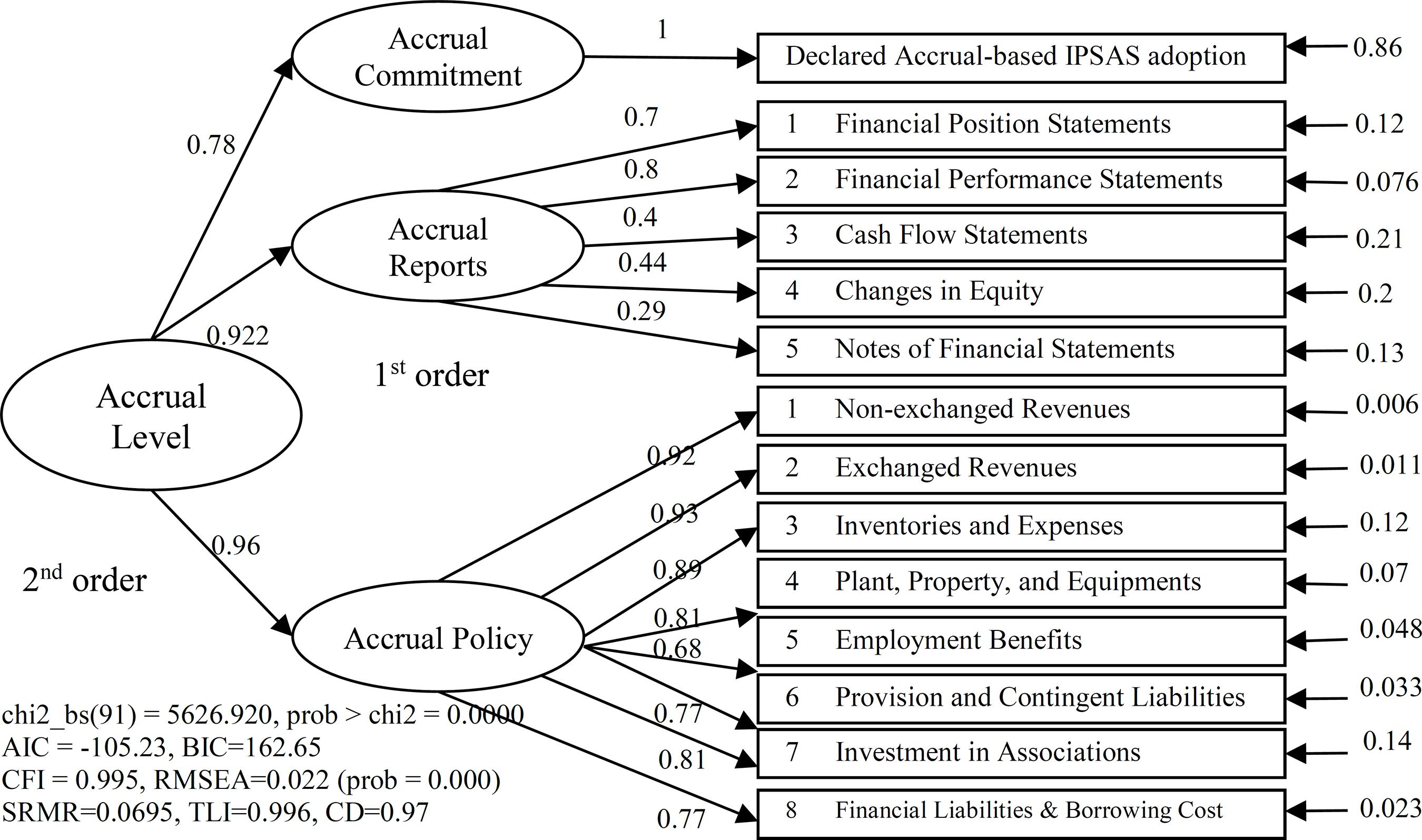

CFA can generate a single set of factor scores for the next research objective: regression analysis. Using multilevel measurement of a second-order latent variable, the accrual level scores (Accrual.Level) are formed by the scores for the accrual commitment (Accrual.Commitment), accrual report (Accrual.Report), and accrual policy (Accrual.Policy) latent variables (see Figure 1).

