ABSTRACT

Purpose:

To analyze the real estate sector of a Brazilian metropolis in the recent period of great valuation of the asset in the country and to investigate if there are signs of a speculative bubble in this market.

Originality/gap/relevance/implications:

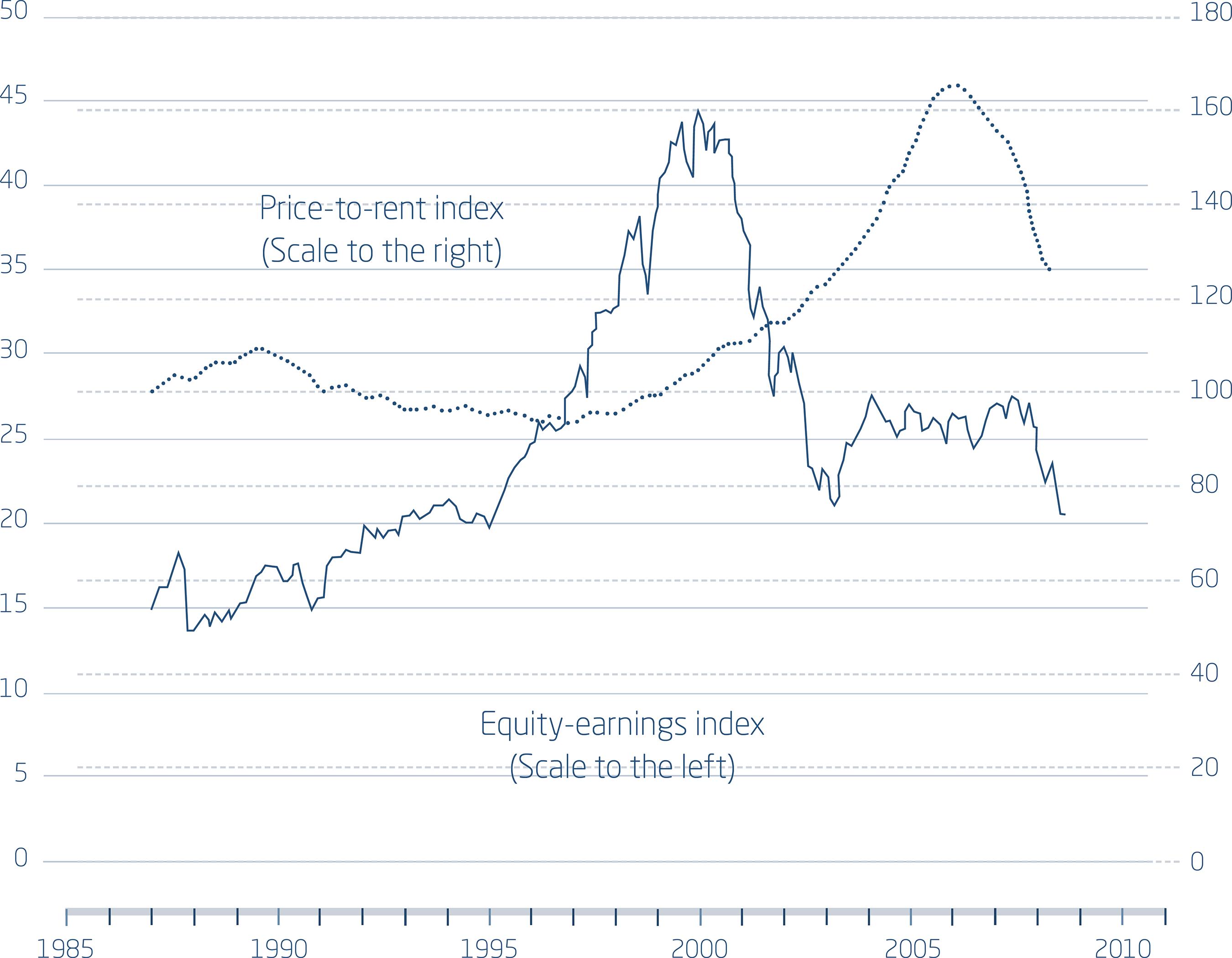

