| Índice de Negociabilidade no quadrimestre correspondente |

Relação direta entre liquidez e retorno, de 1994 a 1998. |

Sanvicente e Minardi (1998)SANVICENTE, A. Z.; MINARDI, A. M. A. F. A liquidez é relevante no mercado de ações? Instituto Brasileiro de Mercado de Capitais. São Paulo: Ibmec, 1998.

|

| Índice de Negociabilidade |

Prêmio de risco pela baixa liquidez, de 1988 a 1996. |

Bruni e Famá (1998)BRUNI, A. L.; FAMÁ, R. Liquidez e Avaliação de Ativos Financeiros. In: ENANPAD - ENCONTRODA ASSOCIAÇÃO NACIONALDE PÓS-GRADUAÇÃOEM ADMINISTRAÇÃO. Anais… Foz do Iguaçu: ANPAD, 1998.

|

| Razão entre quantidades (diárias) de ações negociadas e quantidade de ações em circulação |

Maiores retornos de ações mais líquidas no curto prazo (até 12 meses), de 1965 a 1995. |

Lee e Swaminathan (2000)LEE, C. M. C.; SWAMINATHAN, B. Price momentum and trading volume. Journal of Finance, New York, v. 55, n. 5, p. 2017-2069, Oct. 2000.

|

| Modelo autoregressivo de liquidez, mensurada pelo bid-ask-spread. |

Relação positiva entre liquidez e choques de volatilidade |

Chordia, Sarkar e Subrahmanyam (2005)CHORDIA, T.; SARKAR, A.; SUBRAHMANYAM, A. Na Empirical Analysis of Stock and Bond Market Liquidity. The Reviewof Financial Studies, Oxford, v. 18, n. 1, p. 85-129, 2005.

|

| Razão entre retorno diário e volume negociado em dólar no dia, semana ou mês. |

Maiores retornos de ações ilíquidas, os quais não compensaram os maiores custos de transação, de 1962 a 2002. |

Avramov, Chordia e Goyal (2006)AVRAMOV, D.; CHORDIA, T.; GOYAL, A. Liquidity and Autocorrelations in Individual Stock Returns. The Journal of Finance, New York, v. 61, n. 5, out. 2006.

|

| Beta de liquidez, com flutuações associadas aos retornos e custos de transação. |

Maiores retornos de ações ilíquidas não compensados por altos custos de transação. Maior retorno por elevada liquidez, não influenciado pelo tamanho. |

Watanabe e Watanabe (2008)WATANABE, A.; WATANABE, M. Time-Varying Liquidity Risk and the Cross-Section of Stock Returns. The Review Financial Studies, Oxford, v. 21, n. 6, p. 2249-2486, nov. 2008.

|

|

Turnover e Volume em Dólar |

Relação significativa entre iliquidez e retorno no caso de pequenas empresas |

Chordia, Huh e Subrahmanyam (2009)Chordia, T.; Huh, S. W.; Subrahmanyam, A. Theory-Based Illiquidity and Asset Pricing. The Review of Financial Studies, Oxford, v. 22, n. 9, 2009.

|

| Oscilações nos preços provocadas por investidores supostamente irracionais |

Prêmio de risco (em relação ao índice CRSP) de iliquidez |

Hu, Pan e Wang (2013)HU, G. X.; PAN, J.; WANG, J. Noise as Information for Iliquidity. The Journal of Finance, New York, v. 68, n. 6, Dec. 2013.

