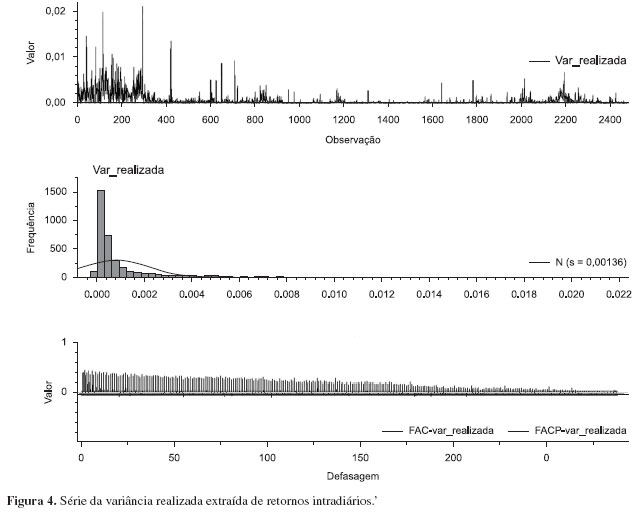

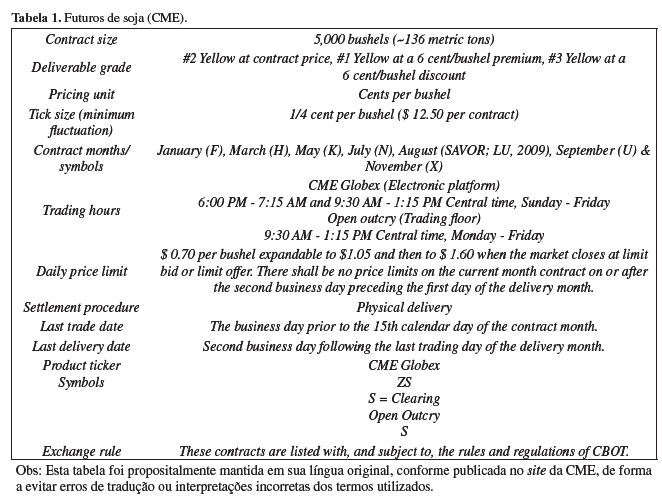

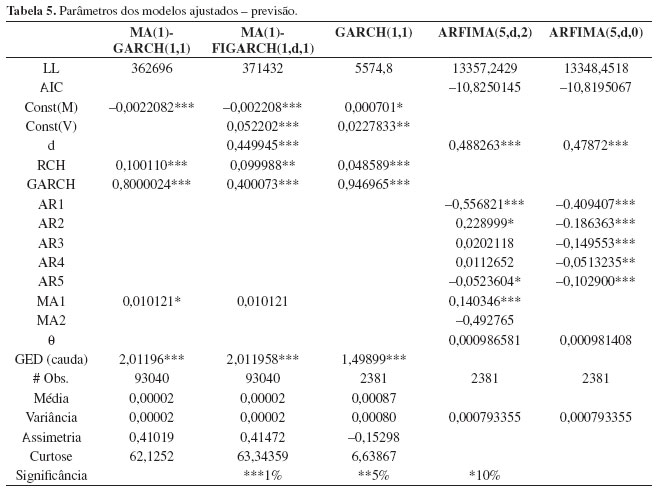

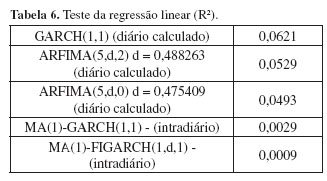

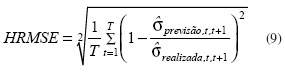

Neste trabalho foram avaliados os ajustes de cinco modelos para previsão da variância, utilizando-se uma série de preços de soja, uma commodity negociada na bolsa de mercadorias de Chicago (CBOT), com dados de alta frequência. Os modelos utilizados foram do tipo GARCH, FIGARCH e ARFIMA. Foi possível observar características desta série de preços de uma commodity negociada globalmente que se apresentaram inteiramente diferentes daquelas de ativos financeiros anteriormente estudados, possivelmente em virtude da característica contínua dos preços observados, induzida pela sua negociação global independente de pregões com início e fim. Foi possível concluir que a série de dados de alta frequência encerra informações adicionais às séries de dados diários, também no caso estudado de preços da soja, e que o tradicional modelo GARCH(1,1) tem um bom desempenho também no caso dos dados de alta frequência, assim como aqueles da família ARFIMA. Recomenda-se mais investigação para o caso dos modelos FIGARCH, procurando um melhor ajuste.

Volatilidade; Alta frequência; Volatilidade realizada; Soja; GARCH; ARFIMA