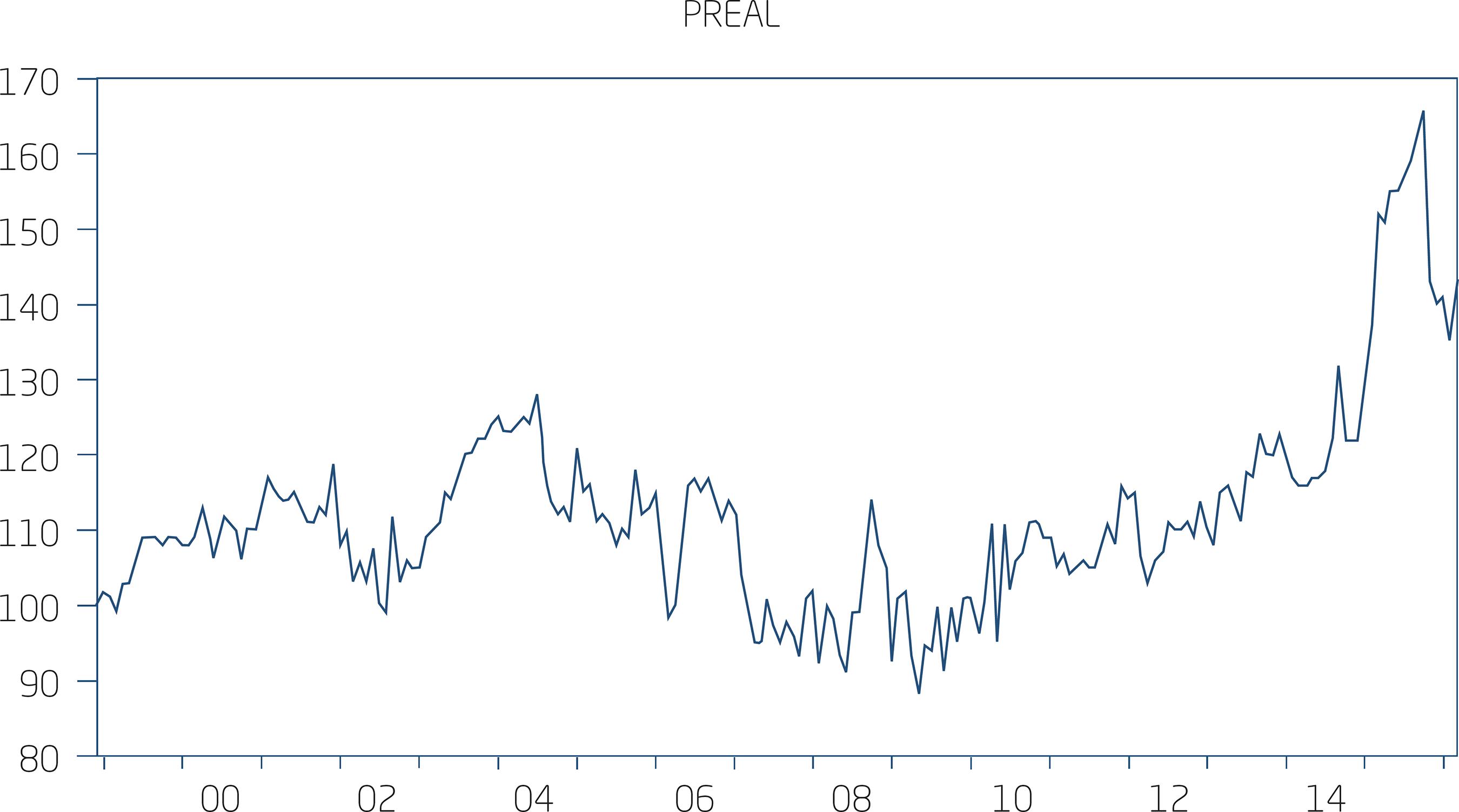

This article presents a version of the Case-Shiller Index, which describes the evolution of the relationship between house prices and rental prices and uses models in order to identify if the rise in property prices rests on good economic fundamentals.

