Resumo:

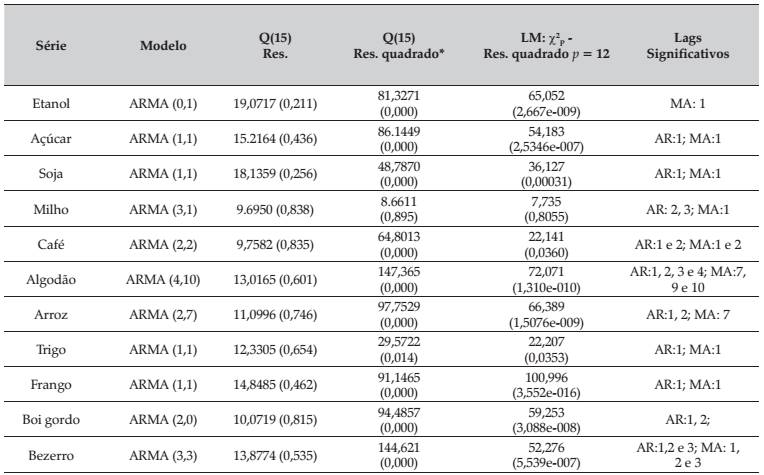

Este estudo analisou (2005-2013) a persistência, a alavancagem e a variância incondicional dos retornos de commodities agropecuárias3 3 As séries estudadas foram: o açúcar, a soja, o milho, o café, o algodão, o arroz, o trigo, o frango, o boi gordo e o bezerro. A fonte dessas informações são as séries de preços do CEPEA/ESALQ, disponíveis em: http://www.cepea.esalq.usp.br. Acesso: 26/04/2013. . Assim, recorreu-se ao modelo denominado APARCH. As estimativas apontaram que a alavancagem não foi confirmada nessas séries; a variância condicional foi assimétrica nos retornos do etanol, do café, do algodão, do boi gordo e do bezerro; as volatilidades mais intensas, embora com convergência às suas médias históricas, ocorreram nos retornos do açúcar, da soja, do café, do trigo, do frango e do boi gordo; as maiores volatilidades incondicionais foram dos retornos do etanol, do frango, do algodão, da soja e do açúcar.

Palavras-chaves:

Efeito alavancagem; Modelo da família ARCH; Séries agropecuárias; Potência assimétrica.

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail

Thumbnail