|

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

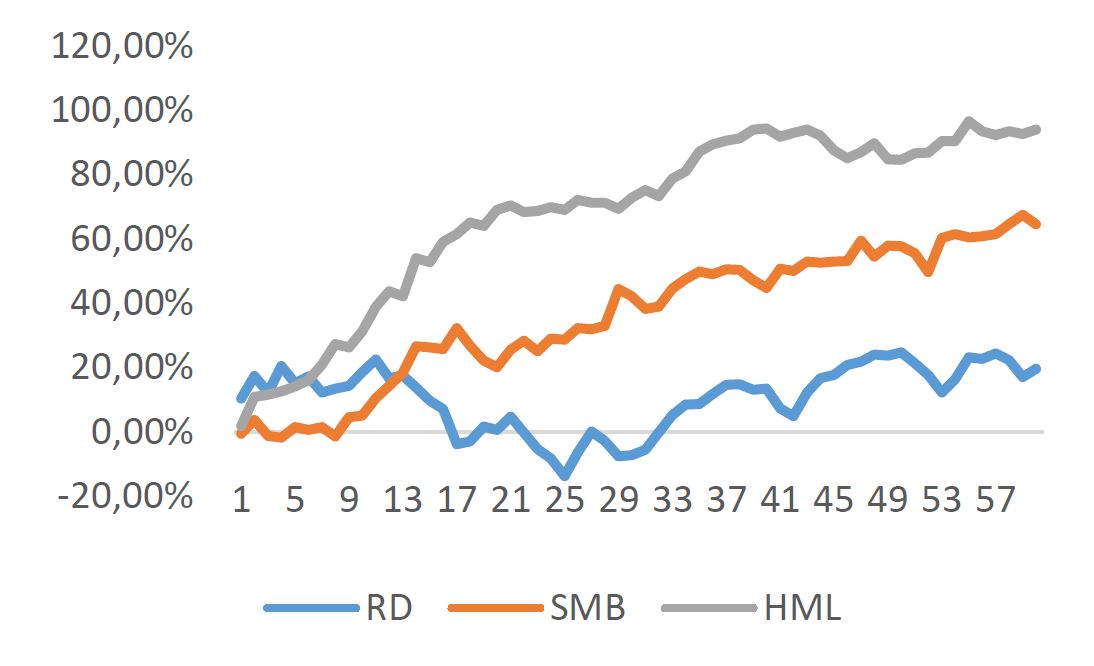

Fonte: Elaboração própria

Fonte: Elaboração própria

Fonte: Elaboração própria

Fonte: Elaboração própria

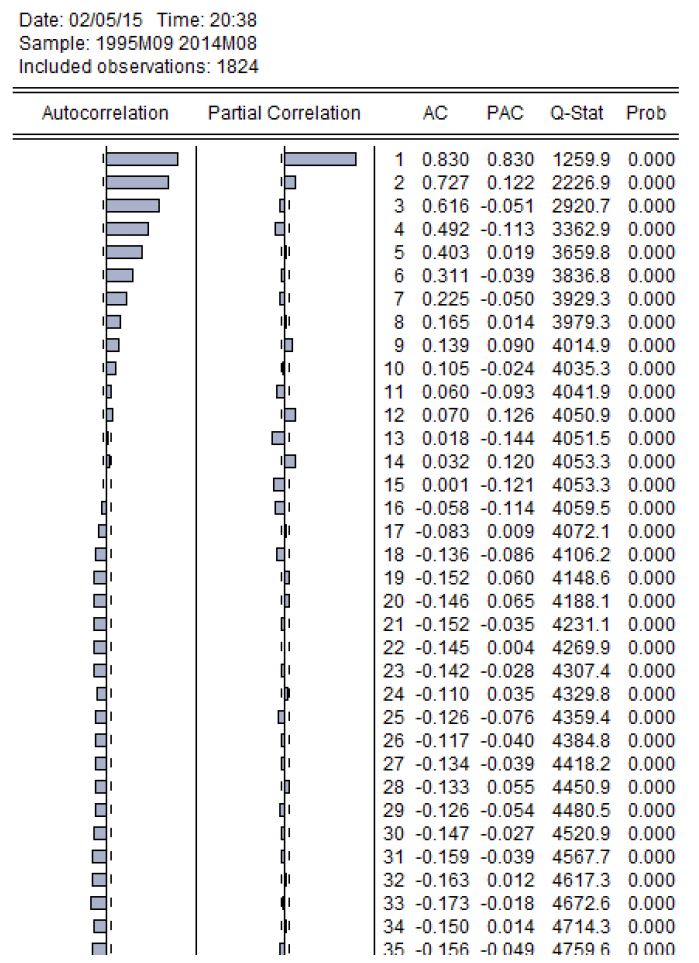

Fonte: Eviews 7

Fonte: Eviews 7

Fonte: Eviews 7

Fonte: Eviews 7