Key methodological aspects:

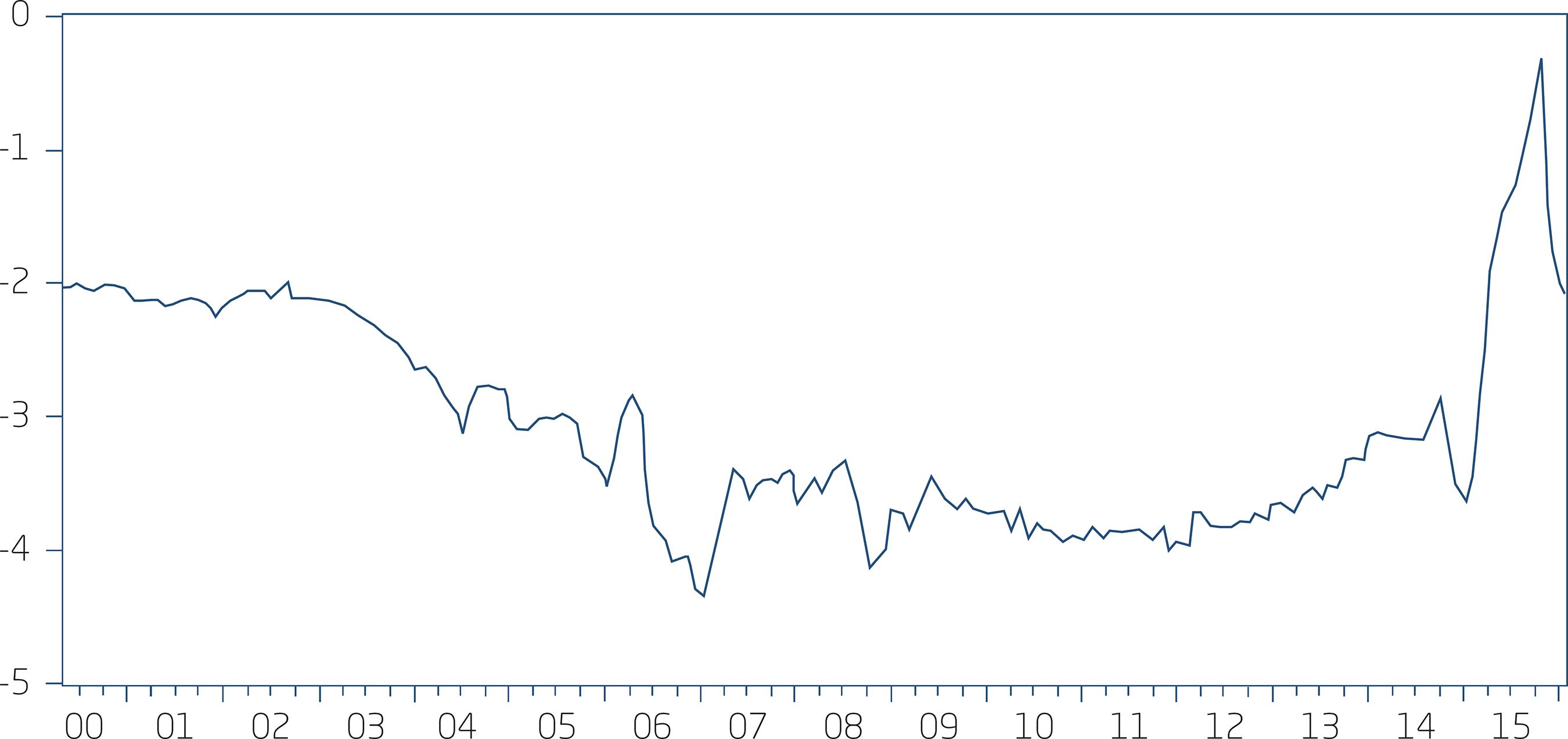

The approach is quantitative and involves the construction of the price-rent index, unit root test with an instrument that allows structural break with trend (Innovation Outlier Model) and analysis of cointegration using estimates of a Vector Error Correction Model (VECM).

Summary of the results:

The results do not favor the interpretation that the real estate market rests on solid economic fundamentals. On the contrary, the evolution of the price-rent index and the lack of causal relationship of rents to prices towards long-term equilibrium are suggestive of the existence of a speculative bubble.

Key considerations/conclusions:

The results support authors who are critical to the efficient market hypothesis (EMH) and suggest that the relative increase in property prices stems only from the belief that their selling price will be higher in the future. It is therefore foreseeable a decrease of real prices of housings, with equity losses for the participants in that market.

KEYWORDS

Real estate market; Speculative bubble; Financial crisis; Index Price-to-Rent; VECM

Source:

Source: Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.

Source: Elaborated by the authors.