Research model

Conducting panel regression estimation and for external validity purposes, this study applies the following research model to test H1:

As the dependent variable, Fiscal Transparency score (Fiscal.Transp) is based on OBI surveys and ranges from 0 to 100 (IBP, 2008International Budget Partnership. (2008). The open budget survey 2008. Retrieved from https://www.internationalbudget.org/wp-content/uploads/2011/06/2008FinalFullReportEnglish1.pdf

https://www.internationalbudget.org/wp-c...

, 2010International Budget Partnership. (2010). The open budget survey 2010. Retrieved from https://www.internationalbudget.org/wp-content/uploads/2011/06/2010_Full_Report-English.pdf

https://www.internationalbudget.org/wp-c...

, 2012International Budget Partnership. (2012). Open budget survey methodology. Retrieved from http://www.internationalbudget.org/publications/obi-methodology-201-english-2/

http://www.internationalbudget.org/publi...

, 2015International Budget Partnership. (2015). Open budget survey 2015. Retrieved from http://www.internationalbudget.org/wp-content/uploads/OBS2015-Report-English.pdf

http://www.internationalbudget.org/wp-co...

). The main independent variables, accrual-based IPSAS scores, are generated from CFA predictions which result in standardized values of latent variables. There are four constructs (latent) of accrual-based IPSAS levels. The first order of CFA estimation generates factor scores for accrual commitment (Accrual.Commit), accrual report (Accrual.Report), and accrual policy (Accrual.Policy). The second order of CFA results from factor scores of total accrual level scores (Accrual.Level). It is expected that accrual-based IPSAS practices will have a positive association with fiscal transparency.

The rule of law (Rule.of.Law) indicates a good public governance environment that represents the quality of government regulation, contract enforcement, law enforcement, and courts (Kaufmann, Kraay, & Mastruzzi, 2011Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: methodology and analytical issues. Hague Journal on the Rule of Law, 3(2), 220-246. https://doi.org/10.1017/S1876404511200046

https://doi.org/10.1017/S187640451120004...

). The indicators range from -2.5 to 2.5 in units. The demands for fiscal transparency are expected to be driven by better law enforcement and obedience to the legal environment. Based on Arapis and Reitano's (2017)Arapis, T., & Reitano, V. (2017). Examining the evolution of cross-national fiscal transparency. The American Review of Public Administration, 17(5), 643-660. https://doi.org/10.1177/0275074017706740

https://doi.org/10.1177/0275074017706740...

study, the democratization index (Democ) measures democratic system scores from the least democratic (0) to the most democratic (10). Public participation and voice are predicted to be the determinants of fiscal transparency improvement.

Debt per GDP (Debt.per.GDP) reflects demands for transparency. High sovereign debt motivates policymakers to be more transparent to persuade legitimacy. However, previous studies have exhibited reverse results (see Alt & Lassen, 2006Alt, J. E., & Lassen, D. D. (2006). Fiscal transparency, political parties, and debt in OECD countries. European Economic Review, 50(6), 1403-1439. https://doi.org/10.1016/j.euroecorev.2005.04.001

https://doi.org/10.1016/j.euroecorev.200...

; Bastida, Guillamon, & Benito, 2015Bastida, F., Guillamón, M.-D., & Benito, B. (2015). Fiscal transparency and the cost of sovereign debt. International Review of Administrative Sciences, 83(1), 106-128. https://doi.org/10.1177/0020852315574999

https://doi.org/10.1177/0020852315574999...

). Excessive debt induces subsequent complex problems such as borrowing cost or the risk of default, thus inspiring elected policymakers to be opaque about the real fiscal stance (Bastida et al., 2015Bastida, F., Guillamón, M.-D., & Benito, B. (2015). Fiscal transparency and the cost of sovereign debt. International Review of Administrative Sciences, 83(1), 106-128. https://doi.org/10.1177/0020852315574999

https://doi.org/10.1177/0020852315574999...

