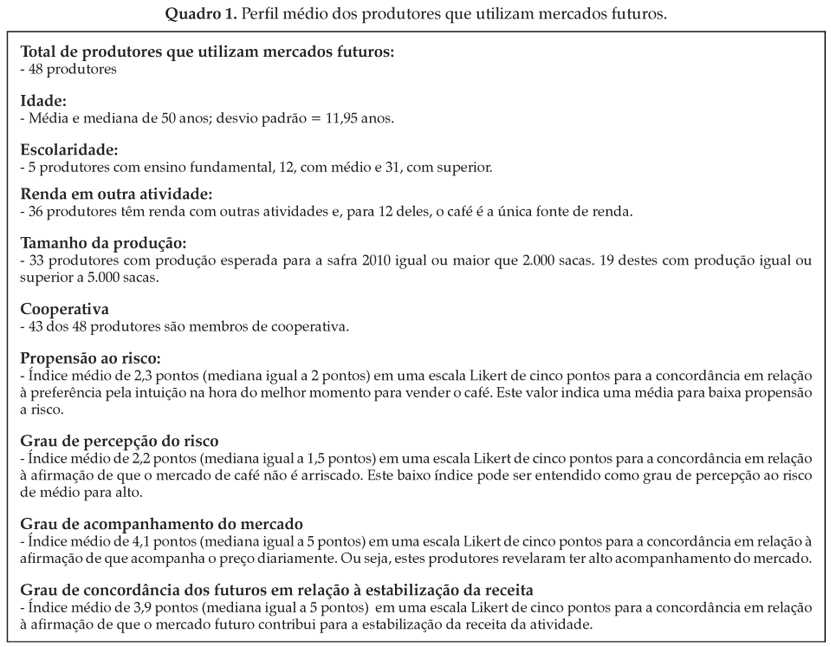

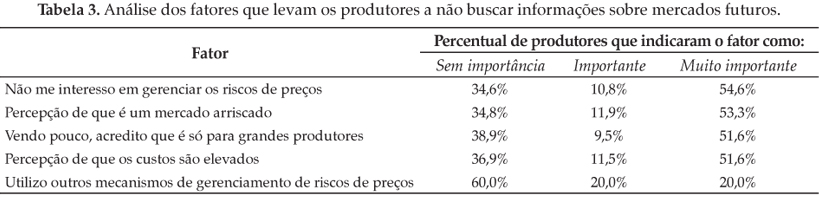

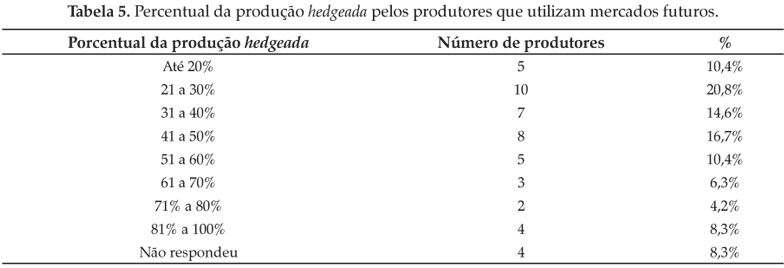

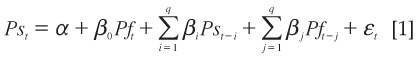

Os mercados futuros possuem uso restrito entre os cafeicultores brasileiros, o que, de certa maneira, não condiz com as altas razões ótimas de hedge obtidas nos modelos de mínima variância. Os motivos para esta baixa utilização estão associados às características do produtor e de seu negócio, preferências em relação ao modelo de administração de risco da atividade e questões comportamentais. Diante disso, o presente estudo buscou verificar quais fatores interferem na decisão de uso destes derivativos entre os cafeicultores brasileiros. Em uma primeira etapa, foram calculadas razões ótimas de hedge, de acordo com Myers e Thompson (1989), para os mercados da BM&FBOVESPA e ICE Futures. Tais razões apresentaram valores superiores a 50%. Em uma segunda etapa, a partir da aplicação de 373 questionários, observou-se que 12,9% da amostra declara conhecer e utilizar futuros, sendo que, na média, a razão de hedge adotada esteve abaixo de 50%. Em uma terceira etapa, a partir de um modelo logit, concluiu-se que os fatores que influenciaram o uso dos contratos foram grau de aversão ao risco de preço, tamanho da produção, nível de conhecimento sobre derivativos e dimensão pela qual se entende que tais instrumentos levam à maior estabilidade da receita da atividade.

Mercados futuros; café arábica; gerenciamento de risco