ABSTRACT

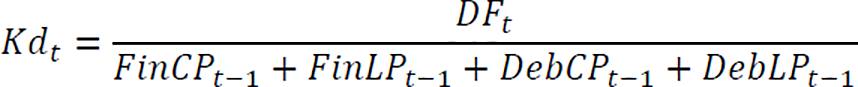

The reduced access to debt capital, especially to long-term maturity debt, is one of the main problems of the Brazilian corporate environment. Agency conflicts and the existence of asymmetric information in transactions carried on the financial markets result in higher cost of capital and credit rationing. The adoption of best practices of corporate governance by enterprises, results in a reduced cost of capital, expands the role played by the market in raising funds for investment, and mitigates the problem of business financing. The purpose of this study is to evaluate the relationship between best practices of corporate governance and cost of debt among Brazilian non-financial listed companies during 2010-2014. Panel data with 230 companies and Generalized Method of Moments (GMM-Sis) method were used. Results suggested that a better corporate governance pattern has contributed to lowering the cost of debt of the companies. In addition, one-year-lagged cost of debt, profitability and issuance of preference shares have influenced the contemporary cost of debt.

Keywords:

corporate governance; cost of capital; panel data; system GMM