ABSTRACT.

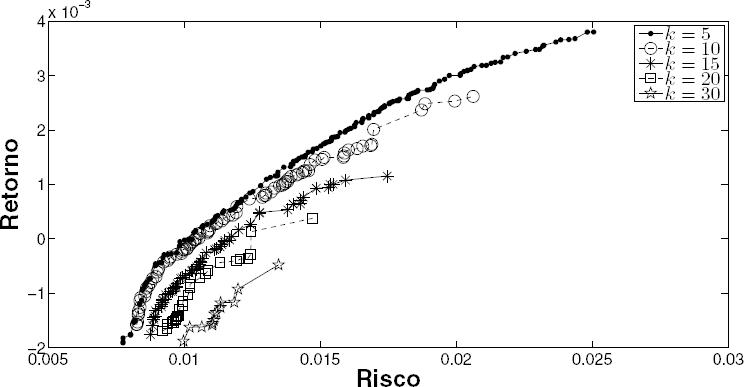

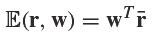

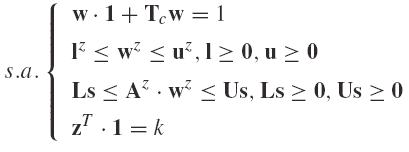

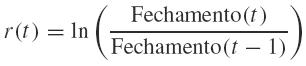

This work presents a multiobjective model for portfolio selection that takes into account cardinality constraint, transaction costs and investment limits for each asset and asset groups. The objective functions consider the conditional value-at-risk (CVaR) as the risk measure and the expected value of the historical returns weighted by the investment proportions, discounted the transactions costs. To cope with the model, a specific version of a multiobjective genetic algorithm is used. Results show the ability of the algorithm to achieve several efficient solutions, as well the usability of the proposed model to assist the market investor decision in obtaining potfolios with good relation between risk and return according to a given cardinality.

Keywords:

multiobjective optimization; portfolio selection; conditional value at risk; genetic algorithms