)

GDP per Capita (GDP.per.Cap) is the proxy of citizen’s economic welfare. Previous research has exhibited that higher income is associated with high-quality public services and transparent tax usage. Based on legitimacy theory, both GDP per Capita and population represent pressure from citizens for financial information transparency (Bolívar, Muñoz, & Hernández, 2013Bolívar, M. P. R., Muñoz, L. A., & Hernández, A. M. L. (2013). Determinants of financial transparency in government. International Public Management Journal, 16(4), 557-602. https://doi.org/10.1080/10967494.2013.849169

https://doi.org/10.1080/10967494.2013.84...

).

OECD countries are characterized as having established good public governance practices. The OECD has created a good governance framework and is committed to implementing its principles, such as accountability, transparency, efficiency, effectiveness, responsiveness, and the rule of law (OECD, 2011Organisation for Economic Co-operation and Development. (2011). Public governance. Retrieved from http://www.oecd.org/investment/toolkit/policyareas/publicgovernance/41890394.pdf

http://www.oecd.org/investment/toolkit/p...

). See Table 3 for explanations of the independent and dependent variables.

Analysis

Latent variables for each accrual-based IPSAS level

Table 4 demonstrates accrual-based IPSAS aggregate scores before performing CFA estimation. More than one-third of central governments in the sample commit to and are intent on accrual-based IPSAS practices: thus, IPSAS has referred to national accounting standards. Most of the central governments publish more financial report elements and disclosures. Particularly, more than half of central governments have considered supplying statements of their financial position and financial performance (see Irwin, 2012). However, central government accrual policies that conform to IPSAS are relatively low compared to financial report publications. Related to Christiaens et al.'s (2010Christiaens, J. R., Reyniers, B., & Rolle, C. (2010). Impact of IPSAS on reforming governmental financial information systems: A comparative study. International Review of Administrative Sciences, 76(3), 537-554. https://doi.org/10.1177/0020852310372449

https://doi.org/10.1177/0020852310372449...

, 2014)Christiaens, J. R., Vanhee, C., Manes-Rossi, F., Aversano, N., & Cauwenberge, P. van (2014). The effect of IPSAS on reforming governmental financial reporting: An international comparison. International Review of Administrative Sciences, 81(1), 158-177. https://doi.org/10.1177/0020852314546580

https://doi.org/10.1177/0020852314546580...

findings, accrual-based IPSAS policies were not the only reference for accrual practices. Central governments could apply accrual accounting based on domestic GAAP, statistic-based (GFS), or modified IPSAS.

Figure 1 exhibits the CFA model for accrual-level latent variable measurements. The first order of latent variables, Accrual.Commitment, represents a dummy score of declared accrual-based IPSAS implementations. The Accrual.Report reflects strong latent unobserved variables from standardized loading factors of observed variables, except for changes in equity (0.4 < 0.5), cash flow statements (0.44 < 0.5), and notes of financial statements (0.29 < 0.50). The Accrual Policy shows strong reliability and importance of the accrual level measurement, indicated by higher standardized loading factors (>0.5).

The second order of latent variable is developed from three types of accrual level construct variables. The Accrual.Policy latent variable is the most reflective (0.96) to form an accrual level variable. All latent variables have relative importance and significance to form accrual level variables with higher standardized loading factors (>0.5). Therefore, the accrual level construct is reliable as an accrual measure.

Generally, in CFA, a good and fit model is indicated by a strong Comparative Fit Index (CFI) (0.995 ≥ 0.9), Tucker-Lewis Index (TLI) (0.996 ≥ 0.95), Coefficient Determinant (CD) (0.970 closer to 1), and significant Root Mean Square Error of Approximation (RMSEA) (0.022 ≤ 0.08), relatively small value of Akaike’s information criterion (AIC) and Bayesian information criterion (BIC), with some notes. The significant value of baseline vs. saturated Chi-squared (prob of chi2_bs < 0.05) and Standardized Root Mean Square Residual SRMR (0.069>0.05) indicates improper goodness and fit. However, good and fit CFA model indicators dominate the results. Therefore, for measurement purposes, the predicted latent variables from loading scores of accrual level measures are feasible, with some notices and limitations.